Europe Insurance Brokerage Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-958 | IT and Telecom | Last updated: May, 2025 | Formats*:

The insurance broking market includes activities that connect individual insurance seekers with insurance providers. Unlike insurance agents who merely represent a single company, brokers are independent and access the entire range of insurance products made available by multiple insurers. Their main objective is to read the client's needs and research policies to quote the best coverage plans at the best prices. Assisting with the application process, claims filing, and continuous management of policies are some of the other duties of brokers. Ultimately, the insurance broking market makes the entire insurance world so easy to understand for the regular consumer. Brokers provide expert advice and customised solutions that direct clients to fulfilling their insurance needs. The market even has subcategories or types of brokers, including life insurance brokers, health insurance brokers, property and casualty brokers, and so on.

Insurance Brokerage Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 202 |

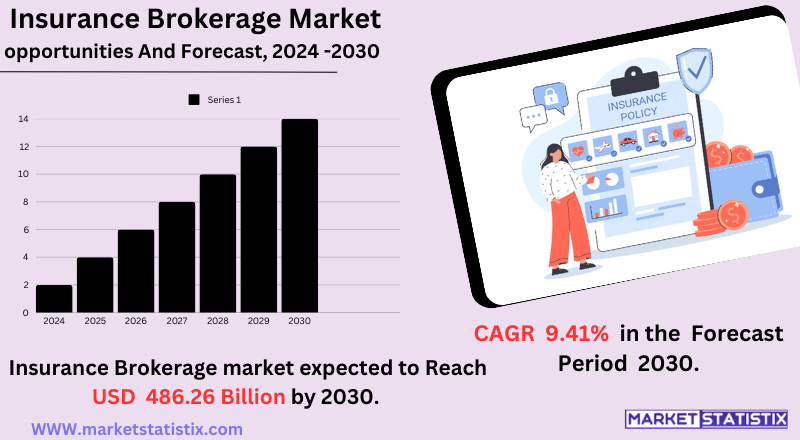

| Growth Rate | CAGR of 9.41% |

| Forecast Value (2030) | USD 486.26 Billion |

| By Product Type | Retail, Wholesale |

| Key Market Players | Aon (United Kingdom), Arthur J. Gallagher & Co. (United States), Brown & Brown, Inc. (United States), HUB International (United States), Marsh & McLennan (United States), Lockton, Inc. (United States), Truist Financial Corporation (United States), NFP Corp. (United States), AmWINS Group Inc. (United States), Willis Towers Watson (United Kingdom) |

| By Region |

|

Insurance Brokerage Market Trends

Some of the major trends that would shape the market of insurance broking in 2025 include digitalisation, which thrives on insurance companies forming digital platform agendas to better customer interactions and operations, as well as a growing emphasis on customer-centric experiences, such as embedded insurance predicted to surpass $722 billion in premiums worldwide by 2030. This means bundling insurance products with industry-partnered integrated solutions in areas such as automotive, retail, and real estate. The increasing demand for insurance policies is now largely resulting from premiums attached to current security services and customised financial services. Most rapidly growing segments are life insurance products, which manage to woo more and more buyers due to rising awareness and tailored choices available to them. Brokers and insurers alike are also concentrating on sustainability, data-driven decision-making, and technological innovation in order to remain competitive and make a meaningful impact for clients.

Insurance Brokerage Market Leading Players

The key players profiled in the report are Aon (United Kingdom), Arthur J. Gallagher & Co. (United States), Brown & Brown, Inc. (United States), HUB International (United States), Marsh & McLennan (United States), Lockton, Inc. (United States), Truist Financial Corporation (United States), NFP Corp. (United States), AmWINS Group Inc. (United States), Willis Towers Watson (United Kingdom)Growth Accelerators

Demand mainly consists of insurance policies: An increasing insurance awareness is alarming individuals to protect their assets, income, and health. Thus, in the wake of economic development and population increase, the demand further is centred on individual and business needs for insurance coverage. Hence, insurance brokers play such an important role in interpreting the complexity of insurance so that customers can choose the appropriate coverage for their needs and thereby make the insurance process more accessible and understandable. Additionally, increasing complexities in insurance products and the personalised approach of the insurance solutions warrant a push-up of this market. Recent advancements in technologies such as digital platforms, data analytics, and artificial intelligence have also contributed to efficiently customised products and maximised consumer satisfaction. Other factors affecting growth in the insurance broking market include the emergence of SMEs, increasing cybersecurity threats, and risk management with customer-orientated solutions.

