Global Commercial & Corporate Card Market Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-476 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Commercial & Corporate Card Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

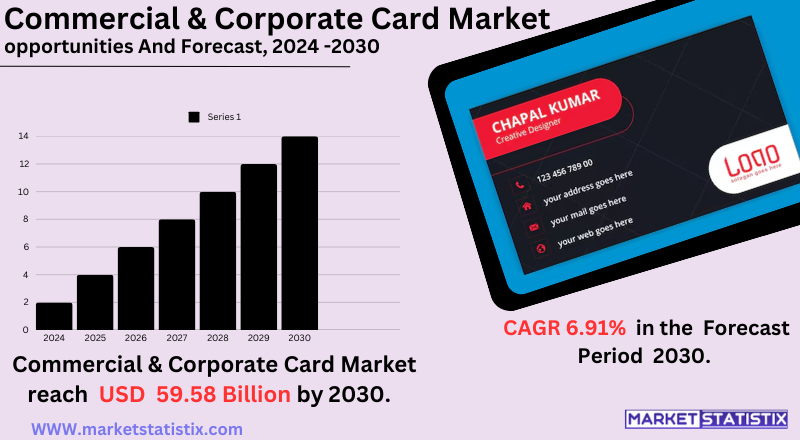

| Growth Rate | CAGR of 6.91% |

| Forecast Value (2030) | USD 59.58 Billion |

| By Product Type | Open-Loop Cards, Closed-Loop Cards |

| Key Market Players |

|

| By Region |

Commercial & Corporate Card Market Trends

The commercial & corporate card market is going through strong digital change with a strong movement towards virtual cards and mobile payments. This development is responding to the growing need for secure, convenient, and contactless payments. There's also a rise in focus on expense management platforms that are integrated with real-time data analytics, expense reporting automation, and direct integration with accounting systems. Market analysis depicts a concentration on improving user experience and security. Artificial intelligence (AI) and machine learning (ML) are being implemented to identify fraudulent activity and deliver tailored insights. Additionally, there's an increasing call for sustainable and socially responsible card programs, prioritising environmental consideration and ethical procurement. Globalisation of business processes is also spurring demand for multi-currency cards and cross-border payment platforms.Commercial & Corporate Card Market Leading Players

The key players profiled in the report are Hang Seng Bank (Hong Kong), Bank of Brazil (Brazil), Discover Financial Services (United States), Chase Commercial Banking (United States), MUFG (Japan), Mizuho (Japan), Synchrony Financial (United States), SBI Holdings (Japan), SMBC (Japan), Bank of America Merrill Lynch (United States), American Express (United States), Citigroup (United States), Wells Fargo & Company (United States), SimplyCash (United States), Banco Itau (Brazil), Sodexo (France), Bank of East Asia (Hong Kong), Resona Bank (Japan), U.S. Bancorp (United States), Diner’s Club (United States), JP Morgan (United States), MasterCard (United States), OtherGrowth Accelerators

The commercial & corporate card market is mainly fuelled by the rising requirement for enterprises to maximise expense control and simplify financial processes. Major drivers are the expanding use of digital payment systems, the need for increased transparency and spending control, and the intent to automate expense reporting. Furthermore, the market is fuelled by advantages to companies, including better cash flow management, better data analysis of spending behaviour, and earning rewards and rebates. Greater emphasis on corporate governance and compliance also fuels demand for commercial cards, as they offer comprehensive audit trails and make it easier to comply with regulations. The incorporation of advanced technologies, such as AI and machine learning, for fraud prevention and expense categorisation also bolsters the growth of the market.Commercial & Corporate Card Market Segmentation analysis

The Global Commercial & Corporate Card is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Open-Loop Cards, Closed-Loop Cards . The Application segment categorizes the market based on its usage such as SMEs, Large Enterprises. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The commercial & corporate card market has high susceptibility to competition, but it is occupied mostly by major financial institutions and payment networks. Emerging fintech firms contend with the established banks and credit card companies because of innovative solutions. Competition takes place based on credit limits up to which a customer can make use of a card, reward programs, expense management tools, and integration. Traditional banks use their existing connections and trust, while fintech has been hitting at speed, using user-friendly interfaces with specialised features useful to certain business needs. Another interesting trend in this market is the many partnerships and alliances being formed between banks and technology providers to better their offerings.Challenges In Commercial & Corporate Card Market

The Commercial & Corporate Card Market is also confronted with a number of key challenges, such as growing regulatory pressure and the requirement to meet changing data privacy and security regulations. Combating fraud and risk management are still top priorities, calling for ongoing investment in sophisticated technology. The market is also very competitive, with larger established players and new fintech firms competing for market share. To keep up with the fast speed of technological evolution, for example, the emergence of digital wallets and instant payment systems, is also a major challenge. In addition, economic uncertainty and changing interest rates may affect corporate expenditures and card usage, thereby affecting issuers. Sustaining customer relationships and acquiring new customers in an over-saturated market involves the provision of differentiated values and customised service. Lastly, providing hassle-free cross-border payments and coping with divergent sets of regulations within various countries remain a challenge to issuers based across the world.Risks & Prospects in Commercial & Corporate Card Market

