Global Portable Filtration System Market – Industry Trends and Forecast to 2030

Report ID: MS-593 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Portable Filtration System Report Highlights

| Report Metrics | Details |

|---|---|

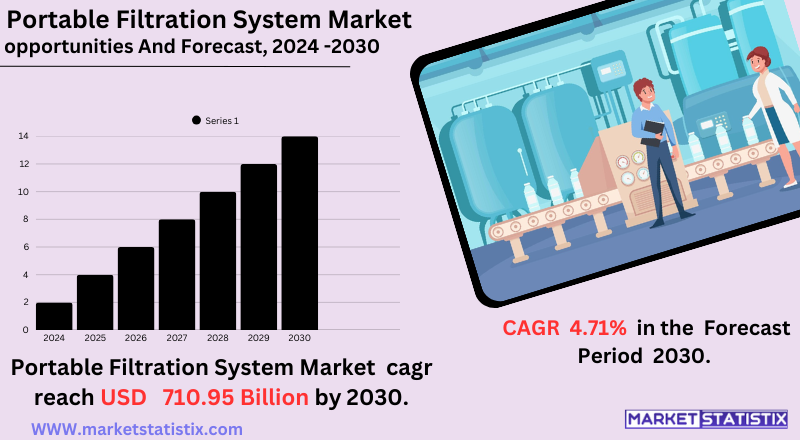

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 4.71% |

| Forecast Value (2030) | USD 710.95 Billion |

| Key Market Players |

|

| By Region |

Portable Filtration System Market Trends

Market analysis indicates present scenarios on innovations and diversification in product offerings. Among the numerous regions, an emerging area is Asia-Pacific, which is largely due to the rapid pace of industrialization and urbanization bringing high levels of pollution. The demand for portable water filtration systems is also increasing in developing countries due to limited access to clean water. In addition, the pandemic has greatly increased demand for portable air purifiers, especially for those that are antiviral. So, many market players are developing strategic partnerships and collaborations to enrich their product offerings and geographic reach. There's a general shift toward sustainable and green filtration practices and toward exploring biodegradable and reusable filtration materials, too.Portable Filtration System Market Leading Players

The key players profiled in the report are Pall Corporation (United States), BWF Envirotec (Germany), 3M Company (United States), Pentair plc (United Kingdom), MANN+HUMMEL Group (Germany), Veolia Water Technologies (France), Donaldson Company, Inc. (United States), Clean TeQ Holdings Limited (Australia), Sartorius AG (Germany), Parker Hannifin Corporation (United States), Ecolab Inc. (United States), Cummins Inc. (United States), Ahlstrom-Munksjö (Finland), Camfil AB (Sweden), Graver Technologies (United States)Growth Accelerators

Increasing awareness about the importance of clean air, water, and oil in industrial and residential applications is driving the market growThe demand from different sectors, including oil and gas, power generation, manufacturing, and water treatment, is what mainly fuels the portable filtration system market. It offers good reliability and efficiency in operations through the maintenance of cleanliness in fluids. The primary drivers for such technology are concerns associated with promotional waterborne pathogens and the demand for clean energy alternative sources, especially in remote areas where the installation of water filtration technology becomes compulsory. Furthermore, these systems are well designed to be light and portable; hence, they easily attract hikers and campers. All sustainability initiatives, such as reduced plastics and eco-friendly alternatives to bottled water, have, therefore, stimulated market demand. With innovative smart sensors and IoT implementation, it is now possible to monitor and propose a predictive method for maintenance to ensure that there would be less downtime and operational costs incurred. Other advances in filtration technologies, such as pressure, centrifugal, and vacuum filtration, have made the filtration system more efficient and versatile for use in different applications. Environmental regulation compliance push and a focus on sustainability have further stimulated growth in these industries in petrochemicals, paper and pulp, and manufacturing. thPortable Filtration System Market Segmentation analysis