Insurance Brokerage Market Segmentation analysis

The Europe Insurance Brokerage is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Retail, Wholesale . The Application segment categorizes the market based on its usage such as Property, Institution, Individual. Geographically, the market is assessed across key Regions like Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The insurance broking market is characterised by a competitive environment dominated by some major players globally, such as Marsh & McLennan, Aon, Willis Towers Watson, and Gallagher, and myriad regional and independent broking firms. Within this context, the companies compete on service delivery, industry knowledge, and development of value-added insurance solutions across the various realms, including health, property and casualty, and life. Digital transformation and data analytics have emerged as clear differentiators by which organisations perform AI-driven assessments and client insights to bolster their service. The bulk of consolidation takes place here, with an increasing number of mergers and acquisitions being the crowning glory in support of larger firms expanding global footprints and boasting their portfolios. On the other hand, tech-driven start-ups are shaking the very foundations of this business by building digital-first platforms that offer AI-based policy recommendations and automated claims processing.

Challenges In Insurance Brokerage Market

The insurance broking market encounters challenges such as growing regulatory compliance and changing laws that create a situation whereby brokers are constantly adapting their operations. Stricter laws on data protection and transparency further complicate the environment brokers work within, making it more imperative to comply so as to sustain customers' trust. On the other hand, digital insurance platforms and direct-to-consumer models are now gaining traction, creating stiff competition for traditional broking services. Yet another pressing concern is the ever-increasing change in expectations from customers. Clients are now demanding more in terms of personalising policies while ensuring a seamless digital experience. To be in the race, brokers have to invest further in newer technologies like AI-based analytics and customer relationship management. Economic uncertainties, market dynamics, and fluctuating insurance premiums also further weaken the forecast for revenue and maintainability. All these changes thus render it very hard for brokers to keep clients in this fierce industry.

Risks & Prospects in Insurance Brokerage Market

The insurance broking market is set for growth, which results from increasing demand for insurance policies from customised financial services and security. Conducive to this are government initiatives, for example, relaxed Foreign Direct Investment (FDI) limits in India, and promoting competition and innovation through more foreign ownership in an insurance company or broking firm. This includes growing digital insurance platforms and increased participation of data analytics for brokers in terms of personalised selling, innovative risk management, and optimal pricing strategies. There are opportunities for brokers in the future, such as emergent risks like AI-based insurance. Other possible avenues for growth include customer-centric experiences, such as embedded insurance that is expected to grow over US$722 billion in premiums internationally by 2030, which will offer a chance for partnership with the automotive, retail, and real estate industries. The shift in regulation allowing insurance agents to sell multiple insurance companies will also benefit the consumers to have more choices in insurance products and to be able to select the most suitable insurance according to their needs.

Key Target Audience

The primary target audience in the insurance broking market comprises individuals, businesses, and organisations that require professional advice on insurance policies. Businesses, whether small or large, count on their insurance brokers to procure coverage in areas like property, liability, employee benefits, and risk management. On the other side, individuals, including high-net-worth clients, are looking for tailor-made insurance solutions for health, life, auto, and home insurance through brokers who compare policies and negotiate better terms. A second major audience consists of insurance firms, reinsurers, and financial institutions that work with brokers to increase their outreach and distribute their products. Moreover, government agencies, regulatory bodies, and professional associations participate as partners influencing the formulation of industry standards and compliance. As digitalisation has gathered momentum, tech-driven startups and online platforms are emerging as new actors in the market, targeting modern consumers who want a seamless, data-led insurance broking experience.

