Asia Pacific Bentonite Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-291 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Bentonite Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

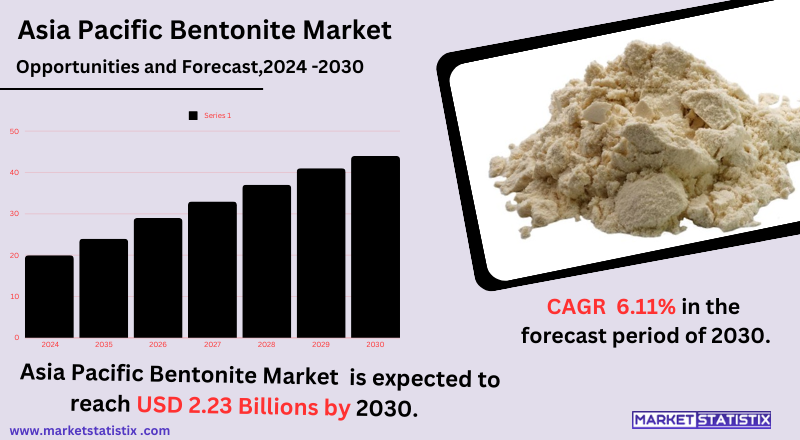

| Growth Rate | CAGR of 6.11% |

| Forecast Value (2030) | USD 2.23 Billion |

| By Product Type | Sodium Bentonite, Calcium Bentonite, Organoclays |

| Key Market Players |

|

| By Region |

Bentonite Market Trends

Currently, the bentonite market is projected to grow significantly due to the flexible applications bentonite has across several industries. Now, its utilisation is primarily in oil and gas drilling fluids to lubricate drills and prevent collapse of the wellbore during drilling. This sector still remains one of the most growing drivers of the market, proving much demand for energy coupled with specific exploratory activities. Furthermore, increasing bentonite use for environmental purposes—for example, in water treatment and as a natural sealant for landfills—is inviting a wider market for this commodity. An additional feature of the bentonite market is its increasing application in construction, especially for making concrete and stabilising soils. In addition, the growing demand of consumers for personal care products, especially facial masks and cosmetics containing bentonite, also informs market trends. Because people are not shying away from using natural and organic beauty and skin care products, the market can only be expected to burgeon further.Bentonite Market Leading Players

The key players profiled in the report are Ashapura Group, Bentonite Performance Minerals LLC., Black Hills Bentonite, LLC, Kunimine Industries Co. Ltd, Minerals Technologies Inc., Pacific Bentonite Ltd., Wyo-Ben Inc., Cimbar Performance Minerals Inc., Clariant AG, ImerysGrowth Accelerators

Diversity of applications in construction, drilling, and foundry industries makes bentonite a major driver of its market. It serves as a slurry ingredient in tunnelling and as a sealing agent in landfills and ponds in construction. Increasing infrastructure development, especially in developing economies, pushes increased bentonite use in civil engineering projects. In oil and gas activities, bentonite serves as an important component for drilling fluids, which cool, lubricate, and stabilise drill bits, and thus, account for substantial use in the energy sector. Moreover, it finds increasing usages in the agricultural industry as a soil conditioner and additives in animal feeds, paving the way for further growth in the market. Rising cognisance concerning the versatile properties of bentonite and an eco-friendly approach towards its utilisation boosts demand in different sectors, therefore playing a pivotal role in the overall expansion of the market.Bentonite Market Segmentation analysis

The Asia Pacific Bentonite is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Sodium Bentonite, Calcium Bentonite, Organoclays . The Application segment categorizes the market based on its usage such as Drilling Fluids, Foundry Sand, Civil Engineering. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive bentonite market comprises both international and regional players, dominating the business for a variety of applications, including drilling, foundry, construction, and the environmental industry. This study will deal with some of the most important market players, such as Ashapura Minechem, Imerys, and Halliburton. Such players are considered stalwarts in the market through their extensive portfolio, geographic reach, and vertical integration, thus making them providers of various bentonite grades for specific industrial needs. Such resourceful companies practice almost heft R&D spending to improve product quality and meet the increasing demand for materials brought into productive services in an environment-friendly and sustainable manner, which in turn builds a mosaic around them.Challenges In Bentonite Market

The bentonite market is subject to many types of problems, like variations in raw material prices and disruptions in the supply chain. The reserve of bentonite is mostly natural-mined. Thus, any kind of variation in the high-quality deposit’s availability would cause volatility in the prices of bentonite. Supply chain interruptions can also occur with respect to geopolitical affairs and transport problems. These interruptions could lead to inconsistency in the consumption of bentonite across industries like drilling, foundries, and agricultural activities. The other critical factor affecting the bentonite market is environmental concerns. It has been noted in recent years that mining operations are now being scrutinised for their environmental effects, including land degradation and water pollution caused by these operations. Regulatory pressures to have sustainable mining practices and reduce environmental harm may see operating costs increase for companies in the bentonite industry.Risks & Prospects in Bentonite Market

