Asia Pacific Metaverse in Manufacturing Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-1007 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The metaverse in the manufacturing market refers to the integration of immersive technologies, such as augmented reality (AR), virtual reality (VR), digital twins, and AI into manufacturing environments, to create virtual replica ecosystems for design, testing, training, and real-time operations. This digital convergence allows manufacturers to simulate production processes, collaborate remotely, and optimise workflows with minimal physical intervention. As industries adopt industry practices 4.0, the metaverse serves as a transforming layer, improving operational agility, reducing inactivity time, and increasing innovation through virtual prototyping and predictive maintenance. The market is gaining traction quickly due to the need for safer, more efficient, and more scalable manufacturing solutions in a competitive and digitally orientated global economy.

Metaverse in Manufacturing Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

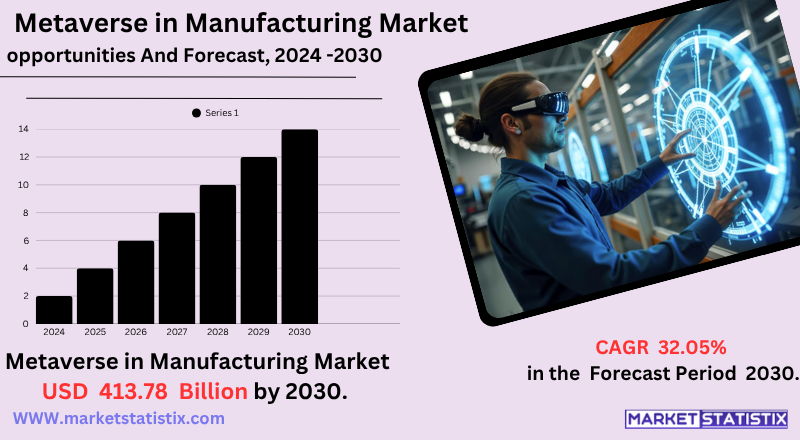

| Growth Rate | CAGR of 32.05% |

| Forecast Value (2030) | USD 413.78 Billion |

| By Product Type | Virtual Reality, Augmented Reality, Digital Twins, Others |

| Key Market Players |

|

| By Region |

|

Metaverse in Manufacturing Market Trends

Metaverse in manufacturing develops rapidly and integrates digital twins, AI, AR/VR, and IoT to create virtual copies of factories and products. This enables real-time collaboration, virtual prototyping, remote monitoring, and predictive maintenance. It also transforms training through safe, simulated environments and promotes sustainability by optimising production processes. Despite the initial costs, the pressure for advanced production and digital transformation drives its widespread adoption, leading to more interconnected, AI-enhanced, and immersive industrial environments. Furthermore, it transforms training by offering safe, simulated environments for employees to practice complex procedures, reduce the risk, and speed learning. The focus is also growing on using the industrial metaverse to increase sustainability by practically optimising production to cut waste and energy consumption.

Metaverse in Manufacturing Market Leading Players

The key players profiled in the report are Upskill (United States), Magic Leap, Inc. (United States), Scope AR (Canada), SAP SE (Germany), Siemens AG (Germany), OverIT S.p.A. (Italy), Epic Games (United States), DAQRI (United States), Dassault Systèmes (France), Trimble Inc. (United States), Unity Technologies (United States), PTC Inc. (United States), Microsoft Corporation (United States), Rockwell Automation, Inc. (United States), Autodesk, Inc. (United States), Vuforia (United States)Growth Accelerators

- Digital twin integration: Manufacturers are increasingly using digital twins to create virtual replicas in real time of physical assets and processes. This integration enables predictive maintenance, process optimisation, and improved decision-making, leading to improved operating efficiency.

- Enhanced Remote Collaboration: Metaverse facilitates real-time collaboration between geographically dispersed teams through virtual environments. This opportunity improves communication, accelerates the decision, and reduces time to market for new products.

- Focus on Workforce Training and Safety: Metaverse offers immersive training environments that improve skills development and safety awareness among workers. Virtual simulations allow employees to practice procedures without the risk associated with training in the real world.

Metaverse in Manufacturing Market Segmentation analysis

The Asia Pacific Metaverse in Manufacturing is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Virtual Reality, Augmented Reality, Digital Twins, Others . The Application segment categorizes the market based on its usage such as Training and Simulation, Prototyping, Product Life cycle Management, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Metaverse in the manufacturing market is fiercely competitive, led by tech giants such as Nvidia (Omniverse), Siemens (Xcelerator), Microsoft (Microsoft Mesh), and Dassault Systèmes (3DEXPERIENCE). These important players offer integrated platforms that include digital twins, AI, AR/VR, and IoT for industrial use. They actively form strategic partnerships, such as Siemens and Nvidia's collaboration on generative AI for industrial visualisation, to improve their solutions and marketing reach. Specialised start-ups also appear, focusing on niche applications or MAAS (metaverse as a service) offers. The competition is centred on continuous innovation in immersive experiences, advanced simulations, and secure data management, which aims to provide scalable and interoperable platforms that provide a significant return for manufacturers.

