Asia Pacific 5G Enterprise Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-961 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The 5G enterprise market refers to the application and adoption of fifth-generation wireless technology specifically in business environments. Unlike the 5G consumer, enterprise 5G is adapted to meet the rigorous demands of various industries, leveraging the main benefits of 5G, such as ultra-fast speeds (up to 10 Gbps and beyond), extremely low latency and solid connectivity capacity. This type of technology allows companies to build highly efficient, connected and intelligent operations, facilitating the transfer of data in real time, supporting a wide range of Internet of Things Devices (IoT) and allowing advanced applications such as Artificial Intelligence (AI), augmented reality (AR) and virtual reality (VR). The market covers the implementation of 5G public networks and private 5G networks, devices and services designed to improve productivity, allow digital transformation and promote innovation between the sectors.

5G's ability to provide secure, reliable and personalised network solutions, usually through network slicing and border computing, makes it a critical facilitator for companies that want to optimise their processes, improve decision-making and create new services.

The 5G enterprise market refers to the application and adoption of fifth-generation wireless technology specifically in business environments. Unlike the 5G consumer, enterprise 5G is adapted to meet the rigorous demands of various industries, leveraging the main benefits of 5G, such as ultra-fast speeds (up to 10 Gbps and beyond), extremely low latency and solid connectivity capacity. This type of technology allows companies to build highly efficient, connected and intelligent operations, facilitating the transfer of data in real time, supporting a wide range of Internet of Things Devices (IoT) and allowing advanced applications such as Artificial Intelligence (AI), augmented reality (AR) and virtual reality (VR). The market covers the implementation of 5G public networks and private 5G networks, devices and services designed to improve productivity, allow digital transformation and promote innovation between the sectors.

5G's ability to provide secure, reliable and personalised network solutions, usually through network slicing and border computing, makes it a critical facilitator for companies that want to optimise their processes, improve decision-making and create new services.

5G Enterprise Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

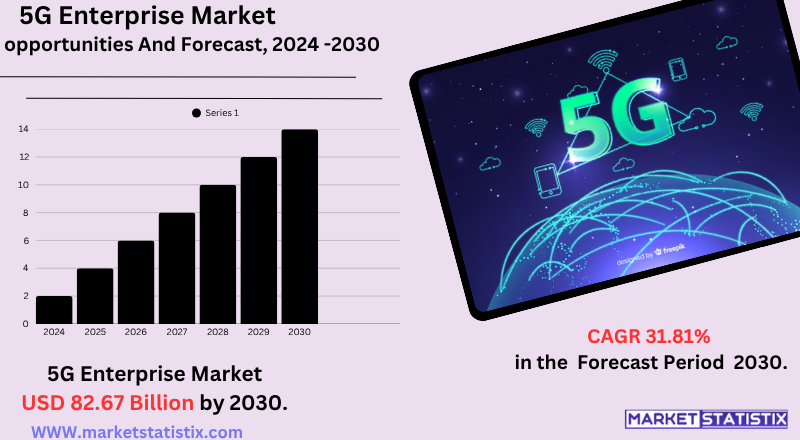

| Growth Rate | CAGR of 31.81% |

| Forecast Value (2030) | USD 82.67 Billion |

| By Product Type | Enterprise Networks, Private Networks, CSP Network, Hybrid Network, Others |

| Key Market Players |

|

| By Region |

|

5G Enterprise Market Trends

A significant trend is the increase in private 5G network deployments, especially in industries such as manufacturing, where dedicated networks offer improvement, control and performance for critical applications such as IoT Industrial (IIOT), connected machines and automated guided vehicles. Although public 5G networks remain predominant due to their wide availability and cost-effectiveness, 5G private is gaining strength in niche and high-demand environments. This trend is fed by the need for custom network solutions that can deal with massive connectivity and real-time data processing, essential for advanced technologies such as AI, AR and VR.

Another important trend is the diversification of 5G use cases besides the Enhanced Mobile Broadband (eMBB). Industries such as health are quickly adopting 5G for remote monitoring of patients, telemedicine and AI-based diagnoses, requiring high-speed safe networks for live data transfer. The market is also seeing a growing emphasis on network slicing, which allows companies to create custom and personalised network segments, adapted to specific application requirements, offering flexibility and allocation of efficient resources.

