Global AI in Fintech Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1051 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

AI in the fintech industry refers to the integration of artificial intelligence technologies—such as machine learning, natural language processing, and predictive analysis—in financial services and products to improve efficiency, accuracy, and customisation. It enables banks, insurers, and investment platforms to automate routine tasks such as customer service through chatbots, detect real-time fraud, improve credit scores, and provide personalised financial recommendations. AI also simplifies risk assessment, negotiation algorithms, and regulatory compliance processes, allowing faster decision-making and smarter financial operations. As consumer expectations evolve, AI is becoming central to providing agile, secure, and data-orientated financial experiences in segments B2B and B2C.

AI in Fintech Report Highlights

| Report Metrics | Details |

|---|---|

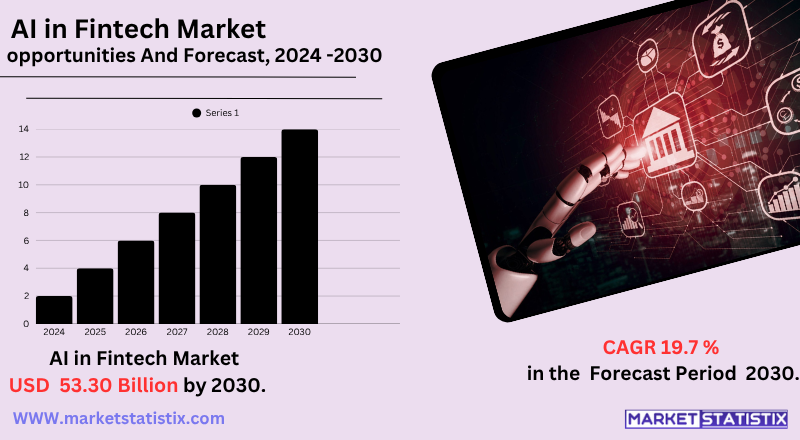

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 19.7% |

| Forecast Value (2030) | USD 53.30 Billion |

| Key Market Players |

|

| By Region |

AI in Fintech Market Trends

- Generative & Agentic AI Integration

Financial institutions are incorporating the agentic AI-accessible systems for autonomous decisions—trade-in trade, customer service, and back-office operations—shifting AI from experimental to fully operational at fintech.

- Human-machine collaboration models

Companies are increasingly pairing with human supervision, creating functions such as algorithm auditors and crisis intervention experts to ensure ethical and transparent results and prevent unmarked automation.

- Embedded & Open Finance Ecosystems

Fintech is evolving with built-in finance platforms that integrate services directly into non-financial applications, while open finance APIs expand safe data sharing in banks, insurance, and investments.

AI in Fintech Market Leading Players

The key players profiled in the report are Narrative Science, Nuance Communications, Inc., Intel, Affirm, Inc.., Upstart Network, Inc., Amelia U.S. LLC, International Business Machines Corp., Inbenta Technologies, Amazon Web Services, Instructure, Inc, Google LLC, Salesforce, Inc., ComplyAdvantage.com, Microsoft, OracleGrowth Accelerators

- Operational efficiency and cost reduction

As transaction volumes increase and margins tighten; financial companies take advantage of AI to automate repetitive processes—from loan subscription to compliance checks—increasing speed and reducing hand overload.

- =Enhanced fraud detection and risk management

Real-time analysis of transaction patterns allows the proactive identification of suspicious activity, reinforcing cybersecurity and strengthening confidence without human latency.

Personalised customer experiences

Through chatbots, robotic consultants, and personalised recommendations, AI meets consumer evolution expectations of convenience and personalisation in digital financial services

AI in Fintech Market Segmentation analysis

The Global AI in Fintech is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Business Analytics and Reporting, Customer Behavioural Analytics, Virtual Assistant (Chatbots), Fraud Detection. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

AI's competitive scenario in the fintech industry is characterised by intense innovation and rapid adoption in established financial institutions and agile technology startups. Main players such as IBM, Google Cloud, and Microsoft Azure are offering cloud platforms and AI analysis adapted for financial services, while fintech companies, such as Upstart, Zest AI, and Kasisto, are leveraging AI to redefine loans, wealth management, and customer involvement. Traditional banks are increasingly forming partnerships or acquiring AI startups to stay competitive. The landscape is also shaped by a wave of specialised AI companies focused on niche areas such as fraud detection, robotic consulting, and conformity automation. With advances in progress in generative AI and predictive modelling, the race to offer safer, more efficient, and more personalised financial solutions continues to intensify.

