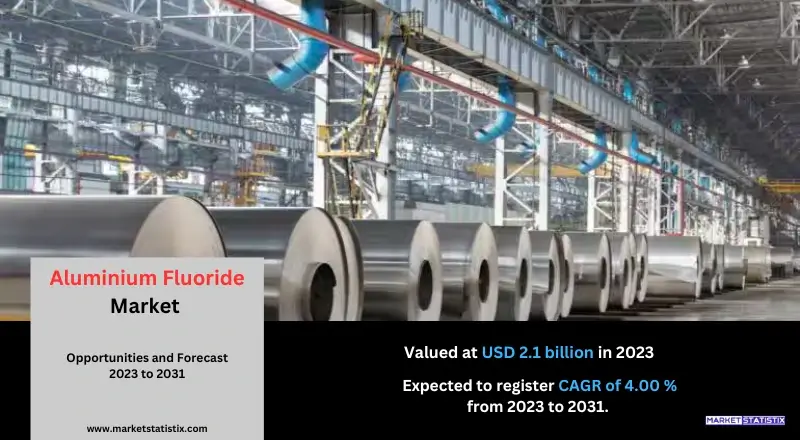

Global Aluminium Fluoride Market – Industry Trends and Forecast to 2031

Report ID: MS-1899 | Chemicals And Materials | Last updated: Oct, 2024 | Formats*:

Aluminium Fluoride Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 4.00% |

| By Product Type | Wet Process, Dry Process, Anhydrous |

| Key Market Players |

|

| By Region |

|

Aluminium Fluoride Market Trends

Several significant developments are presently shaping the global aluminium fluoride market, largely due to the growing production levels in the aluminium sector and innovations in the manufacturing processes. One such trend is the increase in aluminium fluoride consumption for aluminium production processes, particularly where it acts as a fluxing agent—to reduce the melting temperature of aluminium oxide, thereby enhancing energy use efficiency. Environmental concerns are becoming an integral part of almost every industry, and the aluminium production industry is very much focused on reducing the carbon footprint and making processes more sustainable. This increases the demand for aluminium fluoride with minimum environmental burden and thus fuels the aluminium fluoride market. Furthermore, this trend is also reflected in the market as it is leaning towards more advanced technologies of production, such as the adoption of new feedstock and better waste management in production, in order to comply with the regulations and cut down on costs. This also emphasises the ever-changing trends in the market for aluminium fluoride as well as the production of such materials with regard to the overall goals of sustainability and the pace of technological revolutions.Aluminium Fluoride Market Leading Players

The key players profiled in the report are Do-Fluoride Chemicals Co., Ltd (China), Hunan Nonferrous Metals Corporation Limited (China), Fluorsid S.p.A. (Italy), Qingzhou Hongyuan Chemical Co Ltd (China), Rio Tinto Alcan Inc (Canada), Gulf Fluor (United Arab Emirates), DuPont (United States), Alfa Aesar. (United States), Mexichem S.A.B de C.V. (Mexico), PhosAgro (Russia), RUSAL (Russia)Growth Accelerators

The increasing demand from the aluminium-producing industries, specially manufacturing aluminium metal by the Hall-Héroult process, is the main factor fuelling the growth of the global aluminium fluoride market. In the Hall-Héroult process of electrolytic reduction of aluminium oxide, aluminium trifluoride enhances the electrolysis process while lowering its temperature. The need for aluminium, which is light and resistant to corrosion, is projected to create a corresponding increase in the need for aluminium fluoride as other industries such as construction, automobile manufacture, and packaging embrace it. Moreover, improvements in aluminium fluoride production technology as well as high purity-grade development for different applications are also adding to the growth of the market. The growing spending on the aluminium industry, coupled with the drive for green projects, presents a good opportunity for growth of the aluminium fluoride market.Aluminium Fluoride Market Segmentation analysis

The Global Aluminium Fluoride is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Wet Process, Dry Process, Anhydrous . The Application segment categorizes the market based on its usage such as Aluminium Metallurgy, Depressor, Ceramics, Glass, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global aluminium fluoride market presents a hybrid competition that involves well-known as well as new firms that produce aluminium fluoride for different usages, mainly for aluminium smelting. The market comprises large chemical manufacturers and specialised chemical companies with in-house production, extensive distribution systems, and high R&D costs. These companies are really good at processes and sourcing raw materials; as such, they produce aluminium fluoride products that address their client’s needs without breaking any laws concerning the environment. Furthermore, besides the already existing competition, within smaller and regional manufacturers who seek to penetrate these niche segments and localised markets, there are also competitors. Such companies are mostly low-cost and adapted to the production of tailored goods and services for markets in countries that have a growing appetite for aluminium fluoride because of increasing production and use of aluminium, especially in developing industries. In addition, as the aluminium fluoride market is set for more changes over the years, these pillars, namely, technological developments, strategic mergers and acquisitions or collaborations, and green initiatives, will have very significant impacts on the competitive environment of the aluminium fluoride market, especially in relation to pricing, products, and market growth as a whole.Challenges In Aluminium Fluoride Market

