Asia Pacific Cyber Attack Simulation Tools Market – Industry Trends and Forecast to 2030

Report ID: MS-978 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The cyber-attack simulation tools market covers software solutions that allow organizations to proactively evaluate and strengthen their cybersecurity defences, emulating real-world attack scenarios. These tools simulate various cyber threats – such as phishing, ransomware and side motion attacks – in controlled environments, allowing security teams to identify vulnerabilities, test incident response protocols, and validate the effectiveness of existing security controls. By leveraging automation and integration with structures such as Mitre Att & CK, these platforms provide continuous and comprehensive evaluations of an organisation's safety posture. Industries such as finance, medical assistance and government are particularly investing in these tools to improve their resilience against evolving cyber threats.

Cyber Attack Simulation Tools Report Highlights

| Report Metrics | Details |

|---|---|

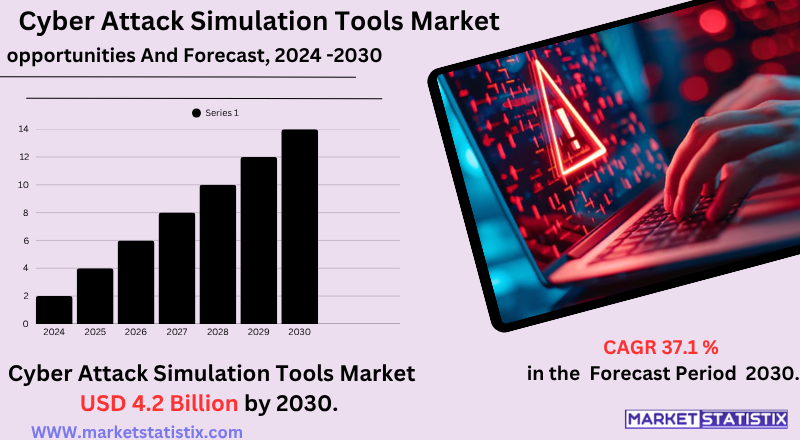

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 37.1% |

| Forecast Value (2030) | USD 4.2 Billion |

| By Product Type | On-Premise, Cloud-Based |

| Key Market Players |

|

| By Region |

|

Cyber Attack Simulation Tools Market Trends

The main trends indicate a strong focus on AI integration and machine learning (ML), allowing for more realistic, dynamic and automated attack simulations for continuous safety validation. There is a remarkable change for cloud-based solutions for scalability and ease of deployment, serving large companies and a rapidly growing SMB segment. In addition, the market emphasises integration with existing safety tools such as SIEM and sounding for simplified threat detection and response and increasing proactive safety posture management demand to identify vulnerabilities before real attacks occur, finally reducing general cyber risk.

Cyber Attack Simulation Tools Market Leading Players

The key players profiled in the report are Verodin (USA), Cyberbit (Israel)CyCognito (USA), IBM Corporation (USA), Cymulate (Israel), Netragard LLC (USA), SafeBreach (Israel), Picus Security (Turkey), Sophos Ltd. (UK), Cronus-Cyber Technologies (Israel), NopSec (USA), AttackIQ (USA), FireEye (USA), Rapid7, Inc. (USA), XM Cyber (Israel)Growth Accelerators

- Escalating Cyber Threats: Increasing frequency and sophistication of cyber-attacks, including ransomware and advanced persistent threats, are attractive organizations to adopt simulation tools for proactive defence.

- Regulatory Compliance Requirements: Strict data protection laws such as GDPR and HIPAA require regular security assessments, boosting simulation tools to ensure compliance.

- Integration of AI and Machine Learning: AI and ML incorporation enhances simulation tools, allowing the detection and response of more sophisticated and automated threats.

- Adoption of Cloud-Based Solutions: Change to cloud computing requires scalable and flexible safety solutions, with simulation tools providing continuous tests in dynamic cloud environments.

Cyber Attack Simulation Tools Market Segmentation analysis

The Asia Pacific Cyber Attack Simulation Tools is segmented by Type, Application, and Region. By Type, the market is divided into Distributed On-Premise, Cloud-Based . The Application segment categorizes the market based on its usage such as Electrical & Electronics, BFSI, Education & Researc, Automobile, Aerospace & Defense, Healthcare, Retail & E-Commerce, Other. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The cyberattack simulation tools market is characterised by intense competition between established cyber security giants and specialised violation and attack suppliers (BAS). Players – such as Chave, Cymlate, Picus Security, Sperach, XM Cyber and IBM– are continually innovating. Real-time trends show a strong emphasis on the integration of AI and machine learning for more realistic and adaptive attack simulations, allowing proactive identification of vulnerabilities. There is a significant impulse towards continuous safety validation to ensure that organizations are always updated against evolving threats. North America currently leads the market due to high cybersecurity investments, while the Asia-Pacific region is experiencing rapid growth.