5G Enterprise Market Leading Players

The key players profiled in the report are Ericsson – Sweden, NEC – Japan, Huawei – China, Nokia – Finland, ZTE – China, Qualcomm – United States, Intel – United States, AT&T – United States, Cisco – United States (California, Samsung – South KoreaGrowth Accelerators

The 5G enterprise market is driven by several critical factors, especially the growing demand for transformation and digital automation in various sectors. Companies are increasingly adopting advanced technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), Augmented Reality (AR) and Virtual Reality (VR) to improve operational efficiency, optimise processes and gain a competitive advantage. These technologies require robust, high-speed and low-latency connectivity that 5G provides exclusively. 5G's capacity to support a massive number of simultaneously connected devices, together with their low-latency communication resources (URLLC), is indispensable for applications such as smart factories, real-time remote monitoring, automated guided vehicles (AGVs) and immersive training simulations.

Another significant factor is the growing investment in private 5G networks. While 5G audience offers wide coverage, companies are increasingly recognising the benefits of dedicated private networks that offer improved security, greater control over data traffic, and custom network solutions adapted to specific industrial needs. This allows companies to optimise their internal communication and data flow, ensuring that mission-critical applications work perfectly without interference from the congestion of the public network.

5G Enterprise Market Segmentation analysis

The Asia Pacific 5G Enterprise is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Enterprise Networks, Private Networks, CSP Network, Hybrid Network, Others . The Application segment categorizes the market based on its usage such as Mobile Network, Communication, Drones, Others. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The 5G enterprise market is highly competitive, with major telecommunications players such as Ericsson, Nokia, Huawei and Cisco leading the accusation of providing 5G end-to-end solutions to companies. These companies are strongly investing in R&D to offer advanced network infrastructure, 5G private networks and border computing resources adapted to various sectors such as manufacturing, logistics and medical assistance. In addition, technology giants like Qualcomm, Intel and Samsung are strengthening the market with chipsets and hardware that support faster and more reliable connectivity. Strategic partnerships, mergers and acquisitions are also shaping the scenario, allowing companies to expand their market reach and technological abilities.

Startups and niche players are gaining strength, offering personalised 5G apps, particularly industrial automation and smart city initiatives. Regional telecommunications operators are also entering the space, especially in Asia Pacific and North America, capitalising on government support and increasing corporate demand. Competition is even more intensified by the need for data security, low latency and scalability, pushing companies to differentiate through innovation, specific vertical solutions and managed services. As the market matures, it is expected that the focus will change the implementation of infrastructure for monetisation through various cases of use.

Challenges In 5G Enterprise Market

The 5G corporate market faces several remarkable challenges that can slow its widespread adoption. The main one is the high cost of infrastructure implementation and development, which includes significant investments in new hardware, such as antennas, base stations and network equipment. For many companies, especially small and medium-sized companies, these initial and continuous maintenance costs can be prohibitive. In addition, the complexity of integration with IT systems and existing operational technology (OT) has a significant barrier, usually requiring specialised skills and causing operational interruptions during updates. Security and regulation concerns also appear in large, as companies should browse complex compliance landscapes and invest in robust cybersecurity measures to protect sensitive data.

Other important challenges include insufficient data subsidies and 5G (FWA) wireless access plans, which are often seen as very expensive or restrictive for intensive data in sectors. Limited availability of qualified personnel with 5G experience and the integration of IT/OT systems further complicate adoption, especially in industrial environments.

Risks & Prospects in 5G Enterprise Market

Market opportunities are abundant, particularly in sectors such as manufacturing, health, logistics and IT and telecommunications, where 5G allows automation, remote monitoring, augmented reality and seamless integration. AI and IoT integration with 5G, the development of 5G private networks and the rise of edge computing are the main trends that feed expansion. In addition, government initiatives, industry-specific solutions, and digital transformation efforts are accelerating adoption and innovation.

Regionally, North America currently leads the 5G corporate market due to advanced infrastructure, early implementation and strong investments in the private and public sectors, especially in the US and Canada. Meanwhile, Pacific Asia is designed to witness faster growth, driven by significant government-supported 5G projects, smart city initiatives and rapid digitisation in countries such as China, South Korea, Japan and India. Europe is also one of the leading participants, with Germany, France and the United Kingdom focusing on Industry 4.0 and the adoption of sustainable technology, while Latin America is emerging with early-stage adoption in the industrial automation and telecommunications sectors.