Merger and acquisition

The insurance broking market in 2024 experienced heightened levels of M&A activity, with 849 announced transactions in the U.S., up 5.2% from the earlier year. The post-pandemic M&A surge has been gradually winding down, but activities in the market remain high, spurred on by various strategic imperatives such as enhancements in digital capabilities and customer-centric approaches. Private equity investment has remained strong in insurance distribution assets, and these accounted for about 70% of transactions in 2024. Several significant acquisitions took place in early 2024, such as Travellers acquiring Corvus Insurance for an estimated $435 million and Pan-American Life Insurance Group merging with Encova Life Insurance Company. The most predominant acquirers in 2024 included BroadStreet Partners Inc., Inszone Insurance Services Inc., and Hub International Ltd. MarshBerry continues to predict an active M&A market in 2025, with demand from buyers continuing to outstrip supply from sellers.

>Analyst Comment

The insurance broking market is growing at a swift pace, with the size of the market projected to grow from $119.37 billion in 2024 to $125.38 billion in 2025. This growth is spurred by the increasing demand for insurance policies, arising mainly from customised financial services and security. Activity is also being recorded in the Asia-Pacific region, which is predicted to be the fastest-growing in the coming years, owing to the large populations in countries such as China and India. There are some key players in the insurance broking market: Acrisure LLC, Aon Plc, and Marsh & McLennan Companies Inc. These companies provide professional advice and extensive lines of insurance products, including property and casualty, health insurance, and medical insurance. Digital transformation via AI and data analytics has become important to brokers in providing the improved customer experience while also implementing streamlined operations and more tailored insurance products.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Insurance Brokerage- Snapshot

- 2.2 Insurance Brokerage- Segment Snapshot

- 2.3 Insurance Brokerage- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Insurance Brokerage Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Retail

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Wholesale

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Insurance Brokerage Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Property

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Institution

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Individual

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Insurance Brokerage Market by Brokerage

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Retail

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Wholesale

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Insurance Brokerage Market by Insurance

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Life Insurance

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Property & Casualty Insurance

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Insurance Brokerage Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 Germany

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.3 France

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.4 Italy

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.5 United Kingdom

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.6 Benelux

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.7 Nordics

- 8.7.1 Key trends and opportunities

- 8.7.2 Market size and forecast, by Type

- 8.7.3 Market size and forecast, by Application

- 8.7.4 Market size and forecast, by country

- 8.8 Rest of Europe

- 8.8.1 Key trends and opportunities

- 8.8.2 Market size and forecast, by Type

- 8.8.3 Market size and forecast, by Application

- 8.8.4 Market size and forecast, by country

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Aon (United Kingdom)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Arthur J. Gallagher & Co. (United States)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Brown & Brown

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Inc. (United States)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 HUB International (United States)

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Marsh & McLennan (United States)

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Lockton

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Inc. (United States)

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Truist Financial Corporation (United States)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 NFP Corp. (United States)

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 AmWINS Group Inc. (United States)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Willis Towers Watson (United Kingdom)

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Brokerage |

|

By Insurance |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Insurance Brokerage in 2030?

+

-

Which type of Insurance Brokerage is widely popular?

+

-

What is the growth rate of Insurance Brokerage Market?

+

-

What are the latest trends influencing the Insurance Brokerage Market?

+

-

Who are the key players in the Insurance Brokerage Market?

+

-

How is the Insurance Brokerage } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Insurance Brokerage Market Study?

+

-

What geographic breakdown is available in Europe Insurance Brokerage Market Study?

+

-

Which region holds the second position by market share in the Insurance Brokerage market?

+

-

How are the key players in the Insurance Brokerage market targeting growth in the future?

+

-

Demand mainly consists of insurance policies: An increasing insurance awareness is alarming individuals to protect their assets, income, and health. Thus, in the wake of economic development and population increase, the demand further is centred on individual and business needs for insurance coverage. Hence, insurance brokers play such an important role in interpreting the complexity of insurance so that customers can choose the appropriate coverage for their needs and thereby make the insurance process more accessible and understandable. Additionally, increasing complexities in insurance products and the personalised approach of the insurance solutions warrant a push-up of this market. Recent advancements in technologies such as digital platforms, data analytics, and artificial intelligence have also contributed to efficiently customised products and maximised consumer satisfaction. Other factors affecting growth in the insurance broking market include the emergence of SMEs, increasing cybersecurity threats, and risk management with customer-orientated solutions.