Asia Pacific mHealth Services Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-869 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The mHealth Services Market is the industry of healthcare that applies mobile communication devices, including smartphones, tablets, and wearable technology, to provide health services and information. Such services involve various applications, such as remote monitoring of patients, tracking of fitness and well-being, medication, diagnostic support, telemedicine consultation, and sharing of health information. The mHealth industry utilises the growing penetration of mobile technology to enhance the accessibility, efficiency, and patient outcomes of healthcare by facilitating real-time data capture, tailored interventions, and improved communication between healthcare providers and patients.

The market for mHealth services is growing significantly based on the increasing rates of chronic diseases, the ageing population, the spreading use of smartphones and mobile internet, and the demand for affordable healthcare solutions. Advancements in technology, such as the inclusion of AI, IoT, and 5G, are additionally driving market growth through providing more complex remote monitoring and diagnostic applications.

mHealth Services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

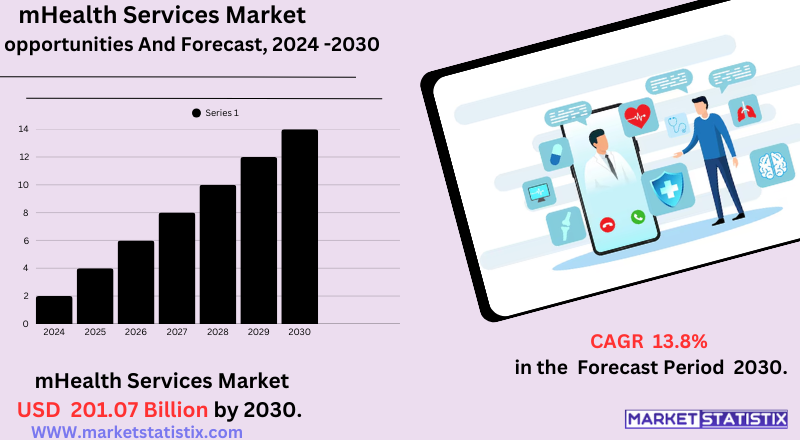

| Growth Rate | CAGR of 13.8% |

| Forecast Value (2030) | USD 201.07 Billion |

| By Product Type | Diagnostic Service, Monitoring Service, Treatment, Wellness Service, Prevention, Information and reference |

| Key Market Players |

|

| By Region |

|

mHealth Services Market Trends

The mHealth services market is now experiencing strong trends that are defining its future. One of the leading trends is the growing use of remote patient monitoring (RPM) devices and platforms. This is fuelled by the growing incidence of chronic diseases and the necessity for ongoing health management outside of the conventional healthcare environment. Wearable devices, combined with mHealth applications, are becoming increasingly advanced in monitoring vital signs and physiological information, facilitating proactive interventions and individualised care.

The other significant trend is the increasing adoption of artificial intelligence (AI) and machine learning (ML) in mHealth solutions. AI algorithms are now employed to process the large volumes of data generated by mHealth devices and applications, offering rich insights for the detection of diseases at an early stage, customized treatment advice, and enhanced patient engagement. In addition, the creation of easy-to-use mobile health apps centred on wellness, fitness, and mental health is increasing, an indication of expanding consumer interest in active health management.

mHealth Services Market Leading Players

The key players profiled in the report are Cerner Corporation (United States), AT&T Inc. (United States), Omron Corporation (United States), Symantec Corporation (United States), Apple Inc. (United States), Medtronic plc (Ireland), Alcatel-Lucent (France), Airstrip Technologies Inc. (United States), SoftServe Inc. (Ukraine), Vodafone Group Plc. (United Kingdom)Growth Accelerators

The mHealth Services Market is driven by a number of key drivers. First, the growing penetration of smartphones and mobile internet across the world offers a huge infrastructure for providing health services directly to patients. The ease and convenience provided by mobile devices enable patients to take an active role in managing their health, monitoring fitness targets, and accessing medical information anywhere, anytime. This is further boosted by the increasing use of mobile health apps for several purposes, such as remote monitoring, medication reminders, and lifestyle management.

