Global Oxygen Scavenger Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-553 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Oxygen Scavenger Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

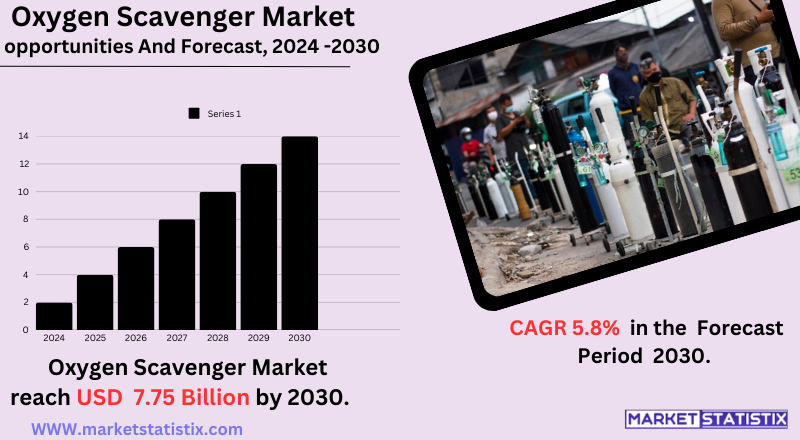

| Growth Rate | CAGR of 5.8% |

| Forecast Value (2030) | USD 7.75 Billion |

| By Product Type | Organic, Inorganic |

| Key Market Players |

|

| By Region |

Oxygen Scavenger Market Trends

The trend ramping up the oxygen scavenger market is driven by the gradually growing demand for extended shelf life and reduced food waste across the globe. One significant theme is that active packaging solutions have gained traction, with oxygen scavengers directly integrated into packaging that is truly convenient and efficient. Another key driving factor is the ever more prevalent acceptance of minimally processed and natural products that are demanding better preservation systems. Bio-based oxygen scavengers and sustainable packaging have also been garnering attention as innovations that reflect the industry's conscience about the environment. The pharmaceutical and electronic sectors are also enabling this market to gain tremendous importance as the need for protection of oxygen-sensitive products gains momentum. The demand for effective oxygen scavenging solutions is also being fuelled by the rising adoption of modified atmosphere packaging (MAP) and vacuum packaging among various industries. The relentless efforts towards the development of cost-competitive yet high-performance oxygen scavengers are likely to further propel the growth of the Global Oxygen Scavengers Market.Oxygen Scavenger Market Leading Players

The key players profiled in the report are Toyo Seikan Kaisha Ltd. (Japan), Toagosei Chem. Ind. Co. (Japan), Finetec Co., Ltd. (Japan), Amoco Chemicals (United States), Cryovac Sealed Air Co. (United States), Dessicare Ltd. (United States), CSIRO/Southcorp Packaging (Australia), W.R. Grace and Co. (United States), Nippon Soda Co., Ltd. (Japan), Mitsubishi Gas Chemical Co., Ltd. (Japan), Multisorb Technologies Inc. (United States), Ciba Specialty Chemicals (Switzerland), Toyo Pulp Co. (Japan), CMB Technologies (United Kingdom)Growth Accelerators

Demand for longer shelf life in packaged food drives the oxygen scavenger market. Consumers increasingly prefer fresh products, which minimally processed products by oxygen scavengers can ensure storage free from spoilage and other quality-degrading factors. Consciousness about the wastage of food and sustainable packaging solutions is also growing. The pharmaceutical and healthcare sectors, where oxygen-sensitive drugs and medical devices demand efficient oxygen scavenging for the preservation of their efficacy and integrity, are strong market drivers. E-commerce and global supply chain considerations necessitate longer shelf life and product protection, causing additional growth for the market. Stringent regulations concerning food safety and product quality in different regions add to market momentum, holding manufacturers accountable for the implementation of efficient oxygen scavenging.Oxygen Scavenger Market Segmentation analysis

The Global Oxygen Scavenger is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Organic, Inorganic . The Application segment categorizes the market based on its usage such as Pharmaceutical, Chemical, Food & Beverage, Pul & Paper, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario for any oxygen scavenger market consists of an amalgamation of consolidated and global competitors with a few regional companies. The key competitors have concentrated their efforts toward innovations, product differentiation, and market outreach through strategic partnering and acquisition endeavours. They have undertaken research and development for the purpose of generating more efficient and sustainable oxygen scavenging solutions to meet a growing demand for longer shelf life and less food wastage. With such a set of goals, the competition is intense, with one competitor seeking rents against others by keeping competitive pricing, better performance, and custom products in tune with the industry-specific needs.Challenges In Oxygen Scavenger Market

