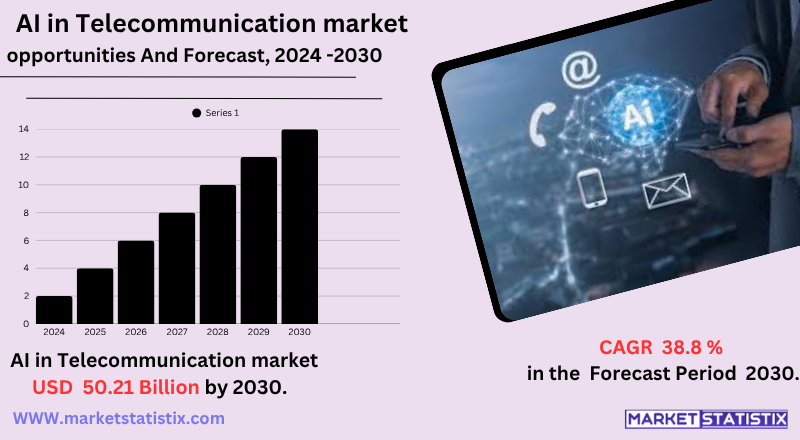

Global AI in Telecommunication Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-1053 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

AI in the telecommunications sector involves the implementation of artificial intelligence technologies—such as machine learning, natural language processing, and predictive analysis—to improve network performance, automate customer service, and optimise infrastructure management. Telecommunications providers use AI to detect and resolve network anomalies in real time, activate self-healing networks, customise user experiences, and improve fraud detection. It also feeds virtual assistants, smart chatbots, and predictive maintenance for telecommunications equipment. As networks evolve to 5G and beyond, AI is becoming essential for managing massive data volumes, improving service reliability, and supporting demand-orientated dynamic network operations.

AI in Telecommunication Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 38.8% |

| Forecast Value (2030) | USD 50.21 Billion |

| Key Market Players |

|

| By Region |

|

AI in Telecommunication Market Trends

- Edge-centric AI and AI RAN architectures

Telecommunications players are incorporating AI into RAN networks and cell towers in real-time traffic management, anomaly detection, and dynamic resource allocation on the edge.

- Shift toward autonomous network operations

Carriers and suppliers are building “self-healing” infrastructure fuelled by AI, designed to detect failures, correct problems, and optimise performance with minimal human intervention.

- AI-enhanced customer experiences

Virtual assistants, chatbots, and predictive churn prevention tools are being widely implemented to customise interactions, speed support, and reduce dependence on human agents.

AI in Telecommunication Market Leading Players

The key players profiled in the report are Intel Corporation, Microsoft, NVIDIA Corporation, AT&T Intellectual Property, Evolv Technologies Holdings Inc., IBM Corporation, Cisco Systems, Inc., Infosys Limited, Google LLC, Nuance Communications, Inc., Salesforce, Inc., H2O.ai.Growth Accelerators

- Network complexity & automation needs

As networks expand with 5G, IoT and edge computing increasingly implement AI to automate configuration, failure detection, and resource optimisation, boosting reliability and reducing manual intervention.

- Enhanced customer experience

AI-powered virtual assistants and targeted marketing support and customised offers improve satisfaction and retention by meeting rising consumer expectations.

- Real-time fraud and security monitoring

With increasing cyber threats and service abuse, operators use AI to quickly detect anomalies, prevent fraud, and protect networks—impairing customer assets and confidence.

AI in Telecommunication Market Segmentation analysis

The Global AI in Telecommunication is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Customer Analytics, Network Optimization, Network Security, Virtual Assistance. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Telecom's AI space is dominated by major technology and network players—IBM, Microsoft, Intel, Google, AT&T, Cisco, and Nokia/Ericsson—which together capture significant market share through integrated AI suites for network automation, predictive maintenance, and customer involvement. Microsoft, taking advantage of Azure and Google (via twin-powered tools with Verizon), is advancing virtual assistants and network intelligence fed in collaboration with major operators. Regional telecommunications and infrastructure companies—Verizon Business (with Nokia) and Lumen Technologies—are implementing 5G + AI private solutions, directing corporate and operational-level private networks. Meanwhile, cloud suppliers (AWS, Infosys/Cisco) are in partnership with telecommunications companies to incorporate AI in operations, reducing human workload and the power transformation telecommunications.

Challenges In AI in Telecommunication Market

- High infrastructure and edge computing demands

AI workloads need low latency and heavy computing at the edges of the network, while training models require massive centralised resources, creating complex orchestration charges.