Secondly, the increasing rate of chronic diseases and the ageing world population are major drivers of demand for mHealth services. Remote patient monitoring and telehealth services provided via mHealth allow for ongoing care and management of chronic diseases, minimising the necessity for recurrent hospital visits and enhancing patient outcomes. Additionally, the growing emphasis on patient-centred care models and the necessity for cost-efficient healthcare solutions are compelling healthcare providers and payers to adopt mHealth technologies for enhanced efficiency and enhanced patient engagement.

mHealth Services Market Segmentation analysis

The Asia Pacific mHealth Services is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Diagnostic Service, Monitoring Service, Treatment, Wellness Service, Prevention, Information and reference . The Application segment categorizes the market based on its usage such as General Healthcare and Fitness, Medication Information, Remote Monitoring, Collaboration, and Consultancy, Healthcare Management, Health Data and Record Access. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment in the mHealth services market is dynamic and comprises a combination of large technology firms, well-established healthcare providers, mHealth solution specialists, and many startups. Some of the key players are firms such as Apple, Google, Samsung, and Teladoc Health, which use their technological capabilities and brand names. Conventional healthcare organizations also increasingly penetrate the market by creating their own mHealth apps and platforms to engage patients more and monitor them remotely. This produces a competitive market centred on innovation, user experience, and incorporation of mHealth services into existing healthcare workflows.

The competition is fierce in the market based on the scope of services available, ease of use of applications, data analytics, and patient data security. Strategic partnerships and associations between healthcare providers and technology companies are prevalent to develop all-round and integrated mHealth solutions. Access to navigate regulatory regimes and maintain data privacy is also an essential consideration to sustain the competitive advantage in this dynamic market.

Challenges In mHealth Services Market

The mHealth services market is growing rapidly and is faced with a number of major challenges. Major hurdles include ongoing issues around privacy and security of data, as sensitive health information handled by mHealth applications can be vulnerable to security breaches and abuse. The industry also faces poor reimbursement coverage, which creates challenges for providers and developers in obtaining sustainable revenue streams from insurance or government coverage. Regulatory barriers also make market entry and expansion difficult, as varied and changing healthcare policies necessitate ongoing adjustment and compliance efforts.

Another significant challenge is the technological unawareness and digital literacy of older segments, who are among the prime targets for most mHealth solutions, as they have greater healthcare needs. Interoperability problems – in which various health systems and devices cannot exchange information automatically – compromise the effectiveness and scalability of mHealth services. Resolving these challenges is important for further success and widespread use of mHealth services worldwide.

Risks & Prospects in mHealth Services Market

The stage is set for new and incumbent players, both, given rising consumer knowledge and acceptance of mHealth solutions and the trend toward industry consolidation and R&D spending driving increased pace of innovation within the sector.

North America leads the market for mHealth services today in terms of share of revenues on account of having a more sophisticated healthcare system, a high level of healthcare spending, and a strong embrace of digital health technologies across its population. Yet, Asia Pacific is expected to see the quickest expansion, powered by the fastest growths in mobile broadband adoption, an ageing population, and increasing healthcare expenditure in India and China. Europe exhibits consistent expansion, fuelled by an increase in startups and remote patient monitoring demand. Overall, every region offers distinct opportunities that are influenced by local healthcare demand, technology adoption, and policy environments.

Key Target Audience

The major target market of the mHealth (mobile health) services market consists of a wide variety of stakeholders, mainly divided into healthcare providers, patients, payers, and technology firms. The mHealth solutions are used by healthcare providers like hospitals, clinics, and solo practitioners for better patient monitoring, communication, and delivery of services, mainly to remote and underserved locations. These services help patients, especially those with chronic diseases, through mobile applications, wearable technology, and telemedicine that provide real-time monitoring, medication reminders, and online consultations.

,

, Another important segment consists of insurance companies and government institutions looking to minimise healthcare expenditures and enhance public health results. And then, of course, there are tech firms and app developers, who take a central position by providing platforms and tools that are integrated with medical networks. Increasingly, emerging markets, ageing populations, and technologically advanced younger users are fuelling demand, so the mHealth market is diverse and fast-growing. And that diversified target audience speaks volumes for the scalability, ease of use, and security of mobile health solutions.

