Global Ammonium Fluoride Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-284 | Chemicals And Materials | Last updated: May, 2025 | Formats*:

Ammonium Fluoride Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

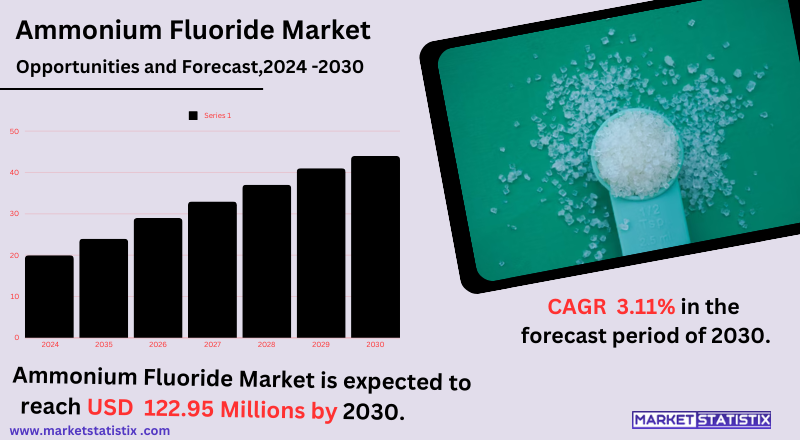

| Growth Rate | CAGR of 3.11% |

| Forecast Value (2030) | USD 122.95 Million |

| By Product Type | Solid, Liquid, Others |

| Key Market Players |

|

| By Region |

Ammonium Fluoride Market Trends

The growth of the ammonium fluoride market is mainly attributed to its increasing application in the electronics and semiconductor industries. Ammonium fluoride has been put to wide usage and application in the etching and cleaning paths of silicon wafers, thus driving the growth of this industry. With the advancement of smart devices, rapid adaptation toward 5G infrastructure, and also growing renewable energy systems, the demand for high-purity ammonium fluoride is on the rise. Moreover, another aspect affecting the trend is the growing emphasis on sustainable and eco-friendly manufacturing. Manufacturers adopt innovative technologies as a way of reducing the environmental footprints from the production and processing of ammonium fluoride. The chemical industry in North America and Europe also has regulatory frameworks to promote the safe use and handling of chemicals and to advance chemical innovations and compliance. Emerging markets in Asia-Pacific arising from increased industrialization and growing manufacturing activities have turned out to be instrumental in shaping market dynamics.Ammonium Fluoride Market Leading Players

The key players profiled in the report are Juhua Group, Zhejiang Hailan Chemical Group, Fubao Group, Fujian Kings Fluoride, FDAC, Yingpeng Chemicals, Fujian Shaowu Yongfei, Stella Chemifa, Shaowu Huaxin Chemical, Chengde Yingke Fine Chemical, KMG Electronic ChemicalsGrowth Accelerators

Ammonium fluoride is widely applied in many industries, including electronics, chemicals, and glass, which drives the ammonium fluoride market. In electronics, it is used for etching and cleaning semiconductors and circuit boards. This is mainly driven by the growing need for advanced electronic devices and other such technologies. Ammonium fluoride is used as a reagent in the chemical industry for different syntheses and also for frosting and etching in the glass industry. The progressive increase in the adoption of these processes in the manufacturing of industrial and consumer goods propels the growth of this market. Sustainable and efficient chemical processes encouraged by environmental regulations have further spurred the growth of the market of ammonium fluoride. Its role as a pH regulator in water treatment and its usage in speciality chemicals for green applications have been on the rise recently. It is also noted that the increase in the infrastructure and automotive production falls under increased demand for high-performance materials, which also indirectly supports the application of ammonium fluoride in related industries.Ammonium Fluoride Market Segmentation analysis

The Global Ammonium Fluoride is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Solid, Liquid, Others . The Application segment categorizes the market based on its usage such as Water Treatment, Pharmaceuticals, Electronics, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Recent mergers and acquisitions have reshaped the competitive landscape of the ammonium fluoride market. Notable developments include investments aimed at expanding production capabilities and enhancing technological advancements in manufacturing processes. The focus on eco-friendly products and advanced manufacturing techniques is also becoming a priority as companies strive to meet environmental standards while catering to the rising trend of miniaturization in electronics. This dynamic environment presents lucrative opportunities for businesses and investors looking to capitalize on the growing ammonium fluoride sector.Challenges In Ammonium Fluoride Market

