Global Ankle and Foot Braces Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2259 | Medical Devices | Last updated: Dec, 2024 | Formats*:

Ankle and Foot Braces Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

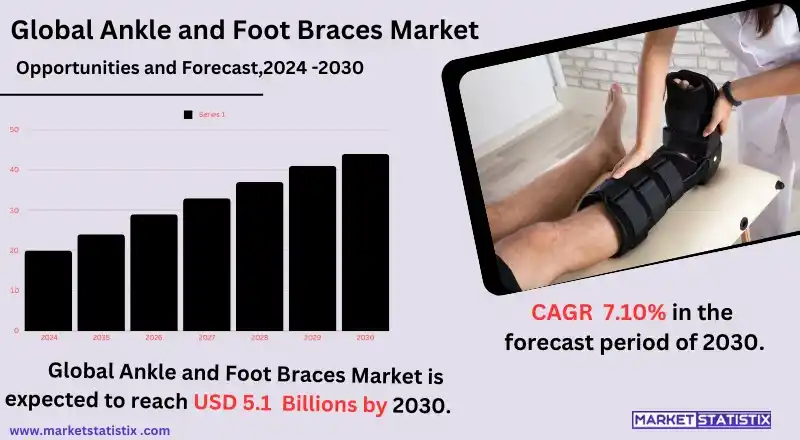

| Growth Rate | CAGR of 7.10% |

| Forecast Value (2030) | USD 5.1 Billion |

| By Product Type | Bracing and Support, Joint Implants, Soft Tissue Orthopedic Devices, Orthopedic Fixation, Prosthetics |

| Key Market Players |

|

| By Region |

|

Ankle and Foot Braces Market Trends

With the need for precautionary measures and rehabilitation massively increasing, the ankle and foot braces market has been surging with rapid growth in recent times. These products are being adopted by most types of consumers, especially athletes and fitness enthusiasts, for injury prevention during exercise and recovery benefits. As sports participation increases around the world, so does the demand for high-performance braces that provide support, comfort, and mobility along with reducing the chances of sprains, strains, and fractures. Another important trend found in the ankle and foot braces market is indeed the increasing number of customised and technologically advanced products. 3D printing and personalised designs are facilitating the manufacturers to produce braces designed in accordance with individual needs and demands, ensuring better comfort and effectiveness. Also, with the increasing adoption of e-commerce, the scope of availability of such products increased so much that it allowed consumers to go through the options available and the product in question before making a purchase.Ankle and Foot Braces Market Leading Players

The key players profiled in the report are Stryker, Johnson & Johnson (De PuySynthes), Zimmer Biomet, Smith+Nephew, Össur, Enovis, Acumed LLC, Arthrex, Inc., Paragon 28, Orthofix Medical Inc., Breg Inc., The Richie Brace, BioSkin, 3M, Medline Industries LP.Growth Accelerators

The increasing incidence of sports injuries and the rising tendency toward preventive care have driven the market for ankle and foot braces. As the population gets involved in more sports and physical activities, so the use of ankle and foot braces also increases, especially among those recovering from sprains, fractures, or other injuries. Thus, professionals or amateur athletes have to wear braces at some point for support, stability, and protection from the probability of sustaining further injury during rehabilitation or other high-intensity activities. The increasing use of ankle and foot braces for prevention has further drained the funds from the widening pool. The other major driver, among several others, is the growing aged population that is increasingly suffering from arthritis, diabetes, or other musculoskeletal conditions in the feet and ankles. With increased numbers looking for ways to relieve pain and improve movement, the demand for orthopaedic braces increases.Ankle and Foot Braces Market Segmentation analysis

The Global Ankle and Foot Braces is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Bracing and Support, Joint Implants, Soft Tissue Orthopedic Devices, Orthopedic Fixation, Prosthetics . The Application segment categorizes the market based on its usage such as Hammertoe, Trauma, Osteoarthritis, Rheumatoid Arthritis, Neurological Disorders, Bunions, Osteoporosis. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Competition in the ankle and foot braces market is characterised and defined by both established companies and some entrant firms making available orthopaedic solutions. The major global brands, such as DonJoy, Bauerfeind, and Össur, dominate the market based on a wide range of high-quality, medically approved ankle and foot braces. These and many other multinational brands have strong strategic partnerships and distribution networks as well as a large number of departments for research and development to provide superior customer services. They all spend much to ensure product innovation, such as adjustable-sized and lightweight materials and more comfortable designs that give them value proposition differentiation.Challenges In Ankle and Foot Braces Market