Key Target Audience

,

The main target audience of the 5G enterprise market includes large-scale companies, SMEs, industrial manufacturers and government agencies that seek enhanced connectivity, low latency and high bandwidth for digital transformation. These audiences cover industries such as manufacturing, health, logistics, energy and intelligent cities, where IoT's real-time, automation and integration are critical. Companies in these sectors require reliable and safe networks to support mission criticism, border computing and emerging technologies such as AI and AR/VR.

, Another important segment includes IT service providers, telecommunications operators and system integrators that allow 5G deployment and offer personalised solutions to companies. These stakeholders are interested in monetising 5G through value-added services and infrastructure management. Its priorities are in network slicing, private 5G networks and cloud-native architectures to provide personalised services that align with corporate requirements. Understanding these audiences helps suppliers develop industry-specific use cases and scalable business models.

Merger and acquisition

The 5G enterprise market has recently experienced significant fusion and acquisition activity (M&A), reflecting a tendency towards consolidation and strategic realignment. Notably, Vodafone and three from the United Kingdom were approved by the UK Competition and Market Authority in December 2024 to merge with the country's largest mobile network operator, serving more than 27 million customers. This £ 16.5 billion agreement includes commitments to invest £ 11 billion in updating 5G networks and implement short-term protections against price increases. Similarly, Swisscom completed its acquisition of € 8 billion from Vodafone Italia in December 2024, merging with Fastweb to improve its position in the Italian market. In the US, T-Mobile has announced plans to acquire US Cellular wireless and wireless operations for $4.4 billion to expand its customer base and 5G coverage.

However, not all efforts of mergers and acquisitions continued without problems. The US Department of Justice filed an antitrust action to block $14 billion from Hewlett Packard Enterprise by Juniper Networks, citing concerns about reducing competition in the wireless network. Meanwhile, Nokia has been actively restructuring its portfolio, acquiring Infinera for $2.3 billion in June 2024 to reinforce its optical networking resources and defile its device management businesses for Lumine Group for 185 million euros. These strategic movements indicate a focus on strengthening essential skills and adapting to the evolution of the 5G corporate scenario.

>

Analyst Comment

The global 5G business market is experiencing rapid growth, driven by increasing demand for high-speed, low-latency connections across industries. By 2024, the market was valued between $4.6 billion and $6.0 billion, with estimates indicating a jump to around $6.5 billion in 2025 and potentially over $82 billion by 2034. Key growth drivers include the adoption of private 5G networks, integration, the Internet of Things (IoT) and log initiatives, and artistic and smart city applications.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 5G Enterprise- Snapshot

- 2.2 5G Enterprise- Segment Snapshot

- 2.3 5G Enterprise- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: 5G Enterprise Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hybrid Network

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Private Networks

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Enterprise Networks

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 CSP Network

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: 5G Enterprise Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Mobile Network

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Drones

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Communication

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: 5G Enterprise Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Huawei – China

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Intel – United States

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cisco – United States (California

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ericsson – Sweden

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 NEC – Japan

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Nokia – Finland

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Qualcomm – United States

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 ZTE – China

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 AT&T – United States

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Samsung – South Korea

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of 5G Enterprise in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific 5G Enterprise market?

+

-

How big is the Asia Pacific 5G Enterprise market?

+

-

How do regulatory policies impact the 5G Enterprise Market?

+

-

What major players in 5G Enterprise Market?

+

-

What applications are categorized in the 5G Enterprise market study?

+

-

Which product types are examined in the 5G Enterprise Market Study?

+

-

Which regions are expected to show the fastest growth in the 5G Enterprise market?

+

-

Which application holds the second-highest market share in the 5G Enterprise market?

+

-

What are the major growth drivers in the 5G Enterprise market?

+

-

The 5G enterprise market is driven by several critical factors, especially the growing demand for transformation and digital automation in various sectors. Companies are increasingly adopting advanced technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), Augmented Reality (AR) and Virtual Reality (VR) to improve operational efficiency, optimise processes and gain a competitive advantage. These technologies require robust, high-speed and low-latency connectivity that 5G provides exclusively. 5G's capacity to support a massive number of simultaneously connected devices, together with their low-latency communication resources (URLLC), is indispensable for applications such as smart factories, real-time remote monitoring, automated guided vehicles (AGVs) and immersive training simulations.

Another significant factor is the growing investment in private 5G networks. While 5G audience offers wide coverage, companies are increasingly recognising the benefits of dedicated private networks that offer improved security, greater control over data traffic, and custom network solutions adapted to specific industrial needs. This allows companies to optimise their internal communication and data flow, ensuring that mission-critical applications work perfectly without interference from the congestion of the public network.