Global Advanced IC Substrate Market - Industry Dynamics, Size, And Opportunity Forecast To 2031

Report ID: MS-404 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

Advanced IC Substrate Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

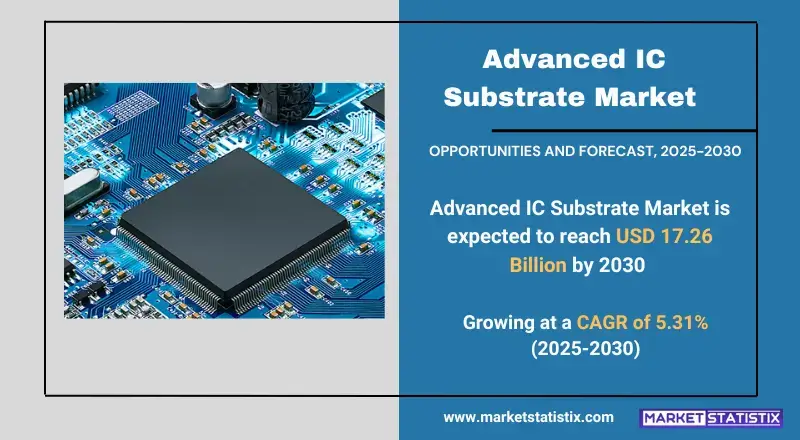

| Growth Rate | CAGR of 5.31% |

| Forecast Value (2031) | USD 17.26 Billion |

| By Product Type | FC BGA, FC CSP |

| Key Market Players |

|

| By Region |

|

Advanced IC Substrate Market Trends

The advanced IC substrate market is on a high-growth trajectory sustained by the continuous demand for smaller, faster, and more powerful electronic devices. This mostly arises from the diffusion of 5G networks, artificial intelligence, and high-performance computing, which in themselves require advanced substrates that will support complex chip architectures. In tandem, manufacturers have adopted advanced packaging technologies such as fan-out wafer-level packaging, as well as 2.5D/3D integration, further bringing about the necessity of substrates with fine pitch, high density, and enhanced thermal management capabilities. The other major trend sees power efficiency and miniaturization promoted. A parallel demand is felt for substrates that are able to support a very high density of components while minimizing power consumption, as devices are getting smaller and more portable. New substrate materials and designs have come up in this regard, such as thinner substrates, embedded passives, and those with improved thermal diffusion characteristics.Advanced IC Substrate Market Leading Players

The key players profiled in the report are Nan Ya PCB Co. Ltd. (Nan Ya Plastics Corporation), LG Innotek Co. Ltd., Ibiden Co. Ltd., ASE Group, KYOCERA Corporation, Fujitsu Limited, JCET Group Co. Ltd, Kinsus Interconnect Technology Corp., Korea Circuit Co. Ltd., TTM Technologies Inc., AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, Unimicron Technology Corporation (United Microelectronics Corporation)Growth Accelerators

The advanced IC substrate market has a huge potential and has been growing tremendously owing to unquenchable thirst for the performance of a high-end electronic device. This demand has intensified while consumers and industries turn towards sophisticated devices such as smartphones, artificial intelligence, and cloud computing, thereby putting pressure on ICs. The augury of decreased size into smaller systems has begun for yet another reason. Packed with more and more functionality in space-constrained areas, portable devices are developed to be smaller, lighter, highly integrated, and more powerful. Miniaturization is a driver that is re-realised through high-density interconnections and efficient thermal management, which comprise advanced IC substrates. It is expected to further energise the advanced object market in electronics, wearables, and IoT.Advanced IC Substrate Market Segmentation analysis

The Global Advanced IC Substrate is segmented by Type, Application, and Region. By Type, the market is divided into Distributed FC BGA, FC CSP . The Application segment categorizes the market based on its usage such as IT and Telecom, Automotive and Transportation, Consumer Electronics, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The advanced IC substrate market remains an area of fierce competition today, playing host to a number of key players. The big boys like ASE Group, AT&S, and Ibiden enjoy a large share of the market, attracting customers by combining their expertise in manufacturing with established ties to semiconductor manufacturers. As a group, these players continually engage in R&D activities to push the frontiers of their substrate technologies, concentrating on miniaturization, higher performance, and greater integration. Additionally, competitive dimensions are added by the increasing number of niche players and the entry of prospective new entrants. Various strategies for gaining a competitive advantage are being adopted by the players—from strategic alliances, mergers, and acquisitions to capacity expansion. Some players are increasingly pursuing vertical integration, focusing on self-supply for raw material to finished products.Challenges In Advanced IC Substrate Market

