Global AI in Endoscopy Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2224 | Healthcare and Pharma | Last updated: Dec, 2024 | Formats*:

AI in Endoscopy Report Highlights

| Report Metrics | Details |

|---|---|

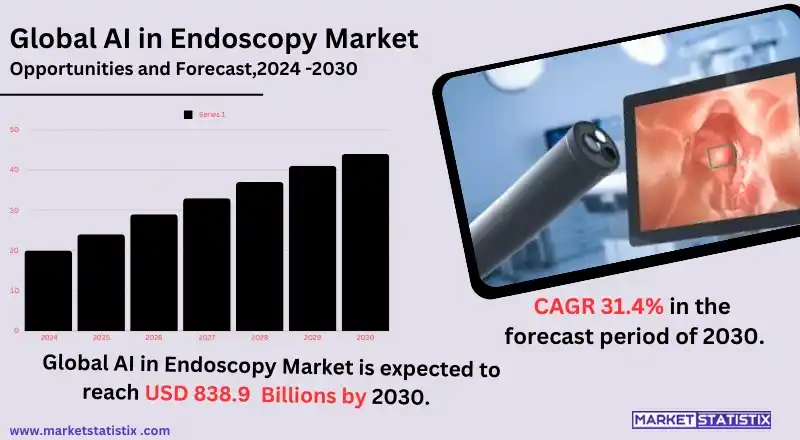

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 31.4% |

| Forecast Value (2030) | USD 838.9 Billion |

| By Product Type | Flexible Endoscopes, Rigid Endoscopes |

| Key Market Players |

|

| By Region |

|

AI in Endoscopy Market Trends

The AI in the endoscopy industry is poised for rapid growth as the use of artificial intelligence is increasingly embraced in improving diagnostic accuracy and outcomes in patients. AI-powered endoscopic systems now have the ability to detect the presence of underlying conditions such as tumours, polyps, and lesions in real time, thus achieving precision and minimising human error. This is further augmented by deep learning and computer vision technologies, which allow the aid of AI in image interpretation and automation of routine tasks, thus further enhancing the process of endoscopy. The trend now is that the patient undergoes robotic endoscopy, which has gone along seamlessly with AI integration. Such procedures can be carried out with the least possible invasiveness with improved control and precision. AI serves critical functions in analysis and predictive diagnostics by helping clinicians find possible early-stage conditions and develop customised treatment pathways. As well, the ageing population has also complemented the pace of uptake of AI in the endoscopy market due to more patients getting surgery with the very latest minimally invasive techniques.AI in Endoscopy Market Leading Players

The key players profiled in the report are Richard Wolf, Stryker, Intuitive Surgical, Hoya Corporation, Cook Medical, Karl Storz, Conmed, Smith Nephew, Erbe Elektromedizin, PENTAX Medical, Fujifilm Holdings, Olympus Corporation, Ambu A/S, Medtronic, Boston ScientificGrowth Accelerators

Increased demand to improve diagnostic accuracy and detect diseases at an early stage is what puts the AI in the endoscopy industry mainly. To capture the images in real-time and analyse images done at a higher density, use AI technologies such as machine learning and computer vision. This will help health professionals see any abnormalities that appear like tumours, polyps, or other gastrointestinal problems. According to increased use of AI in medicine, such innovations really reduce human errors at the same time accelerating diagnoses and improving treatment outlay. Hence, they are creating a market for AI in endoscopy tools. The other trend is the trend for minimally invasive surgeries, and there is the pressing need for more value-based solutions in healthcare. These endoscopy tools that are AI-enabled not only improve imaging but also analysis in real time, providing surgeons with great accuracy and enhancing recovery time while reducing costs per procedure.AI in Endoscopy Market Segmentation analysis

The Global AI in Endoscopy is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Flexible Endoscopes, Rigid Endoscopes . The Application segment categorizes the market based on its usage such as Gastrointestinal Endoscopy, Urological Endoscopy, Respiratory Endoscopy, Colonoscopy. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

In recent times, there have been various important mergers and acquisitions among the companies dealing in AI in the endoscopy market, which is indicative of the growing trend of artificial intelligence being intertwined in medical procedures. In January 2024, one of the most recognised MedTech industries, KARL STORZ, bought a British manufacturer of AI software, Innersight Labs Ltd. This acquisition would serve to fortify the portfolio of KARL STORZ with competent AI in their laparoscopic and robotic imaging equipment to achieve better surgical outcomes in novel 3D modelling technologies emanated in medical scans. The collaboration shall ground KARL STORZ as a thought leader in implementing AI solutions across endoscopic procedures for a diverse customer base of healthcare professionals around the world. Medtronic recently extended its partnership with Cosmo Pharmaceuticals, securing up to $200 million in investments to develop the GI Genius platform, an AI-enabled real-time polyp detection system for colonoscopy. This partnership shall create an integrated platform that will allow different AI diagnostic tools from other companies to be utilised by the current endoscopy systems. The collaboration with Cosmo and the technological absorption of partners such as Nvidia is indicative of a strong push toward making AI-assisted healthcare a norm in routine treatment of patients, especially with regard to gastrointestinal diagnostics. These developments underscore the emerging role of AI in both increasing the accuracy with which diagnosis is done and improving efficiency in the operations of endoscopy.Challenges In AI in Endoscopy Market

