Global Advanced millimeter wave reflectors and repeaters Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2564 | Machinery and Equipment | Last updated: Apr, 2025 | Formats*:

Advanced millimeter wave reflectors and repeaters Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

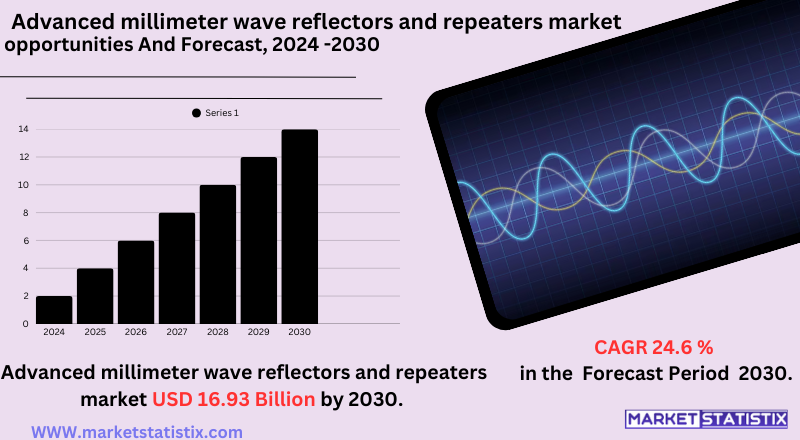

| Growth Rate | CAGR of 24.6% |

| Forecast Value (2030) | USD 16.93 Billion |

| By Product Type | Scanning systems, Radar and satellite communication systems |

| Key Market Players |

|

| By Region |

|

Advanced millimeter wave reflectors and repeaters Market Trends

These innovations in materials such as graphene-enhanced composites, along with phased array antenna systems for active repeaters, are improving signal performance and coverage while overcoming the intrinsic challenges to mmWave signal propagation. Key trends are the telecommunications industry drives market growth, with major players significantly investing in 5G infrastructure. North America is expected to account for the largest share of the market due to the early deployment of advanced 5G infrastructure and governmental initiatives, while Europe is expected to register the fastest growth. Although the adoption of mmWave technology entails high capital costs, increasing demand for high-bandwidth applications and continuous advancements in reflector and repeater designs are projecting a market upsurge around Kolhapur and globally.Advanced millimeter wave reflectors and repeaters Market Leading Players

The key players profiled in the report are DKK NA, TMY Technology Inc., Millimeter Wave Products Inc., Dai Nippon Printing Co., Ltd., Teledyne Technologies, SOLiD, Movandi Corporation, Anteral S.L., Mitsubishi Corporation, FRTek, PIVOTAL COMMWARE, Eravant, Wilson Electronics, GreenerwaveGrowth Accelerators

The advanced millimetre wave (mmWave) reflectors and repeaters market is primarily driven by a rapid deployment of high-frequency 5G and beyond-5G networks. These next-generation networks demand ultra-high bandwidth and low latency, delivered using mmWave technology. However, because mmWave signals have short transmission ranges and are very susceptible to blockage, reflectors and repeaters are needed to improve signal propagation, extend coverage, and ensure high-speed connectivity, especially in crowded urban and industrial areas such as Kolhapur. Further, the increasing demand from almost every part of the economy for applications that consume massive amounts of data has created market growth opportunities. The video-on-demand HD streaming, cloud gaming, VR, AR, and IoT applications all depend on mmWave technology for high data rates and low latencies. Advanced reflectors and repeaters will pave the way for these applications by optimising signal delivery and overcoming the limitations of mmWave signals to thereby unleash the full potential of the technologies across diverse use cases, such as smart cities, autonomous vehicles, and industrial automation.Advanced millimeter wave reflectors and repeaters Market Segmentation analysis

The Global Advanced millimeter wave reflectors and repeaters is segmented by Type, and Region. By Type, the market is divided into Distributed Scanning systems, Radar and satellite communication systems . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the high-end advanced millimetre wave (mmWave) reflectors and repeaters market is currently very niche yet fast-expanding. It has all of the private specialised outfits as well as some larger public entities that are turning their eyes to it as demand increases for both high-bandwidth 5G and beyond 5G networks. These would include Pivotal Commware, Movandi Corporation, FRTek, Wilson Electronics, TMY Technology Inc., and Millimetre Wave Products Inc. These companies are often marked by their innovation in beamforming, materials science (e.g., metamaterials), and active repeater designs overcoming the propagation challenges of mmWave signals. Competition is heating up as mmWave technology deployment picks up in earnest, especially into dense urban areas and industrial settings. The key differentiators in competition will become the efficiency and effectiveness of reflector and repeater designs in extending signal range and overcoming obstacle performance; smart technology integration for real-time optimisation; and cost competitiveness.Challenges In Advanced millimeter wave reflectors and repeaters Market

The advanced millimetre wave reflectors and repeaters sector primarily endures major challenges that stem from the costs associated with technology acceptance. Integrating advanced components like metasurfaces, low-noise amplifiers (LNA), AI optimisation systems, and advanced thermal management raises development and deployment costs considerably. These high upfront costs often discourage small companies from entering the market and impede adoption in cost-sensitive areas, where microwave systems are preferred alternatives. Furthermore, intrinsic subsets of technical limitations existent in millimetre-wave signals – high path loss, short-range, and drastic attenuation in non-line-of-sight (NLOS) situations – from buildings to trees to foliage – need quite continuous innovations in their respective signal propagation and amplification technologies. Recent advancements in phased-array antennas and Gallium Nitride (GaN) electronics have honed performance, yet the market still grapples with scaling issues, regulatory challenges, and ensuring robust coverage for networks across multiple urban settings and different indoor environments.Risks & Prospects in Advanced millimeter wave reflectors and repeaters Market

