Global AKTA Chromatography Purification Instrument Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-612 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

AKTA Chromatography Purification Instrument Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

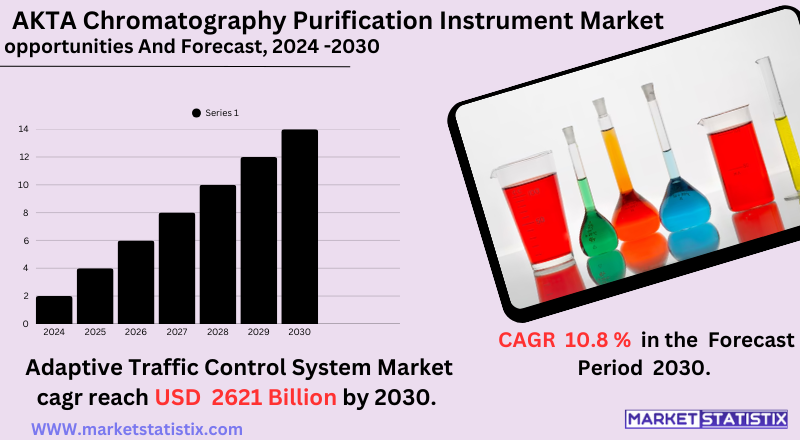

| Growth Rate | CAGR of 10.8% |

| Forecast Value (2030) | USD 2621 Billion |

| By Product Type | FPLC Systems, HPLC Systems |

| Key Market Players |

|

| By Region |

AKTA Chromatography Purification Instrument Market Trends

As the market for ÄKTA chromatography purification instruments shifts from the traditional to state-of-the-art interface technologies, manufacturers adopt state-of-the-art robotics and high-grade performance software into systems to streamline the processes, broaden replicability, and improve data management. Furthermore, the demand for high throughput and greater efficiency has carved the research laboratory and manufacturing facility for biopharmaceuticals into a compelling space for the automation enhancement in production plants. Growing demand for modular and scalable systems is another trend worth mentioning. Customization and scalability are evidently improved by providing the application-specific needs of the users to be covered, while also extending onward to operation increases when required. Other things to mention are user-friendliness improvements with intuitive software to simplify operation and provide less training. The market also comes under a rise in single-use technologies that are deployed to minimize cross-contamination and impede their cleaning in sensitive biopharmaceutical production.AKTA Chromatography Purification Instrument Market Leading Players

The key players profiled in the report are Shinwa, Tosoh Bioscience, ChromaCon, Agilent, Kromasil, Merck, Waters, GE Healthcare, Cytiva, YMC, Showa Denko, Beijing Huideyi Technolog, Dupont, Nomura Chemical, DaicelGrowth Accelerators

The rising biopharmaceutical industry is the primary driver for the growth of the ÄKTA chromatography purification instrument market because this industry requires the separation of biomolecules with high purity for drug development and manufacturing use. Therapeutic proteins, monoclonal antibodies, and vaccine demands continue to surge due to increasing incidences of chronic diseases; hence, there is a rising need for advanced purification technology. Furthermore, the regulatory requirements for drug purity and safety are stringent, which inclines the desire for reliable and accurate chromatography systems, thereby fuelling market growth. Also, several technological advancements, such as improved automation, increased sensitivity, and the integration of advanced software for data analysis, are contributing to market growth by enabling high efficiency and performance of these instruments.AKTA Chromatography Purification Instrument Market Segmentation analysis

The Global AKTA Chromatography Purification Instrument is segmented by Type, Application, and Region. By Type, the market is divided into Distributed FPLC Systems, HPLC Systems . The Application segment categorizes the market based on its usage such as Academic & Research Institutions, Pharmaceutical Industry, Biotechnology Industry, Contract Research Organizations. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for ÄKTA chromatography purification instruments presents a rather concentrated competition scenario and is dominated by a few important companies that provide complete biomolecule purification solutions. Competition is based on technological advances, product efficacy, and integrated software and support services. Big players spend a considerable amount of money on research and development to improve the automation, throughput, sensitivity, and precision of instruments. Offering the capability to provide customized solutions to meet the specific needs of biopharmaceutical companies and research institutions across small-scale laboratory and large-scale industrial processes is an essential competitive edge.Challenges In AKTA Chromatography Purification Instrument Market

There are numerous challenges faced by AKTA Chromatography Purification Instruments as hurdles to their growth. One major hurdle is the high cost of the instruments, which thus affects adoption by small- and medium-sized enterprises (SMEs) and research institutions that operate with constrained budgets. Because setting up the machines requires a significant amount of capital investment and the recurrent costs of consumables, this therefore imposes a high barrier to entry, especially in developing markets having little-developed infrastructure. Another very formidable challenge arises from the technical complications in operating and maintaining AKTA chromatography systems. These instruments require special knowledge and training to be operated efficiently, which in itself deters laboratories with no skilled personnel. Training operators adds further complications to operational costs. In addition to all this, meeting stringent regulatory requirements in biopharmaceutical production adds another layer to the manufacturers' burden, reducing adoption rates. All these fairly point toward the need for cost-effective and easy-to-use solutions to solve market restraints.Risks & Prospects in AKTA Chromatography Purification Instrument Market

