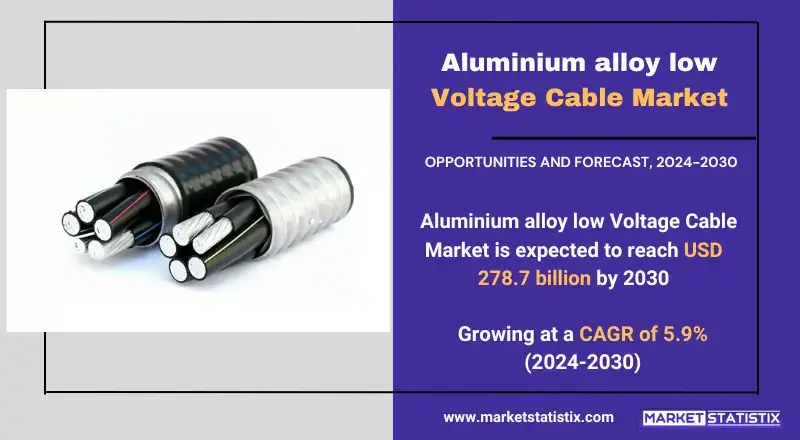

Global Aluminium Alloy Low Voltage Cable Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2095 | Energy and Natural Resources | Last updated: Dec, 2024 | Formats*:

Aluminium Alloy Low Voltage Cable Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.6% |

| By Product Type | Single-core Aluminum Alloy Cable, Multi-core Aluminum Alloy Cable |

| Key Market Players |

|

| By Region |

|

Aluminium Alloy Low Voltage Cable Market Trends

Increased demand by the power and utility sectors, cost efficiency, and an increase in infrastructure investments account for significant growth in the global aluminum alloy low voltage cable market. Aluminum alloy cables, being the lighter variants with more corrosion resistance and at a relatively lower price than copper cables, gain preference. This trend is more pronounced in areas such as North America, driven by government initiatives aimed at upgrading its power infrastructure. The Asia-Pacific region is also experiencing strong growth due to industrialization and urbanization within the country economies of China and India. Technological advances and the trend towards ever-increasing sustainable energy solutions, such as solar power and smart grids, are also driving the aluminum cable adoption. However, risks include raw material price volatility; alternative products, such as copper cables, will be available, which would pose risks to the market stability. The market has thus been expected to continue at a steady pace of expansion; hence, aluminum alloy cables remain critical in residential and commercial applications.Aluminium Alloy Low Voltage Cable Market Leading Players

The key players profiled in the report are Acome Group, Cleveland Cable Company, Mingda Wire and Cable, Nexans, Shunxin Cable, Top Cable, Tuojin Cable, Yanggu Cable GroupGrowth Accelerators

Energy efficiency electrical solutions" have thrust this market with increased demand from the global industrial and commercial sectors, thanks to aluminum alloys increasingly being used as an alternative to the traditional copper-based cables in low-voltage applications such as power distribution, residential, and industrial, primarily for their lightweight nature, lower cost, and greater conductivity. It is combined with the demand for reduced material costs to be achieved in electrical installations; aluminum alloy cables are well suited to be used in infrastructure projects, electrical networks, and renewable energy systems that also include solar and wind energy installations but adopt energy-efficient solutions. Rapid growth in urban and industrialization activities in developing countries is growing demand for electricity and related infrastructure; the government's moves to upgrade the electrical grid system, along with the replacement of legacy copper wiring in the existing infrastructure, accelerate the adoption of aluminum alloy cables. All these, along with sustainable construction and energy transmission trends, are giving further impetus to the market.Aluminium Alloy Low Voltage Cable Market Segmentation analysis

The Global Aluminium Alloy Low Voltage Cable is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Single-core Aluminum Alloy Cable, Multi-core Aluminum Alloy Cable . The Application segment categorizes the market based on its usage such as Construction, Electricity, Transportation, Industrial, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The aluminum alloy low voltage cable market is multi-dimensional in its competition space. Consequently, it has the leaders of Prysmian Group, Nexans, and Southwire Company in the space. These companies continue to remain competitive by having large product portfolios and an established supply chain. Regional manufacturers have also made their presence felt with a growing focus on innovation and cost-effective methods of production. With the increasing demand in sustainable and efficient solutions, the top players are investing heavily in research and development aimed at improving cable performance to keep up with changing industry standards. Its growing use of aluminum cables in renewable energy projects and electric vehicle infrastructure is bound to make the market even more competitive for established and new players in this industry.Challenges In Aluminium Alloy Low Voltage Cable Market

