Global B2B E-Commerce for Tyre Market – Industry Trends and Forecast to 2030

Report ID: MS-1033 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

B2B e-commerce for the tyre market refers to digital platforms and online systems that make it easier to buy and sell tyres in bulk between companies such as manufacturers, wholesalers, distributors, auto workshops and fleet operators. This market simplifies purchasing processes, inventory management and order service, offering real-time prices, product catalogues, logistics tracking and integration with ERP systems. It is growing rapidly as tyre brands and after-sales players go from traditional sales channels to digital models, with the goal of broader reach, faster transactions and better transparency in global supply chains.

B2B E-Commerce for Tyre Report Highlights

| Report Metrics | Details |

|---|---|

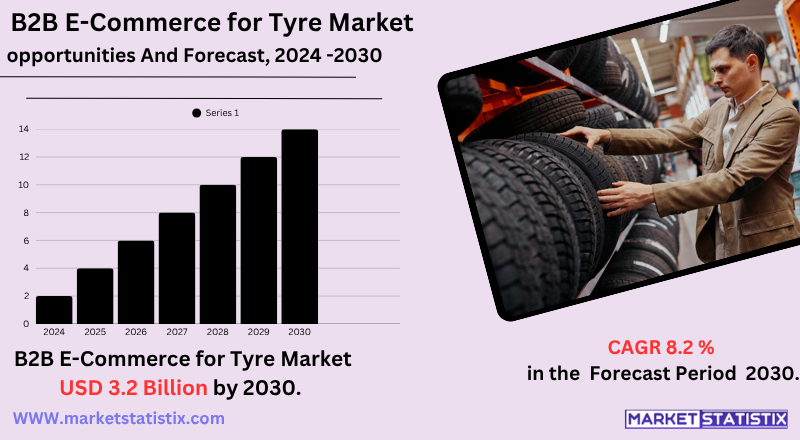

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.2% |

| Forecast Value (2030) | USD 3.2 Billion |

| By Product Type | Material Handling Tires, Agricultural Tires, Construction Tires |

| Key Market Players |

|

| By Region |

|

B2B E-Commerce for Tyre Market Trends

An important trend is the strong demand for convenience, which is prompting manufacturers and distributors to develop user-friendly e-commerce solutions that offer real-time reserving status, adapted prices and detailed product specifications. This shift is also driven by increasing emphasis on sustainability, as B2B platforms facilitate the discovery and procurement of environmentally friendly and energy-efficient tyres and correspond to environmental regulations and consumer preferences. Furthermore, the market sees increased adoption of integrated systems that connect inventory and customer data and improve productivity and flexibility. The development of specialised solutions that are easily integrated into existing functions such as accounting and ordering systems is also a prominent feature.

B2B E-Commerce for Tyre Market Leading Players

The key players profiled in the report are Groupe Michelin France (France), Goodyear (U.S.), Kumho (South Korea), Sumitomo (Japan), Hankook (South Korea), Yokohama (Japan), Michelin (France), Bridgestone (Japan), Continental (Germany), Pirelli (Italy)Growth Accelerators

- Expansion of comprehensive online tyre platforms: A growing number of markets now offer extensive tyre brand catalogues, allowing companies to compare models without effort and online prices. This scanned selection process reduces dependence on traditional sales channels and simplifies bulk acquisition.

- Streamlined Procurement and Supply Chain Efficiency: Companies are taking advantage of digital tools for faster inventory visibility, real-time logistics tracking and continuous order processing. This greatly increases operational productivity and cost-effective tyre management.

- Cost Savings Through Disintermediation: B2B platforms eliminate intermediates connecting buyers directly to manufacturers or distributors, leading to more competitive prices. These cost benefits are a strong incentive for mass buyers, such as fleet operators and workshops.

B2B E-Commerce for Tyre Market Segmentation analysis

The Global B2B E-Commerce for Tyre is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Material Handling Tires, Agricultural Tires, Construction Tires . The Application segment categorizes the market based on its usage such as Passenger Car, Heavy Commercial Vehicle. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of B2B e-commerce for the tyre market is evolving rapidly, with a mixture of traditional manufacturers, large distributors and specialised online platforms vying for market share. Key players include established tyre manufacturers that increasingly invest in their own B2B digital portals to offer direct sales and services integrated with dealers and fleets. Simultaneously, B2B e-commerce independent platforms are gaining strength, providing aggregate inventory, transparent prices and efficient logistics, with the aim of optimising the traditionally fragmented tyre distribution ecosystem. The emphasis is on the provision of real-time inventory visibility, competitive prices and efficient delivery to commercial customers. Companies are also taking advantage of technology, such as AI, for better CRM recommendations and tools to improve dealer relationships and optimise stock management.

Challenges In B2B E-Commerce for Tyre Market

- Legacy systems and manual processes: Many tyre players still depend on manual orders and outdated systems, making it difficult to transform digitally without expensive infrastructure and team training.

- Complex supply chain integration: coordinating multiple stakeholders – factories, distributors, and workshops – in a unified platform is difficult and intensive in resources.