The main opportunities are driven by the progress of AI-based automation, integration of IoT for remote monitoring, and energy efficiency. With enhanced R&D funding for drug development and government aid for biopharmaceutical innovation, these factors are most likely to propel the expansion of this market. From a regional perspective, North America leads the market with a well-established pharmaceutical base and high adoption of advanced technologies; sales revenue is poised to reach $901.6 million by the year 2033. Europe is the second-largest region, growing in large part because of stringent regulations and high demand for environmentally friendly purification systems in countries such as Germany and France. The Asia-Pacific region has been experiencing the highest rate of growth, with countries like China and India benefiting from rapid industrialization and increasing investments in healthcare infrastructure. The emerging markets in South America and those of the Middle East show potential for this growth owing to increased uptake of biotechnology applications.Key Target Audience

The main audiences to be targeted in the ÄKTA Chromatography Purification Instrument Market include professionals who majored in biopharmaceuticals, biotechnology, or academic research. These would include scientists working on protein purification methods or drug discoveries and bioprocess development involving research and development laboratories' quality control departments and biomanufacturing facilities. All these professionals represent critical decision-making and use of these instruments. Precision and reliability in purification render the tools much more critical for these people to access growth in the market.,, Such institutions and research centers would be important in active consumption, as these ÄKTA system products are used for primary research and education. Pharmaceutical companies focused on releasing products related to biologics and biosimilars serve as another retail entity that buys these systems—these entities are concerned with primary throughput scales and purification.Merger and acquisition

The dynamics in the AKTA Chromatography Purification Instrument market are marked by notable merger and acquisition activities, indicating a clear trend toward consolidation by key players looking to enhance their market positions and technological capabilities. The most prominent example was the transition of GE Healthcare's Life Sciences division, the developer of the ÄKTA™ chromatography systems, following its acquisition by Danaher Corporation in 2020 and subsequent rebranding as Cytiva. This acquisition aimed to reinforce Danaher's position in bioprocessing, whereby the chromatography purification instruments available with Cytiva were integrated into the greater life sciences portfolio. Besides the acquisition, other major actors in the chromatography market have engaged in targeted mergers and acquisitions to broaden their horizons for product offerings and access to the market. The examples presented include Sartorius AG acquiring a selection of life science businesses of Danaher Corporation in 2020, and the acquisition appears to strengthen Sartorius's position in chromatography and bioprocessing. The consolidation efforts among the leading companies are expected to drive innovations and provide integrated solutions capable of responding to the increasingly complex demands placed upon biopharmaceutical development and manufacturing. >Analyst Comment

The rapid growth of the Adaptive Traffic Control System (ATCS) market can be attributed to increasing urbanization and rising traffic congestion, as well as government initiatives on smart cities. Adaptive traffic control systems use real-time data, artificial intelligence, and IoT-enabled sensors to optimize traffic flow, reduce delays, and improve road safety. Major manufacturers, such as Siemens, Swarco, Cubic Corporation, and Econolite, are investing heavily in AI-based signal control systems and cloud-based traffic management solutions. Furthermore, the increasing adoption of connected vehicle technologies and advancements in 5G communication are improving the overall efficiency of the adaptive traffic control systems.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AKTA Chromatography Purification Instrument- Snapshot

- 2.2 AKTA Chromatography Purification Instrument- Segment Snapshot

- 2.3 AKTA Chromatography Purification Instrument- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AKTA Chromatography Purification Instrument Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 FPLC Systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 HPLC Systems

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: AKTA Chromatography Purification Instrument Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Pharmaceutical Industry

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Biotechnology Industry

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Academic & Research Institutions

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Contract Research Organizations

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Cytiva

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Showa Denko

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 ChromaCon

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 GE Healthcare

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Nomura Chemical

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Tosoh Bioscience

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Agilent

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Merck

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Waters

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 YMC

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Beijing Huideyi Technolog

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Shinwa

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Dupont

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Kromasil

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Daicel

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of AKTA Chromatography Purification Instrument in 2030?

+

-

What is the growth rate of AKTA Chromatography Purification Instrument Market?

+

-

What are the latest trends influencing the AKTA Chromatography Purification Instrument Market?

+

-

Who are the key players in the AKTA Chromatography Purification Instrument Market?

+

-

How is the AKTA Chromatography Purification Instrument } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the AKTA Chromatography Purification Instrument Market Study?

+

-

What geographic breakdown is available in Global AKTA Chromatography Purification Instrument Market Study?

+

-

How are the key players in the AKTA Chromatography Purification Instrument market targeting growth in the future?

+

-

What are the opportunities for new entrants in the AKTA Chromatography Purification Instrument market?

+

-

What are the major challenges faced by the AKTA Chromatography Purification Instrument Market?

+

-