Global Flip Flops Market Trends and Forecast to 2030

Report ID: MS-540 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Flip Flops Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

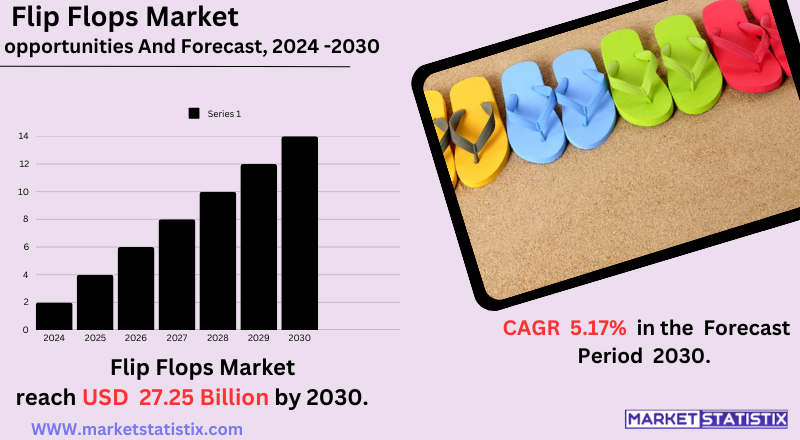

| Growth Rate | CAGR of 5.17% |

| Forecast Value (2030) | USD 27.25 Billion |

| By Product Type | Ethylene-vinyl acetate (EVA), Polyvinyl chloride (PVC), Rubber flip-flops, Others |

| Key Market Players |

|

| By Region |

Flip Flops Market Trends

During recent shifts in the flip-flops market inclining towards more comfort and eco-friendliness, in particular, the growing appeal of ergonomic design with cushioned soles on the previously basic flat models. With ecological awareness developing amongst consumers, the new market trend is recycled plastics and natural rubber as comparable materials. Much more, brands show concern in durability and quality through manufacturing styles that an individual can wear for the sake of the daily grind. On the other side, online selling is quite skyrocketing in this market because it provides a wider reach to various brands and designs. Social networks and influencer marketing play a crucial role in this trend creation and consumer preference formatting. The athleisure dandy now affects flip-flop design, angling somewhere between casual and sporty. Branded collaborations and limited editions have also been emerging more regularly, stirring the gossip pot and thereby increasing sales. In summary, the market in flip-flops is compliant with requests for comfort, sustainability, and style and has an important influence on digital marketing and selling online.Flip Flops Market Leading Players

The key players profiled in the report are Crocs, Kappa, Adidas AG, C. & J. Clark International Ltd, Nike, Inc., Deckers BrandsFat Face, Havaianas, Skechers USA, Inc, Tory Burch LLCGrowth Accelerators

The flip-flops business emerges from demand for economy and convenience—it is thus fairly universal domestically for leisurely footwear in casuals. Such items receive big seasonal boosts in sales, most pronouncedly during the warm months and in tropical countries. Fit for casual and relaxed fashion styles from athleisure to beachwear, much was recently added in terms of market possibilities. Travel and tourism also work within this as flip-flops are mostly the vacation for travel destinations with beaches. The increase in the size of online retailing has also made accessibility easy, enabling individuals to search and buy many varieties of flip-flops from their houses and thus having the market beyond geographical confines. Also, the growing inclination from the consumers to have comfortable and casual footwear is in favour of flip-flops. Practical, economical, and ever-changing fashion trends seal the future upward movement of the market for flip-flops.Flip Flops Market Segmentation analysis

The Global Flip Flops is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Ethylene-vinyl acetate (EVA), Polyvinyl chloride (PVC), Rubber flip-flops, Others . The Application segment categorizes the market based on its usage such as Men, Woman, Kids. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The flip-flops market is rather competitive since there is a good mix of global brands, well-known specialised footwear companies, and numerous local manufacturers. Major players engage in brand-building, product innovation, and superb distribution as weapons of market competition. Brand differentiation plays a crucial part, with the companies promoting their styles, comfort, durability, and sustainability. Price competition prevails in the mass market, while the premium segment focuses on quality materials and original designs. The advent of e-commerce has further increased competition, providing opportunities for smaller brands and direct-to-consumer businesses to reach out to a wider audience.Challenges In Flip Flops Market

In addition to these inhibiting factors for the growth of the flip-flop market, environmental issues are a major concern regarding the use of non-biodegradable and synthetic materials such as PVC and rubber, which are considered major contributors to plastic pollution. With over a billion flip-flops produced every year, disposal issues and environmental impacts have attracted the scrutiny of regulators and criticism of consumers. Another leading challenge for the flip-flop market remains high competition from local and unorganised players offering alternatives at very low costs, thus allowing established brands to hold on to their market share in price-sensitive regions. Supply chain disruptions also plague the markets, caused by geopolitical tensions or raw material shortages, delaying and hiking costs. Adapting to changes presents an opportunity for companies to innovate: sustainable materials and green product durability combined with a well-thought-out e-commerce expansion plan allowing for discussion on environment-friendly issues.Risks & Prospects in Flip Flops Market

