Global Horse Riding Equipment Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-492 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Horse Riding Equipment Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

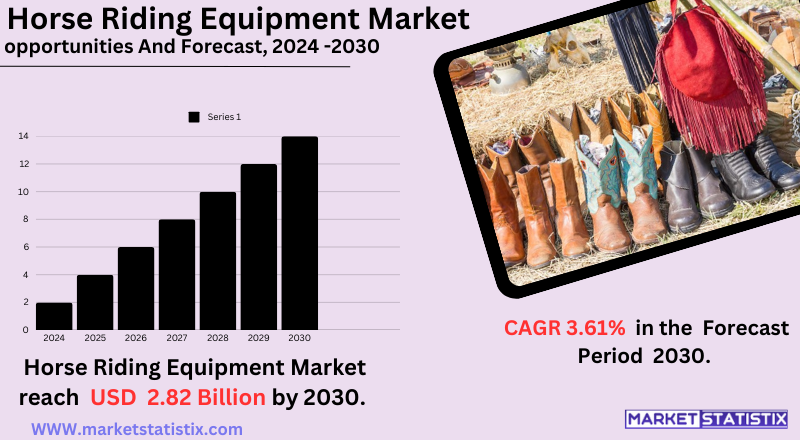

| Growth Rate | CAGR of 3.61% |

| Forecast Value (2030) | USD 2.82 Billion |

| By Product Type | Helmet, Safety Vest, Rider Equipment, Pants, Boots, bridles, stirrups, Equine Equipment, saddles, Others |

| Key Market Players |

|

| By Region |

|

Horse Riding Equipment Market Trends

Technological momentum and shifting consumer preferences are strong driving forces of several interesting phenomena seen in the horse-riding equipment market. One of them is the move toward the use of advanced materials: Composites of low weight and breathable fabrics are being used to enhance rider comfort and horse performance. Also being avidly sought nowadays are smart equestrian devices, of the kind of smart GPS for tracking, smart wearables for horse health monitoring, and tools to aid with training. Besides, the market is also seeing an optimal growth in e-commerce, which is comfortable for consumers to gain access to innumerable product options and brands. Customisation and personalisation are very much in vogue; riders want equipment tailored to their specific needs and preferences. The market is rife with innovation, sustainability, and personalisation, capable of catering to the ever-changing needs of both riders and horses.Horse Riding Equipment Market Leading Players

The key players profiled in the report are Resistol (United States), Mountain Horse (United States), Cashel Company (United States), Dainese (Italy), Colonial Saddlery (India), Cavallo GmbH (Germany), Antares Sellier (France), Fabtron Inc. (United States), Charlie1Horse (United States), Justin Boots (United States), Decathlon (France), HKM Sports Equipment (Germany), Georg Kieffer Sattlerwarenfabrik GmbH (Germany), Professional's Choice (United States)Growth Accelerators

The ever-increasing popularity of equestrian sports and recreational riding is the major driving force behind the horse-riding equipment market. The increase in the participation of amateurs and professionals for riding now translates directly into an increased demand for extreme essential equipment, such as saddles, bridles, and protective gear. Growing awareness about horse welfare and rider safety is also a major factor in driving consumers to purchase quality, reliable products that prioritize comfort and protection. In addition, innovations in materials and technologies spur the market development. Current innovations focus on developing equipment into lighter, durable, and ergonomic designs, improving its performance and user experience. Social media and online communities should be seen as influential as they foster knowledge and trends exchanged among equine enthusiasts, thus influencing demand for certain products and brands. Thus, the digital connectivity increases the market reach and influences consumer patterns thereby contributing to the overall growth of the market.Horse Riding Equipment Market Segmentation analysis

The Global Horse Riding Equipment is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Helmet, Safety Vest, Rider Equipment, Pants, Boots, bridles, stirrups, Equine Equipment, saddles, Others . The Application segment categorizes the market based on its usage such as Sports Retail, Independent Sports Outlet, Chain, Hypermarket and supermarket, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the Horse-Riding Equipment Market has a mixture of established international brands and smaller specialised manufacturers serving niche equestrian disciplines. These key players focus on product innovation, quality, and brand reputation to gain a competitive edge. They are also investing more into research and development to offer advanced materials and ergonomic designs for comfort and safety for both horse and rider. The shift toward customisation is also noted, with companies developing saddles, bridles, and other equipment according to the unique preferences of the rider and the needs of the horse. The diversified distribution channels range from brick-and-mortar tack shops to online retailers and direct sales through brand websites, causing intense competition for consumer attraction.Challenges In Horse Riding Equipment Market

The horse-riding equipment market is dogged by a host of challenges, including the increasing price of quality equipment, which limits accessibility for beginners and budget buyers. One of the more expensive items considered luxury (saddles, helmets, boots, etc.) makes it a challenge for some riders to invest in basic gear. Many counterfeit and low-quality products can, by contrast, threaten rider safety and damage the credibility of honest brands. Apart from being dangerous products themselves, counterfeit items represent unfair competition to manufacturers operating with safety and durability standards. Another big challenge is the regulatory requirements facing the market in various states, especially where safety-relevant equipment like helmets and body protectors is concerned. Different certification standards increase production costs and complexity for manufacturers. Furthermore, since this market has a seasonal demand design, demand fluctuates, affecting revenue stability. Also, in addition to supply-chain disruptions and rising raw material costs, these are other operational issues manufacturers face in maintaining profitability while insisting on high quality.Risks & Prospects in Horse Riding Equipment Market