One of the major challenges in ammonium fluoride marketing seems to be environmental and safety concerns. It is toxic and poses severe danger if not handled properly. Therefore, there are strict regulations and safety rules during the manufacturing processes, transportation, and use. This creates impediments for new entries into the market while increasing operational costs for existing players. Another challenge is that prices of raw materials are volatile, and this can affect the cost structure of ammonium fluoride. The production process of the market remains dependent on chemicals such as ammonia and hydrogen fluoride, and the prices of such chemicals can be affected by demand and supply trends, geopolitical environments, and natural resource establishments. These price fluctuations can disturb the chain of supply, impacting stability and profitability for ammonium fluoride manufacturers. Plus, competition from other chemicals in industrial applications may restrict the growth of this market, as companies opt for cheaper or safer substitutes for similar purposes.Risks & Prospects in Ammonium Fluoride Market

The ammonium fluoride (AF) market is promising for the electronics, pharmaceutical, and chemical manufacturing industries. In electronics, it uses AF as a supplement for a flux agent in semiconductor fabrication and presents high growth potential where demand for electronic appliances is expected to increase globally. AF also brings opportunities that go with the trends from the expanding global healthcare sector, such as the pharmaceutical industry's synthesis of active pharmaceutical ingredients (APIs). Another area of growth would be future green technology and environmental application opportunities where ammonium fluoride finds its significance in the public domain for treatment of water and waste. The innovative shift of industries to sustainable and eco-friendly practices may boost the effectiveness of AF's applications in these fields, such as cleaning impurities from industrial effluents. The propensity of renewable energy to grow and new avenues developing in battery technologies may open dynamic possibilities for ammonium fluoride, particularly in energy storage applications. The diversification of the applications will keep an increasingly solid basis for future growth in the ammonium fluoride market.Key Target Audience

, The main audience of the ammonium fluoride (AF) market would include industries such as electronics, metal finishing, and chemical manufacturing. In electronics, ammonium fluoride has great relevance in semiconductor and microchip production, hence the importance to the manufacturers producing electronic devices and equipment. In metal finishing, this function is ascribed to the industries importing the chemical for usage as an etching and cleaning agent, such as automotive, aerospace, and machinery, for its effectiveness in surface treatment and polishing processes., Another major audience includes agriculture, where ammonium fluoride acts as a pesticide or fungicide. Also, for some specific drug formulations and processes in the pharmaceutical industry, ammonium fluoride is used, albeit a little niche. In addition, more need for fluorine-based products regarding applications such as water treatment and refrigeration will further augment ammonium fluoride demand. Such areas hence have a significant share of the market consumer base.Merger and acquisition

The ammonium fluoride marketplace is indeed presently growing remarkably through several great mergers and collaborations among the leading players in the sector. Such companies include Solvay, Honeywell International, and Stella Chemifa Corporation, all of which entered strategic partnerships aimed at enhancing their product offering and reach. Innovations are made possible through partnerships, as companies capitalise on each other's strengths to innovate products satisfying the growing needs of various sectors like electronics, glass etching, and metal processing. >Analyst Comment

The ammonium fluoride market is expected to witness promising growth in the upcoming years owing to its multifarious applications in different industries. The growth will be catalysed by increasing demand for metal surface treatment, expanding the electronics industry, and an upsurge in requirements for efficient wood preservative applications. Ammonium fluoride acts on metals in cleaning, descaling, and brightening processes. This improves the quality and function of the metal parts in many industries. Also, the production of electronic components includes etching processes and is very important to the growth of the electronics industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Ammonium Fluoride- Snapshot

- 2.2 Ammonium Fluoride- Segment Snapshot

- 2.3 Ammonium Fluoride- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Ammonium Fluoride Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Liquid

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Solid

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Ammonium Fluoride Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Electronics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceuticals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Water Treatment

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Stella Chemifa

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 FDAC

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Shaowu Huaxin Chemical

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Chengde Yingke Fine Chemical

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Zhejiang Hailan Chemical Group

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Yingpeng Chemicals

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Fujian Shaowu Yongfei

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Fujian Kings Fluoride

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Fubao Group

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Juhua Group

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 KMG Electronic Chemicals

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Ammonium Fluoride in 2030?

+

-

Which type of Ammonium Fluoride is widely popular?

+

-

What is the growth rate of Ammonium Fluoride Market?

+

-

What are the latest trends influencing the Ammonium Fluoride Market?

+

-

Who are the key players in the Ammonium Fluoride Market?

+

-

How is the Ammonium Fluoride } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Ammonium Fluoride Market Study?

+

-

What geographic breakdown is available in Global Ammonium Fluoride Market Study?

+

-

Which region holds the second position by market share in the Ammonium Fluoride market?

+

-

Which region holds the highest growth rate in the Ammonium Fluoride market?

+

-