- Integration with legacy systems and interoperability

Telecommunications providers struggle to merge the AI with outdated architecture, requiring expensive reformulation or middleware to ensure the flow of system data and cohesion.

- Scarcity of talent gaps and experience in AI

Operators do not have sufficient skills in AI and data science, making it difficult to build, implement, and maintain advanced AI solutions.

Risks & Prospects in AI in Telecommunication Market

AI in the telecommunications industry presents convincing opportunities, combining several strategic advantages that are reinforced: Telecommunications operators are experiencing exponential growth in the complexity of the release of 5G networks, edge computing, IoT proliferation, and OTT, which make the AI essential for real-time network optimisation, automation, and intelligent faults. At the same time, consumer expectations are evolving quickly: users now require highly personalised digital experiences, faster resolutions, and proactive support that chatbots, virtual assistants, and predictive analyses can provide on a scale. Together, these factors propel AI as a cornerstone in telecommunications, arranging smarter networks, richer customer experiences, and robust all-expertise essential to master a dynamic and intensive data market.

Key Target Audience

With chatbots, virtual assistants, and automated calling of calls, AI helps optimise problem-solving, customise experiments, and reduce call volumes to the front-line team., They use AI-powered systems to detect real-time network anomalies, predictive maintenance, and ideal capacity planning, ensuring high reliability and minimal inactivity time.

,

- , ,

- Customer service teams and operations

,- Marketing and customer segmentation teams

,

,- Telecommunications network operators and engineers

, AI-orientated analyses allow hyper-personalised campaigns and targeted offers, and segmentation needs to be based on behaviour and life.

, - Marketing and customer segmentation teams

Merger and acquisition

- Telus’ bid for remaining Telus Digital shares

Telus offered to acquire approximately 43% of the Telus digital it does not yet have, evaluating the unit at ~C$947 million. This movement aims to consolidate control over AI resources on your digital service arm and support its broader AI and data strategy.

- Zscaler acquires Red Canary cloud security expert.

Zscaler bought Red Canary to integrate AI-orientated workflows into a Unified Security Operations Centre. This acquisition extends the skills detection skills and emphasises human collaboration.

- Metaswitch acquired by Alianza.

The MetaSwitch, a telecommunications software provider, was purchased by Alianza in March 2025. The agreement reinforces AI Alianza-guided communication solutions to service providers, expanding its software resources.

>

Analyst Comment

The adoption of AI at Telecom is increasing, with the estimated market around $3 to 4 billion in 2024-25, expanding rapidly until the end of the decade. It is fuelled by 5G/EDGE computing proliferation, increased network complexity, automated customer service, network optimisation, and security demands. The key AI applications include the detection of real-time anomalies, virtual assistants, network self-care, predictive maintenance, and dynamic resource management by presenting their fundamental role in improving service reliability, cost efficiency, and readiness to state-of-the-art network demands.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AI in Telecommunication- Snapshot

- 2.2 AI in Telecommunication- Segment Snapshot

- 2.3 AI in Telecommunication- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AI in Telecommunication Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Network Security

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Network Optimization

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Customer Analytics

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Virtual Assistance

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: AI in Telecommunication Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 IBM Corporation

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Microsoft

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Infosys Limited

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Salesforce

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Inc.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 NVIDIA Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Intel Corporation

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Google LLC

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 AT&T Intellectual Property

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Cisco Systems

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Inc.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Nuance Communications

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Inc.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Evolv Technologies Holdings Inc.

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 H2O.ai.

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of AI in Telecommunication in 2030?

+

-

Which application type is expected to remain the largest segment in the Global AI in Telecommunication market?

+

-

How big is the Global AI in Telecommunication market?

+

-

How do regulatory policies impact the AI in Telecommunication Market?

+

-

What major players in AI in Telecommunication Market?

+

-

What applications are categorized in the AI in Telecommunication market study?

+

-

Which product types are examined in the AI in Telecommunication Market Study?

+

-

Which regions are expected to show the fastest growth in the AI in Telecommunication market?

+

-

Which application holds the second-highest market share in the AI in Telecommunication market?

+

-

What are the major growth drivers in the AI in Telecommunication market?

+

-

- Network complexity & automation needs

As networks expand with 5G, IoT and edge computing increasingly implement AI to automate configuration, failure detection, and resource optimisation, boosting reliability and reducing manual intervention.

- Enhanced customer experience

AI-powered virtual assistants and targeted marketing support and customised offers improve satisfaction and retention by meeting rising consumer expectations.

- Real-time fraud and security monitoring

With increasing cyber threats and service abuse, operators use AI to quickly detect anomalies, prevent fraud, and protect networks—impairing customer assets and confidence.