The horse-riding equipment market holds lucrative opportunities for growth, given the increased interest in equestrian activities, rise in disposable income, and an influx of safety and comfort for the riders and the horses alike. Added to these trends is the convenience that has enabled consumers worldwide to find a plethora of equipment thanks to the growing e-commerce platforms. There are also opportunities for the markets with concerns for their consumer base regarding sustainable materials and eco-friendly designs, as well as the newer markets that are becoming popular with equestrians. In terms of geographical market share, Europe is in control with a considerable share of the pie because equestrian sports have a very strong cultural presence in the region, and consumers spend high amounts on premium equipment. The U.S. market is still quite steadily growing as there's a consistent participation for equestrian activities across a wide demographic range. Meanwhile, Asia-Pacific is emerging as potentially lucrative due to the combination of urbanisation, rising disposable incomes, and growing interest in recreational horse riding. Such regional dynamics well present the market potential for the horse-riding equipment in a globalised sense across developed and developing regions.Key Target Audience

In the horse-riding equipment market, the target audience includes recreational riders, competitive equestrians, and equestrian institutions such as riding schools and clubs. Most often, recreational riders range from beginners to hobbyists, and this segment usually seeks safety gear such as helmets and vests to help increase the enjoyment of their riding experience. Competitive equestrians engaged in sports such as dressage, show jumping, and racing require equipment that is tailored for performance in precision and durability. They seek high-end products that ensure safety, comfort, and performance.,, Another important target will be affluent people and their families who take horseback riding as a leisure activity or use it as a status symbol, particularly in those regions with strong equestrian cultures such as North America and Europe. The affluent tend to prefer more high-end or customised among such consumers. Online platforms open more gates to widening the audience with convenience, many choices in products and price comparisons, making horse riding equipment available to a far broader audience across the globe.Merger and acquisition

In the horse-riding equipment market, there have been waves of mergers and acquisitions over the years, and analysts note a trend toward consolidation among industry players. On 1 January 2022, NCK Capital, based in Dallas, Texas, completed a majority recapitalisation of English Riding Supply (ERS), a company based in the USA that markets English-style equestrian equipment. This move will in turn enable ERS's growth plans and also make the company stronger in terms of its presence in the equestrian equipment arena. On a similar note, two leading equestrian companies, Horseware Ireland and EquiFit, announced their merger in February 2025, whereby they will aggregate their high-quality equestrian product lines. This merger is said to have a broad opportunity in the market, thus leading to becoming a one-stop shop for all equestrian equipment needs, thereby combining the Horseware Ireland know-how in horse rugs and apparel with that of EquiFit regarding innovative equestrian gear. >Analyst Comment

The horse-riding equipment market is poised for gradual growth due to increased involvement in equestrian activities and increased consideration for horse welfare. Major driving factors include the growing popularity of recreational riding as well as competitive equestrian sports, along with growing awareness regarding the safety of the rider. Technological advances with materials and designs for more comfort, durability, and performance enhancement are also working in favour of the market. With an increase in disposable incomes in several regions, more people are now able to purchase high-quality horse-riding equipment.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Horse Riding Equipment- Snapshot

- 2.2 Horse Riding Equipment- Segment Snapshot

- 2.3 Horse Riding Equipment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Horse Riding Equipment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Rider Equipment

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Helmet

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Safety Vest

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Pants

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Boots

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Equine Equipment

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 saddles

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 stirrups

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

- 4.10 bridles

- 4.10.1 Key market trends, factors driving growth, and opportunities

- 4.10.2 Market size and forecast, by region

- 4.10.3 Market share analysis by country

- 4.11 Others

- 4.11.1 Key market trends, factors driving growth, and opportunities

- 4.11.2 Market size and forecast, by region

- 4.11.3 Market share analysis by country

5: Horse Riding Equipment Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hypermarket and supermarket

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Independent Sports Outlet

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Sports Retail

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Chain

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Horse Riding Equipment Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Colonial Saddlery (India)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Dainese (Italy)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Georg Kieffer Sattlerwarenfabrik GmbH (Germany)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Decathlon (France)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Cavallo GmbH (Germany)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Antares Sellier (France)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Fabtron Inc. (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Mountain Horse (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 HKM Sports Equipment (Germany)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Charlie1Horse (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Resistol (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Justin Boots (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Cashel Company (United States)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Professional's Choice (United States)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Horse Riding Equipment in 2030?

+

-

Which type of Horse Riding Equipment is widely popular?

+

-

What is the growth rate of Horse Riding Equipment Market?

+

-

What are the latest trends influencing the Horse Riding Equipment Market?

+

-

Who are the key players in the Horse Riding Equipment Market?

+

-

How is the Horse Riding Equipment } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Horse Riding Equipment Market Study?

+

-

What geographic breakdown is available in Global Horse Riding Equipment Market Study?

+

-

Which region holds the second position by market share in the Horse Riding Equipment market?

+

-

How are the key players in the Horse Riding Equipment market targeting growth in the future?

+

-