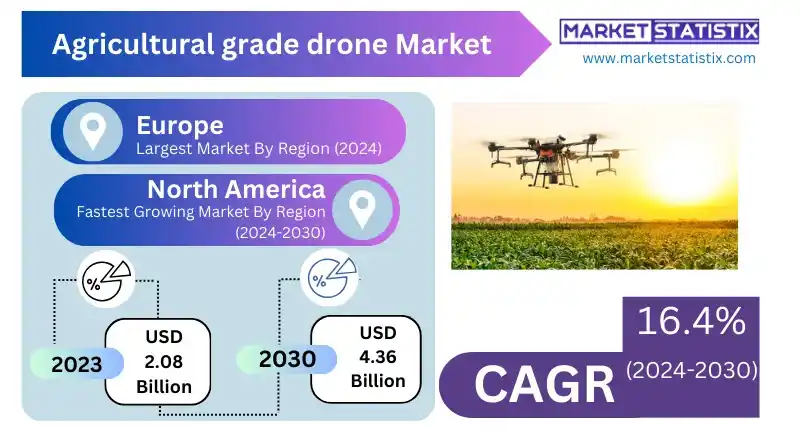

Global Agricultural grade drone Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-1946 | Agriculture | Last updated: Oct, 2024 | Formats*:

Agricultural grade drone Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 16.04% |

| By Product Type | Fixed Wing, Rotary Wing, Hybrid |

| Key Market Players |

|

| By Region |

|

Agricultural grade drone Market Trends

The agriculture application drone market is on an upward growth trajectory owing to the widespread use of advanced farming technologies. These have moved to advanced farm drones that are capable of taking quantitative readings on the state of a crop in a given field, such as how sick the crops are, the condition of the soil, irrigation, and even the application of fertilizers. This is driven by the need for sustainable farming and also because there are demands for more crops as drones tend to avail data that assists the farmers in the decision-making process, thereby increasing all the productivity of farms. Another important trend is the escalation in the use of investment in drone technology as well as the introduction of policies that allow their use in agricultural production. Policymakers and agricultural stakeholders have begun to appreciate the use of drones as a way of enhancing the efficiency and sustainability of operations. Hence, there is an increasing focus on R&D programs geared towards enhancing the performance of drones, such as increasing their flight endurance, payload capacity, and navigation capabilities.Agricultural grade drone Market Leading Players

The key players profiled in the report are Parrot Drones (France), DroneDeploy (US), Yamaha Motor Co. Ltd. (Japan), 3DR (US), AgEagle Aerial Systems Inc. (US), Trimble Inc. (US), Sentera Inc. (US), PrecisionHawk (US), ATMOS UAV (Netherlands), Nileworks Inc. (Japan), Sentera Inc. (US), SlantRange (US), Delair (France), DJI (China), AeroVironment Inc. (US)Growth Accelerators

The need for precision farming practices and better crop management practices is one of the main factors currently driving the growth of the agricultural-grade drone market. In the case of farmers who have to combat issues such as high labour costs, weather changes, and sustainability regulations, for example, drones provide solutions that simplify the monitoring of crops, check the condition of the soil, and use the resources efficiently. Thanks to imaging and sensing technologies, agricultural drones can gather and transmit information regarding crop status and growth progress as well as the need for irrigation in real-time, thus enabling resource maximisation and wastage minimisation, hence improving yield. In addition, developments in drone technology, including better batteries, more significant payloads, and greater machine automation, are making these machines more turn-key for farmers. Furthermore, since agricultural methods are becoming more and more advanced technologically, the rate of growth in the agricultural drone’s sector will increase, hence enhancing creativity and development in the sector.Agricultural grade drone Market Segmentation analysis

The Global Agricultural grade drone is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fixed Wing, Rotary Wing, Hybrid . The Application segment categorizes the market based on its usage such as Field Mapping & Monitoring, Crop Spraying, Crop Scouting, Variable Rate Application, Livestock Monitoring, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Both established and emerging start-ups will compete keenly for market share within a highly growing industry; thus, the competitive landscape in the agricultural-grade drone market. Established players with significant experience and expertise in the drone market, such as DJI, Parrot, and Yuneec, develop high-end agricultural solutions for farmers. The focus of the companies has been on high-resolution imaging, precision mapping, and data analytics capabilities that help farmers manage their crops in the most effective manner, which also ensures maximum yield in the process. Emerging players try to carve a niche for themselves in the agricultural drone market by introducing new innovative solutions addressed towards some specific agricultural need. Among these, some of the startups focus on niche markets such as crop monitoring, pest management, or irrigation management to create an identity for themselves rather than trying to compete with those larger in size. The demand for precision agriculture will continue to escalate, and the competitive landscape of agricultural-grade drones will change as innovation and co-creation keep it at the forefront.Challenges In Agricultural grade drone Market