Challenges In AI in Fintech Market

- Algorithmic bias and opacity

Fintech AI models usually operate as "black boxes", making it difficult for institutions to explain credit decisions or detect discrimination. This lack of transparency undermines customer confidence and can expose companies to regulatory scrutiny.

- Regulatory and compliance complexity

AI is evolving faster than traditional regulatory structures, forcing regulators to update. Fintech companies must navigate fragmented and evolving rules—sometimes without explicit guidelines—creating legal uncertainty and an overload of compliance.

- Risks of privacy and data security

The handling of sensitive financial and personal data makes AI systems prime targets. Strict data protection laws and high-risk reputation risks require strong governance that is usually daunting for fintech startups.

Risks & Prospects in AI in Fintech Market

Market opportunities for AI in the fintech industry are driven by the urgent need for automation, customisation, and real-time decision-making in the industry. As digital bank management platforms like Insurtch and Wealth grow rapidly, AI allows them to scale services without compromising safety or compliance. The opportunity is in leveraging AI to fill in shortcomings in needy markets, improve customer experience through smart interfaces, and reduce operating costs with predictive analysis and risk modelling. In addition, the proliferation of digital payment ecosystems and open bank APIs creates fertile ground for AI-orientated innovation, particularly fraud detection, credit subscription, and investment consulting, making these applications dominant due to their direct impact on profitability, confidence, and customer retention.

Key Target Audience

, Companies and platforms use robotic consultation tools, algorithmic negotiation, and portfolios to provide personalised investment strategies and insights, usually in collaboration with human consultants., ,- , These institutions take advantage of AI for real-time fraud detection, enhanced subscription, and 24/7 continuous customer support through chatbots to prime operational accuracy and reduce risks.

- Fintech startups and neobanks

, , - Retail and digital seats

,- Wealth and investment consultants

,Merger and acquisition

- Xero acquires Melio (U.S.): New Zealand's Xero is buying U.S. payment supplier Melio to integrate payments into its accounting platform, directing improved offers to small and medium enterprises in North America. The agreement marks a major change to strengthen the presence in the US market.

- Tipalti Acquires Statement: Tipalti acquired the treasury automation startup Statement, incorporating AI-orientated cash flow forecasts and real-time liquidity insight about its financial set for global customers.

- Cube acquires Acin (U.K.): Regtech firm Cube bought Acin, a platform for AI-powered risk management data, to reinforce its operational and non-financial risk offers for financial institutions.

>Analyst Comment

- Retail and digital seats

These institutions take advantage of AI for real-time fraud detection, enhanced subscription, and 24/7 continuous customer support through chatbots to prime operational accuracy and reduce risks.

- Fintech startups and neobanks

Agile innovators in loan tools, robotic consultations, and personal financing depend on AI-orientated credit scores, predictive analysis, and personalised budgets, allowing rapid scalability and competitive differentiation.

- Wealth and investment consultants

Companies and platforms use robotic consultation tools, algorithmic negotiation, and portfolios to provide personalised investment strategies and insights, usually in collaboration with human consultants.

- Wealth and investment consultants

,, Agile innovators in loan tools, robotic consultations, and personal financing depend on AI-orientated credit scores, predictive analysis, and personalised budgets, allowing rapid scalability and competitive differentiation.

,

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AI in Fintech- Snapshot

- 2.2 AI in Fintech- Segment Snapshot

- 2.3 AI in Fintech- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AI in Fintech Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Virtual Assistant (Chatbots)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Business Analytics and Reporting

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Customer Behavioural Analytics

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Fraud Detection

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Microsoft

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Google LLC

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Salesforce

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Inc.