Innovations in reflector and repeater designs are done making use of meta-materials, phased-array technologies, and AI-driven optimisation to turn the inherent limited range and high signal attenuation associated with mmWave into great opportunities. Demand emphasis due to the rising intelligent cities, autonomous vehicles, and industrial automation is tending in the direction of ultra-high bandwidth and low latency-interconnected environments, thus providing a vast opportunity to manufacturers and integrators in connecting devices. Regionally, North America has a thrust in the mmWave market due to its advanced 5G infrastructure, huge expenditures in high-frequency communications, and enabling government initiatives, including the FCC's mmWave spectrum auctions. This position is enhanced by the high demand for telecommunications, defence, the IoT, and autonomous vehicles. Europe is projected to grow at the fastest rate owing to the boost of rapidly rolling out 5G infrastructures, increased demand for higher-capacity wireless transmission, and funding for advanced telecom technologies. The next most promising region for strong growth is anticipated to be the Asia-Pacific region due to unprecedented urbanisation and industrial automation, as well as the deployment of 5G technologies.Key Target Audience

The advanced millimetre-wave reflectors and repeaters market has a major focus on telecommunications companies that are deploying the 5G network. This technology is crucial in enhancing the level of signal coverage and capacity in high-frequency millimetre-wave bands that are parts of the 5G infrastructure. Telecom operators use these devices in the urban environment to prolong the reach of the network and deliver uninterrupted connectivity and high-speed access to residential and business customers.,, Another meaningful audience is represented by governmental and public safety agencies. Such agencies use advanced reflectors and repeaters for mission-critical communication networks in vital infrastructure and transportation systems, along with emergency response situations. They are also leveraging these technologies for military and defence communication in difficult terrains – secured and uninterrupted. Furthering smart city initiatives will escalate (in year-on-year terms) the demand since these technologies are critical in sustaining the interconnected systems that enable urban development.Merger and acquisition

The dynamic millimetre-wave (mmWave) reflectors and repeater market is also coupled with various mergers and acquisitions in recent times owing to the effervescent growth of the industry and the upsurge in demand for high-frequency communications technology. This led to several strategic movements in 2024 to enhance the capabilities of the RF and microwave domains. For example, Mobix Labs, a fabless semiconductor company that focuses on next-generation connectivity solutions, finally acquired RaGE Systems, a market leader in radio frequency design and manufacturing services. In fact, Mobix Labs would now benefit from RaGE's skills in 5G communications, mmWave imaging, and software-defined radio systems applied to commercial, industrial, defence, and aerospace sectors and mature its innovation and customer base while broadening its outreach and speeding up developing next-generation wireless products. The acquisition of CAES Systems Holdings LLC by Honeywell for around $1.9 billion consolidated the defence technology portfolio of Honeywell and further expanded its RF, radar, and sensing technology capabilities. CAES, apart from being a leader in reinforcing electromagnetic defence systems on platforms such as the F-35, AMRAAM, and UAS, highly leverages Honeywell's defence operations. Such acquisitions evince a strategic drive and thrust on mmWave technologies as well as enrich the market presence in critical sectors. >Analyst Comment

The advanced millimetre-wave reflectors and repeaters market has a major focus on telecommunications companies that are deploying the 5G network. This technology is crucial in enhancing the level of signal coverage and capacity in high-frequency millimetre-wave bands that are parts of the 5G infrastructure. Telecom operators use these devices in the urban environment to prolong the reach of the network and deliver uninterrupted connectivity and high-speed access to residential and business customers. Another meaningful audience is represented by governmental and public safety agencies. Such agencies use advanced reflectors and repeaters for mission-critical communication networks in vital infrastructure and transportation systems, along with emergency response situations. They are also leveraging these technologies for military and defence communication in difficult terrains – secured and uninterrupted. Furthering smart city initiatives will escalate (in year-on-year terms) the demand since these technologies are critical in sustaining the interconnected systems that enable urban development.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Advanced millimeter wave reflectors and repeaters- Snapshot

- 2.2 Advanced millimeter wave reflectors and repeaters- Segment Snapshot

- 2.3 Advanced millimeter wave reflectors and repeaters- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Advanced millimeter wave reflectors and repeaters Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Scanning systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Radar and satellite communication systems

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Advanced millimeter wave reflectors and repeaters Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Eravant

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Millimeter Wave Products Inc.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 PIVOTAL COMMWARE

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Wilson Electronics

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 TMY Technology Inc.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Dai Nippon Printing Co.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Ltd.

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 DKK NA

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Anteral S.L.

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Movandi Corporation

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 FRTek

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 SOLiD

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Mitsubishi Corporation

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Teledyne Technologies

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Greenerwave

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Advanced millimeter wave reflectors and repeaters in 2030?

+

-

Which type of Advanced millimeter wave reflectors and repeaters is widely popular?

+

-

What is the growth rate of Advanced millimeter wave reflectors and repeaters Market?

+

-

What are the latest trends influencing the Advanced millimeter wave reflectors and repeaters Market?

+

-

Who are the key players in the Advanced millimeter wave reflectors and repeaters Market?

+

-

How is the Advanced millimeter wave reflectors and repeaters } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Advanced millimeter wave reflectors and repeaters Market Study?

+

-

What geographic breakdown is available in Global Advanced millimeter wave reflectors and repeaters Market Study?

+

-

Which region holds the second position by market share in the Advanced millimeter wave reflectors and repeaters market?

+

-

How are the key players in the Advanced millimeter wave reflectors and repeaters market targeting growth in the future?

+

-