The global aluminium fluoride market has numerous constraints, which mainly concern the changes in the prices of the raw materials and the supply chain management of the companies. In the case of aluminium fluoride, fluorspar and aluminium hydroxide are the basic raw materials. Their prices tend to change depending on the demand from the market, the legal requirements related to the environment, and mining issues. Such changes contribute to the changes in production costs and influence the pricing decisions of the manufacturers. In addition, political risks may cause interruptions in the supply chain, making it hard to source the required raw materials, therefore reducing the overall installed capacity. Moreover, it is also notable that the requirements related to the use of resources and the environmental concerns are increasingly becoming strict. Nations all over the world are enacting tighter legislation on greenhouse gas emissions and the use of toxic materials; thus, aluminium fluoride producers have to make changes in their production methods. Unfortunately, this will also mean that considerable resources need to be directed towards cleaner technologies and processes, which can disadvantage small players.Risks & Prospects in Aluminium Fluoride Market

The aluminium fluoride market across various regions of the globe is expected to present distinct fashion owing to the fact that the demand for aluminium production is rising, especially due to its use in the aerospace, automotive, and construction sectors. With aluminium becoming a common material that has lightweight and energy-efficient applications, the consumption of aluminium fluoride, which is a flux in the process of electrolysis during aluminium smelting, will be on the upward trend. In addition, the increasing emphasis on the recycling of aluminium in order to mitigate the environmental damage and save on current resources also allows the use of aluminium fluorides in the recycling processes, which provides room for expansion of the market. Moreover, the growing inclusion of sophisticated technologies and innovations in structures such as that of the production of aluminium fluoride at low or reduced temperatures is expected to increase efficiency and reduce costs, thereby increasing its appeal to manufacturers. Given the dynamics of trends, the scope of the global market for aluminium fluoride is set to expand and gain new industries.Key Target Audience

The global aluminium fluoride market’s primary end-user comprises the aluminium manufacturing and processing sectors. These players produce aluminium fluoride as their principal additive in the aluminium-greed smelting electrolytic process, where the substance reduces the process temperature of alumina, thus aiding in the effective extraction of aluminium. As the problem of demand for aluminium in use in automotive, aircraft, and building, among other uses, increases, aluminium producers turn to aluminium fluoride of high quality to enhance their productivity and lower energy costs in their processes.,, In addition to this, a plethora of industries that use aluminium fluoride in its specific applications, such as ceramics, glass, and in the manufacture of drugs, make up another important portion of the target group. This is because aluminium fluoride is most often used in these processes due to its ability to enhance the quality and performance of end products.Merger and acquisition

The growing consumption of aluminium in end-user industries like aluminium, lithium-ion batteries, ceramics, etc. has resulted in substantial growth of the global aluminium fluoride market. In this regard, important companies such as Alufluoride Ltd., Rio Tinto Plc, and Fluorsid S.p.A. have been performing M&As in order to reinforce their influence and broaden their scope of business. This restructuring, among other reasons, seeks to improve production efficiency and quality and satisfy growing needs from other industries. The widening of the market due to recent activities like Fluorsid acquiring Brazilian companies illustrates the trends in the core regions. Additionally, the market is facing changes due to new technologies, with companies putting more resources in R&D in order to improve how they manufacture aluminium fluoride to be more environmentally friendly. This emphasis on advancement is important for enhancing compliance with regulations and promoting local bauxite production. Although the interest in aluminium fluoride in its application in, for instance, lithium-ion batteries is on the rise, such a phenomenon is part of a wider shift towards cleaner and more efficient processes within the industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Aluminium Fluoride- Snapshot

- 2.2 Aluminium Fluoride- Segment Snapshot

- 2.3 Aluminium Fluoride- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Aluminium Fluoride Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Wet Process

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Dry Process

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Anhydrous

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Aluminium Fluoride Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aluminium Metallurgy

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Depressor

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Ceramics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Glass

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Aluminium Fluoride Market by End User

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Automotive

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Construction

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Pharmaceuticals

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Aerospace

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Aluminium Fluoride Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Do-Fluoride Chemicals Co.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Ltd (China)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Hunan Nonferrous Metals Corporation Limited (China)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Fluorsid S.p.A. (Italy)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Qingzhou Hongyuan Chemical Co Ltd (China)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Rio Tinto Alcan Inc (Canada)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Gulf Fluor (United Arab Emirates)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 DuPont (United States)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Alfa Aesar. (United States)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Mexichem S.A.B de C.V. (Mexico)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 PhosAgro (Russia)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 RUSAL (Russia)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Aluminium Fluoride market?

+

-

How do regulatory policies impact the Aluminium Fluoride Market?

+

-

What major players in Aluminium Fluoride Market?

+

-

What applications are categorized in the Aluminium Fluoride market study?

+

-

Which product types are examined in the Aluminium Fluoride Market Study?

+

-

Which regions are expected to show the fastest growth in the Aluminium Fluoride market?

+

-

What are the major growth drivers in the Aluminium Fluoride market?

+

-

Is the study period of the Aluminium Fluoride flexible or fixed?

+

-

How do economic factors influence the Aluminium Fluoride market?

+

-

How does the supply chain affect the Aluminium Fluoride Market?

+

-