Global Amphoteric Surfactant Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-285 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

Amphoteric Surfactant Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

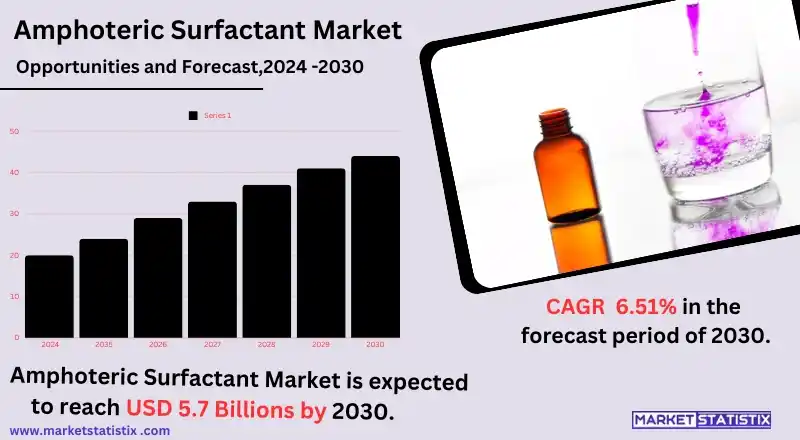

| Growth Rate | CAGR of 6.51% |

| Forecast Value (2030) | USD 5.7 Billion |

| By Product Type | Betaine, Amine Oxide, Amphoacetate, Amphopropionate, Others |

| Key Market Players |

|

| By Region |

Amphoteric Surfactant Market Trends

The amphoteric surfactant market is manifesting a growing trend toward the use of eco-friendly and sustainable surfactants. The growing consumer awareness of the many environmental hazards posed by conventional surfactants has increased demand for bio-based and biodegradable amphoteric surfactants for personal care, household cleaning, and industrial applications. Derived purely from natural sources such as coconut oil and palm kernel oil, these surfactants can be branded as less toxic, safer alternatives, thereby luring conscious consumers and industries alike. The other key trend being noted in the amphoteric surfactant market is the innovation in product formulations aimed at enhanced performance across applications. Consumers are being drawn to these amphoteric surfactants because of their applicability in high-end personal care products such as shampoos, body washes, and cleansers. They are considered mild, compatible with skin, and serve a wide pH range. Thus, the demand for premium and multifunctional product ranges in personal care and cosmetics, where consumer preferences are increasingly changing toward more effective, gentler, and higher-performance ingredients, comes into play.Amphoteric Surfactant Market Leading Players

The key players profiled in the report are Akzonobel N.V (Netherlands), Clariant AG (Switzerland), BASF SE (Germany), Evonik Industries AG (Germany), Lion Corporation (Japan), Solvay (Belgium), Kao Corporation (Japan), Indorama Ventures Public Company Limited (Thailand), Ashland Global Holdings Inc. (U.S.), Croda International Plc (U.K.), Stepan Company (U.S.)Growth Accelerators

The growth prospects for the amphoteric surfactant industry mainly rely on the increasing demand for mild and skin-friendly personal care products. With growing awareness on health and wellness, the customers are more inclined towards shampoos, body washes, and facial cleansers that contain mild and irritant-free ingredients. Amphoteric surfactants are widely used in cosmetics and personal care formulations because of their mildness and suitability for sensitive skin. The increasing household cleaning and industrial cleaning sectors will be other important catalysts. Amphoteric surfactants have proven to perform excellently in formulations targeting detergents, surface cleaners, and disinfectants as they function effectively at widely varying pH levels. Awareness about the sustainability and demand for various cleaning products that are safer and low in toxicity can also be noted as some of the factors propelling the amphoteric surfactants market. Their property versatility, such as foaming, emulsifying, and detergency, lends its significance to them for application across varied industrial uses such as textiles and oil field chemicals, thus adding value to the market.Amphoteric Surfactant Market Segmentation analysis

The Global Amphoteric Surfactant is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Betaine, Amine Oxide, Amphoacetate, Amphopropionate, Others . The Application segment categorizes the market based on its usage such as Personal Care, Household, Industrial, Agricultural. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario in the amphoteric surfactant market includes both established multinational companies and regional players. This market is dominated by major global manufacturers that offer a wide range of amphoteric surfactants for personal care, detergents, pharmaceuticals, and agricultural applications. Leading companies such as BASF, Huntsman Corporation, and Clariant continue investing in R&D to enhance product performance, sustainability, and eco-friendliness. These giants in the industrial sphere focus on expanding their product portfolios with innovative and customized solutions to cater to the increasing demand for biosurfactants, non-toxic surfactants that are now becoming a trend due to rising consumer awareness about the effects of the environment.Challenges In Amphoteric Surfactant Market