The Global Portable Filtration System is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Power Generation, Oil & Gas, Paper & Pulp, Manufacturing, Petrochemicals, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Portable filtration systems usually involve competition techniques like technological advantages, innovative products, and partnerships in the market. Major players in the market focused on the manufacturing sector, oil & gas sector, power generation sector, and water treatment sectors to stay at the forefront with efficient and durable filtration solutions like Parker Hannifin, Pall Corporation, Donaldson Company, Eaton Corporation, and HYDAC. This group of players continuously invests in R&D to improve filtration efficiency, portability, and automation as per ever-evolving industrial demands. Now, regional and emerging players have joined in the fray with cut-price and customized solutions, specifically designed for different applications. Common strategies for fast-tracking the expansion of product portfolios and global reach are mergers, acquisitions, and collaborations. Thus, with ever-growing industrial requirements for clean fluids and contamination control, the competitive scene will constantly remain dynamic and innovation-driven.Challenges In Portable Filtration System Market

The portable filtration system market experiences a myriad of challenges that could impede growth. The high initial costs of advanced systems and regular maintenance are major sticking points, especially in price-sensitive markets. In addition, fluctuating prices of raw materials and the availability of cheaper substitutes exert competitive pressure on manufacturers. Diverse regulations further complicate market expansion on a regional basis and urge companies to ensure compliance with a myriad of dissonant standards. Concerns among consumers regarding the efficacy and longevity of these systems equally pose an obstacle in need of educational efforts to nurture trust and build awareness. The development of competing technologies and renewable energy solutions is also another cause for concern, since this might cut their demand in the old-fashioned sectors such as power generation and oil and gas. However, advancements in technologies incorporating IoT-enabled features and eco-friendly designs introduce yet another layer of complexity to production. It also increases production costs. To surpass these challenges, it is important for market players to innovate their products in a way that enhances affordability, improves energy efficiency, and increases the life cycle of the product. Strategic partnerships, target marketing, and investments in sustainable materials can jointly help address these issues while increasing consumer acceptance.Risks & Prospects in Portable Filtration System Market

Key opportunities arise from the increasing level of awareness regarding waterborne diseases, the necessity for clean water in disaster-struck or remote areas, and the surge in outdoor recreational activities. Innovations in filtration technology that demonstrate their eco-friendliness and cost-effectiveness are another pull factor for the market growth. Being able to reduce contaminants and enhance operational efficiency, the systems are becoming favourites in industries like oil and gas, healthcare, and power generation. Region-wise, the market is led by Asia-Pacific, owing to fast industrialization and growing populations of countries such as China and India. North America and Europe are substantial players as well, mainly due to progress in the manufacturing and chemical industries. Latin America remains a relatively steady growth market due to its increasing manufacturing sector, while the Middle East and Africa benefit from construction booms tied to visionary projects such as Saudi Vision 2030. Such regional dynamics bring different opportunities that market players can explore to cater to targeted needs in varying geographical locations.Key Target Audience

The key target audiences for the market of portable filtration systems are numerous—individuals, organizations, and industries. Outdoor enthusiasts such as hikers, campers, and travellers constitute a major consumer segment seeking personal water and air filtration solutions. Another major group includes those whose environment has compromised air or water quality or heightened health concerns. Organizations dealing in disaster relief, humanitarian aid, and emergency response rely heavily on these systems, which are rapidly deployed in crisis situations.,, The analysis of the market's target audience affirms that health and safety are gaining prominence across the board. The rise in environmental pollution and its effect on individual health have driven consumer interest in personal filtration devices. Industrial and organizational buyers want reliability and efficiency in whatever they are getting for personal filtration; they want the systems to be able to pass stringent regulations on safety. This is why manufacturers are customizing their products to meet the needs and price sensitivities of different target audiences, with a focus on portability, durability, and filtration efficiency.Merger and acquisition