There are great growth potentials in the flip-flops market owing to high demand for economical, comfortable, and fashionable footwear. The changing dynamics of fashion trends from casual to beachwear, especially in a hot climate, expedite the growth rate for this market. Customisation trends mean personalisation and collaborations have new avenues of income potential for manufacturers. The growth of e-commerce and direct-to-consumer routes opens the market to more clientele; hence, brands could reach a much larger target audience quicker. From a regional perspective, the Asia-Pacific aggregate holds the highest in terms of flip-flops demand—substantially backed up by high production capacity, inexpensive labour, and good consumer bases from countries like China, India, and Indonesia. Demand for premium to eco-friendly flip-flops is gaining traction in North America and Europe, with brands focusing on sustainability in terms of materials and production practices. Latin America constitutes an important market considering the beach culture exerted through Brazil, while the Middle East and Africa can be considered potential markets given rising urbanisation and disposable incomes. The market is influenced by changing consumer preferences, sustainability trends, and growing digital retail avenues.Key Target Audience

The key target audience for the flip-flops market is very heterogeneous concerning demographic and lifestyle spread. Most of the casual wear consumers account for a majority of the target market for flip-flops, especially those residing in warmer climates or those flocking to beaches or pools. Students, youngsters, and families look for comfortable yet affordable footwear for summer or tropical use. A significant target group is made up of travellers and tourists. Flip-flops are ideal for travel, being easily packed in suitcases.,, Some niche aspects the market serves include athletes needing footwear for poolside and others who want comfortable slippers for home. The consumers, whose main characteristics might be divided into such factors as price sensitivity and brand loyalty, form segments of the flip-flop market. Budget preference consumers emphasise low prices and function, while fashion-orientated consumers may go for current designs and brand names. Flip-flops come appealingly brightly coloured or theme-populated for children and teenagers. Niche markets also deal in orthopaedic flip-flops employed for comfort and support. Further, the environmentally conscious segment of the consumer base has increasingly found sustainable and eco-friendly options in flip-flops catered to them. Henceforth, the targeting in the market will segment to address the needs of all these divergent groups.Merger and acquisition

The mergers and acquisitions scenario in the flip-flops market in the last couple of years has become an industry-wide trend: Companies have been making strategic moves to strengthen their market hold and product range. In February 2022, Crocs acquired HEYDUDE, a casual footwear brand, with the ambition of furthering HEYDUDE's growth and reach by employing Crocs' worldwide infrastructure. In April 2023, it was similarly announced that Skechers was going to carry out the acquisition of Sports Connection Holding, a Scandinavian distributor, in an effort to cement its presence in Europe. These strategic acquisitions show a prevalent tendency among players to diversify their portfolios and reach out to newer segments of consumers in the flip-flops and casual footwear business. Such companies as Crocs and Skechers plan to compete better through their acquisition of established brands and distribution networks so they can take advantage of the growing consumer demand for comfort-driven footwear. >Analyst Comment

The flip-flops market experiences seasonal highs primarily due to warm weather and periods of holidays. The market is characterised by high volumes and price-sensitive demands as a wide array of consumers seek affordable and convenient options. The market is segmented based on material specifications, where rubber and foam constitute the more basic and cheaper variants, while leather and synthetic types drive the more designer-orientated sales. E-commerce came into the picture, extending the distribution in many directions with a variety of styles and brands, resulting in ever-escalating competition. Comfort and ergonomics have also become an increasing focus, with brands incorporating features like arch support and cushioned soles.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Flip Flops- Snapshot

- 2.2 Flip Flops- Segment Snapshot

- 2.3 Flip Flops- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Flip Flops Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Ethylene-vinyl acetate (EVA)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Polyvinyl chloride (PVC)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Rubber flip-flops

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Flip Flops Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Men

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Woman

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Kids

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Havaianas

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Skechers USA

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Crocs

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Deckers BrandsFat Face

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Adidas AG

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 C. & J. Clark International Ltd

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Kappa

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Nike

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Tory Burch LLC

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Flip Flops in 2030?

+

-

Which type of Flip Flops is widely popular?

+

-

What is the growth rate of Flip Flops Market?

+

-

What are the latest trends influencing the Flip Flops Market?

+

-

Who are the key players in the Flip Flops Market?

+

-

How is the Flip Flops } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Flip Flops Market Study?

+

-

What geographic breakdown is available in Global Flip Flops Market Study?

+

-

Which region holds the second position by market share in the Flip Flops market?

+

-

Which region holds the highest growth rate in the Flip Flops market?

+

-