Challenges In Cyber Attack Simulation Tools Market

- High implementation costs: The significant initial investment required for licensing, integration, training and maintenance can be prohibitive, especially for small and medium-sized companies operating with limited budgets.

- Complexity of integration: The incorporation of existing security infrastructure simulation tools usually involves complex processes, requiring additional integration hardware, software and integration efforts.

- Scarcity of qualified professionals: Managing and effectively interpreting the results of these tools requires specialised cybersecurity experience, which is currently missing globally.

- Demonstrating Return on Investment (ROI): Organizations may find it difficult to quantify the benefits of these tools, making it difficult to justify the investment to stakeholders.

Risks & Prospects in Cyber Attack Simulation Tools Market

Cyber-attack simulation tools (also known as violation and attack simulation, or BAS) have significant opportunities due to the increasing volume and sophistication of cyber threats, along with growing regulatory compliance demands (e.g. GDPR, HIPAA). Real-time data indicates a strong growth trajectory driven by the need for continuous safety validation beyond traditional penetration tests, especially with the broad adoption of cloud infrastructure and remote work. The main opportunities are in the integration of AI and machine learning for more realistic and automated attack simulations, providing deeper information about an organisation's actual security posture and expanding in emerging markets such as Asia Pacific.

Key Target Audience

- ,

- Healthcare Providers: Adopt simulation tools to protect patient data and ensure compliance with health information regulations. ,

- IT & Telecom Companies: Implement these solutions to secure complex networks and maintain service integrity. ,

These sectors are increasingly investing in cyber-attack simulation tools to proactively identify and mitigate potential security threats.

Merger and acquisition

- High implementation costs: The significant initial investment required for licensing, integration, training and maintenance can be prohibitive, especially for small and medium-sized companies operating with limited budgets.

- Complexity of integration: The incorporation of existing security infrastructure simulation tools usually involves complex processes, requiring additional integration hardware, software and integration efforts.

- Scarcity of qualified professionals: Managing and effectively interpreting the results of these tools requires specialised cybersecurity experience, which is currently missing globally.

- Demonstrating Return on Investment (ROI): Organizations may find it difficult to quantify the benefits of these tools, making it difficult to justify the investment to stakeholders.

Analyst Comment

The cyber-attack simulation tools market is experiencing significant growth, driven by the increasing frequency and sophistication of cyber threats. By 2025, the market should reach approximately $ 2.59 billion. This expansion is fuelled by the growing need for organizations to proactively evaluate and strengthen their cybersecurity defences, meet rigorous data protection regulations, and address the shortage of qualified cybersecurity professionals. The integration of artificial intelligence and machine learning into simulation tools enhances the realism and effectiveness of threat scenarios, allowing continuous safety assessments and improved incident response strategies. Industries such as finance, medical assistance and government are particularly investing in these tools to reinforce their resilience against evolving cyber threats.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Cyber Attack Simulation Tools- Snapshot

- 2.2 Cyber Attack Simulation Tools- Segment Snapshot

- 2.3 Cyber Attack Simulation Tools- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Cyber Attack Simulation Tools Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 On-Premise

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cloud-Based

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Cyber Attack Simulation Tools Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Healthcare

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Education & Researc

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 BFSI

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Automobile

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Aerospace & Defense

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Electrical & Electronics

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Retail & E-Commerce

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Other

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

6: Cyber Attack Simulation Tools Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AttackIQ (USA)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Cronus-Cyber Technologies (Israel)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cyberbit (Israel)CyCognito (USA)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Cymulate (Israel)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 FireEye (USA)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 IBM Corporation (USA)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Netragard LLC (USA)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 NopSec (USA)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Picus Security (Turkey)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Rapid7

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Inc. (USA)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 SafeBreach (Israel)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Sophos Ltd. (UK)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Verodin (USA)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 XM Cyber (Israel)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Cyber Attack Simulation Tools in 2030?

+

-

Which type of Cyber Attack Simulation Tools is widely popular?

+

-

What is the growth rate of Cyber Attack Simulation Tools Market?

+

-

What are the latest trends influencing the Cyber Attack Simulation Tools Market?

+

-

Who are the key players in the Cyber Attack Simulation Tools Market?

+

-

How is the Cyber Attack Simulation Tools } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Cyber Attack Simulation Tools Market Study?

+

-

What geographic breakdown is available in Asia Pacific Cyber Attack Simulation Tools Market Study?

+

-

Which region holds the second position by market share in the Cyber Attack Simulation Tools market?

+

-

How are the key players in the Cyber Attack Simulation Tools market targeting growth in the future?

+

-

,,

- ,

- Integration of AI and Machine Learning: AI and ML incorporation enhances simulation tools, allowing the detection and response of more sophisticated and automated threats. ,,

- ,,

- ,, ,,

,

,,

- ,,

- Adoption of Cloud-Based Solutions: Change to cloud computing requires scalable and flexible safety solutions, with simulation tools providing continuous tests in dynamic cloud environments. ,

,