In February 2025, Thermo Fisher Scientific entered into an agreement to acquire, for about $4.1 billion, the purification and filtration business from Solventum. With this acquisition, Thermo Fisher aims to improve its capability to develop and manufacture biologic medicines, as Solventum's filtration unit contributed approximately $1 billion in revenue in the year 2024. The transaction is expected to close by late 2025, thereby significantly enlarging Thermo Fisher's bioprocessing segment. In February 2017, Parker-Hannifin Corporation announced a cash acquisition of CLARCOR, a prominent manufacturer of filtration products, for approximately $4.3 billion. This acquisition enabled Parker-Hannifin to tap into new markets, regional growth, and increased production in the filtration industry. Such strategic plays demonstrate a trend amongst large corporations willing to complement their filtration capabilities and market coverage by means of acquisition. >Analyst Comment

Besides, the global market for portable filtration systems is growing at a fast pace due to concerns regarding air and water quality around the world. The primary impetus of the market includes raising pollution awareness, increasing demand for clean water in remote regions, and the need for portable solutions in emergency settings. Applications include personal use during outdoor activities or industrial applications, as well as disaster relief. Advances in technology, including better filter materials and smaller designs, improve the efficiency and portability of these systems. Smart filtration systems are also becoming part of this market, which integrates sensors and connectivity to provide real-time monitoring.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Portable Filtration System- Snapshot

- 2.2 Portable Filtration System- Segment Snapshot

- 2.3 Portable Filtration System- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Portable Filtration System Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Power Generation

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Oil & Gas

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Paper & Pulp

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Manufacturing

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Petrochemicals

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Pall Corporation (United States)

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Parker Hannifin Corporation (United States)

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 3M Company (United States)

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Sartorius AG (Germany)

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Cummins Inc. (United States)

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Ecolab Inc. (United States)

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Donaldson Company

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Inc. (United States)

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Veolia Water Technologies (France)

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Pentair plc (United Kingdom)

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 BWF Envirotec (Germany)

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 Camfil AB (Sweden)

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

- 6.13 MANN+HUMMEL Group (Germany)

- 6.13.1 Company Overview

- 6.13.2 Key Executives

- 6.13.3 Company snapshot

- 6.13.4 Active Business Divisions

- 6.13.5 Product portfolio

- 6.13.6 Business performance

- 6.13.7 Major Strategic Initiatives and Developments

- 6.14 Clean TeQ Holdings Limited (Australia)

- 6.14.1 Company Overview

- 6.14.2 Key Executives

- 6.14.3 Company snapshot

- 6.14.4 Active Business Divisions

- 6.14.5 Product portfolio

- 6.14.6 Business performance

- 6.14.7 Major Strategic Initiatives and Developments

- 6.15 Ahlstrom-Munksjö (Finland)

- 6.15.1 Company Overview

- 6.15.2 Key Executives

- 6.15.3 Company snapshot

- 6.15.4 Active Business Divisions

- 6.15.5 Product portfolio

- 6.15.6 Business performance

- 6.15.7 Major Strategic Initiatives and Developments

- 6.16 Graver Technologies (United States)

- 6.16.1 Company Overview

- 6.16.2 Key Executives

- 6.16.3 Company snapshot

- 6.16.4 Active Business Divisions

- 6.16.5 Product portfolio

- 6.16.6 Business performance

- 6.16.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Portable Filtration System in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Portable Filtration System market?

+

-

How big is the Global Portable Filtration System market?

+

-

How do regulatory policies impact the Portable Filtration System Market?

+

-

What major players in Portable Filtration System Market?

+

-

What applications are categorized in the Portable Filtration System market study?

+

-

Which product types are examined in the Portable Filtration System Market Study?

+

-

Which regions are expected to show the fastest growth in the Portable Filtration System market?

+

-

Which application holds the second-highest market share in the Portable Filtration System market?

+

-

What are the major growth drivers in the Portable Filtration System market?

+

-