Global 3D Printing Metal Market – Industry Trends and Forecast to 2030

Report ID: MS-2308 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

3D Printing Metal Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

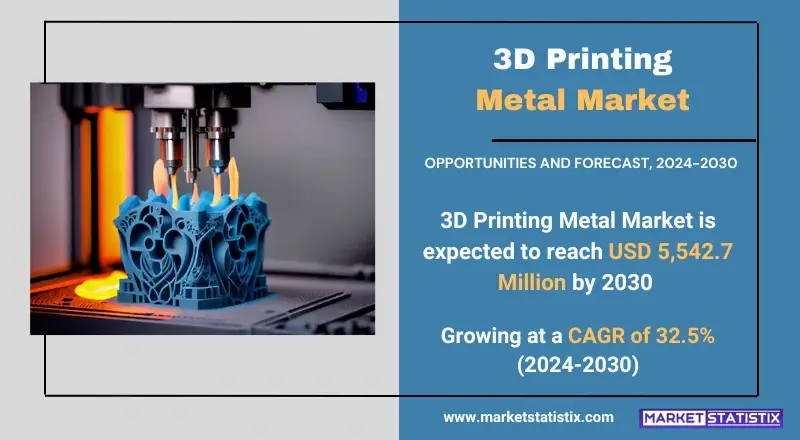

| Growth Rate | CAGR of 32.5% |

| Forecast Value (2030) | USD 5,542.7 Million |

| Key Market Players |

|

| By Region |

|

3D Printing Metal Market Trends

A market for metals through 3D printing really thrives owing to the technological advancement in additive manufacturing and demand for lightweight, strong materials in aerials, automobiles, and health sectors. The adoption of metal powders like titanium, aluminium, and steel would be a trend because of the superior properties and scalability they offer. The aerospace and defence world sectors constitute the chief users of it, producing complex and personalised designs while minimising waste and cost of manufacture. Another significant trend is the intensive resource investment in R&D for developing better metal printing materials and technologies. There is an accent on solutions that are cost-effective and expand the range of products to take care of broader applications. The emerging markets are also significantly grabbing hold of such induction because they are industrialising and investing government resources to support additive manufacturing.3D Printing Metal Market Leading Players

The key players profiled in the report are 3D Systems, Inc., Arcam AB, Autodesk, Inc., EOS (Electro Optical Systems) GmbH, ExOne, GE Additive, Materialise NV, Matsuura Machinery USA Inc., Optomec, Inc., Renishaw plc., Luiten Metal 3D Printings BV, SLM SolutionsGrowth Accelerators

The continuous adoption of 3D printing across a range of industries like aerospace, automotive, and healthcare is driving the 3D printing metal market. The advantage being derived through 3D printing in these sectors is being able to create lightweight, very complex, very customised parts with the least amount of material waste, in addition to the reduction in the manufacturing cost and time associated with 3D printing. Additive manufacturing further demands an increase in the adoption of metal 3D printing due to the emerging requirement for improved manufacturing efficiency and cost-effectiveness. Besides the investment in research and development, another driver of the advanced manufacturing technologies will be government support. The industrial-grade 3D printers keep expanding with advanced metal powders available at competitive pricing, opening the bottlenecks to a wider market reach. Alongside the business call for sustainable manufacturing, the energy-efficient and sustainable waste-minimising nature of metals 3D printing further adds impetus to its global adoption.3D Printing Metal Market Segmentation analysis

The Global 3D Printing Metal is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Aerospace & Defense, Automotive, Medical & Dental, Others (Marine, Art & Sculpture, Jewelry, and Architecture). Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive arena of the 3D printing metal market is characterised by ongoing rapid innovations and an increasing number of players building in the field. Key companies participating in the market include General Electric, EOS GmbH, 3D Systems Corporation, and Renishaw plc, and they are allocating their investments toward an R&D continuum on providing the best materials quality, production speed, and cost efficiency. Ordinarily, these companies exploit strategic alliances, acquisitions, and joint ventures whereby they can further develop their offerings and penetrate more regions. When you add up all the startups developing niche applications and materials, competition just gets tougher, hence quite dynamic and competitive.Challenges In 3D Printing Metal Market

The market for 3D printing metals has a lot of barriers that come between it and mass acceptance. High initial investments for equipment and materials combined with the need for skilled experts are proving quite the hindrance, particularly for small and medium-sized enterprises (SMEs). These issues further compound the already complex requirements of post-processing and some quality control standards, making productions relatively longer and costlier than the traditional methods of manufacture—with all these factors pointing at a metal 3D printing scalability and economic infeasibility within mainly high-volume production industries. Another major problem is that there is no standard material or processing across the industry. Different properties of the materials and their diversely variable performance in connection with different 3D printing systems are the major reasons for concerns about reliability by the end user. Moreover, the entire process is also complicated because of regulatory hurdles, more so in highly regulated sectors such as aerospace and healthcare.Risks & Prospects in 3D Printing Metal Market

