Asia-Pacific Anionic Surfactants Market – Industry Trends and Forecast to 2031

Report ID: MS-286 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Anionic Surfactants Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

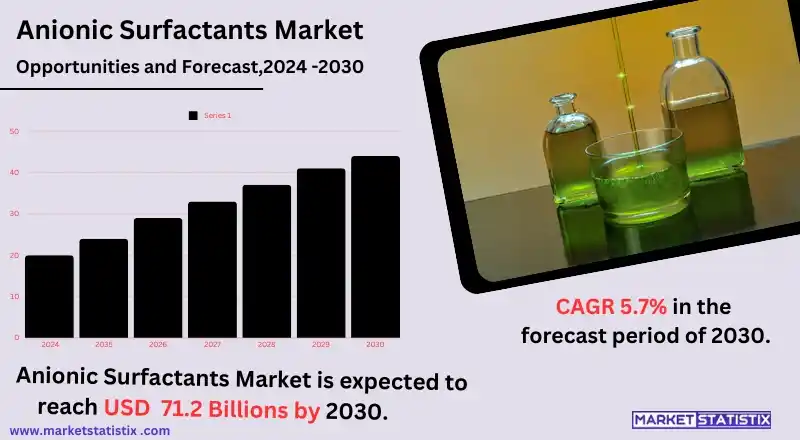

| Growth Rate | CAGR of 5.7% |

| Forecast Value (2031) | USD 71.2 Billion |

| By Product Type | Linear Alkylbenzene Sulfonate (LABS), Fatty Alcohol Sulfates, Others |

| Key Market Players |

|

| By Region |

Anionic Surfactants Market Trends

The market for anionic surfactants is anticipated to expand tremendously because of the wide application of their use in household and personal care products. Anionic surfactants are coming forward as important ingredients for use in detergents, shampoos, and body washes owing to their properties of effective cleaning and foaming performance. The market is valued close to USD 20.5 billion in 2022 and is expected to reach around USD 34.05 billion by 2032. About Asia-Pacific, it holds a significant part of the market due to its huge population, rapid urbanisation, and growing demand for personal care as well as home care products. The improving living standards and growing industries in the region contribute to the increasing demand. Moreover, consumers are increasingly inclined towards preferring green and sustainable products as a consequence of the growing demands for new products and the development of bio-based anionic surfactants towards global sustainability goals to create further scope in the market.Anionic Surfactants Market Leading Players

The key players profiled in the report are RSC Publishing, OnePetro, ACS Publications, INFLIBNET Centre, ASME Digital Collection, Laboratory of Formulation, Interfaces, Rheology and Processes, American Oil Chemists' Society, Vidyasagar University, National Institutes of Health (NIH), U.S. Environmental Protection Agency, USGS Publications Warehouse, Environmental Working Group (EWG)Growth Accelerators

The anionic surfactants market is driven primarily by the increasing demand from industries such as personal care, home care, and industrial cleaning. The rising awareness of hygiene and cleanliness has significantly boosted the use of products like detergents, shampoos, and dishwashing liquids, which heavily rely on anionic surfactants for their effective cleansing properties. Additionally, the growing urbanization and expanding middle-class population in emerging economies have contributed to the surge in demand for high-performance and cost-effective cleaning solutions, further propelling market growth. Another key driver is the adoption of anionic surfactants in industrial applications, such as oil and gas, agriculture, and textiles. These surfactants enhance the emulsification and dispersion processes, improving efficiency in various industrial operations. Moreover, the increasing focus on eco-friendly and biodegradable surfactant formulations to meet stringent environmental regulations has spurred innovations in the industry, opening new opportunities for growth.Anionic Surfactants Market Segmentation analysis

The Asia-Pacific Anionic Surfactants is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Linear Alkylbenzene Sulfonate (LABS), Fatty Alcohol Sulfates, Others . The Application segment categorizes the market based on its usage such as Household, Industrial, Personal Care, Agricultural. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The anionic surfactants market is highly competitive as different participants compete with their own regional or global players. Some of the key players in the industry are BASF SE, Dow Chemical Company, Akzo Nobel N.V., Stepan Company, etc. These companies have established various strategic initiatives, such as attempts at innovations in product development, mergers and acquisitions, and further expanding the capacities of manufacturing, all aiming towards increasing their position in the competitive market. Increasing consumption demand for cationic surfactants in detergents, personal care products, and other industrial cleaning applications is powerful enough, and this increases competition between players due to the investment required to fund products that are environmentally friendly and cost-efficient, compelling them to comply with consumer and regulatory preferences. The established giants are being contested by nascent niche entrants offering niche surfactant solutions in sustainable and biodegradable surfactants. But most of the regional companies will definitely benefit from the production cost and growing consumer base advantages, like the Asia-Pacific region, in competing against global giants.Challenges In Anionic Surfactants Market

