Global Night Vision Device Market – Industry Trends and Forecast to 2030

Report ID: MS-639 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Night Vision Device Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

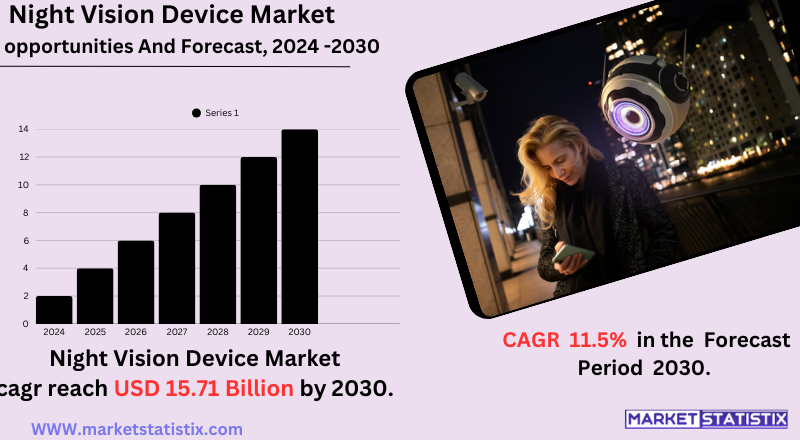

| Growth Rate | CAGR of 11.5% |

| Forecast Value (2030) | USD 15.71 Billion |

| By Product Type | Thermal Imaging Process, Low Light Imaging Process, Infrared Illumination |

| Key Market Players |

|

| By Region |

Night Vision Device Market Trends

A modern wonder of technology is its ever-increasing penetration into the realm of digital. Probably the most beautiful and pronounced effect of this is higher image clarity, recording capabilities, and the seamless integration with other digital systems. With the development of higher-resolution image sensors, these images continue to become liberated, along with their usefulness, because they have continually improved the performance of their devices under low-light conditions. Moreover, there is a growing demand for both commercial and private night-vision devices in security and surveillance applications. Governments and private sectors have been focused on investing massively in developing more advanced surveillance systems due to increasing concern about border security, terrorism, and public safety. The new trends are also observed: rising use of night-vision-equipped drones in the sectors, such as security, search and rescue, and agriculture. The rise of smart cities, with an emphasis on creating greater public safety and monitoring infrastructure, is providing further opportunities for incorporating this technology into night vision.Night Vision Device Market Leading Players

The key players profiled in the report are Thales Group (France), BAE Systems (United Kingdom), Teledyne FLIR LLC (United States), Leonardo S.p.A. (Italy), DRS Technologies (United States), L3Harris Technologies Inc. (United States), Elbit Systems Ltd. (Israel)Growth Accelerators

The market for night vision devices is evidently driven by increasing requirements for security and monitoring in various sectors. This represents a huge additional demand owing to the increased global concern towards security for borders, terrorism, and general public safety. These investments create a strong market thrust for extensive night vision technology utilization in the public and private sectors in bolstering their security infrastructure. The other important aspect is the integration of night vision functionalities into unmanned platforms, mainly drones. Drones equipped with night vision capabilities are fast becoming a primary feature among several applications, including surveillance, search and rescue missions, or military operations, thus widening the growth path that the market is taking. These improvements in night vision systems will make the technology more usable and attractive to many people, from law enforcement to military and recreational users. The new upward trend in the market also holds true in terms of applications utilized commercially, such as infrastructure monitoring and wildlife observation.Night Vision Device Market Segmentation analysis

The Global Night Vision Device is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Thermal Imaging Process, Low Light Imaging Process, Infrared Illumination . The Application segment categorizes the market based on its usage such as Wild Life Observation,, Hidden Object Detection, Material Testing, Security, Navigation, Law Enforcement, Surveillance, Entertainment, Hunting, Paranormal Research, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment of the night vision device market is a unique mixture of defense contractors and very specialized technology companies. Many of these players, including Teledyne FLIR, L3Harris Technologies, and BAE Systems, amass a huge chunk of the market share due to their experience in developing advanced imaging technologies for military and government applications. Alongside this, consistent innovation has always been one of their top priorities, hence the vast amount of money being injected to research and develop better-performing devices with clearer images that expand the range of detection. It is thereby a market wherein technological superiority and previously established government contracts become the main competitive edges. Also, there are certain changes in the competitive dynamics that occur due to regulatory environments and export restrictions, which can lead to major changes in the market access and distribution models of both large and small players as well.Challenges In Night Vision Device Market

