Global Anxiety Disorders and Depression Treatment Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-852 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Market for Anxiety Disorders and Depression Treatment involves the business of treating and managing the mental illness defined by excessive worry, fear, sadness, and loss of interest. The market involves a broad range of therapeutic interventions, from drug treatments like antidepressants and anxiolytics to non-drug treatments like psychotherapy (including cognitive behavioural therapy or CBT), counselling, and newer treatments like transcranial magnetic stimulation (TMS) and digital therapeutics. The objective of this market is to offer practical solutions that enhance the quality of life for patients suffering from these common mental health conditions.

The market addresses a large and increasing worldwide population, driven by conditions such as rising awareness of mental health, lower stigma related to treatment seeking, and greater insight into the biological and environmental determinants of these conditions. It encompasses a rich ecosystem of pharmaceutical firms that create and sell drugs, mental health practitioners who deliver therapy and counselling, tech firms that build digital health platforms and apps, and research organizations that seek to improve treatment options and diagnostic tools.

Anxiety Disorders and Depression Treatment Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

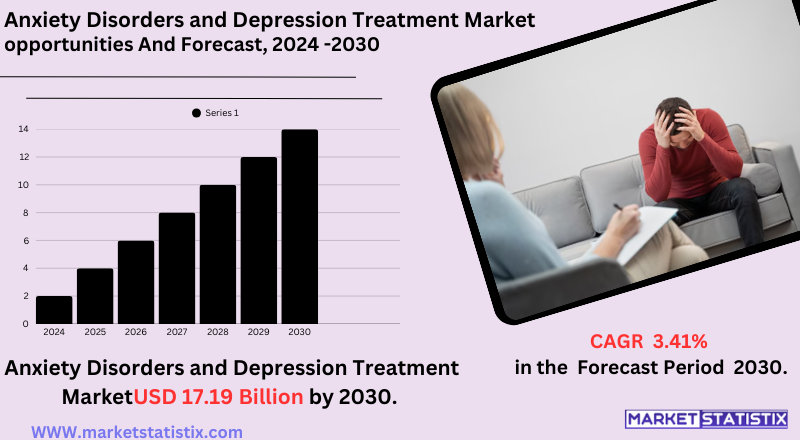

| Growth Rate | CAGR of 3.41% |

| Forecast Value (2030) | USD 17.19 Billion |

| By Product Type | Noradrenergic Agents, Anxiolytics, Anticonvulsants, Antidepressants, Atypical Antipsychotics |

| Key Market Players |

|

| By Region |

|

Anxiety Disorders and Depression Treatment Market Trends

The dominant trend is the growing emphasis on innovative and customized treatment methods. Pharmaceutical firms keep investing in research and development to introduce novel drugs with better efficacy and fewer side effects. At the same time, there is an increasing implementation of non-pharmacological interventions, such as different types of psychotherapy and complementary medicine. The market is also witnessing an increased focus on holistic care that incorporates mental and physical health. Additionally, the contribution of employers and educational institutions towards the delivery of mental health services is increasing, with new opportunities for market expansion and service delivery emerging in India.

Second, the market is experiencing a major consolidation of digital health solutions. Telehealth platforms, mobile apps that provide therapy and self-management capabilities, and AI-driven chatbots are increasing access to mental health care, especially in underserved regions of India, and making it more convenient and often anonymous for people to access help.

Anxiety Disorders and Depression Treatment Market Leading Players

The key players profiled in the report are Bristol-Myers Squibb Company (United States, H. Lundbeck A/S (Denmark), Pfizer Inc. (United States), Johnson & Johnson (United States), Merck KGaA (Germany), Otsuka Holdings Co., Ltd. (Japan), AstraZeneca (United Kingdom), GlaxoSmithKline Plc (United Kingdom), Bayer AG (Germany), Allergan Plc (Ireland), Eli Lilly and Company (United States), Sanofi (France), AbbVie Inc. (United States), Novartis AG (Switzerland), Teva Pharmaceutical Industries Ltd. (Israel)Growth Accelerators

The market for anxiety disorders and depression treatment is largely influenced by the rising global incidence of these mental illnesses. Causes of modern stressors such as urbanisation, societal expectations being higher, rapid living standards, and social media effects lead to an increasing rate of anxiety and depression among all ages in India and globally. The growing patient base demands increased access to and demand for efficient treatment mechanisms, driving the market's growth.

