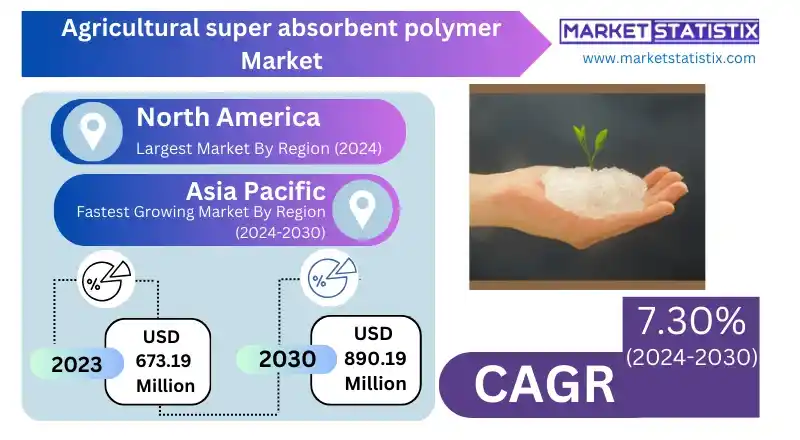

Global Agricultural super absorbent polymer Market – Industry Trends and Forecast to 2030

Report ID: MS-2038 | Agriculture | Last updated: Nov, 2024 | Formats*:

Agricultural super absorbent polymer Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.30% |

| By Product Type | Natural Polymer, Synthetic Polymer |

| Key Market Players |

|

| By Region |

|

Agricultural super absorbent polymer Market Trends

The market for agricultural super absorbent polymers (SAP) is impacted more and more with a movement towards sustainable agriculture as the reliance on water and the need to increase food production continue to grow. The changing climate has resulted in farmers’ control of the weather becoming unreliable and extended periods of dryness prompting the usage of SAPs to retain moisture in the soil for longer periods and making irrigating infrequent. These or similar polymers are particularly important in such water-challenged areas, as these materials soak up a great deal of liquid and administer it to the plant's root system as needed over time. Another trend worth mentioning is herbaceous as well as food speciality crops and opportunities in precision agriculture technology. Due to the increased interest in high-value crops matched with the growth of precision farming technologies, these super absorbent polymers are being widely used in many areas, including horticulture landscaping and greenhouse growing. Such practices incorporate the careful management of water and nutrients to optimize site yield and quality. In addition, growing innovations in SAP technology are improving the modified compositions of these products with improved hydration, biodegradability, and soil adaptability.Agricultural super absorbent polymer Market Leading Players

The key players profiled in the report are Evonik Industries, KAO Corporation, Sumitro Seika Chemicals Co. Ltd., LG Chem Ltd., BASF SE, Songwon Industil Co. Ltd., Nippon Shokubai Co. Ltd., Sanyo ChemicalsGrowth Accelerators

The agricultural super absorbent polymer (SAP) industry is primarily propelled by the rising adoption of water-smart and resource-conserving agricultural practices. As water scarcity grows through the years, farmers are already considering super absorbent polymers for better retention of moisture in the soils. These assistive materials are capable of soaking and storing considerable quantities of water, which is later released gradually to the plants, thus minimising the intervals of irrigation and ensuring that the vegetation survives in dry and semi-dry areas. This increasing concern for sustainable agriculture improves production and aids environmental protection, hence satiating the needs of modern farmers in the usage of SAPs. Another important factor is the increasing popularity of high-efficiency farming methods and growing agriculture’s production. In view of the escalating world population, the demand for food is even greater than ever, which means that more food has to be produced with fewer resources to help the polymers. Super absorbent polymers help to make sure less input is used by enhancing the soil structure and lowering the nutrient levels available to make crops healthy.Agricultural super absorbent polymer Market Segmentation analysis

The Global Agricultural super absorbent polymer is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Natural Polymer, Synthetic Polymer . The Application segment categorizes the market based on its usage such as Hydroponics, Root Dipping, Seed Coating, Soil Moisture Retention. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

This upsurge in demand can be attributed to the increasing use of super absorbent polymer (SAP) in agriculture, which plays a significant role in retaining soil moisture, minimising water loss, and increasing yields, especially in the arid areas. Emphasis on reliable SAPs as a way to fine-tune irrigation is gaining importance because water is becoming scarce and farmers have to look for sustainable ways of using it. The agricultural super absorbent polymer global market is comprised of several international companies that include BASF SE, Nippon Shokubai Co., Ltd., and Evonik Industries AG, who all participate in strategic research and development targeting the introduction of improved formulations of SAP for agricultural applications. They are focused on product development strategies, including bio-based alternatives as well as biodegradable approaches, on the basis of the high trend towards sustainable agriculture. The market is predicted to be controlled by the Asia Pacific region owing to the large agricultural area and the rise in modern farming practice investments.Challenges In Agricultural super absorbent polymer Market

