Global Acetone Market – Industry Trends and Forecast to 2030

Report ID: MS-281 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

Acetone Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

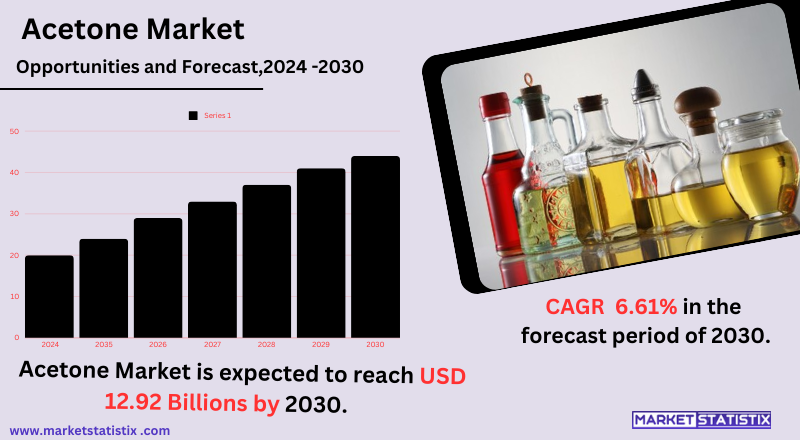

| Growth Rate | CAGR of 6.61% |

| Forecast Value (2030) | USD 12.92 Billion |

| By Product Type | Solvents, Raw Materials |

| Key Market Players |

|

| By Region |

Acetone Market Trends

The significant increase in the acetone market is caused by the increasing requirement of it in the pharmaceutical and cosmetic industries, where acetones are an inevitable factor involved in the making of active pharmaceutical ingredients (APIs), nail polish remover, and skin care products, as well as the growing focus of consumers on personal care. Under the additional developments, one of the major trends also being witnessed is the increased adoption of sustainable practices, which is all the more pointing towards bio-based acetone. All pretty much restrictive environmental regulations and preferences of the customer for greener products prompt a manufacturer's attempt in exploring renewable sources. The segment is additionally boosted by the continuous growth of end-use industries like automotive electronics and construction, as acetones are used greatly in the manufacture of paints, coatings, and adhesives.Acetone Market Leading Players

The key players profiled in the report are Arkema, CEPSA Quimica, S.A., DOMO Chemicals, Honeywell International Inc, INEOS, Kumho P&B Chemicals, Mitsui Chemicals, Inc., SABIC, Shell plc, SolvayGrowth Accelerators

The main driving force of the acetone market is its very extensive use as a solvent in different industries such as paints & coatings, adhesives, and pharmaceuticals. In addition, the increasing application of acetone solvents in the construction and automobile industries for cleaning and thinning applications also propels market growth significantly. Another driving factor for growth is the increasing use of acetone in personal care and cosmetics applications in products like nail polish removers and skin cleansers for their effectiveness and economy. Emerging economies continue to expand end-user industries and fuel innovations in acetone production processes. Creating new market opportunities are environmental regulations that promote and regulate sustainable and bio-based acetone production.Acetone Market Segmentation analysis

The Global Acetone is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Solvents, Raw Materials . The Application segment categorizes the market based on its usage such as Chemicals, Pharmaceuticals. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The acetone market is quite competitive and is highly visited by major global players and very few regional manufacturers. The industry's prominent leaders, including BASF, INEOS, LyondellBasell, and Royal Dutch Shell, keep the acetone market by virtue of their production capacity, advanced technologies, and distribution networks. These companies deal with high-quality acetone, either expanding their capacity in production or implementing cost-effective methods of its manufacture with a view of meeting the demand among different sectors such as chemicals, pharmaceuticals, and automobiles.Challenges In Acetone Market