In addition, growing awareness and destigmatisation of mental illness are important factors. With more people acknowledging the need for help and social stigma against mental illness decreasing, there is more willingness to seek diagnosis and treatment. This change in public opinion, combined with government and non-government efforts encouraging mental health awareness and access to care in India, further drives the expansion of the anxiety and depression treatment market.

Anxiety Disorders and Depression Treatment Market Segmentation analysis

The Global Anxiety Disorders and Depression Treatment is segmented by Type, and Region. By Type, the market is divided into Distributed Noradrenergic Agents, Anxiolytics, Anticonvulsants, Antidepressants, Atypical Antipsychotics . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the Indian market for treating anxiety disorders and depression is similar to global trends in that it has both established global pharmaceutical players and a growing field of mental health service providers and digital health start-ups. Established branded pharmaceutical companies reign in the pharmacological treatment sector with their branded and generic anxiolytics and antidepressants. Competition here revolves around such issues as drug efficacy, side effect profiles, price, and patent protection. But there is an increasing focus on non-pharmacological interventions and models of integrated care in India.

The non-pharmacological portion is growing more competitive with an upsurge in the number of counsellors, psychologists, and psychiatrists providing a host of different approaches to therapy. The space of digital health in India is also changing quickly, with many start-ups creating apps on mental well-being, online therapies, and teleconsulting services to make treatment more accessible and decrease stigma. This builds convenience, cost-based, and innovative feature competition.

Challenges In Anxiety Disorders and Depression Treatment Market

The market for depression and anxiety disorder treatment is threatened by numerous major challenges despite its future growth. Some of the major challenges are side effects and shortcomings of traditional antidepressants, which normally result in patient noncompliance and thus a need for other treatments. Financially prohibitive costs of newer treatments, including new biologics and psychedelic-assisted treatments, limit access for most patients, especially from lower-income countries. In addition, ongoing mental illness stigma still discourages people from obtaining treatment, particularly in the developing world, restricting market growth.

Regulatory barriers also add to the complexity, as approval for new drugs – especially novel or controlled products – involves huge investments and long processes, making it difficult for smaller firms and delaying the launch of breakthrough treatments. This sudden growth of digital mental health offerings also poses worries regarding data confidentiality, security, and varying levels of regulatory adherence, which contribute to the eroding of trust in patients and impede overall adoption of digital treatments. Succeeding over these issues will be important in unlocking the marketplace's complete value and enhancing the availability of successful treatments for mental ailments.

Risks & Prospects in Anxiety Disorders and Depression Treatment Market

Primary growth drivers are government and non-government organisation efforts to decrease stigma, increased public awareness, and investments in research and development that have resulted in the approval of next-generation treatments like Transcranial Magnetic Stimulation (TMS) and Deep Brain Stimulation (DBS). The market is also supported by the desperate need for successful therapies, especially among young adults experiencing academic, financial, and social pressures, and by the growth of targeted therapies and electronic mental health solutions.

Geographically, North America leads the market, generating more than half of world revenue, based on high levels of awareness, mature healthcare infrastructure, and aggressive take-up of new therapies. Europe is next, and the Asia-Pacific area will experience the most rapid expansion with increasing awareness of mental illness and enhanced healthcare accessibility.