The significantly growing bentonite market offers a substantial opportunity in the oil and gas sector, especially for applications such as drilling. A significant application of bentonite is in drilling fluids, where it is widely used for stabilising boreholes and controlling fluid loss. Moreover, increasing adoption in the environmental industry, such as barriers and soil remediation, opens considerable market prospects for industries with sustainable solutions for waste management and land reclamation. Bentonite is also becoming increasingly popular as a soil conditioner and an animal feed additive, owing to its capacity to retain water and absorb nutrients in agriculture. The increase in organic cultivation and the increasing demand for healthier livestock feeds is a guarantee for a robust opportunity for market growth. Further, the cosmetic and pharmaceutical industries are studying the possible uses of bentonite in skincare products and medicines, and demand is mostly driven by consumers who prefer natural, non-toxic ingredients.Key Target Audience

The bentonite useful to the drilling, construction, and foundry industries utilizes unique properties such as viscosity, binding, and absorption. These industries are the primary customers for the bentonite market. Oil and gas drilling utilize bentonite as a drilling mud for cooling and lubricating drill bits and controlling pressure. Various waterproofing and soil stabilization applications in construction employ bentonite along with its use in cement and adhesive manufacture.,, Other potential bentonite market targets are manufacturers in agriculture, cosmetics, and the environment. Bentonite is proving to be increasingly helpful as a contrived moisture-absorbing agent in fertilizers and animal feeds for improved quality of soil. In the cosmetics domain, such properties are most valued. They have formulated skincare products, such as facial masks and exfoliants, that use bentonite.Merger and acquisition

Emerging trends in merger and acquisition activities within the bentonite market are being seen from the broad strategic imperative of expansion and sustainability among popular companies. In January 2024, GHCL Limited signed a memorandum of understanding to invest about USD 413 million in Gujarat, India, out of which investing specifically in mining bentonite and sands will comprise approximately USD 113 million. Such enhancement of production will cater to the wide spectrum of industries, including fertilisers, foundries, and cosmetics. For example, a Bosnian firm focused on bentonite products called Bentoproduct recently proposed acquiring Nemetali, a mining company in Bosnia, signalling further consolidation in the bentonite industry as consolidation continues. The bentonite market is booming significantly based on the increasing role of demands in construction and environmental applications. As such, industry players like Imerys, Ashapura Group, and Minerals Technologies Inc. are vigorously involved in mergers and acquisitions aimed at diversifying their product offerings and improving their operational efficiencies. It is expected that by 2034, the market would be valued at USD 2.6 billion by emphasizing sustainable and green products. Thus, the means of employing strategic collaboration and acquisition have been proven relevant for companies that wish to stay competitive. >Analyst Comment

"Bentonite refers to a dynamic and emerging market characterised by all-around applications of this clay mineral. Totally unique properties, including swelling capacity, thixotropy, and adsorption capability, are essential ingredients in various applications, such as oil and gas drilling, foundry, construction, and pharmaceuticals. The continued growth is expected owing to industrialization, infrastructure development, and the emergent application avenues such as environmental remediation and renewable energy that drive increasing demand for bentonite. Major market players have a keen eye for R&D to improve performance and sustainability in bentonite-based products."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bentonite- Snapshot

- 2.2 Bentonite- Segment Snapshot

- 2.3 Bentonite- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bentonite Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Sodium Bentonite

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Calcium Bentonite

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Organoclays

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Bentonite Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Drilling Fluids

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Foundry Sand

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Civil Engineering

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Ashapura Group

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Bentonite Performance Minerals LLC.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Black Hills Bentonite

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 LLC

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Kunimine Industries Co. Ltd

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Minerals Technologies Inc.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Pacific Bentonite Ltd.

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Wyo-Ben Inc.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Cimbar Performance Minerals Inc.

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Clariant AG

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Imerys

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Bentonite in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific Bentonite market?

+

-

How big is the Asia Pacific Bentonite market?

+

-

How do regulatory policies impact the Bentonite Market?

+

-

What major players in Bentonite Market?

+

-

What applications are categorized in the Bentonite market study?

+

-

Which product types are examined in the Bentonite Market Study?

+

-

Which regions are expected to show the fastest growth in the Bentonite market?

+

-

Which application holds the second-highest market share in the Bentonite market?

+

-

Which region is the fastest growing in the Bentonite market?

+

-