Global Architectural Coating Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-288 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Architectural Coating Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

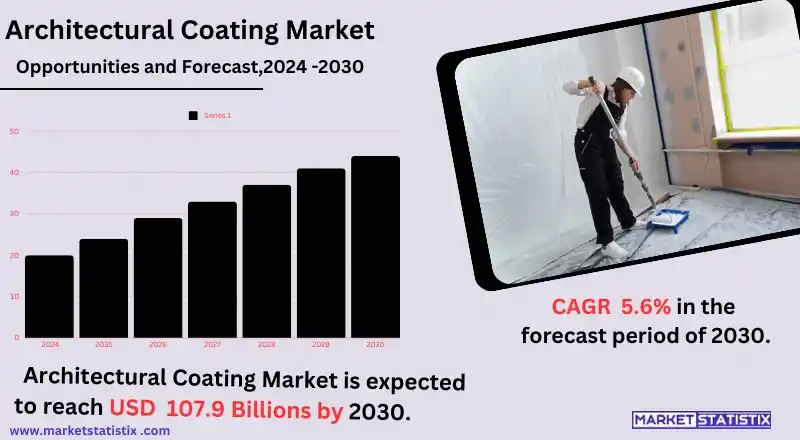

| Growth Rate | CAGR of 5.6% |

| Forecast Value (2031) | USD 107.9 Billion |

| By Product Type | Water-based, Solvent-based, Powder, Others |

| Key Market Players |

|

| By Region |

Architectural Coating Market Trends

Shifts are taking place in architectural coatings markets toward environmental products and reduction of debris. Thus, an increase in environmental awareness and stringent regulations urges customers ranging from businesses to consumers to choose low-VOC (volatile organic compounds) and water-based formulations with minimal environmental impacts and improved indoor air quality. For this reason, the manufacturers are innovating in the production of coatings that are both high-performance and eco-responsible, such as non-toxic and biodegradable coatings and energy-saving ones. Further, decorative and aesthetic coatings start to dominate the market, considering that many say they want to see customised colours, textures, or finishes in residential and commercial spaces. Furthermore, innovations happening in the architectural coatings sector include nanotechnology, or the smart coatings that make the products stronger in functionality. It allows self-cleaning surfaces, UV protection, and moisture resistance. Therefore, increased urbanisation and construction activity, specifically in growing economies, will still continue to propel the market for architectural coatings needed for better security, beauty, and sustainability in buildings.Architectural Coating Market Leading Players

The key players profiled in the report are PPG Industries, Asian Paints, Nippon Paints, The Valspar Corporation, Midwest Industrial Coatings Inc., Sumter Coatings, BASF SE, The Sherwin-Williams Company, Axalta Coatings, RPM International Inc.Growth Accelerators

The architectural coating market usually thrives on housing and commercial construction demand, with urban and infrastructure development expanding globally. Indeed, the number of new buildings and renovations is gradually increasing with the need for protective and decorative coatings, adding value and durability to structures. This has been further boosted by the tendency for customers and builders to prefer low-VOC and eco-friendly formulations as an emerging driver in the trend towards eco-friendly and sustainable products. Apart from this, another important driver is the growing renovation and remodelling activities. Because both owners of homes and commercial properties invest in upgrading and beautifying their spaces, demand for high-performance coatings, such as weather resistance, colour retention, and other similar features, is growing.Architectural Coating Market Segmentation analysis

The Global Architectural Coating is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Water-based, Solvent-based, Powder, Others . The Application segment categorizes the market based on its usage such as Residential, Commercial, Industrial, Automotive. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario in the architectural coating market is somewhat characterised by the involvement of multiple global and local players with a large assortment of products tailored individually to the residential and commercial applications. Among the leading firms in this market are PPG Industries, Sherwin-Williams, AkzoNobel, and BASF, who sell the largest collections of goods through their strong distribution networks along with superior technology. These companies invest a larger part of their investment in research and development for the properties of their products for developing eco-compatible, long-lasting, and performance-enhancing coatings that cater to an increasingly emerging market.Challenges In Architectural Coating Market

Emerging environmental legislation and sustainability challenges are affecting the architectural coating marketplace. The more stringent demand for low volatile organic compounds (VOCs) and the changeover towards eco-friendly products have resulted in the development of low-VOC and water-based coatings. Such alternatives, however, often have a greater price and less performance and, therefore, have made a balancing act for the manufacturers. Additionally, much more sustainable formulations would require substantial research and development costs, thereby raising larger operational costs for companies. Another significant factor facing the industry is competition emanating from substitute materials and counterfeits. With the growing architectural coatings demand, there would also be a corresponding increase in low-end, inferior quality, counterfeit coatings, disquieting the reliance on manufactured products and even the market itself. Additionally, spiking raw material prices, including those of pigments, resins, and solvents, would adversely affect production costs and disrupt the supply chain.Risks & Prospects in Architectural Coating Market

