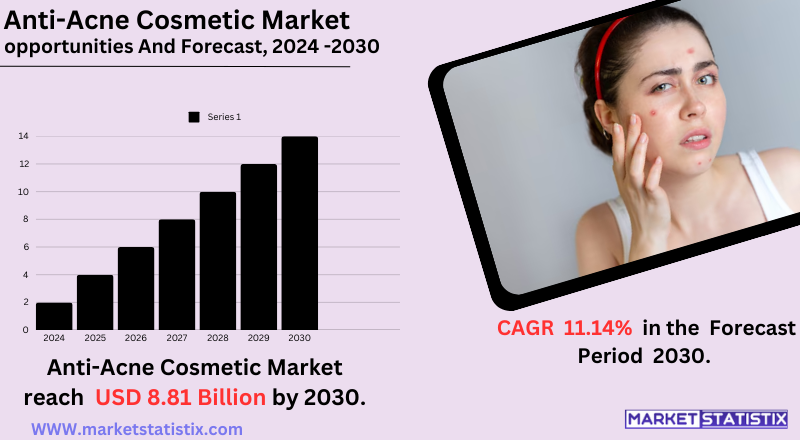

Global Anti-Acne Cosmetic Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-449 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

Anti-Acne Cosmetic Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.81% |

| Forecast Value (2030) | USD 11.14 Billion |

| By Product Type | Cleansers, Emulsions, Lotions, Masks, Others |

| Key Market Players |

|

| By Region |

Anti-Acne Cosmetic Market Trends

Demand for natural and organic products in the anti-acne cosmetic market continues to grow. Consumers seek milder and more sustainable options; thus, manufacturers are following suit by using ingredients such as tea tree oil, salicylic acid, and niacinamide. There is an awakening awareness of the troubling hypocrisy of certain synthetic chemicals, and consumers implant a paradigm of cleaner and greener skincare solutions. Another popular trend is the e-commerce expansion and digital marketing of anti-acne cosmetics. Online platforms allow customers to access a diverse array of products and adequate product data and customer reviews with ease. This, in turn, is resulting in increased competition and a greater emphasis on marketing strategies to reach target audiences. Social media also heavily influences consumer choices and helps drive sales, with brands using platforms such as Instagram and TikTok to promote products and develop a rapport with potential customers.Anti-Acne Cosmetic Market Leading Players

The key players profiled in the report are Coty Inc. (United States), Amorepacific Corporation (South Korea), Valeant Pharmaceuticals International,, L'Oréal S.A. (France), Shiseido Company, Limited (Japan), Johnson & Johnson (United States), Neutrogena Corporation (United States), LVMH Moët Hennessy – Louis Vuitton SE (France), Unilever Group (Netherlands), Inc. (Canada),, Galderma Laboratories LP (Switzerland), Procter & Gamble Company (United States), Revlon, Inc. (United States), Estée Lauder Companies Inc. (United States), Church & Dwight Co., Inc. (United States), Beiersdorf AG (Germany), OthersGrowth Accelerators

The global increasing number of acne cases makes the greatest contribution to the growth of this market. This condition is not only common but also requires people to pay attention to their skin and appearance, as this will create further demand for practical anti-acne products. That is why currently, the consumers are looking for products that will solve their acne problems, thus creating high demand for anti-acne cosmetics. On top of this, the lifestyle changes, such as increasing stress and diet, are seen to further increase acne cases and thus propel the market growth. The social media and beauty influencers further sway consumer judgement through specific anti-acne products. All these factors contribute towards the growth of the anti-acne cosmetic market.Anti-Acne Cosmetic Market Segmentation analysis

The Global Anti-Acne Cosmetic is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cleansers, Emulsions, Lotions, Masks, Others . The Application segment categorizes the market based on its usage such as Dermatology Clinics, Medspa. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The anti-acne cosmetic market is characterised by fierce competition with a multitude of players competing for market share. The players include both large multinational corporations like L'Oréal, Johnson & Johnson, and Unilever, as well as smaller niche brands and independent companies. Competition is a result of product efficacy, brand loyalty, price, and distribution channels. Companies are constantly innovating and bringing new products with better formulations and ingredients to suit the changing needs and preferences of consumers.Challenges In Anti-Acne Cosmetic Market

Individual responses to treatment are one of the major concerns of the anti-acne cosmetic market. Acne is a multifactorial disease, influenced by genetics, hormones, lifestyle, etc., which means that what may have worked for one person may not necessarily work for another. This creates a lot of frustration for consumers because of their disbelief in anti-acne products, which slows market growth. Some anti-acne ingredients like benzoyl peroxide have side effects such as dryness and irritation, making treatment quite complicated and often resulting in reduced consumer satisfaction. Again, challenges arise with the advent of an increase in demand for natural and organic products. It does seem that as consumers enquire for gentler, more eco-efficient alternatives, it has become much more difficult to formulate effective acne treatments with natural agents. Almost all stock traditional anti-acne agents have a proven record of effectiveness, and to replicate something close to that efficacy alone using a natural source, besides stability and shelf life, is really a big hurdle for formulators.Risks & Prospects in Anti-Acne Cosmetic Market