Merger and acquisition

The mHealth services market in 2024 has witnessed a strategic redirection in mergers and acquisitions (M&A) focusing on consolidation and technology integration in the face of macroeconomic difficulties. Though aggregate volumes of deals have come down—witnessed by a 60% decline in mobile health-related pharma deals in Q3 2024 versus the last quarter—notable investments continue across segments such as telehealth, remote patient monitoring, and care coordination. Examples include Global Health Systems' acquisition of TeleMed Solutions for $2 billion to support virtual care strengths and Health Catalyst's growth through acquisitions of Carevive Systems, Quarvis Health, and Lumeon Limited.

Even as there has been a broad-based weakening in M&A valuations from forces such as increasing interest rates and inflation, the healthcare IT industry continues to be strong, with 265 deals in 2024, up 2.7% from last year. Private equity players have sharply ramped up their activity, representing 49.8% of sector M&A deals, as they seek scalable platforms and recurring revenue models. This trend indicates a strategic emphasis on purchasing interoperable B2B healthcare IT solutions with long-term profitability and integration prospects.

Analyst Comment

The international mHealth services market is driven by the large-scale use of smartphones, rising internet penetration, and growing rates of chronic conditions. Market size is estimated differently, but the common indication is swift growth: the market will grow from some USD 81.7 billion in 2025 to between USD 268.5 billion in 2034 and USD 780.7 billion in 2037. North America dominates the market now, representing around 38% of world revenue in 2024, driven by high-level digital infrastructure, high expenditure on healthcare, and a high proportion of older population.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 mHealth Services- Snapshot

- 2.2 mHealth Services- Segment Snapshot

- 2.3 mHealth Services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: mHealth Services Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Wellness Service

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Prevention

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Monitoring Service

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Diagnostic Service

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Treatment

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Information and reference

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: mHealth Services Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 General Healthcare and Fitness

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Medication Information

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Remote Monitoring

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Collaboration

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 and Consultancy

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Healthcare Management

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Health Data and Record Access

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: mHealth Services Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Airstrip Technologies Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Alcatel-Lucent (France)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Apple Inc. (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 AT&T Inc. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Cerner Corporation (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Medtronic plc (Ireland)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Omron Corporation (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 SoftServe Inc. (Ukraine)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Symantec Corporation (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Vodafone Group Plc. (United Kingdom)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of mHealth Services in 2030?

+

-

How big is the Asia Pacific mHealth Services market?

+

-

How do regulatory policies impact the mHealth Services Market?

+

-

What major players in mHealth Services Market?

+

-

What applications are categorized in the mHealth Services market study?

+

-

Which product types are examined in the mHealth Services Market Study?

+

-

Which regions are expected to show the fastest growth in the mHealth Services market?

+

-

Which application holds the second-highest market share in the mHealth Services market?

+

-

What are the major growth drivers in the mHealth Services market?

+

-

The mHealth Services Market is driven by a number of key drivers. First, the growing penetration of smartphones and mobile internet across the world offers a huge infrastructure for providing health services directly to patients. The ease and convenience provided by mobile devices enable patients to take an active role in managing their health, monitoring fitness targets, and accessing medical information anywhere, anytime. This is further boosted by the increasing use of mobile health apps for several purposes, such as remote monitoring, medication reminders, and lifestyle management.

Secondly, the increasing rate of chronic diseases and the ageing world population are major drivers of demand for mHealth services. Remote patient monitoring and telehealth services provided via mHealth allow for ongoing care and management of chronic diseases, minimising the necessity for recurrent hospital visits and enhancing patient outcomes. Additionally, the growing emphasis on patient-centred care models and the necessity for cost-efficient healthcare solutions are compelling healthcare providers and payers to adopt mHealth technologies for enhanced efficiency and enhanced patient engagement.

Is the study period of the mHealth Services flexible or fixed?

+

-