The architectural coatings market possesses globally promising avenues toward eco-friendliness and sustainability product demand. More consumers are shifting preferences towards low-VOC (volatile organic compound) and water-based coatings as awareness increases. As such, innovation with a touch of the green movement will be found beneficial. Emerging economies showcase trends of urbanisation and infrastructure development, thus becoming one of the highest potentials in demand for residential and commercial buildings for coatings made specifically for buildings. Emerging avenues for growth are also opened in the previously unimagined advanced technological applications such as nanotechnology and smart coatings. These improvements guarantee to ramp up the durability in terms of self-cleaning properties and better resistance from environmental effects, which appeal for longer endurance in the minds of the consumers. Besides, renovation and remodelling help in creating a niche market due to consumers who will want high-performance paints that appeal aesthetically and functionally. Therefore, these developments put the architectural coatings market in a very comfortable state for expansion in both high and developing regions.Key Target Audience

Architectural coatings are widely used and considered an integral part of construction and real estate activities, as these coatings are usually required for residential and non-residential buildings. These coatings are mostly used by architects, contractors, and developers for beautifying the structures, improving their durability, and protecting them from ambient factors like weathering, UV rays, and moisture. One of the most important applications for them is exteriors, where they provide long-lasting finishes that prolong the life span of the building while maintaining visual appeal. Interior applications can also be convenient for residential spaces, public spaces, and offices; they beautify different surfaces, protect them from damage, and create a good atmosphere.,, Another audience segment encompasses the facility managers and maintenance pros who will depend on architectural coatings as part of keeping up with existing building maintenance and refurbishing those buildings. Increased interest driven by consumers and businesses in seeking eco-friendly and sustainable products has expanded this market, as low-VOC, non-toxic, and environmentally friendly solutions are increasingly available for renovation and new construction projects.Merger and acquisition

Firstly, the present architectural coating market in the world is seeing a constant inflow of mergers and acquisitions, which in turn are indicative of strategic issues among the big companies in very successful planned manoeuvres to widen their market bases. PPG Industries has announced selling its architectural coatings in the US and Canada to American Industrial Partners in a deal worth 550 million dollars. The sale, which PPG said would close late next year or early the following year, involves a unit that generated close to $2 billion in PPG's 2023 net sales. This enables PPG to focus on its core areas and also gives the American Industrial Partners a chance to improve their footprint in the coatings industry. Sudarshan Chemical Industries is also acquiring the Heubach Group, with the plan that their operations will amalgamate with the technology of Heubach to develop a pigmented giant in the world. The value attributed to this buy is a combination of asset and share deal and is expected to close in a couple of months, paving the way for significant diversification of Sudarshan's product portfolio and market presence in Europe and America. It confirms the trend towards consolidation in the area of architectural coatings for the future because of the need to innovate and be competitive in the fast-changing area of market dynamics. >Analyst Comment

"Architectural coatings refer to protective and decorative finishes that can be applied to structures such as buildings and bridges, and this is a major sector of the market. The range of architectural coatings encompasses paints, varnishes, enamels, and a host of other products, each of which can fall under a wide variety of needs, such as weather and corrosion resistance as well as aesthetic enhancement. This entire expansion of the architectural coatings market will be subject to the rise in construction activity across the world, tougher regulations imposed for efficiency in energy consumption, and aesthetics as well as durability in finishes. The global coating industry profile is expected to majorly comprise Asia-Pacific countries as they undertake a wave of pop-up urbanisation and increasing income levels."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Architectural Coating- Snapshot

- 2.2 Architectural Coating- Segment Snapshot

- 2.3 Architectural Coating- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Architectural Coating Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Water-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Solvent-based

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Powder

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Architectural Coating Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Automotive

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Architectural Coating Market by Function

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Ceramics

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Inks

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Lacquers

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Paints

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Powder Coatings

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Primers

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 Sealers

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

- 6.9 Stains

- 6.9.1 Key market trends, factors driving growth, and opportunities

- 6.9.2 Market size and forecast, by region

- 6.9.3 Market share analysis by country

- 6.10 Varnishes

- 6.10.1 Key market trends, factors driving growth, and opportunities

- 6.10.2 Market size and forecast, by region

- 6.10.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 PPG Industries

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Asian Paints

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Nippon Paints

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 The Valspar Corporation

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Midwest Industrial Coatings Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Sumter Coatings

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 BASF SE

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 The Sherwin-Williams Company

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Axalta Coatings

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 RPM International Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Function |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Architectural Coating in 2031?

+

-

Which type of Architectural Coating is widely popular?

+

-

What is the growth rate of Architectural Coating Market?

+

-

What are the latest trends influencing the Architectural Coating Market?

+

-

Who are the key players in the Architectural Coating Market?

+

-

How is the Architectural Coating } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Architectural Coating Market Study?

+

-

What geographic breakdown is available in Global Architectural Coating Market Study?

+

-

Which region holds the second position by market share in the Architectural Coating market?

+

-

Which region holds the highest growth rate in the Architectural Coating market?

+

-