- Balancing digital with personal relationships: the sector values interactions and demos, and transitioning online risks losing that direct customer confidence and personalised touch.

Risks & Prospects in B2B E-Commerce for Tyre Market

Companies are increasingly seeking convenience, transparency and efficiency offered by online platforms for the procurement of bulk tyres. This change is allowing real-time inventory tracking, competitive price comparisons, and streamlined order fulfilment, moving away from the often-fragmented traditional supply chain. The emphasis on sustainability is also opening doors, as e-commerce platforms can highlight and facilitate the sale of eco-friendly tyre options. In addition, the growing trend of "Tyre-as-a-Service" models, where companies pay for mileage instead of full ownership, is creating new paths for sales and digital management.

Key Target Audience

The competitive scenario of B2B e-commerce for the tyre market is evolving rapidly, with a mixture of traditional manufacturers, large distributors and specialised online platforms vying for market share. Key players include established tyre manufacturers that increasingly invest in their own B2B digital portals to offer direct sales and services integrated with dealers and fleets. Simultaneously, B2B e-commerce independent platforms are gaining strength, providing aggregate inventory, transparent prices and efficient logistics, with the aim of optimising the traditionally fragmented tyre distribution ecosystem. The emphasis is on the provision of real-time inventory visibility, competitive prices and efficient delivery to commercial customers. Companies are also taking advantage of technology, such as AI, for better CRM recommendations and tools to improve dealer relationships and optimise stock management.

Merger and acquisition

- TyreOps launches new B2B marketplace: although it is not a traditional acquisition, TyreOps has expanded its platform to include a dedicated B2B tyre sales market, accelerating purchasing efficiency and allowing companies to compare and buy directly from suppliers.

- Bond International acquires tyre industry software firms: Bond International recently bought Tyresoft Ltd and Tyrenescope, increasing its digital arsenal with integrated tyre management systems for wholesale and technology service infrastructure.

- Infopro Digital’s acquisition of DriveRightData: In February 2024, Infopro Digital acquired DriveRightData to strengthen its global tyre and wheel data features, merging rich industry datasets with enterprise-grade insights for aftermarket solutions.

>

Analyst Comment

B2B e-commerce for the tyre market is undergoing substantial growth, driven by the growing digitisation of purchasing processes and the demand for greater convenience and efficiency in the automotive supply chain. Valued at approximately US $1.3 billion by 2024, the market is expected to reach $1.41 billion by 2025 and about $3 billion in 2033, reflecting a constant CAGR. This expansion is fuelled by companies seeking simplified inventory management, real-time access to product specifications and prices, and automated order systems. Main trends include the adoption of B2B platforms by manufacturers, wholesalers and distributors to facilitate mass sales, the integration of enhanced data with existing ERP systems and the growing emphasis on sustainable tyre options.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 B2B E-Commerce for Tyre- Snapshot

- 2.2 B2B E-Commerce for Tyre- Segment Snapshot

- 2.3 B2B E-Commerce for Tyre- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: B2B E-Commerce for Tyre Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Agricultural Tires

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Material Handling Tires

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Construction Tires

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: B2B E-Commerce for Tyre Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger Car

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Heavy Commercial Vehicle

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: B2B E-Commerce for Tyre Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Yokohama (Japan)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Bridgestone (Japan)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Kumho (South Korea)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Sumitomo (Japan)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hankook (South Korea)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Continental (Germany)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Goodyear (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Michelin (France)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Groupe Michelin France (France)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Pirelli (Italy)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of B2B E-Commerce for Tyre in 2030?

+

-

Which application type is expected to remain the largest segment in the Global B2B E-Commerce for Tyre market?

+

-

How big is the Global B2B E-Commerce for Tyre market?

+

-

How do regulatory policies impact the B2B E-Commerce for Tyre Market?

+

-

What major players in B2B E-Commerce for Tyre Market?

+

-

What applications are categorized in the B2B E-Commerce for Tyre market study?

+

-

Which product types are examined in the B2B E-Commerce for Tyre Market Study?

+

-

Which regions are expected to show the fastest growth in the B2B E-Commerce for Tyre market?

+

-

Which application holds the second-highest market share in the B2B E-Commerce for Tyre market?

+

-

What are the major growth drivers in the B2B E-Commerce for Tyre market?

+

-

- Expansion of comprehensive online tyre platforms: A growing number of markets now offer extensive tyre brand catalogues, allowing companies to compare models without effort and online prices. This scanned selection process reduces dependence on traditional sales channels and simplifies bulk acquisition.

- Streamlined Procurement and Supply Chain Efficiency: Companies are taking advantage of digital tools for faster inventory visibility, real-time logistics tracking and continuous order processing. This greatly increases operational productivity and cost-effective tyre management.

- Cost Savings Through Disintermediation: B2B platforms eliminate intermediates connecting buyers directly to manufacturers or distributors, leading to more competitive prices. These cost benefits are a strong incentive for mass buyers, such as fleet operators and workshops.