One major challenge facing the acetone market is the fluctuation of raw material prices, which are all dependent on volatility from crude oil and natural gas prices. Most of the acetone production is based on the cumene process; hence, availability and prices of petrochemical derivatives determine this production. And with these price swings, production costs become highly uncertain, which may manifest in either unstable or unprofitable markets. Regulatory and environmental factors shape the acetone market as it's being classified as a volatile organic compound (VOC). It has a very stringent regulation on its usage, handling, and disposal, mostly concerning paint, coatings, and pharmaceuticals. This pressure restriction is bound to be coupled with the growing demands of much safer and greener solvents to limit or curb their growth in the market in the next few years.Risks & Prospects in Acetone Market

The market in acetone is, according to its application, diversified across numerous regions and sectors and has huge growth opportunities. In the automobile and construction industries, acetone is used as a solvent within paint thinners, coatings, and adhesives, central to manufacturing and finishing processes. There is a substantial market opportunity due to increased production in the automotive industry globally, along with rising demand for superior materials such as composites and coatings. Another one of the great opportunities lies in the pharmaceutical and personal care industries, where acetone is used in the synthesis of pharmaceuticals, cosmetics, and cleaning products. Increasing demand for personal care products in emerging markets makes acetone an important aid in formulation and purification. The increasing use of acetone within laboratories for chemical synthesis and research, among other applications, fuels demand.Key Target Audience

Acetone is consumed more in coating, paint, and adhesive formulations, added to automotive, construction, and consumer goods segments as significant end-user industries for surface preparation and finishing. The major target market for the acetone market is industries or companies that use acetone through different applications as a solvent. Acetone is used in cleaning and solvent applications in producing drugs and other chemicals in the chemical and pharmaceutical industries.,, One of the most obvious applications of acetone is for the removal of material from human nails. So it comes under the beauty and personal care segment, and that is a huge part of the acetone market—mainly dictating sales in personal care for nail polish removers, skin care products, and other types of cosmetic formulations. The electronics and textiles industries also consume acetone as a degreasing agent and for cleaning purposes.Merger and acquisition

Mergers and acquisitions have paved the way for the acetone industry and are making the market more dynamic with time. The most thrilling among them would include Aceto Corporation's acquisition of Finar Limited—an Indian company engaged in manufacturing pharmaceutical excipients and lab chemicals such as acetone—from U.S.-based speciality materials dealers in May 2021. Also in December 2023, INEOS Group Ltd heavily invested in acquiring the production site and all the assets of Mitsui Phenols Singapore Pte. Ltd. for $330 million. The increased production of acetone, which is also expected to spur demand projected to surge globally from $5.13 billion in 2023 to $5.5 billion in 2024, is anticipated to boost INEOS significantly. >Analyst Comment

"At present, an incredible number of billions belong to the worldwide acetone market, which is a developing industry and expected to attain impressive growth in the future. The major reason behind this development is heightened demand from sectors such as pharmaceuticals, paints and coatings, and plastics. The wide versatility of acetone, both as a solvent and a precursor to chemicals or cleaning agents, makes it an important commodity in many manufacturing processes. The market is expected to show a moderate annual compound growth rate (CAGR) during the forecast period due to expanding industrial applications, technological advancements in production processes, and increasing global economic activity."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Acetone- Snapshot

- 2.2 Acetone- Segment Snapshot

- 2.3 Acetone- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Acetone Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Solvents

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Raw Materials

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Acetone Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Chemicals

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceuticals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Acetone Market by Grade

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Technical Grade

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Specialty Grade

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Arkema

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CEPSA Quimica

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 S.A.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 DOMO Chemicals

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Honeywell International Inc

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 INEOS

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Kumho P&B Chemicals

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Mitsui Chemicals

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SABIC

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Shell plc

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Solvay

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Grade |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Acetone in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Acetone market?

+

-

How big is the Global Acetone market?

+

-

How do regulatory policies impact the Acetone Market?

+

-

What major players in Acetone Market?

+

-

What applications are categorized in the Acetone market study?

+

-

Which product types are examined in the Acetone Market Study?

+

-

Which regions are expected to show the fastest growth in the Acetone market?

+

-

Which application holds the second-highest market share in the Acetone market?

+

-

Which region is the fastest growing in the Acetone market?

+

-