The corporate and commercial card market has high opportunities fuelled by the expansion of digital payment solutions, more business travel, and increased expense management tool demand. The key opportunities are virtual card expansion, which provides increased control, fewer fraud risks, and more flexibility. New technologies such as blockchain and mobile payments will influence the future of the market by facilitating more secure and efficient transactional processes. Geographically, North America leads as the biggest market for corporate and commercial cards, followed by Europe and Asia-Pacific. The North American market is boosted by strong demand from big companies and government agencies, whereas Europe and Asia-Pacific are growing because of rising usage of digital payments. Asia-Pacific nations such as China and India are experiencing speedy growth in corporate card business based on growing sectors of business and growing adoption of digital payments. Latin America, the Middle East, and Africa also present the potential for expansion, though their market shares are smaller. As a whole, the market is very competitive, with industry giants such as American Express and Mastercard holding command.Key Target Audience

The corporate and commercial card market targets mainly large companies and small to medium-sized businesses (SMEs). Large companies use these cards to simplify expense management, improve operational effectiveness, and prevent fraud, gaining full-fledged features like advanced analytics and added security. In the same vein, SMEs use commercial cards to better control expenses, optimise cash flow, and ease accounting procedures, tending to avail themselves of customised solutions that meet their individual requirements., Furthermore, the market caters to different industry sectors such as retail, hospitality, healthcare, transport, and manufacturing. The retail sector, for example, utilises commercial cards to enable smooth transactions and effectively handle supplier payments. The specific requirements of each industry propel the uptake of certain card features, emphasising the need for tailored solutions in the commercial and corporate card market.Merger and acquisition

The corporate and commercial card industry has seen considerable merger and acquisition activity in recent times, which indicates a pattern of consolidation and growth. Of particular interest, late 2024 saw Capital One Financial Corporation launching a $35 billion offer to purchase Discover Financial Services. The strategic act is designed to form the biggest U.S. credit card issuer by balance outstanding and the sixth-largest bank by assets. The deal is expected to go through smoothly in the pro-business regulatory climate of the present government, which is likely to benefit such mergers. In the travel industry, American Express Global Business Travel (Amex GBT) made an offer of $570 million for the acquisition of competitor CWT. The UK's Competition and Markets Authority (CMA) initially felt that the merger would substantially reduce competition. But after considering fresh evidence of CWT's poorer financial health and the availability of alternative suppliers, the CMA provisionally cleared the deal in early 2025. This is a reflection of the CMA's revised strategy under pressure from the government to facilitate economic growth and investment, weighing consumer protection against a pro-business mandate. >Analyst Comment

The commercial & corporate card market is witnessing steady growth due to growing acceptance of digital payment solutions and requirements from companies to improve expense management. Some of the core trends that are happening in the market include increased usage of virtual cards for secure transactions online, the use of AI and machine learning to detect fraud and analyse expenses, and increased requirements for mobile-first solutions. The market is also driven by the growth of e-commerce and the globalisation of business activities, which require secure and efficient payment mechanisms. In addition to this, small and medium enterprises are also increasingly using these card solutions, not only big companies.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Commercial & Corporate Card- Snapshot

- 2.2 Commercial & Corporate Card- Segment Snapshot

- 2.3 Commercial & Corporate Card- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Commercial & Corporate Card Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Open-Loop Cards

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Closed-Loop Cards

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Commercial & Corporate Card Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 SMEs

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Large Enterprises

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 American Express (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Banco Itau (Brazil)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Bank of America Merrill Lynch (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Bank of Brazil (Brazil)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Bank of East Asia (Hong Kong)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Chase Commercial Banking (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Citigroup (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Diner’s Club (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Discover Financial Services (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Hang Seng Bank (Hong Kong)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 JP Morgan (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 MasterCard (United States)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Mizuho (Japan)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 MUFG (Japan)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Resona Bank (Japan)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 SBI Holdings (Japan)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 SimplyCash (United States)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 SMBC (Japan)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 Sodexo (France)

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Synchrony Financial (United States)

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 U.S. Bancorp (United States)

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 Wells Fargo & Company (United States)

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 Other

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Commercial & Corporate Card in 2030?

+

-

Which type of Commercial & Corporate Card is widely popular?

+

-

What is the growth rate of Commercial & Corporate Card Market?

+

-

What are the latest trends influencing the Commercial & Corporate Card Market?

+

-

Who are the key players in the Commercial & Corporate Card Market?

+

-

How is the Commercial & Corporate Card } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Commercial & Corporate Card Market Study?

+

-

What geographic breakdown is available in Global Commercial & Corporate Card Market Study?

+

-

Which region holds the second position by market share in the Commercial & Corporate Card market?

+

-

How are the key players in the Commercial & Corporate Card market targeting growth in the future?

+

-