Global Advanced Electronic Material Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-586 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Advanced Electronic Material Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

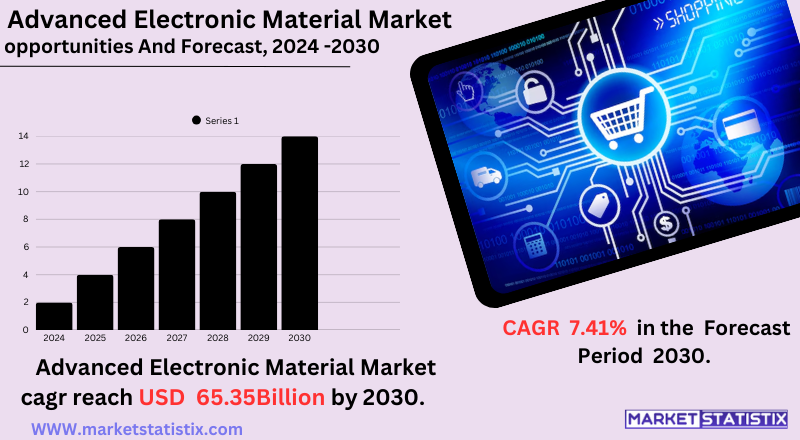

| Growth Rate | CAGR of 7.41% |

| Forecast Value (2030) | USD 65.35 Billion |

| By Product Type | Nanomaterials, Ceramics, Polymers, Composites, Others |

| Key Market Players |

|

| By Region |

Advanced Electronic Material Market Trends

Market trends proving very superior regarding advanced electronic materials are those emerging from innovations in technology at a great pace. Thus, the increase in the need for these materials spurred by the consumer electronics market, automotive, and health care industries keeps a key open-ended trend emerging in electro-conductive nanomaterials. These include graphene and carbon nanotubes, which have been heralded for their greater conductivity and flexibility and have made possible innovations in flexible displays and wearable devices. In addition, miniaturization in electronic components has further propelled the demand for very high-performance materials, such as advanced semiconductors and dielectric materials, for highly compact, efficient devices as far as the needs for cost and size are concerned. The most favourite of such cases is that of an increasing incorporation of advanced electronic materials into a developing technology such as 5G, IoT, and electric vehicles (EVs). The rollout of 5G networks opens an upsurge of demand for high-frequency materials, like ceramics and polymers that furnish the transceiver of data transmission at higher speeds. Meanwhile, in the EV sector, SiC and GaN are those whose names are trending. They are very efficient materials for power electronics applications that help in better battery performance.Advanced Electronic Material Market Leading Players

The key players profiled in the report are Hitachi Chemical Co., Ltd. (Japan), Hexcel Corporation (United States), Morgan Advanced Materials plc (United Kingdom), Hanwa Group (South Korea), Smartglass International Ltd (Ireland), Huntsman Corporation (United States), 3M Advanced Materials (United States), Materion Corporation (United States), Altairnano Blue Spark Technologies (United States)Growth Accelerators

The advanced electronic materials market is fuelled by the ever-increasing demand for high-performance electronic instruments from various industries. Gems such as smartphones, tablets, and wearables will be important candidates, since those in consumer electronics can rapidly escalate and require every material conceivable that possesses capabilities such as superior conductivity, thermal management, and miniaturization. Furthermore, the expanding automotive industry with a focus on electric vehicles (EVs) and advanced driver assistance systems (ADAS) is driving demand for materials that improve battery performance, sensor accuracy, and overall efficiency of the vehicle. The growth of 5G along with IoT infrastructure is also a great contributor to requiring advanced materials for high-frequency applications and reliable connectivity. Another important market driver is the increasing concern toward energy efficiency and sustainability. Consequently, the development of materials for advanced solar cells, LED lighting, and energy storage devices is witnessed. An equally important market force follows Moore's, albeit in a reverse direction—the shrinkage into modern structured chips, which becomes more difficult by every day and in turn creates the need for ultra-high purity materials as well as advanced lithography materials.Advanced Electronic Material Market Segmentation analysis

The Global Advanced Electronic Material is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Nanomaterials, Ceramics, Polymers, Composites, Others . The Application segment categorizes the market based on its usage such as Industrial, Healthcare, Electrical & Electronics, Plants, Automotive & Aerospace, Petrochemicals, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The advanced electronic materials market is characterized by fierce competition between well-established companies and newly emerging companies in the sector. Most major players like BASF SE, Samsung Electronics, and Panasonic established their competitive positions through progressive research and development, wide-ranging portfolios of products, and strategic partnerships. For example, BASF SE is offering a variety of materials for applications in electronics, while Samsung Electronics ventures into the innovative realm of conducting semiconductors. New companies such as Nanosys Inc. are already going places, especially in some specialized sectors such as quantum dots and nanomaterials, thereby bringing dynamism to the market.Challenges In Advanced Electronic Material Market