Key Target Audience

, Another critical segment comprises healthcare professionals, i.e., psychiatrists, psychologists, general practitioners, and mental health clinics, who prescribe and recommend treatment to patients. Pharmaceutical firms, providing antidepressants, anti-anxiety drugs, and complementary therapies, and creators of digital mental health solutions, e.g., mobile apps for CBT, are significant contributors. Growing emphasis on mental health along with the trend toward personalised care and non-conventional therapies has a substantial impact on the growth pattern of this market.,The primary target population for the treatment market of anxiety disorders and depression is those who have been diagnosed with anxiety, depression, or other mental conditions. These include various age groups, ranging from teenagers to middle-aged adults, who are in search of both medication and non-medication treatments like therapy, counselling, and mindfulness exercises. These consumers are usually swayed by such considerations as the efficacy of treatment modalities, side effects, availability of mental health professionals, and cost of care. Knowledge and increasing tolerance of mental health care, particularly with the emergence of telemedicine, have also increased the market. The depression and anxiety disorders treatment market has seen significant merger and acquisition (M&A) activity, led by Johnson & Johnson's $14.6 billion buyout of Intra-Cellular Therapies. The strategic move will bolster J&J's neuroscience portfolio, led by Intra-Cellular's Caplyta, an oral therapy that has received approval for schizophrenia and bipolar depression, and its emerging pipeline, such as anxiety treatments and symptom treatments for Alzheimer's. The deal is indicative of a wider industry trend of renewed interest in mental health therapies, fuelled by advances in science and increasing demand for new therapy approaches. The worldwide market for the treatment of anxiety disorders and depression is growing steadily, with its value in 2024 estimated at USD 21.45 billion and expected to reach USD 29.36 billion by 2030. The growth is fuelled by increasing prevalence rates, particularly among young adults, greater public awareness, and government efforts to decrease mental illness stigma and enhance access to care. The market covers a broad array of treatments, from antidepressants and anxiolytics to anticonvulsants and cutting-edge neuromodulation therapies like Transcranial Magnetic Stimulation (TMS) and Deep Brain Stimulation (DBS).

,

, Merger and acquisition

In the overall behavioural health industry, M&A has remained robust amidst macroeconomic downturns. The year 2024 so far has seen 68 deals in North America, as strategic and financial acquirers seek expansion through deals. Key catalysts involve geographical expansion, diversification of services, and growing patient volumes. Specifically, outpatient mental health services have received investor favour on account of positive reimbursement patterns as well as scalability.Analyst Comment

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Anxiety Disorders and Depression Treatment- Snapshot

- 2.2 Anxiety Disorders and Depression Treatment- Segment Snapshot

- 2.3 Anxiety Disorders and Depression Treatment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Anxiety Disorders and Depression Treatment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Antidepressants

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Anxiolytics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Anticonvulsants

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Noradrenergic Agents

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Atypical Antipsychotics

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Anxiety Disorders and Depression Treatment Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 AbbVie Inc. (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Allergan Plc (Ireland)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 AstraZeneca (United Kingdom)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Bayer AG (Germany)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Bristol-Myers Squibb Company (United States

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Eli Lilly and Company (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 GlaxoSmithKline Plc (United Kingdom)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 H. Lundbeck A/S (Denmark)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Johnson & Johnson (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Merck KGaA (Germany)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Novartis AG (Switzerland)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Otsuka Holdings Co.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ltd. (Japan)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Pfizer Inc. (United States)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Sanofi (France)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Teva Pharmaceutical Industries Ltd. (Israel)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Anxiety Disorders and Depression Treatment in 2030?

+

-

Which type of Anxiety Disorders and Depression Treatment is widely popular?

+

-

What is the growth rate of Anxiety Disorders and Depression Treatment Market?

+

-

What are the latest trends influencing the Anxiety Disorders and Depression Treatment Market?

+

-

Who are the key players in the Anxiety Disorders and Depression Treatment Market?

+

-

How is the Anxiety Disorders and Depression Treatment } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Anxiety Disorders and Depression Treatment Market Study?

+

-

What geographic breakdown is available in Global Anxiety Disorders and Depression Treatment Market Study?

+

-

Which region holds the second position by market share in the Anxiety Disorders and Depression Treatment market?

+

-

How are the key players in the Anxiety Disorders and Depression Treatment market targeting growth in the future?

+

-

,,

,

The market for anxiety disorders and depression treatment is largely influenced by the rising global incidence of these mental illnesses. Causes of modern stressors such as urbanisation, societal expectations being higher, rapid living standards, and social media effects lead to an increasing rate of anxiety and depression among all ages in India and globally. The growing patient base demands increased access to and demand for efficient treatment mechanisms, driving the market's growth.

, In addition, growing awareness and destigmatisation of mental illness are important factors. With more people acknowledging the need for help and social stigma against mental illness decreasing, there is more willingness to seek diagnosis and treatment. This change in public opinion, combined with government and non-government efforts encouraging mental health awareness and access to care in India, further drives the expansion of the anxiety and depression treatment market.