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 International Business Machines Corp.

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Amelia U.S. LLC

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Upstart Network

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Inc.

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Instructure

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Inc

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 Nuance Communications

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 Inc.

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

- 6.13 ComplyAdvantage.com

- 6.13.1 Company Overview

- 6.13.2 Key Executives

- 6.13.3 Company snapshot

- 6.13.4 Active Business Divisions

- 6.13.5 Product portfolio

- 6.13.6 Business performance

- 6.13.7 Major Strategic Initiatives and Developments

- 6.14 Narrative Science

- 6.14.1 Company Overview

- 6.14.2 Key Executives

- 6.14.3 Company snapshot

- 6.14.4 Active Business Divisions

- 6.14.5 Product portfolio

- 6.14.6 Business performance

- 6.14.7 Major Strategic Initiatives and Developments

- 6.15 Affirm

- 6.15.1 Company Overview

- 6.15.2 Key Executives

- 6.15.3 Company snapshot

- 6.15.4 Active Business Divisions

- 6.15.5 Product portfolio

- 6.15.6 Business performance

- 6.15.7 Major Strategic Initiatives and Developments

- 6.16 Inc..

- 6.16.1 Company Overview

- 6.16.2 Key Executives

- 6.16.3 Company snapshot

- 6.16.4 Active Business Divisions

- 6.16.5 Product portfolio

- 6.16.6 Business performance

- 6.16.7 Major Strategic Initiatives and Developments

- 6.17 Intel

- 6.17.1 Company Overview

- 6.17.2 Key Executives

- 6.17.3 Company snapshot

- 6.17.4 Active Business Divisions

- 6.17.5 Product portfolio

- 6.17.6 Business performance

- 6.17.7 Major Strategic Initiatives and Developments

- 6.18 Inbenta Technologies

- 6.18.1 Company Overview

- 6.18.2 Key Executives

- 6.18.3 Company snapshot

- 6.18.4 Active Business Divisions

- 6.18.5 Product portfolio

- 6.18.6 Business performance

- 6.18.7 Major Strategic Initiatives and Developments

- 6.19 Amazon Web Services

- 6.19.1 Company Overview

- 6.19.2 Key Executives

- 6.19.3 Company snapshot

- 6.19.4 Active Business Divisions

- 6.19.5 Product portfolio

- 6.19.6 Business performance

- 6.19.7 Major Strategic Initiatives and Developments

- 6.20 Oracle

- 6.20.1 Company Overview

- 6.20.2 Key Executives

- 6.20.3 Company snapshot

- 6.20.4 Active Business Divisions

- 6.20.5 Product portfolio

- 6.20.6 Business performance

- 6.20.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of AI in Fintech in 2030?

+

-

Which application type is expected to remain the largest segment in the Global AI in Fintech market?

+

-

How big is the Global AI in Fintech market?

+

-

How do regulatory policies impact the AI in Fintech Market?

+

-

What major players in AI in Fintech Market?

+

-

What applications are categorized in the AI in Fintech market study?

+

-

Which product types are examined in the AI in Fintech Market Study?

+

-

Which regions are expected to show the fastest growth in the AI in Fintech market?

+

-

Which application holds the second-highest market share in the AI in Fintech market?

+

-

What are the major growth drivers in the AI in Fintech market?

+

-

- Operational efficiency and cost reduction

As transaction volumes increase and margins tighten; financial companies take advantage of AI to automate repetitive processes—from loan subscription to compliance checks—increasing speed and reducing hand overload.

- =Enhanced fraud detection and risk management

Real-time analysis of transaction patterns allows the proactive identification of suspicious activity, reinforcing cybersecurity and strengthening confidence without human latency.

Personalised customer experiences

Through chatbots, robotic consultants, and personalised recommendations, AI meets consumer evolution expectations of convenience and personalisation in digital financial services