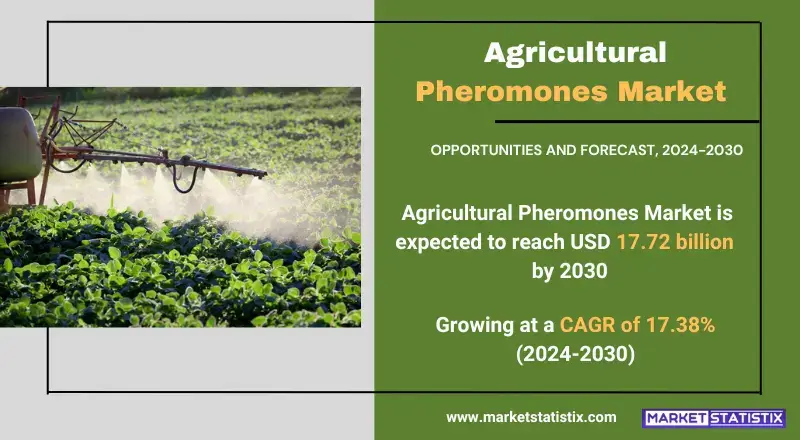

Global Agricultural Pheromones Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-2045 | Agriculture | Last updated: Nov, 2024 | Formats*:

Agricultural Pheromones Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 17.38% |

| By Product Type | Sex Pheromones, Aggregation |

| Key Market Players |

|

| By Region |

|

Agricultural Pheromones Market Trends

A prevailing trend in the agricultural pheromones market is the shift towards sustainable farming practices due to the growing requirement for organic and environment-friendly pest controls. Since consumers are becoming conscious of the environmental implications resulting from conventional pesticides, people are resorting to pest control using pheromones, as this does not affect other insects that are useful. This trend is encouraging the research on the new pheromone products with improved delivery systems that are more effective and environmentally safe. Thus, the development of agro-biologicals and natural pest control measures is also supporting the expansion of the market. Farmers nowadays are also supporting the use of agricultural pheromones by using advanced equipment, which includes precision farming and digital agriculture. The agricultural industry is rapidly adopting smart farming, data analytics, remote sensing, and IoT-connected devices to track pest dynamics and apply pheromones effectively. This integration facilitates better targeted pheromone applications, resulting in better efficiencies and lower costs.Agricultural Pheromones Market Leading Players

The key players profiled in the report are Biobest Group (Belgium), Isagro S.p.A. (Italy), ISCA Global (U.S.), Koppert Biological Systems (Netherlands), Pacific Biocontrol Corporation (U.S.), Provivi, Inc. (U.S.) , Russell IPM (U.K.), SEDQ Healthy Crops SL (Spain), Shin-Etsu Chemical Company (Japan), Suterra LLC (U.S.)Growth Accelerators

The market for agricultural pesticides is experiencing growth due to the rising adoption of pest control measures that are sustainable and eco-friendly. Given the growing concerns over the impact of synthetic pesticides on consumers and the environment alike, there is a desire among farmers to incorporate integrated pest management approaches without using chemicals to control pests. Pheromones, which are environmental-friendly chemical messengers used for disrupting the mating and behaviour of pests, are sparing the use of chemical insecticides. Another important factor to consider is the increased population globally and the consequent need for improved agricultural output. Due to the rising demand for food, it is expected that all farm activities, including growing crops, will be done in excess, and most crops raised will be for sale for the market and also for the preservation of the raised crops against pests. Insect pest control solutions do not endanger such insect species by focusing on the pest organisms and using agricultural pheromones. In addition, the development of new technologies in pheromone formulation and delivery is scaling up the effects of these products, which also encourages their use by farmers.Agricultural Pheromones Market Segmentation analysis

The Global Agricultural Pheromones is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Sex Pheromones, Aggregation . The Application segment categorizes the market based on its usage such as Dispensers, Traps, Spray Method. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Such growth can be attributed to increasing awareness among the public and political bodies regarding the safety of food, thus making growers look for ecological solutions instead of using chemical pesticides. Farmers are also attracted to using pheromones in pest control because they are effective and commercially reasonable as compared to chemical pesticides. For instance, BASF SE, Shin-Etsu Chemical Co., Ltd., and Biobest Group NV, and many others are engaged in increasing their share by investing in innovation and entering into various alliances. Some of the companies in the market have been operational for many years, while others are on the rise, and the competition among them revolves around the innovation of new products and expansion into new regions. North America currently accounts for the largest share of the pest control market due to the existence of better farming techniques and the government’s support towards the use of alternative methods of pest control.Challenges In Agricultural Pheromones Market

The agricultural pheromones market is confronted with a myriad of constraints, most of which are connected to the awareness and education of farmers and other stakeholders. It is possible that a great number of farmers do not know the advantages nor even the use of pheromone-based solutions as compared to the use of other pesticide chemicals. This ignorance can cause difficulties in embracing technological advancement, especially in those areas with age-old practices and dependency on traditional ways. It is also important to note the regulatory and regional differences in market acceptance as another major bottleneck. This is particularly so in certain regions where a complex and painstaking protocol or procedure may be involved before one can gain the approval of new agricultural products like pheromones. These challenges must be resolved through an education campaign, employing a good marketing mix, and working with the relevant sectoral bodies to highlight the merits of ecological pest management through pheromones.Risks & Prospects in Agricultural Pheromones Market