The oxygen scavenger market has faced some challenges that are expected to affect its healthy growth trajectory. The major one is the tendency of the shortage of skilled people who can formulate innovative sustainable solutions. It slows down the creation of new products and technologies, slowing down the market's expansion. Some of these oxygen scavengers have negative properties restricting their usability or field of application. Such limitations may restrict penetration into the industry or application, hence requiring heavy investment in research and development activities on the part of manufacturers to overcome. Another problem is that the regulatory scenario is changing day by day, especially the environmental regulations and food safety standards. The market is, of course, threatened with competition from alternative ways or methods of packaging and preservation that would help reduce the scope for oxygen scavengers in certain areas.Risks & Prospects in Oxygen Scavenger Market

.The oxygen scavenger market is expected to flourish owing to growing demand from different sectors. The food and beverage sector are the largest, with most oxygen scavengers being used to extend shelf life and maintain the quality of products, preventing spoilage, nutrient loss, and rancidity. In addition, other growing industries, like pharmaceuticals and chemicals, are applying oxygen scavengers during storage and transportation to maintain product stability and safety. Region-wise, Asia-Pacific is likely to have the highest growth rate due to demand arising in countries such as China and India. The market is accelerated by urbanisation, changing lifestyles, and the consumption patterns of countries in this region leaning toward packaged foods. China's manufacturing of chemicals and petrochemicals would further enhance demand for industrial applications of oxygen scavengers. Growing population and broader food industry markets also present many opportunities for flexible packaging with oxygen scavengers in India. North America is the largest market owing to its advanced food processing sector and stringent regulations, while Europe focuses on sustainability-induced innovations in packaging.Key Target Audience

The key target client in the Oxygen Scavenger Market is any establishment that packages or preserves perishable goods. Among them are food and beverage producers, who are one of the main groups using oxygen scavengers for prolonged shelf life in products like processed meats, snacks, and beverages. Pharmaceutical applications are another important sector using scavengers for protection against oxidation of sensitive drugs and medical devices. Oxygen scavengers are also used by electronics manufacturers to prevent components from moisture and oxidation damage during storage and transport. Packaging companies, especially those in active and modified atmosphere packaging, are another important target group, as they incorporate oxygen scavengers into their packaging systems.Merger and acquisition

Solenis, a speciality chemicals manufacturer based in the United States, last month acquired Clearon Corp., a company that specialises in sanitisers and disinfectants. The acquisition, besides establishing Clearon facilities in South Charleston, Virginia, tableting, and packaging in West Virginia, will expand Solenis' residential and commercial pool and spa-treatment portfolios. In addition, in 2021, Solenis came under the auspices of Platinum Equity from Clayton, Dubilier & Rice (CD&R), BASF for a total of $5.25 billion. It should be underlined that when merging with Sigura Water, yet another investment already held by Platinum Equity, it brought the total deal size to about $6.5 billion. Generated through the merger with Sigura Water, the company will realise around $3.5 billion in combined revenues. This will eventually serve to enhance the competitive presence of the merged company on the water treatment market. >Analyst Comment

The oxygen scavenger market has surged with great momentum due to growing demands for longer shelf life and less waste in food and beverages. Rising packaged and processed foods coupled with increasing consumer awareness of safety are more powerful forces that now push for application solutions by means of effective oxygen scavenging. And the same goes with the pharmaceutical and healthcare sectors, where more and more oxygen scavengers are used to keep sensitive drugs and medical devices protected against degradation. Well, on the other hand, the Asia-Pacific region now plays a crucial growth driver, given its performance in the developing food processing industry and escalating disposable incomes.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Oxygen Scavenger- Snapshot

- 2.2 Oxygen Scavenger- Segment Snapshot

- 2.3 Oxygen Scavenger- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Oxygen Scavenger Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Organic

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Inorganic

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Oxygen Scavenger Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Pharmaceutical

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Food & Beverage

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Chemical

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Pul & Paper

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Mitsubishi Gas Chemical Co.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Ltd. (Japan)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Toagosei Chem. Ind. Co. (Japan)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Nippon Soda Co.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Ltd. (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Finetec Co.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Ltd. (Japan)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Toyo Pulp Co. (Japan)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Toyo Seikan Kaisha Ltd. (Japan)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Dessicare Ltd. (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Multisorb Technologies Inc. (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Amoco Chemicals (United States)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ciba Specialty Chemicals (Switzerland)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 W.R. Grace and Co. (United States)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 CSIRO/Southcorp Packaging (Australia)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Cryovac Sealed Air Co. (United States)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 CMB Technologies (United Kingdom)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Oxygen Scavenger in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Oxygen Scavenger market?

+

-

How big is the Global Oxygen Scavenger market?

+

-

How do regulatory policies impact the Oxygen Scavenger Market?

+

-

What major players in Oxygen Scavenger Market?

+

-

What applications are categorized in the Oxygen Scavenger market study?

+

-

Which product types are examined in the Oxygen Scavenger Market Study?

+

-

Which regions are expected to show the fastest growth in the Oxygen Scavenger market?

+

-

Which application holds the second-highest market share in the Oxygen Scavenger market?

+

-

What are the major growth drivers in the Oxygen Scavenger market?

+

-