Challenges In Metaverse in Manufacturing Market

Metaverse in Manufacturing provides significant opportunities by enabling virtual prototyping and product development, drastically cutting design times and costs. It facilitates global cooperation in real time between teams and accelerates decisions and innovation. There is great potential for immersive training and skill development, so employees can learn safely in virtual environments. Furthermore, the convergence of real and virtual worlds allows, through digital twins, superior monitoring in real time and predictive maintenance and optimises factory operations. The continuous development of connection also opens doors for seamless data exchange, crucial to scaling these applications throughout the industry.

Risks & Prospects in Metaverse in Manufacturing Market

Metaverse in Manufacturing provides significant opportunities by enabling virtual prototyping and product development, drastically cutting design times and costs. It facilitates global cooperation in real time between teams and accelerates decisions and innovation. There is great potential for immersive training and skill development, so employees can learn safely in virtual environments. Furthermore, the convergence of real and virtual worlds allows, through digital twins, superior monitoring in real time and predictive maintenance and optimises factory operations. The continuous development of connection also opens doors for seamless data exchange, crucial to scaling these applications throughout the industry.

Key Target Audience

Metaverse in the manufacturing market is fiercely competitive, led by tech giants such as Nvidia (Omniverse), Siemens (Xcelerator), Microsoft (Microsoft Mesh), and Dassault Systèmes (3DEXPERIENCE). These important players offer integrated platforms that include digital twins, AI, AR/VR, and IoT for industrial use. They actively form strategic partnerships, such as Siemens and Nvidia's collaboration on generative AI for industrial visualisation, to improve their solutions and marketing reach. Specialised start-ups also appear, focusing on niche applications or MAAS (metaverse as a service) offers. The competition is centred on continuous innovation in immersive experiences, advanced simulations, and secure data management, which aims to provide scalable and interoperable platforms that provide a significant return for manufacturers.

Merger and acquisition

- CoStar Group Acquires Matterport for $1.6 Billion: In Q2 2024, CoStar Group acquired Matterport, a leader in 3D spatial data and the digital twin technology. This acquisition enhances CoStar's talents in imparting immersive virtual environments for production and commercial packages.

- Improbable Sells Defence Division to NOIA Capital: In June 2023, Improbable, a metaverse infrastructure company, sold its protection division to NOIA Capital. The deal included about 70 engineers and contracts related to synthetic environments, permitting Improbable to focus extra on industrial metaverse programs in production.

- Studio Realive Acquires 51% Stake in Studio Clon: In April 2023, Studio Realive, a South Korean metaverse content material production enterprise, obtained a majority stake in Studio Clon. This flow aims to strengthen Studio Realive's abilities in digital human and VFX production, improving its offerings within the industrial metaverse zone.

>

Analyst Comment

The Metaverse in Manufacturing market is prescribed for significant growth in the manufacturing market, estimated at USD 24.68 billion in 2025, to about USD 413.78 billion by 2034. This expansion of product design, prototyping, and process optimisation is given fuel by widely adopting digital twins, AI, AR, and VR. A prominent driver is the demand for real-time cooperation between global teams and a revolution of workforce training through fake environments. Progress in 5G and edge computing in the market also benefits, which enables important real-time data exchange. Applications such as virtual warehousing, predictive maintenance, and supply chain adaptation are rapidly prevalent, solidifying the role of the metaverse as a transformative force in future construction.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Metaverse in Manufacturing- Snapshot

- 2.2 Metaverse in Manufacturing- Segment Snapshot

- 2.3 Metaverse in Manufacturing- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Metaverse in Manufacturing Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Augmented Reality

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Virtual Reality

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Digital Twins

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Metaverse in Manufacturing Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Prototyping

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Training and Simulation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Product Life cycle Management

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Metaverse in Manufacturing Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Autodesk

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc. (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 DAQRI (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Dassault Systèmes (France)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Epic Games (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Magic Leap

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc. (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Microsoft Corporation (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 OverIT S.p.A. (Italy)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 PTC Inc. (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Rockwell Automation

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Inc. (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 SAP SE (Germany)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Scope AR (Canada)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Siemens AG (Germany)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Trimble Inc. (United States)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Unity Technologies (United States)

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Upskill (United States)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Vuforia (United States)

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Metaverse in Manufacturing in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific Metaverse in Manufacturing market?

+

-

How big is the Asia Pacific Metaverse in Manufacturing market?

+

-

How do regulatory policies impact the Metaverse in Manufacturing Market?

+

-

What major players in Metaverse in Manufacturing Market?

+

-

What applications are categorized in the Metaverse in Manufacturing market study?

+

-

Which product types are examined in the Metaverse in Manufacturing Market Study?

+

-

Which regions are expected to show the fastest growth in the Metaverse in Manufacturing market?

+

-

Which application holds the second-highest market share in the Metaverse in Manufacturing market?

+

-

What are the major growth drivers in the Metaverse in Manufacturing market?

+

-

- Digital twin integration: Manufacturers are increasingly using digital twins to create virtual replicas in real time of physical assets and processes. This integration enables predictive maintenance, process optimisation, and improved decision-making, leading to improved operating efficiency.

- Enhanced Remote Collaboration: Metaverse facilitates real-time collaboration between geographically dispersed teams through virtual environments. This opportunity improves communication, accelerates the decision, and reduces time to market for new products.

- Focus on Workforce Training and Safety: Metaverse offers immersive training environments that improve skills development and safety awareness among workers. Virtual simulations allow employees to practice procedures without the risk associated with training in the real world.