The farming pheromones market is observing healthy growth on account of the shifting trends towards sustainable agriculture practices and pest control measures, especially integrated pest management (IPM). While chemical pesticides are being relied upon less by farmers and agricultural producers, pheromones provide a non-toxic method of pest deterrence wherein the reproduction of harmful insects is interrupted. The increasing preference for organic and sustainable farming practices, both due to regulations and the consumers’ aversion to residues in fresh produce, is an even better reason for the agricultural pheromones market growth. There is a great opportunity for firms that manage to manufacture advanced and reliable pheromone products because this is a market for targeted and green pest management solutions. Moreover, these are also underpinned by the use of technology and research in the discovery of novel and more precisely targeted pheromone-based products. With the advancement in the mode of synthesis of the pheromones, various barriers to neutering have also evolved that include time-release formulations, time-release traps, etc., which improve the wide application of these products in agriculture. This will also contribute to market expansion by informing the farmers of the advantages of using pheromones and their possible roles in fighting against pests with the assistance of manufacturers and research institutions involved in agriculture.Key Target Audience

The primary stakeholders in the agricultural pheromones market are farmers and agriculturalists who are progressively turning to eco-friendly pest management. Such individuals seek safer options to manage pests besides spraying chemical pesticides, which may damage crops. Farmers can use pheromones to lure and capture targeted pests without the use of generalised insecticides. This part of the audience, however, is mainly interested in increasing yields of crops without violating organic farming principles; hence, the use of pheromones is welcome, especially for thermophilic farming as well as conventional farming.,, Another large segment of the target audience is formed by the support industries, such as agricultural extension services, agronomists, and pest control advisors, as far as the recommendations farmers are provided with. Those professionals are important in raising awareness among farmers concerning the usefulness of pheromones in the Integrated Pest Management (IPM) strategies. And with the rising concern about practicing sustainable agriculture, this audience also helps in campaigning for the use of such diagnostic tools.Merger and acquisition

The agricultural pheromones market is experiencing a wave of recent activities marked by high levels of mergers and acquisitions that aim at improving the product range and market presence. For instance, FMC Corporation has revealed that it is to acquire BioPhero, a Danish company dealing in scents for biological pest controls, for close to $200 million. The transaction, which has already been finalised in late 2022, enables FMC to exploit BioPhero’s advanced fermentation processes into its plant’s health segment, with around $1 billion worth of revenues anticipated from sales of pheromones by the year 2030. This move speaks volumes concerning FMC’s aggressiveness in wanting to build up its range of environmentally friendly agricultural products and also hints at the age of mergers and acquisition activities in the goal of enhancing biological pest management approaches among the agrotech companies. In another development, Biobest Group N.V. completed the acquisition of Biotrop Participations S.A., a significant player in the biologicals industry in Brazil, in December 2023. This acquisition forms part of the aforementioned establishment’s biological pest control enhancement strategy, with the objective of being ranked in the top 10 agritech companies by 2034. Besides, some agreements, as in January 2023, between Bayer and M2i Group, were also noted to be focused on selling agriculture-culture-based products. These changes denote that there is a shift towards more sustainable practices, with increasing acceptance of the use of pheromones instead of chemicals, encouraging positive growth in the field.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Agricultural Pheromones- Snapshot

- 2.2 Agricultural Pheromones- Segment Snapshot

- 2.3 Agricultural Pheromones- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Agricultural Pheromones Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Sex Pheromones

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Aggregation

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Agricultural Pheromones Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Dispensers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Traps

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Spray Method

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Agricultural Pheromones Market by Function

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Mating Disruption

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Detection & Monitoring

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Mass Trapping

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Agricultural Pheromones Market by Crop Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Field Crops

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Orchard Crops

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Vegetables

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Others

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Agricultural Pheromones Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Biobest Group (Belgium)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Isagro S.p.A. (Italy)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 ISCA Global (U.S.)

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Koppert Biological Systems (Netherlands)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Pacific Biocontrol Corporation (U.S.)

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Provivi

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Inc. (U.S.)

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Russell IPM (U.K.)

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 SEDQ Healthy Crops SL (Spain)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Shin-Etsu Chemical Company (Japan)

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Suterra LLC (U.S.)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Function |

|

By Crop Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Agricultural Pheromones Market?

+

-

What major players in Agricultural Pheromones Market?

+

-

What applications are categorized in the Agricultural Pheromones market study?

+

-

Which product types are examined in the Agricultural Pheromones Market Study?

+

-

Which regions are expected to show the fastest growth in the Agricultural Pheromones market?

+

-

Which region is the fastest growing in the Agricultural Pheromones market?

+

-

What are the major growth drivers in the Agricultural Pheromones market?

+

-

Is the study period of the Agricultural Pheromones flexible or fixed?

+

-

How do economic factors influence the Agricultural Pheromones market?

+

-

How does the supply chain affect the Agricultural Pheromones Market?

+

-