Global alcohol-based concentrates Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-2052 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

alcohol-based concentrates Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

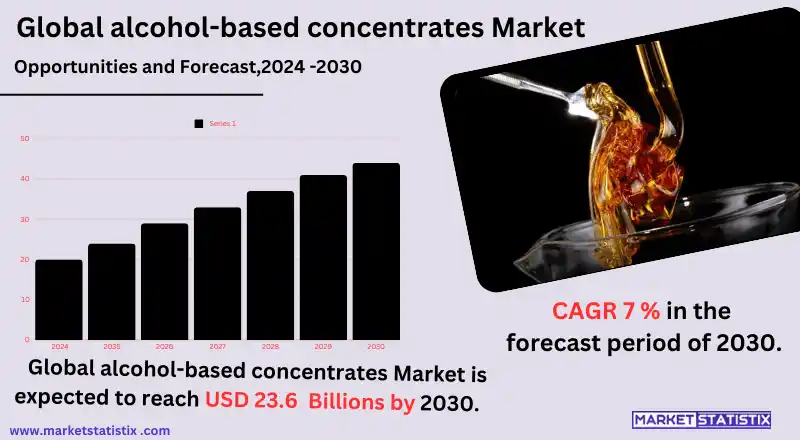

| Growth Rate | CAGR of 7%% |

| Forecast Value (2031) | USD 23.6 Billion |

| By Product Type | Beer Alcohol Concentrates, Whiskey Alcohol Concentrates, Bourbon Alcohol Concentrates, Brandy Alcohol Concentrates, Gin Alcohol Concentrates, Vodka Alcohol Concentrates, Rum Alcohol Concentrates, Cocktail Alcohol Concentrates |

| Key Market Players |

|

| By Region |

|

alcohol-based concentrates Market Trends

There is a noticeable growth in the global market for alcohol-based concentrates owing to the increasing prevalence of ready-to-drink (RTD) cocktails as well as the craft cocktail phenomenon. Nowadays, consumers tend to want more ready-to-consumer products with obedience towards unique tastes, thereby creating a great demand for pre-mixed alcoholic drinks amenable to alcohol concentrates. This is more so among the youth who enjoy new ways of drinking, which, in turn, compels brands to develop new tastes and high-quality ingredients. One more important aspect is the health consciousness among the target consumers, and this has led the companies to offer products that have low alcohol content and even no alcohol at all with the help of alcohol concentrates. This meets the changing consumer interest whereby we are witnessing the introduction of the products that provide the functional benefits of alcohol with none of the intoxicating drawbacks. In addition, there is a growing concern about the sustainability of all business activities, and this has seen predatory brands use sustainable practices such as green packaging to attract such a market. Consequently, the market is witnessing changes in product content, such as the inclusion of organic and natural components, in response to the taste and health consciousness of consumers today.alcohol-based concentrates Market Leading Players

The key players profiled in the report are Givaudan, Döhler, Kerry Group, Firmenich International, Symrise, Sensient Flavors International, Frutarom IndustriesGrowth Accelerators

The worldwide market for concentrates based on alcohol is anticipated to grow further owing to an escalating consumption of ready-to-drink (RTD) beverages, particularly varieties of cocktails, which are quickly becoming popular amongst consumers who desire ease and variety in their drinking experiences. As people get busy, they are tending to easier-to-serve products without sacrificing quality and taste. This is further supported by the social gatherings and events, which, on the other hand, do not require effort in serving the alcoholic beverages. The manufacturers are stepping in by creating new flavours and new products due to the upsurge in premium and artisanal alcohol trends.alcohol-based concentrates Market Segmentation analysis

The Global alcohol-based concentrates is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Beer Alcohol Concentrates, Whiskey Alcohol Concentrates, Bourbon Alcohol Concentrates, Brandy Alcohol Concentrates, Gin Alcohol Concentrates, Vodka Alcohol Concentrates, Rum Alcohol Concentrates, Cocktail Alcohol Concentrates . The Application segment categorizes the market based on its usage such as Bakery Products & Confectionery, Ice-Cream, Meat Products, Sauces, Desserts, Beverages, Chocolate. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

With increasing consumer preference for flavoured drinks and improving the food and beverage industry, the global alcohol-based concentrates market is set for massive expansion. The year 2023 is marking the onset of a rising trend in the applicability of taste varieties, especially for cocktails and sweets, among a range of market participants. The expected compound annual growth rate (CAGR) surfaces a growth in product premiumization and product development, which has resulted in manufacturers using expensive and healthy ingredients in the mixtures to tempt the ever-growing health-conscious consumers. The white space is dominated by companies like Givaudan, Kerry Group, Firmenich International, and Symrise, which in turn leads to barriers to entry of new businesses through strategic alliances, acquisitions, and product development. The structure of the market includes both self-sufficient organisations and new entrants actively engaging in bakery, confectionery, and alcoholic drinks markets, thus competing for the share of different segments. In terms of value, North America is currently the largest market as it has a mature beverage market; however, the Asia-Pacific region is anticipated to witness rapid growth owing to urbanisation and changing consumption trends. There is also enhanced competition within the industry as companies are devoting more resources towards research aimed at coming up with unique products that meet the ever-changing taste preferences of consumers.Challenges In alcohol-based concentrates Market