Main challenges the global aluminum alloy low voltage cable market faces are, on one hand, raw material price volatility or supply chain disruption. The price of aluminum and other alloying elements varies based on demand from world markets and mining activities, which can have a significant impact on the cost of production. Geopolitics and other impediments to free trade may further disrupt a steady supply of these materials, causing supply shortages and delays in production. Other competitors are other materials competing with the aluminum alloys, such as copper cables and new advanced composites that people feel are more durable or efficient. The key strength of aluminum alloys—being light in weight and cost-efficient—cannot conquer the high-performance sectors where, historically, copper cables will continue to be preferred.Risks & Prospects in Aluminium Alloy Low Voltage Cable Market

The global market for aluminum alloy low-voltage cables provides a significant growth opportunity for energy-efficient as well as lightweight applications in construction, automotive, and electrical industries. Aluminum alloy cables have also been an alternative to traditional copper cables that such industries have been looking for to reduce their cost while enhancing their performance. Growth in the renewable energy projects, smart grid developments, and upgradation of infrastructure further fuels the demand for these cables, and with industrialization coupled with urbanization now rapidly taking place in emerging markets, the demand grows. Advances in manufacturing processes and alloy composition are improving the properties of aluminum alloy cables, thereby making them stronger for such high-stakes applications. Around the world, governments are being compelled by their citizens to switch to greener, cleaner, more sustainable energy solutions. Aluminum alloy cables are bound to attract even higher preference from such sectors as solar energy, electric vehicles (EVs), and energy distribution systems.Key Target Audience

The main focus of the target market for the global aluminum alloy low voltage cable is the industries requiring efficient and cost-effective electrical transmission solutions. This includes the construction industry; light-in-weight, anti-corrosive aluminum alloy cables are used in large volumes for residential, commercial, and industrial buildings. There is also high consumption in the energy and utility sectors, as these cables are a part of the distribution system. Examples of such industries include overhead transmission lines and renewable energy projects such as photovoltaic and wind power.,, The other target group is automotive and transport industries, as they increasingly use aluminum alloy cables in the electric vehicles or hybrid cars for weight reduction and improvement of energy efficiency. The sectors deal with producers who appreciate lightweight yet strong materials for wiring in vehicle performance and range. As such, such industrial and economic focus on sustainability and energy efficiency of the industries makes aluminum alloy low-voltage cables a great choice, thus pushing demand for the markets in regions with significant automotive and infrastructure development.Merger and acquisition

Recent action in the global low-voltage cables market of aluminum alloy has been notable mergers and acquisitions, which are the strategic moves by the key participants to better their presence in the markets as well as the product offerings. In April 2023, a prominent cabling and optical fibre manufacturer in France, Nexans SA, acquired Reka Cables Ltd., a Finnish power cable manufacturer renowned for high-quality aluminum power cables. Acquiring Reka helps strengthen the product portfolio of Nexans and expands its activities in the Nordic region, thus positioning it as an all-round electrification player. With the capabilities offered by Reka, Nexans will continue to enrich its expertise in safe and high-quality cable solutions in response to growing demand for efficient electrical infrastructure. Companies are focusing increasingly on innovation through strategic partnerships and acquisitions to fill in the emerging needs created by changing markets. One such trend is the development of cables using low-carbon aluminum. For instance, Nexans recently launched a completely new range of low-carbon aluminum distribution grid cables, which minimize greenhouse gas emissions to the maximum extent possible.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Aluminium Alloy Low Voltage Cable- Snapshot

- 2.2 Aluminium Alloy Low Voltage Cable- Segment Snapshot

- 2.3 Aluminium Alloy Low Voltage Cable- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Aluminium Alloy Low Voltage Cable Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Single-core Aluminum Alloy Cable

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Multi-core Aluminum Alloy Cable

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Aluminium Alloy Low Voltage Cable Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Construction

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Electricity

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Transportation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Industrial

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Aluminium Alloy Low Voltage Cable Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Acome Group

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Cleveland Cable Company

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Mingda Wire and Cable

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Nexans

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Shunxin Cable

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Top Cable

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Tuojin Cable

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Yanggu Cable Group

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Aluminium Alloy Low Voltage Cable Market?

+

-

What major players in Aluminium Alloy Low Voltage Cable Market?

+

-

What applications are categorized in the Aluminium Alloy Low Voltage Cable market study?

+

-

Which product types are examined in the Aluminium Alloy Low Voltage Cable Market Study?

+

-

Which regions are expected to show the fastest growth in the Aluminium Alloy Low Voltage Cable market?

+

-

Which region is the fastest growing in the Aluminium Alloy Low Voltage Cable market?

+

-

What are the major growth drivers in the Aluminium Alloy Low Voltage Cable market?

+

-

Is the study period of the Aluminium Alloy Low Voltage Cable flexible or fixed?

+

-

How do economic factors influence the Aluminium Alloy Low Voltage Cable market?

+

-

How does the supply chain affect the Aluminium Alloy Low Voltage Cable Market?

+

-