The growing landscape of the night vision device (NVD) industry faces innumerable impediments. High production costs and very expensive components such as infrared sensors and image intensifiers are the reasons for the high cost of these devices, challenging their affordability for consumers and small businesses. Also, stringent government regulations on the export and use of NVDs, specifically in military applications, limit market growth. The existence of counterfeit and low-quality products also threatens the industry by hurting the reputation of established brand names since these brands compete for the same pool of customers against counterfeiters. Moreover, rapid technological advances render products overpriced, and manufacturers must continuously innovate and fund research and development. The incorporation of alternative technologies such as thermal imaging and digital night vision enhances competition among electronics and places traditional NVD manufacturers under pressure. Cybersecurity threats posed by the smart TSDs that link to digital networks also pose threats to hacking vulnerabilities and data breaches. Such challenges determine the competitive environment in which the players must operate and will also define the future path of growth for the night vision device market.Risks & Prospects in Night Vision Device Market

Such innovations, therefore, have made a real impact on the development of new combinations, such as ultrathin films for lightweight goggles and fusion technologies combining thermal and traditional imaging. They are proof of the enhanced capability of devices in the treatment of geospatial imaging. The high costs associated with advanced devices are the major challenge in the broadest adoption possible, especially for budget users or organizations. North America possesses such notable features as great defense investments and technological innovations, holding 32% market share in 2024, which makes it have the largest market share in the region. Asia-Pacific is emerging as the fastest-growing region due to increases in military expenditure and adoption of night vision devices in public infrastructure. Europe records considerable growth with vigour in government initiatives to ensure security and counter-terrorism. The slow regional growth for the Middle East & Africa and Latin America is due to increasing local government investment in advanced night vision solutions.Key Target Audience

The night vision device market targets two major types of customers: professionals and civilian users. The professionals include those organizations in military and defense, law enforcement, and security, who depend on these devices for tactical operations, surveillance, and threat assessment. Such users demand high-performance rugged equipment to stand the rigors of the hostile environment and provide them clear, reliable imagery.,, ,, The consumer group includes hunters, birdwatchers, recreational users, and homeowners for whom these devices are serious security solutions. This market desires low cost, simple operation, and lightweight portability. The increase in outdoor lifestyles and the greater accessibility of consumer-grade night vision devices have also grown this segment considerably, hence the need for simple and affordable options.Merger and acquisition

The night vision instrument world has been harvesting the fruits of its capital investment in acquisitions for quite some time. Some of these mergers and acquisitions include the much-publicized agreement between Teledyne Technologies to acquire selected aerospace and defense electronics segments from Excelitas Technologies for $710 million in November 2024. This acquisition will include Qioptiq, a UK firm focused on high-end optics for applications including heads-up displays and tactical night vision systems, as well as the US division producing custom energetics for defense and space. Teledyne's aim is to round up this acquisition in early 2025, ready to consolidate its position in the night vision and defense electronics markets. Furthermore, from July, Force Ordnance, an Australia-based defense partner, announced an agreement with Theon Sensors S.A. in supplying advanced optical systems to the ADF. This will also go toward enhancing the night vision and thermal systems of the Dismounted Combat program within the yet-to-be-named ADF. Theon Sensors has its headquarters in Greece, and it crafts and makes customizable night vision and thermal imaging systems mostly for military and security applications. These strategic moves underscore the industry's focus on enhancing technological capabilities and expanding market reach through mergers, acquisitions, and partnerships. >Analyst Comment

The night vision device market is growing rapidly owing to demand for enhanced security and surveillance across varied sectors. The increased expenditure in the military and defense sectors combined with rising demands in law enforcement and civilian applications foster such growth. Growing technologies in fields such as thermal imaging and digital night vision technology also fuel the growth of the market. Besides, integrating night vision in drones and other unmanned systems creates an entirely new platform for growth.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Night Vision Device- Snapshot

- 2.2 Night Vision Device- Segment Snapshot

- 2.3 Night Vision Device- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Night Vision Device Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Low Light Imaging Process

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Thermal Imaging Process

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Infrared Illumination

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Night Vision Device Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Law Enforcement

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Hunting

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Wild Life Observation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Surveillance

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Security

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Navigation

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Hidden Object Detection

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Entertainment

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Paranormal Research

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

- 5.11 Material Testing

- 5.11.1 Key market trends, factors driving growth, and opportunities

- 5.11.2 Market size and forecast, by region

- 5.11.3 Market share analysis by country

- 5.12 Others

- 5.12.1 Key market trends, factors driving growth, and opportunities

- 5.12.2 Market size and forecast, by region

- 5.12.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Teledyne FLIR LLC (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 L3Harris Technologies Inc. (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 BAE Systems (United Kingdom)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Thales Group (France)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Leonardo S.p.A. (Italy)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 DRS Technologies (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Elbit Systems Ltd. (Israel)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Night Vision Device in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Night Vision Device market?

+

-

How big is the Global Night Vision Device market?

+

-

How do regulatory policies impact the Night Vision Device Market?

+

-

What major players in Night Vision Device Market?

+

-

What applications are categorized in the Night Vision Device market study?

+

-

Which product types are examined in the Night Vision Device Market Study?

+

-

Which regions are expected to show the fastest growth in the Night Vision Device market?

+

-

Which application holds the second-highest market share in the Night Vision Device market?

+

-

Which region is the fastest growing in the Night Vision Device market?

+

-