The worldwide market for alcohol-based concentrates encounters various constraints, most of which include overregulation and changing consumer tastes. Strict laws limiting the production, distribution, or advertising of alcoholic drinks vary greatly by every region, making it difficult for manufacturers and suppliers. Such rules often go along with the need to obtain certain licenses, taxation, age limitations, and many more, thus stifling passion to operate in the market. Furthermore, concerns about drinking habits and health factors related to alcohol consumption have increased the need for alternatives to traditional alcohol-based concentrates, thus reducing the appeal of more traditional ones. One more challenge in this market can be explained by the growing number of competitors and new product attics targeting younger audiences, like non-alcoholic spirits or different ready-to-drink cocktails. Nowadays, as the health trend spreads among the consumers, they are more likely to look for more advanced drink options that satisfy taste but do not have alcohol content; this may also pose a threat to the market of concentrate essences.Risks & Prospects in alcohol-based concentrates Market

The global alcohol-based concentrates market is a vast playing field, as the demand for innovative options in beverages and craft cocktails is on a rise. Consumers continuously look for unique and fine drinking experiences, and these trends may help manufacturers further orchestrate innovative flavourings and formulations with appealing presentations to a broad spectrum of palates. As interest in mixology and home preparation continues to gain traction, consumers are increasing investments in high-end ingredients. Alcohol-based concentrates and convenience, as well as flexibility, for delivering sophisticated beverages, continue to grow as the top choices. Most importantly, this trend can be witnessed in millennials and Gen Z, who not only seem interested in novelties but also actively try different options for the beverages. Moreover, the market is gaining more impetus from on-premise and off-premise distribution channels, such as bars, restaurants, and retail outlets. As the hospitality industry is recovering well from the pandemic, establishments want to strengthen their drink offers to attract patrons. Partnering with these venues could mean that alcohol-based concentrate manufacturers gain further market presence while stimulating sales.Key Target Audience

The main scope of the global market for alcohol-based concentrates is directed at the beverage producers, bars, and restaurants that require high-grade ingredients for making cocktails or mixed drinks. Such establishments use alcohol-based concentrates for preparing various kinds of flavored drinks, thus expanding their drink menu while providing uniform taste and quality. With the growing popularity of cocktail drinking, especially amongst the young, the restaurants and bars are also presenting advanced and upscale concentrates in their drink menus in order to draw in customers and enhance the beverage experience.,, Home mixologists and consumers who are interested in mixology form another large segment of the audience, especially in cities where Drunk Elephant’s cocktail-making at home culture is growing. This audience usually consists of people who like making cocktails and want to be able to do this easily and with good quality products. Since the rise of social media, brands have seen the opportunity in changing the tide and have targeted such audiences through content, recipes, and promotions that are in place.Merger and acquisition

The demand and consumption of alcohol-based concentrates globally have remained positive to the extent that a number of mergers and acquisitions have been experienced in 2024, a characteristic of competitiveness and strategic realignment in the sector in a bid to meet the changes in behaviour owing to the consumer. As early as the first half of the year, 34 significant deals were recorded, with spirits heading the activity with 22 transactions. Some of the exceptional transactions include the full ownership of DeLeón Tequila by Diageo and the acquisition of Single Cask Nation by The Artisanal Spirits Company, which demonstrates growth in innovation and demand for high-quality spirits. Moreover, the increase in demand for ready-to-drink (RTD) drinks also came with seven deals made that particularly focused on canned cocktails and other RTD beverages. In order to enhance their existing portfolios as well as increase their reach in the market, the companies in focus are making acquisitions. For example, Southern Glazer’s Wine & Spirits announced its acquisition of Horizon Beverage Group that seeks to enhance its distribution base in Massachusetts and Rhode Island with the acquisition. This move would not only enlarge Southern Glazer's operational base but also reinforce its portfolio levels across different alcohols offered.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 alcohol-based concentrates- Snapshot

- 2.2 alcohol-based concentrates- Segment Snapshot

- 2.3 alcohol-based concentrates- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: alcohol-based concentrates Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Beer Alcohol Concentrates

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Whiskey Alcohol Concentrates

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Bourbon Alcohol Concentrates

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Brandy Alcohol Concentrates

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Gin Alcohol Concentrates

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Vodka Alcohol Concentrates

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Rum Alcohol Concentrates

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Cocktail Alcohol Concentrates

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: alcohol-based concentrates Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bakery Products & Confectionery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Ice-Cream

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Meat Products

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Sauces

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Desserts

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Beverages

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Chocolate

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: alcohol-based concentrates Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Givaudan

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Döhler

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Kerry Group

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Firmenich International

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Symrise

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Sensient Flavors International

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Frutarom Industries

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of alcohol-based concentrates in 2031?

+

-

What is the growth rate of alcohol-based concentrates Market?

+

-

What are the latest trends influencing the alcohol-based concentrates Market?

+

-

Who are the key players in the alcohol-based concentrates Market?

+

-

How is the alcohol-based concentrates } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the alcohol-based concentrates Market Study?

+

-

What geographic breakdown is available in Global alcohol-based concentrates Market Study?

+

-

Which region holds the second position by market share in the alcohol-based concentrates market?

+

-

How are the key players in the alcohol-based concentrates market targeting growth in the future?

+

-

What are the opportunities for new entrants in the alcohol-based concentrates market?

+

-