There are so many issues affecting the agricultural-grade drone market, but above all, regulatory compliance and airspace management are at the forefront. Governments and aviation authorities have put into place strict rules in relation to the use of drones for commercial purposes, especially in agriculture. In most cases, navigating these regulatory landscapes is a difficult process because, although regulatory compliance varies by region, it generally requires one to obtain licenses and permits before allowing any drone services. Another significant hurdle is the upfront cost and servicing of the agricultural drones, which could be a no-go area for most small-scale farmers. Although drones could significantly transform efficiency and productivity in agricultural practice, the preliminary investment in buying advanced drone systems and their allied software can be a huge amount. All these challenges will have to be transformed through innovative financing options, better education on user operation, and cost-efficient solutions.Risks & Prospects in Agricultural grade drone Market

Agricultural-grade drones are really promising nowadays because the rising tides of precision farming are picking up in both the farmlands and agribusiness. The increased prices and resultant revenue due to these drones will continue to increase the demand for sustainable yet effective agricultural practices, and advanced sensors and techniques ensure efficient crop monitoring, soil analysis, and yield estimation. With all these data-driven decisions, the yield will be maximized, and the wastage will be minimized for farmers. In addition, government initiatives and subsidies for the promotion of technology in agriculture enhance the possibility of increasing adoption that further facilitates the growth of the market. The integration of AI and ML technologies in agricultural drones is the kind of exciting innovation opportunity and functionality amplifier; being able to analyze massive amounts of data immediately generates actionable insights on real-time issues such as managing pests, irrigation, and crop health.Key Target Audience

The main focus of the agricultural-grade drone market is farmers and producers who wish to holistically manage their farms and increase production by using precision farming. These stakeholders are using drones more often for purposes such as field inspection, soil probing, and aerial spraying, which helps them make informed decisions and use resources more efficiently. Because there is a growing focus on sustainability and efficiency in agriculture, agro-specialists are embracing drone technology, which allows for monitoring of vast geographical areas, lowering human labour, and enhancing productivity.,, A related audience segment is made up of technology companies and service-providing companies that integrate drone solutions into the agriculture sector. These companies develop low-cost advanced drones with payloads of sensors and cameras for farmers.Merger and acquisition

There are a number of recent mergers and acquisitions in the agricultural-grade drone market that portend a continued trend of consolidation among these companies. Most of the firms are seeking to enhance their technological capabilities and enter into market areas that may provide them a possible opportunity for growth. For example, in 2023, AG Leader Technology acquired Precision Hawk, the leading provider of drone technology and data analytics solutions for agriculture. It was intended to integrate the advanced aerial imaging and data processing capabilities of Precision Hawk with the farm management software in place at AG Leader, thus offering a more comprehensive solution for farmers interested in optimizing crop production and resource management. DJI, the largest drone manufacturer in the world, has been making strategic acquisitions to strengthen its position in agriculture. In 2022, DJI purchased RoboMaster-enthusiasts of agricultural drones and their autonomous solutions. This move helped DJI expand its precision agriculture product lineup while offering farmers a way to leverage cutting-edge aerial data for greater decisions. These mergers and acquisitions indicate a strategic direction in the agricultural-grade drone market toward innovation and the provision of integrated solutions to meet the changing needs of the agriculture industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Agricultural grade drone- Snapshot

- 2.2 Agricultural grade drone- Segment Snapshot

- 2.3 Agricultural grade drone- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Agricultural grade drone Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fixed Wing

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Rotary Wing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Hybrid

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Agricultural grade drone Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Field Mapping & Monitoring

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Crop Spraying

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Crop Scouting

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Variable Rate Application

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Livestock Monitoring

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Agricultural grade drone Market by Component

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Hardware

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Software

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Agricultural grade drone Market by Hardware

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Frames

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Control Systems

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Propulsion System

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Navigation System

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Payload

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

- 7.7 Avionics

- 7.7.1 Key market trends, factors driving growth, and opportunities

- 7.7.2 Market size and forecast, by region

- 7.7.3 Market share analysis by country

- 7.8 Others

- 7.8.1 Key market trends, factors driving growth, and opportunities

- 7.8.2 Market size and forecast, by region

- 7.8.3 Market share analysis by country

8: Agricultural grade drone Market by Software

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Imaging Software

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Data Management Software

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Data Analytics Software

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Others

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

9: Agricultural grade drone Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Parrot Drones (France)

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 DroneDeploy (US)

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Yamaha Motor Co. Ltd. (Japan)

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 3DR (US)

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 AgEagle Aerial Systems Inc. (US)

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Trimble Inc. (US)

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Sentera Inc. (US)

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 PrecisionHawk (US)

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 ATMOS UAV (Netherlands)

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Nileworks Inc. (Japan)

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Sentera Inc. (US)

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 SlantRange (US)

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 Delair (France)

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 DJI (China)

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 AeroVironment Inc. (US)

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Component |

|

By Hardware |

|

By Software |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Agricultural grade drone Market?

+

-

What are the latest trends influencing the Agricultural grade drone Market?

+

-

Who are the key players in the Agricultural grade drone Market?

+

-

How is the Agricultural grade drone } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Agricultural grade drone Market Study?

+

-

What geographic breakdown is available in Global Agricultural grade drone Market Study?

+

-

Which region holds the second position by market share in the Agricultural grade drone market?

+

-

How are the key players in the Agricultural grade drone market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Agricultural grade drone market?

+

-

What are the major challenges faced by the Agricultural grade drone Market?

+

-