The market for agricultural super absorbent polymers (SAP) is facing many challenges, ranging from cost factors to adoption limitations. It is true that these polymers can help in conserving soil moisture and raising crop production levels, but such production costs may be very high for a farmer, especially in the developing countries where there are budgetary constraints. This factor of cost may affect the underlining subscription since the farmers are not willing to utilise the SAPs without tangible results that will offer that reward. Another challenge is posed by the fact that some people have negative attitudes towards the application of synthetic super absorbent polymers because of environmental issues. Even though their intended purpose is to enhance moisture retention, attention is being drawn to the chemical compounds’ ability to break down and their impact on the soil over time. Ecology fans or even the farmers may be against the use of foreign substances in the crop ecosystems, hence causing doubts over the use of the materials. Natural substitutes, such as biodegradable organic hydrogels, also present a problem to the targeted resource.Risks & Prospects in Agricultural super absorbent polymer Market

The agricultural super absorbent polymer (SAP) market is expected to grow due to the rise in demand for water-efficient farming and sustainable agriculture. Due to the increasing challenges of water scarcity, most farmers are now opting for the use of SAPs, which helps retain moisture in the soil and reduce irrigation intervals. Efficiency in irrigation management can boost both the yield and the quality of crops, which is why it is heavily utilised in dry and semi-dry regions. The other major factor that presents an opportunity is the rising adoption of urban agriculture and vertical farming, which re-engineers the use of available space and resources. Super absorbent polymers can be very useful in such situations, as they help in efficient water and nutrient management to aid the growth of crops within small spaces. In addition, also increasing the horticulture market in the landscaping and gardening segments allows for a great possibility for SAP applications, where they help reduce watering needs for ornamental plants and home gardens, in addition to enhancing soil quality. With the increasing realization of the advantages of utilizing SAPs, the advancement of the market will be accelerated in terms of adoption and innovations in new products.Key Target Audience

The primary target demographic of the agricultural super absorbent polymer (SAP) market are farmers and agricultural producers looking for advanced moisture retention practices to boost crop production. Such polymers are especially effective in areas where there is a risk of water shortage or erratic rainfall because they are capable of storing large volumes of water and making it available to plants in controlled quantities after. Farmers can use super absorbent polymers in their soil management, which will help them minimise water wastage, improve irrigation practices, and encourage responsible farming practices that will boost output and management of resources.,, Another fleet of users comprises agricultural product producers and suppliers that manufacture and market potent resource claims, soil amendments, fertilisers, and other agricultural inputs. These important groups have started to add super absorbent polymers (SAPs) as one of the value-added propositions in their offerings. This will allow them to improve the mixing behaviour of their products and hence the attractiveness of these products to eco-friendly farmers.Merger and acquisition

The agricultural super absorbent polymer market has become a focus of quick movement in semiconductor mergers and acquisitions, solving the problem of the industry’s well-being. In this regard, it is worth noting that in October 2023, BASF reported the launch of a new facility in Antwerp, Belgium, referred to as the new Superabsorbent Excellence Centre. The full purpose of this centre is to upgrade the invention level and increase the manufacturing capacity of superabsorbent polymers that are of great importance to the agricultural industry. Such investments strengthen BASF’s competitive advantage in the concerned market and also show that the decreasing trend in water management technologies is being reversed with more companies coming up to increase their scope of operations for the developing agricultural sector. To add on to the expansion of BASF, Archer Daniels Midland Company (ADM), in collaboration with LG Chem, is working on new sustainable super absorbent polymers for hygiene products that are expected to have a wider application, including agriculture. The goal of this initiative is bio-based acrylic acid, which is important for the production of superabsorbent polymers. It is clear that such initiatives are not without the drive for competitiveness, as promotions for greener products and applicability strategies have a place for all companies in the sector.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Agricultural super absorbent polymer- Snapshot

- 2.2 Agricultural super absorbent polymer- Segment Snapshot

- 2.3 Agricultural super absorbent polymer- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Agricultural super absorbent polymer Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Natural Polymer

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Synthetic Polymer

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Agricultural super absorbent polymer Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hydroponics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Root Dipping

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Seed Coating

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Soil Moisture Retention

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Agricultural super absorbent polymer Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Evonik Industries

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 KAO Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Sumitro Seika Chemicals Co. Ltd.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 LG Chem Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 BASF SE

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Songwon Industil Co. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Nippon Shokubai Co. Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Sanyo Chemicals

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Agricultural super absorbent polymer Market?

+

-

What are the latest trends influencing the Agricultural super absorbent polymer Market?

+

-

Who are the key players in the Agricultural super absorbent polymer Market?

+

-

How is the Agricultural super absorbent polymer } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Agricultural super absorbent polymer Market Study?

+

-

What geographic breakdown is available in Global Agricultural super absorbent polymer Market Study?

+

-

Which region holds the second position by market share in the Agricultural super absorbent polymer market?

+

-

How are the key players in the Agricultural super absorbent polymer market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Agricultural super absorbent polymer market?

+

-

What are the major challenges faced by the Agricultural super absorbent polymer Market?

+

-