Currently, the rapidly advancing manufacturing technologies and their growing demand across industries for custom elements are proving significant opportunities for the metal 3D printing marketplace. Key industries such as aerospace, automotive, and healthcare started incorporating 3D-printing metals into their part designs to add design flexibility, reduce material waste, and improve efficiency in production. For example, parts made of such materials are lightweight but have tremendous strength, thus resulting in saving fuel consumption and better performance. In addition to these trends, the use of additive manufacturing of metal for prototyping and low-volume production will continue to open new avenues in the marketplace. The emergence of Industry 4.0 and the digital technologies integrated into production processes are transforming those processes into more cost-effective and scalable ones. Furthermore, the discovery and development of custom-designed new metal powder and alloys for additive manufacture are bound to result in many new innovations in the scope of high-performance applications, contributing to the upward growth trajectory of the market.Key Target Audience

The key target audience for the 3D printing metal market comprises those industries that require components that are highly accurate yet very durable and lightweight. One of the strongest proponents of 3D printing in building up complex parts, such as turbine blades and engine components, along with lightweight structures, has been the aerospace and defence sectors, for purposes like reducing material waste and enhanced performance. In the same vein, the automotive industry utilises metal 3D printing for the invention of customised tools, prototypes, and end-use parts; this brings an entirely different design flexibility and also shortens production lead times.,, Aside from this, the healthcare and dental end-users put a chunk of their viewing on 3D printing metal for patient-specific implants and prosthetics, as well as surgical tools with high biocompatibility and accuracy. Other segments are then industrial manufacturing with such customised, efficient metal parts, and that converges with energy, covering renewables, oil, and gas applications.Merger and acquisition

Recently, the 3D printing metal market has been a scene of considerable mergers and acquisitions related to activities between Nano Dimension and Desktop Metal, with Desktop Metal stockholders seeming to have approved a merger with Nano Dimension valued at almost $183 million in October 2024. An interesting twist to the story is that the merger is really part of the strategy of Nano Dimension to strengthen its game in the additive manufacturing (AM) field to form a strong player like HP or GE for competitive purposes. Revenue estimates for the combined entities translate to about $340 million based on 2023 statistics across the two companies based on an equal consideration of Desktop Metal's advanced technologies along with Markforged's extensive installed systems in the market. Aside from the Desktop Metal merger, Nano Dimension is also planning to acquire Markforged at about $115 million, thus further consolidating the influence of the giant in the AM space. The deal is expected to close in early 2025, after which Nano Dimension will bring an integrated portfolio of technologies from both companies to the newly combined entity, together improving their value propositions in the metal binder jetting and composite 3D printing arenas. >Analyst Comment

"The worldwide industry of 3D printing in metals is progressively growing due to demands from industries. Some key drivers of this fast-growing market include producing complex geometries, minimising material waste, and providing on-demand production. Its advantages over conventional methods include faster lead times and producing customised components. It is expected that the market will increase tremendously in the years to come owing to evolving technologies and increasing investments in research and development, along with application in a large variety of sectors."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 3D Printing Metal- Snapshot

- 2.2 3D Printing Metal- Segment Snapshot

- 2.3 3D Printing Metal- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: 3D Printing Metal Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Aerospace & Defense

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Automotive

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Medical & Dental

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others (Marine

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Art & Sculpture

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Jewelry

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 and Architecture)

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

5: 3D Printing Metal Market by Form

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Powder

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Filament

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: 3D Printing Metal Market by Technology

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Powder Bed Fusion

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Directed Energy Deposition

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Binder Jetting

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Metal Extrusion

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others (Digital Light Projector

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Multi-jet Fusion

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 and Material Jetting)

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

7: 3D Printing Metal Market by Metal Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Titanium

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Nickel

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Stainless Steel

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Aluminum

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Others (Cobalt-chrome

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

- 7.7 Copper

- 7.7.1 Key market trends, factors driving growth, and opportunities

- 7.7.2 Market size and forecast, by region

- 7.7.3 Market share analysis by country

- 7.8 Silver

- 7.8.1 Key market trends, factors driving growth, and opportunities

- 7.8.2 Market size and forecast, by region

- 7.8.3 Market share analysis by country

- 7.9 Gold

- 7.9.1 Key market trends, factors driving growth, and opportunities

- 7.9.2 Market size and forecast, by region

- 7.9.3 Market share analysis by country

- 7.10 and Bronze)

- 7.10.1 Key market trends, factors driving growth, and opportunities

- 7.10.2 Market size and forecast, by region

- 7.10.3 Market share analysis by country

8: 3D Printing Metal Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 3D Systems

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Inc.

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Arcam AB

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Autodesk

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Inc.

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 EOS (Electro Optical Systems) GmbH

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 ExOne

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 GE Additive

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Materialise NV

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Matsuura Machinery USA Inc.

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Optomec

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Inc.

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Renishaw plc.

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Luiten Metal 3D Printings BV

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 SLM Solutions

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Form |

|

By Technology |

|

By Metal Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of 3D Printing Metal in 2030?

+

-

What is the growth rate of 3D Printing Metal Market?

+

-

What are the latest trends influencing the 3D Printing Metal Market?

+

-

Who are the key players in the 3D Printing Metal Market?

+

-

How is the 3D Printing Metal } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the 3D Printing Metal Market Study?

+

-

What geographic breakdown is available in Global 3D Printing Metal Market Study?

+

-

Which region holds the second position by market share in the 3D Printing Metal market?

+

-

Which region holds the highest growth rate in the 3D Printing Metal market?

+

-

How are the key players in the 3D Printing Metal market targeting growth in the future?

+

-