Environmental and regulatory concerns pose a severe challenge to the anionic surfactants market. Increased awareness of the adverse ecological effects, such as the slow biodegradability and toxicity to aquatic life of synthetic anionic surfactants, has resulted in stringent regulations worldwide. Such pressures compel manufacturers to evolve into environmentally friendly alternatives, which, incidentally, in many cases, are costlier and require a research and development process that is too complex. Such regulations thus place limits on growth opportunities and profitability of the companies in the industry. Another major issue in the industry is that raw material prices keep changing, especially petroleum-based inputs for synthetic anionic surfactants. With supply chain disruptions and geopolitical tensions, along with the increasing competition for bio-based alternatives, volatility goes up in cost. In addition, the anticompetitive forces from the market, such as nonionic and cationic surfactants offering specific advantages in applications for personal care and industrial cleaning, will further limit the scalability and flexibility of anionic surfactants in the dynamic market environment.Risks & Prospects in Anionic Surfactants Market

Emerging demand in several industries, including personal care, household cleaning, and industrial sectors, fuels opportunities for the expansion of the anionic surfactants market. Furthermore, spurred creativity in the formulation and development of anionic surfactants, particularly by industries requiring sustainable solutions, is the demand for greener and biodegradable materials. Increased usage of personal care products such as shampoos, body washes, and detergents is expected as urbanisation and disposable income grow, particularly in emerging economies, thereby providing a further stimulus for market growth. Additionally, with strict requirements for hygiene in the health care and any newly instituted facility since the pandemic, there is greater demand for better surfactants in the industrial and institutional cleaning domain. Newer applications in agriculture, oil and gas, as well as textile processing, create other excellent opportunities for manufacturers. The growing competitive environment, competitive performance, growth, and environmental reduction improve research and development into advanced formulations. All these favourites create new growth opportunities in the market for anionic surfactants.Key Target Audience

Anionic surfactants are one of the major end-user markets: personal care, household cleaning, textiles, and agriculture. Personal care: whether shampoos, body washes, or skin care products, anionic surfactants are used by manufacturers because of their superior foaming and cleaning properties. Similarly, household cleaning products rely on these surfactants for increased efficacy in grease cutting and removal of stains in detergents, dishwashing liquids, or surface cleaners. The processing industry of textiles and leather forms a significant audience since surfactants play an important role in fabric conditioning and as dye dispersants.,, Among the key identified uses of the organic chemical in both agricultural and industrial applications is inclusion in the formulation of pesticides, herbicides, and industrial cleaners. Surfactants, in this case, anionic ones, become more important in this case when they tend to have oil recovery processes, as in the oil and gas industries. Enhanced oil recovery processes are being used by the oil and gas sector through these surfactants, while they are also being used in the pharmaceutical industry for drug formulations.Merger and acquisition

The surveillance of the Anionic Surfactants Market is done with quite a bit of activity taking place in mergers and acquisitions. Enhanced competition among the key players, such as AkzoNobel, BASF, Clariant, and Evonik, has encouraged these companies to form strategic alliances and acquire some other key players in the market. For example, AkzoNobel has invested huge amounts in production facilities, including a $41 million plant sited in Shanghai, to increase production for personal care and detergent applications. Such developments illustrate how much industry leaders are focusing on innovative and environmental regulations and the extent to which they are considering the mergers within which they work toward consolidating their market positions. >Analyst Comment

"Anionic surfactants are a key sector in the broader market, which is really quite major in size because of its usage in many industries. Basically, anionic surfactants are compounds that have a negatively charged hydrophilic head and an opposite hydrophobic tail at one end. These surfactants are primarily used for affecting surface tension or reducing the same to enable effective cleaning, emulsification, etc. These key factors, together with rising consumer demand in hygiene and cleaning products for household and personal care segments, will surely drive the market. In addition, penetrating more industries with anionic surfactants, such as oil recovery, textile processing, and metalworking, would also work well for the growth of the market."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Anionic Surfactants- Snapshot

- 2.2 Anionic Surfactants- Segment Snapshot

- 2.3 Anionic Surfactants- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Anionic Surfactants Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Linear Alkylbenzene Sulfonate (LABS)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Fatty Alcohol Sulfates

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Anionic Surfactants Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Household

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Personal Care

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Agricultural

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 RSC Publishing

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 OnePetro

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 ACS Publications

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 INFLIBNET Centre

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 ASME Digital Collection

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Laboratory of Formulation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Interfaces

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Rheology and Processes

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 American Oil Chemists' Society

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Vidyasagar University

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 National Institutes of Health (NIH)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 U.S. Environmental Protection Agency

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 USGS Publications Warehouse

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Environmental Working Group (EWG)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Anionic Surfactants in 2031?

+

-

Which type of Anionic Surfactants is widely popular?

+

-

What is the growth rate of Anionic Surfactants Market?

+

-

What are the latest trends influencing the Anionic Surfactants Market?

+

-

Who are the key players in the Anionic Surfactants Market?

+

-

How is the Anionic Surfactants } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Anionic Surfactants Market Study?

+

-

What geographic breakdown is available in Asia-Pacific Anionic Surfactants Market Study?

+

-

Which region holds the second position by market share in the Anionic Surfactants market?

+

-

Which region holds the highest growth rate in the Anionic Surfactants market?

+

-