Apart from this, the use of AI in the endoscopy market faces major challenges in the area of costs and integration complexities required to facilitate the introduction of such technologies within existing endoscopic systems. There is a high need for advanced hardware and advanced software coupled with internal high-level investment in training medical staff on the effective use of such tools. This combination of factors may make many hospitals, especially in developing economies, unable to afford the heavy upfront costs required and hence block their gains from widespread adaptation to systems incorporating AI in endoscopy. Regulatory approval and compliance with specific healthcare standards are additional challenges. AI performing medical device functions must pass rigorous tests and adhere to regulatory compliance-specific requirements set by health authorities such as the FDA or EMA. These processes are time-consuming and tend to cost a lot, delaying the entry of innovative solutions via AI into the endoscopy markets. Moreover, even regarding data privacy and cybersecurity, and the concept of the interpretability of AI-generated diagnoses, these have been additional detractors from outright adoption of new technologies in practice.Risks & Prospects in AI in Endoscopy Market

of diagnostic results with high clinical impact on patient outcomes. AI systems can assist in the analysis of endoscopy images and videos, making the diagnosis of abnormalities faster and more accurate, such as tumours, polyps, and lesions. The diagnosis will be faster with greater automated detection, and human error probability will decrease, thus giving an effective treatment. The convergence of AI with such advanced technologies as augmented reality (AR) and robotics in endoscopic procedures further promotes new growth market opportunities. In real-time, AI is expected to help surgeons with better visualisation, thus improving surgical accuracy. The opportunities of using AI in assisting with minimal invasiveness after a shorter recovery time and better patient satisfaction have fostered innovation.Key Target Audience

The major end users of AI in endoscopy are healthcare segments that would include hospitals, diagnostic centres, and speciality clinics importing AI technology into their endoscope procedures. Generally, these institutions use AI technology to assist in the detection and diagnosis of diseases such as cancer and gastrointestinal diseases and other internal health diseases. In addition, AI-based endoscopy tools augment the accuracy of screenings, improve image analysis, and assist the clinician to make rapid and accurate decisions during procedures to bring about a better outcome for the patient.,, Another important audience targeted is the manufacturers of medical devices and technology companies developing AI-powered endoscopic systems. These companies focus on developing innovative products and the adoption of artificial intelligence in conventional endoscopic instruments so as to offer advanced applications such as real-time image interpretation and predictive analytics.Merger and acquisition

In recent times, there have been various important mergers and acquisitions among the companies dealing in AI in the endoscopy market, which is indicative of the growing trend of artificial intelligence being intertwined in medical procedures. In January 2024, one of the most recognised MedTech industries, KARL STORZ, bought a British manufacturer of AI software, Innersight Labs Ltd. This acquisition would serve to fortify the portfolio of KARL STORZ with competent AI in their laparoscopic and robotic imaging equipment to achieve better surgical outcomes in novel 3D modelling technologies emanated in medical scans. The collaboration shall ground KARL STORZ as a thought leader in implementing AI solutions across endoscopic procedures for a diverse customer base of healthcare professionals around the world. Medtronic recently extended its partnership with Cosmo Pharmaceuticals, securing up to $200 million in investments to develop the GI Genius platform, an AI-enabled real-time polyp detection system for colonoscopy. This partnership shall create an integrated platform that will allow different AI diagnostic tools from other companies to be utilised by the current endoscopy systems. The collaboration with Cosmo and the technological absorption of partners such as Nvidia is indicative of a strong push toward making AI-assisted healthcare a norm in routine treatment of patients, especially with regard to gastrointestinal diagnostics. These developments underscore the emerging role of AI in both increasing the accuracy with which diagnosis is done and improving efficiency in the operations of endoscopy. >Analyst Comment

"An endoscopic branch of AI is changing and developing every day, thanks to the advancement of artificial intelligence integrated into endoscopic procedures. These AI applications revolutionise the practice of gastroenterology by allowing high accuracy in diagnosis, better efficiency in conducting procedures, and early detection of illnesses. Key factors driving this market growth are increasing prevalence rates of gastrointestinal diseases, requirements for accurate and timely diagnosis, and growing demand for minimally invasive procedures."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AI in Endoscopy- Snapshot

- 2.2 AI in Endoscopy- Segment Snapshot

- 2.3 AI in Endoscopy- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AI in Endoscopy Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Flexible Endoscopes

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Rigid Endoscopes

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: AI in Endoscopy Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Gastrointestinal Endoscopy

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Urological Endoscopy

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Respiratory Endoscopy

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Colonoscopy

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: AI in Endoscopy Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Richard Wolf

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Stryker

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Intuitive Surgical

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Hoya Corporation

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Cook Medical

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Karl Storz

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Conmed

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Smith Nephew

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Erbe Elektromedizin

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 PENTAX Medical

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Fujifilm Holdings

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Olympus Corporation

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Ambu A/S

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Medtronic

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Boston Scientific

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of AI in Endoscopy in 2030?

+

-

What is the growth rate of AI in Endoscopy Market?

+

-

What are the latest trends influencing the AI in Endoscopy Market?

+

-

Who are the key players in the AI in Endoscopy Market?

+

-

How is the AI in Endoscopy } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the AI in Endoscopy Market Study?

+

-

What geographic breakdown is available in Global AI in Endoscopy Market Study?

+

-

Which region holds the second position by market share in the AI in Endoscopy market?

+

-

How are the key players in the AI in Endoscopy market targeting growth in the future?

+

-

What are the opportunities for new entrants in the AI in Endoscopy market?

+

-