The anti-acne cosmetic industry, with all this uptick in global interest in personal skin care, will have even better prospects from rising cases of acne due to changes in lifestyle, as well as demand for naturally derived and dermatologically assisted products. The current trends of clean beauty, organic formulations, and personalised skin care will create new moments for brand innovation. Similarly, the emerging trends in online retail and influencer-driven marketing will create more access to products and engage more consumers. North America and Europe are currently observed to be dominating the global market in terms of primary consumers owing to elevated expenditures on premium skin care products and possibly advanced dermatological research. Meanwhile, the Asia-Pacific region is identified as the largest growth area among the three regions on the basis of increasing disposable income, growing urbanisation, and the increasing awareness of skin care among the younger population.Key Target Audience

The anti-acne cosmetic market's primary target audience consists of teenagers, young adults, and individuals with acne-prone skin who are looking for effective skincare solutions. With the rising awareness of skincare and the enormous influence of social media, consumers are actively searching for products that are dermatologically tested, non-comedogenic, and based on natural ingredients. People falling in the age group of 15-35 years have a strong demand for products in this category because they are very aware of their skincare routines and are influenced by beauty trends, product reviews, and recommendations of influencers.,, Not limited to private consumers alone, dermatologists, skincare practitioners, and beauty clinics help in growing the anti-acne market by recommending products to patients. The retail sector, such as pharmacies, supermarkets, and online, is another key audience in the market, as anti-acne cosmetics are made available worldwide through the growth of e-commerce. By addressing these target audiences with custom formulations, eco-friendly packaging, and scientific sophistication, brands are adapting to changing consumers' needs to survive in the market.Merger and acquisition

Major players in the anti-acne cosmetics market are increasingly merging and acquiring companies in order to enhance their product offerings and expand their geographical footprint. For example, L'Oréal announced its acquisition of Takami Co. in December 2020. Takami is a Japanese company known for its skincare products, which are the brainchildren of Dr. Hiroshi Takami, with the acquisition intended to bolster L'Oréal's footprint in Asia while adding to its skincare lines. In 2022, Heyday, a brand acquisition platform located in San Francisco, acquired ZitSticka, an anti-acne skincare label founded in 2018. The company bought ZitSticka with the intention of helping expand its portfolio in the skincare category, especially in the acne segment. All of these mergers and acquisitions efforts impact the very dynamic nature of the anti-acne cosmetics market, where businesses strive to position themselves at the forefront of something bigger as demand increasingly rises for effective skincare solutions. >Analyst Comment

The anti-acne cosmetics market is very much buoyed by rising consumer awareness about skin care, climbing incidences of acne due to pollution and rising lifestyle factors, and demand for effective medicines without prescriptions. Therefore, consumers are becoming more inclined toward natural, dermatologically tested, and chemical-free formulations, and hence there is a spurt in innovation of plant-based and microbiome-friendly products. The increasing outreach of social media, beauty influencers, and e-commerce has helped further market expansion, making anti-acne cosmetics quite mainstream and easily accessible.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Anti-Acne Cosmetic- Snapshot

- 2.2 Anti-Acne Cosmetic- Segment Snapshot

- 2.3 Anti-Acne Cosmetic- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Anti-Acne Cosmetic Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cleansers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Masks

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Emulsions

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Lotions

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Anti-Acne Cosmetic Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Dermatology Clinics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Medspa

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 L'Oréal S.A. (France)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Estée Lauder Companies Inc. (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Unilever Group (Netherlands)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Shiseido Company

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Limited (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Johnson & Johnson (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Beiersdorf AG (Germany)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Procter & Gamble Company (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Revlon

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Inc. (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Amorepacific Corporation (South Korea)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 LVMH Moët Hennessy – Louis Vuitton SE (France)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Neutrogena Corporation (United States)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Coty Inc. (United States)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Galderma Laboratories LP (Switzerland)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Valeant Pharmaceuticals International

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Inc. (Canada)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 Church & Dwight Co.

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Inc. (United States)

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 Others

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Anti-Acne Cosmetic in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Anti-Acne Cosmetic market?

+

-

How big is the Global Anti-Acne Cosmetic market?

+

-

How do regulatory policies impact the Anti-Acne Cosmetic Market?

+

-

What major players in Anti-Acne Cosmetic Market?

+

-

What applications are categorized in the Anti-Acne Cosmetic market study?

+

-

Which product types are examined in the Anti-Acne Cosmetic Market Study?

+

-

Which regions are expected to show the fastest growth in the Anti-Acne Cosmetic market?

+

-

Which application holds the second-highest market share in the Anti-Acne Cosmetic market?

+

-

What are the major growth drivers in the Anti-Acne Cosmetic market?

+

-