The advanced IC substrate market has to face a lot of challenges, which include the increasing complexity of manufacturing processes. The process by which chips become sophisticated imposes increasing demands on substrates in terms of density, performance, and reliability. This would entail new kinds of materials, advanced manufacturing techniques, and a rigorous quality control measure, which are difficult and costly to implement. Very high yields and minimum defects with respect to the production of such complex substrates are the major challenges. Another such area of concern is the escalating costs in research and development and in capital expenditure for advanced manufacturing facilities. The market requires continuous improvements and innovations to keep abreast of technological advances, which puts a lot of pressure on manufacturers to invest heavily in R&D and new equipment. This can be particularly daunting for smaller players in the scheme of things.Risks & Prospects in Advanced IC Substrate Market

The market for advanced IC substrates is expected to grow tremendously, as there is a surging demand from various sectors such as consumer electronics, automotive, and telecommunications for high-performance and compact electronic devices. The market value was estimated at about USD 20.23 billion in the year 2025, and it is expected to be worth USD 35.23 billion by 2030. The upturn can be directly attributed to such extensive technologies like 5G, IoT, and AI since they require sophisticated integrated circuits that can support more functionality in smaller forms. Regionally, the Asia-Pacific region, especially China, offers good prospects for market opportunities. The advanced IC substrate market in China is expected to grow at an annual growth rate of approximately 14%, from 2024 to 2029, as the country plans to launch several strategies that would help increase the production of semiconductor components for domestic consumption. In addition, the industry is undergoing a competitive transition toward the commercialization of glass core substrates according to the lines opened by leading players such as Absolics, Intel, and Samsung, which underscores the dynamism of the market and also points toward innovation and investment potential in advanced IC substrate technologies.Key Target Audience

The foremost target customer for the advanced IC substrate market is semiconductor manufacturers and IDMs. These companies utilize advanced substrates to package chips into functional electronic devices. Substrate specifications include high performance, signal integrity, thermal management, and compatibility in terms of advanced packaging technologies. The decision of the organization to purchase or source from any vendor is influenced by cost, reliability, and substrate capability in allowing the design and performance targets specific to their chips.Merger and acquisition

Most of the activities in advanced IC substrates, mergers, and acquisitions (M&A) have erupted because of the desire of companies to acquire more and better technical capabilities and develop a better global footprint. Players in the industry are widely pursuing vertical integration to consolidate their power within the semiconductor value chain. Alongside this process, partnerships are developed with strategic customers in fast-growing sectors like 5G communications, automotive electronics, and high-performance computing. Although particular names of the most recent M&A events are not provided in the available source material, the market is vigorous with collaborations and consolidations. Companies are engaging in strategic mergers and acquisitions to strengthen their market position and leverage emerging opportunities. This further reflects the aspirations of the industry to innovate while adapting to shifting technological needs. >Analyst Comment

Growth in the advanced IC substrate market for these reasons is robust owing to the need for high-performance electronic devices across different industries. The need for advanced substrates that can withstand complex chip architectures and high-speed signal transmission will continue to grow in tandem with the rising popularity of smartphones, tablets, and other connected devices, as well as data-heavy applications including AI and 5G. This market is rife with intense competition among major players investing heavily in R&D for innovating and upgrading their substrate technologies.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Advanced IC Substrate- Snapshot

- 2.2 Advanced IC Substrate- Segment Snapshot

- 2.3 Advanced IC Substrate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Advanced IC Substrate Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 FC BGA

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 FC CSP

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Advanced IC Substrate Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Consumer Electronics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive and Transportation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 IT and Telecom

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Advanced IC Substrate Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 ASE Group

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Fujitsu Limited

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ibiden Co. Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 JCET Group Co. Ltd

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Kinsus Interconnect Technology Corp.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Korea Circuit Co. Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 KYOCERA Corporation

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 LG Innotek Co. Ltd.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Nan Ya PCB Co. Ltd. (Nan Ya Plastics Corporation)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 TTM Technologies Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Unimicron Technology Corporation (United Microelectronics Corporation)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Advanced IC Substrate in 2031?

+

-

What is the growth rate of Advanced IC Substrate Market?

+

-

What are the latest trends influencing the Advanced IC Substrate Market?

+

-

Who are the key players in the Advanced IC Substrate Market?

+

-

How is the Advanced IC Substrate } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Advanced IC Substrate Market Study?

+

-

What geographic breakdown is available in Global Advanced IC Substrate Market Study?

+

-

Which region holds the second position by market share in the Advanced IC Substrate market?

+

-

Which region holds the highest growth rate in the Advanced IC Substrate market?

+

-

How are the key players in the Advanced IC Substrate market targeting growth in the future?

+

-