The market for advanced electronic materials faces many challenges; the major problems, in particular, arise from the complexity and the rapid evolution of the technological landscape. One major area of concern is the high R&D cost involved in developing novel materials that satisfy the increasingly stringent performance criteria required for modern electronics. Such criteria frequently invoke a need for specialized manufacturing and stringent quality control, which in turn elevate the overall cost of production even further. Another big problem is the urgent need to innovate faster than the advancement of electronic device technology. A demand for smaller, faster, and more power-efficient devices brings continuous pressure on improving material properties and processing techniques. Environmental concerns and regulatory pressures to develop sustainable and eco-friendly materials also put a major burden on manufacturers as they try to weigh the performance of their materials against their environmental responsibility.Risks & Prospects in Advanced Electronic Material Market

Market trends proving very superior regarding advanced electronic materials are those emerging from innovations in technology at a great pace. Thus, the increase in the need for these materials spurred by the consumer electronics market, automotive, and health care industries keeps a key open-ended trend emerging in electro-conductive nanomaterials. These include graphene and carbon nanotubes, which have been heralded for their greater conductivity and flexibility and have made possible innovations in flexible displays and wearable devices. In addition, miniaturization in electronic components has further propelled the demand for very high-performance materials, such as advanced semiconductors and dielectric materials, for highly compact, efficient devices as far as the needs for cost and size are concerned. The most favourite of such cases is that of an increasing incorporation of advanced electronic materials into a developing technology such as 5G, IoT, and electric vehicles (EVs). The rollout of 5G networks opens an upsurge of demand for high-frequency materials, like ceramics and polymers that furnish the transceiver of data transmission at higher speeds. Meanwhile, in the EV sector, SiC and GaN are those whose names are trending. They are very efficient materials for power electronics applications that help in better battery performance.Key Target Audience

, The major end-user segments for the advanced electronic materials market are semiconductor manufacturers, electronics component manufacturers, and major research institutions. High-purity metals, specialty chemicals, and dielectric films commonly used in microprocessor and memory chip fabrication processes are the key classes of advanced materials being consumed by semiconductor manufacturers. Electronics component manufacturers, including PCB manufacturers and display panel makers, need advanced materials to develop innovations in flexible electronics, high-speed connectivity, and energy-efficient designs., Another important segment will be industries such as automotive, aerospace, and renewable energies, which are majorly relying on advanced electronic materials for the possible advancements in technology. The automotive market, especially electric vehicles, demands advanced materials for batteries and power semiconductors for efficiency and safety. Aerospace and defense industries require high-performance materials for mission-critical applications and electronics that are unlikely to fail, especially in regions of high radiation.Merger and acquisition

The advanced electronic materials market has recorded a series of mergers and acquisitions over the last year, sharpening its focus on a strategy of consolidation and expansion. Ara Partners acquired Vacuumschmelze (VAC) in October 2023. VAC is the only Western producer of sintered NdFeB electric vehicle-grade permanent magnets, along with being a globally leading advanced magnetic materials producer. This positions VAC as the one to provide high-quality magnetic materials in response to growing demand worldwide for energy transition. Entegris has also made another major announcement about an acquisition—it is acquiring CMC Materials for $6.5 billion. The merger includes a much broader offering in electronic materials, thereby giving a better competitive position to Entegris in semiconductor fabrication. The combined company will become one of the top five in materials and gases for wafer fabrication and would feature a comprehensively diversified and balanced portfolio as it focuses on the most advanced end of the technology spectrum. >Analyst Comment

The advanced electronic materials market has witnessed significant progress, mainly attributed to the growing demand for performance-based electronic devices from various end-use industries. The increasingly popular use of smartphones, tablets, and other consumer electronics, along with the introduction of high-performance technologies such as 5G, IoT, and AI, is compelling the usage of advanced electronic materials. Advanced electronics materials find larger applications in the semiconductor industry. Manufacturers are looking into manufacturing smaller, faster, and energy-efficient chips. The automotive sector is shifting towards electric vehicles and autonomous driving, which is creating a demand for advanced materials for sensors, displays, and power electronics.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Advanced Electronic Material- Snapshot

- 2.2 Advanced Electronic Material- Segment Snapshot

- 2.3 Advanced Electronic Material- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Advanced Electronic Material Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Composites

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Ceramics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Polymers

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Nanomaterials

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Advanced Electronic Material Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Healthcare

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive & Aerospace

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Electrical & Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Industrial

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Petrochemicals

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Plants

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 3M Advanced Materials (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Morgan Advanced Materials plc (United Kingdom)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Huntsman Corporation (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Hexcel Corporation (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Hanwa Group (South Korea)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Materion Corporation (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Smartglass International Ltd (Ireland)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Hitachi Chemical Co.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Ltd. (Japan)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Altairnano Blue Spark Technologies (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Advanced Electronic Material in 2030?

+

-

Which type of Advanced Electronic Material is widely popular?

+

-

What is the growth rate of Advanced Electronic Material Market?

+

-

What are the latest trends influencing the Advanced Electronic Material Market?

+

-

Who are the key players in the Advanced Electronic Material Market?

+

-

How is the Advanced Electronic Material } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Advanced Electronic Material Market Study?

+

-

What geographic breakdown is available in Global Advanced Electronic Material Market Study?

+

-

Which region holds the second position by market share in the Advanced Electronic Material market?

+

-

How are the key players in the Advanced Electronic Material market targeting growth in the future?

+

-