Like any other market, the amphoteric surfactant market also has its problems that relate mostly to negative human activities in the environment. The majority of amphoteric surfactants are derived from petroleum bases, making their production perceived as non-sustainable and damaging to the environment. This calls for manufacturers to develop greener, renewable alternatives, which, in turn, can drive the production cost upward and often require a high initial cost pertaining to research and development. Another case for fragmenting amphoteric surfactants is the fluctuations in raw material price, primarily again for plant fatty acids and chemical precursors. Other price ranges of oils and natural gas directly impact the cost at which they are produced and thus make pricing difficult for manufacturers to maintain. Given this competitive environment, companies must innovate and optimize products constantly to stay ahead in this market segment, which is cost-sensitive and ecologically conscious.Risks & Prospects in Amphoteric Surfactant Market

An increase in demand for environmentally friendly and biodegradable cleaning agents has always been a direct opportunity in the amphoteric surfactant market. Amphoteric surfactants, mild and non-toxic, are used in a plethora of applications as consumers and industries start becoming more aware of sustainability. They serve as essential components in many personal care products, such as shampoos, body washes, and facial cleansers, as the move towards using more natural and safe ingredients creates several new opportunities for growth. Currently, the market is also thriving as people move towards utilising environmentally friendly household cleaning products and laundry detergents, hence offering a greater chance for manufacturers to innovate and meet the changing needs of consumers towards more sustainable solutions. Export opportunity for amphoteric surfactants the market is expected to increase its scope in industrial applications such as oilfield chemicals, agriculture, and textile manufacturing. The growing amphoteric surfactant application in agrochemical formulations to yield efficient herbicides and pesticides is a trend noticed in the market. These surfactants are also used in formulations during the textile manufacturing process, mainly for fabric softeners and dyeing auxiliaries.Key Target Audience

Amphoteric surfactants are of primary consideration to personal care, household cleaning, and industrial applications that target the categories of markets within these industries. This interest in amphoteric surfactants arises mainly from their use in several formulations, appearing in personal use—from shampoos, body washes, and facial cleansers, including other kinds of skin care products—which appeal to consumers whose gratification lies in milder, non-irritating products. Those are the same mild cleansing agent’s household manufacturers find ideal for dirt and grease removal while being gentle on our surfaces.,, Another huge market aware of the applications of amphoteric surfactants is industrial, particularly in oil and gas for enhanced oil recovery and the textile industry for improved fabric processing. These surfactants can work under both acidic and alkaline conditions, thus giving them a wide range of industrial applications. Furthermore, the use of amphoteric surfactants in the agrochemical sector has also received much awareness as emulsifiers, particularly in pesticide formulations, to increase their stability and functionality.Merger and acquisition

The amphoteric surfactant market is very active in recent mergers and acquisitions, highlighted by the OpenGate Capital acquisition of the North American and European amphoteric surfactant business from Solvay at the end of 2022. Following this transaction, the business was rebranded as Verdant Speciality Solutions—with the goal of driving innovation and growth as demand for natural-based products increases in personal care and hygiene markets. OpenGate Capital has really taken a strategic move into this area to align with the trend that increasingly highlighted formulations that are friendly to the environment and with their growth potential for the fast-developing area as consumers tend to move towards sustainable products. BASF, Evonik Industries, and Clariant are major players that continue to aggressively take on strategic initiatives in order to upgrade their positioning in the market with regard to developing and diversifying their offerings. Investment in research and development towards "green" surfactants remains one of the important elements to keep competitive in this fast-paced market while providing product offerings demanded by the market. >Analyst Comment

"The amphoteric surfactant market is not only dynamic but also a growing sector. Today, consumers are becoming much more demanding for high efficiency, eco-friendliness, and multifunctionality in the products they use. These surfactants function well in both very acidic and very alkaline environments, making them very versatile for many applications in personal care, home care, and industrial cleaning. Mild and skin-friendly ingredients in personal care products; increasing demand for eco-friendly firs in consumer products such as personal hygiene items; advances spread demand across industries for effective and efficient cleaning solutions."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Amphoteric Surfactant- Snapshot

- 2.2 Amphoteric Surfactant- Segment Snapshot

- 2.3 Amphoteric Surfactant- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Amphoteric Surfactant Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Betaine

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Amine Oxide

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Amphoacetate

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Amphopropionate

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Amphoteric Surfactant Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Personal Care

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Household

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Agricultural

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Akzonobel N.V (Netherlands)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Clariant AG (Switzerland)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 BASF SE (Germany)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Evonik Industries AG (Germany)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Lion Corporation (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Solvay (Belgium)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Kao Corporation (Japan)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Indorama Ventures Public Company Limited (Thailand)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Ashland Global Holdings Inc. (U.S.)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Croda International Plc (U.K.)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Stepan Company (U.S.)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Amphoteric Surfactant in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Amphoteric Surfactant market?

+

-

How big is the Global Amphoteric Surfactant market?

+

-

How do regulatory policies impact the Amphoteric Surfactant Market?

+

-

What major players in Amphoteric Surfactant Market?

+

-

What applications are categorized in the Amphoteric Surfactant market study?

+

-

Which product types are examined in the Amphoteric Surfactant Market Study?

+

-

Which regions are expected to show the fastest growth in the Amphoteric Surfactant market?

+

-

Which application holds the second-highest market share in the Amphoteric Surfactant market?

+

-

Which region is the fastest growing in the Amphoteric Surfactant market?

+

-