Several challenges beset the ankle and foot braces industry, chief among which is the high price tag of sophisticated braces that bar many from availing themselves of them. Although advancements in technology have birthed very effective and comfortable braces, such always come at unusually high costs, thus leaving many with little access, especially in emerging markets. Awareness and education about the purposes of braces with respect to injury prevention and rehabilitation are also significant factors. For many people, especially athletes and elderly individuals, the benefits of using a brace may not be realised until after an injury occurs. This results in the reactiveness of the prevention market, affecting total demand.Risks & Prospects in Ankle and Foot Braces Market

With increasing incidences of sports injuries, the growing aged population, and increased awareness regarding injury prevention, the ankle and foot braces market also provides substantial opportunities. Most athletes, especially those practicing high-impact sports like basketball, soccer, and running, visit the doctor after getting ankle and foot injuries and use ankle and foot braces while recovering from injury and when doing their activities. Moreover, the innovation in product development encompasses advances in material use, customisation, and comfort. The trend towards smart ankle-foot braces is already catching on, incorporating components such as sensors for real-time monitoring and data collection. As consumers become more health-conscious and more technology-driven, the demand for braces that fulfil both purposes of rehabilitation and performance tracking is expected to increase.Key Target Audience

People recovering from injuries or surgeries such as sprains, fractures, or surgical interventions to the foot and ankle fall in the main target category of the ankle and foot braces market. The target audience also includes athletes or active individuals who require braces to support healing and pain reduction while engaging in sports and help prevent any re-injury. The support provided by braces is also valuable when considering the mobility of those suffering from chronic conditions like arthritis or foot and ankle instability.,, Other significant consumer audiences are the health care providers making use of available facilities, such as orthopaedic clinics, rehabilitation centres, hospitals, and physiotherapists, which would involve the ankle and foot braces in treatment plans for their patients. Another potential audience includes sporting organisations and fitness centres where athletes tend to find products such as ankle and foot protection suitable for them during training or even competition for efficiency and injury reduction.Merger and acquisition

The foot and ankle brace market has been vibrant lately with recent mergers and acquisitions undertaken by companies to augment their product ranges and create wider market penetration. Tornier's acquisition of OrthoHelix Surgical Designs, whose speciality is small bone screw and plate systems for foot and ankle fractures, is one of the major deals. This was a $135 million acquisition in 2012 that increased Tornier's lower extremity product portfolios in its offerings and enabled OrthoHelix to internationalise itself. One more recent strategic move analysed is related to the acquisition of Medline UNITE Foot & Ankle by leading healthcare players. In this deal, Medline has improved ways to deliver an entire collection of foot and ankle trauma systems that will now include innovatively plated and implanted systems for fractures. Acquisitions like these exhibit the rising interest and investments in the ankle and foot braces market, make product lines even stronger, and attend to increasing demands in the North American and global markets. >Analyst Comment

"The market of ankle and foot braces is set to restively grow because of the increasing sports injuries as well as age-related and lifestyle factors in the populace. Such braces are a great help to individuals in restoring much-needed support and stability in their ankle and foot joints while recovering from injury, alleviating pain, or improving performance. Among them, to mention key factors driving the market growth, technological advancements in design and material of braces, increasing healthcare spending, and growing awareness about the importance of preventive measures are included."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Ankle and Foot Braces- Snapshot

- 2.2 Ankle and Foot Braces- Segment Snapshot

- 2.3 Ankle and Foot Braces- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Ankle and Foot Braces Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Bracing and Support

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Joint Implants

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Soft Tissue Orthopedic Devices

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Orthopedic Fixation

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Prosthetics

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Ankle and Foot Braces Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hammertoe

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Trauma

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Osteoarthritis

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Rheumatoid Arthritis

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Neurological Disorders

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Bunions

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Osteoporosis

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Ankle and Foot Braces Market by End-User

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Hospitals

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Ambulatory Surgery Centers

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Orthopedic Clinics

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Homecare Setting

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Ankle and Foot Braces Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Stryker

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Johnson & Johnson (De PuySynthes)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Zimmer Biomet

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Smith+Nephew

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Össur

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Enovis

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Acumed LLC

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Arthrex

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Inc.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Paragon 28

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Orthofix Medical Inc.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Breg Inc.

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 The Richie Brace

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 BioSkin

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 3M

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Medline Industries LP.

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Ankle and Foot Braces in 2030?

+

-

How big is the Global Ankle and Foot Braces market?

+

-

How do regulatory policies impact the Ankle and Foot Braces Market?

+

-

What major players in Ankle and Foot Braces Market?

+

-

What applications are categorized in the Ankle and Foot Braces market study?

+

-

Which product types are examined in the Ankle and Foot Braces Market Study?

+

-

Which regions are expected to show the fastest growth in the Ankle and Foot Braces market?

+

-

What are the major growth drivers in the Ankle and Foot Braces market?

+

-

Is the study period of the Ankle and Foot Braces flexible or fixed?

+

-

How do economic factors influence the Ankle and Foot Braces market?

+

-