Global Artificial Intelligence in BFSI Market – Industry Trends and Forecast to 2030

Report ID: MS-35 | Application Software | Last updated: Oct, 2024 | Formats*:

Artificial Intelligence in BFSI Report Highlights

| Report Metrics | Details |

|---|---|

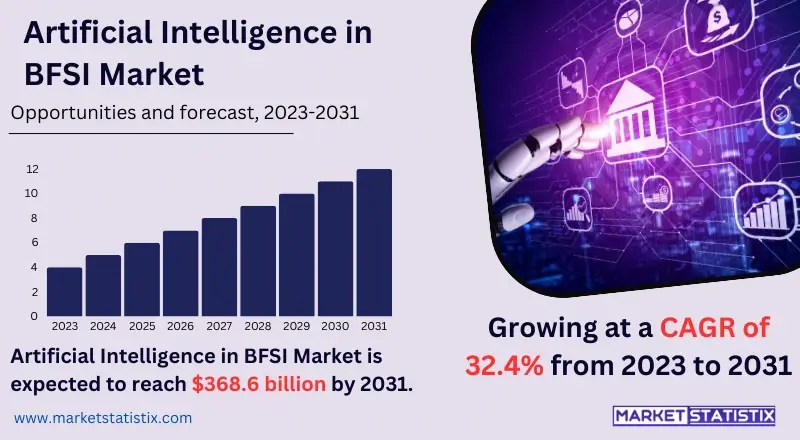

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 32.4% |

| Key Market Players |

|

| By Region |

Artificial Intelligence in BFSI Market Trends

The artificial intelligence (AI) sector within the banking, financial services, and insurance (BFSI) sector is on an upward trajectory mainly because of the rising demand for strategic customer interaction and better operational processes. AI technologies such as machine learning and natural language processing are being utilised by financial service establishments to improve internal processes such as loan underwriting, risk mitigation, and fraud detection. Customers are also benefiting from the development of chatbots and virtual assistants where banks can support their clients 24 hours a day and seven days a week and offer them easily accessible bespoke financial advice, leading to improved client interactions. An additional trend is the increased attention on regulatory compliance and risk mitigation, which is made easier with the help of advanced analytics offered by artificial intelligence. Regulatory policies governing the BFSI sector are quite demanding, prompting institutions to adopt artificial intelligence technologies in mitigating risks, carrying out compliance tasks, tracking transaction activities for abnormal red flags, and scrutinising large volumes of data for actionable insights.Artificial Intelligence in BFSI Market Leading Players

The key players profiled in the report are Google Cloud, AWS Inc., NVIDIA, H2O.ai, DataRobot, Lemonade, Clover Health, Zego, Kabbage, Upstart, Zest AI, Ayasdi, Darktrace, Feedzai, IBM, Microsoft, Kensho Technologies, JPMorgan Chase, Bank of America, Wells FargoGrowth Accelerators

The key market factors influencing the growth of AI (artificial intelligence) in the BFSI (banking, financial services, and insurance) vertical include the increasing need for automation and improved overall efficiency. Financial institutions are progressively utilising tools that are powered by AI technology to enhance operations like fraud prevention, risk assessment, and customer service. AI offers an advantage in that it makes it possible to process information and make necessary decisions faster, thereby eliminating the need for physically probing while enhancing security and accuracy. The digitalisation of the business processes and the need to be on par with competition in the current era characterised by technology is also a major benefit of having artificial intelligence in the institutions of the BFSI. Another key factor is the growing consumer desire for customised financial services. These advanced technologies allow banks and insurers to tap on big data as well as machine learning components to develop specificity offerings in their products, provide real-time offers, and optimise the use of the customers’ time by offering chat bots and other virtual assistants. Given that consumers are in search of faster, better, safer, and more individualised services, AI fulfils these requirements in financial services, resulting in customer retention and expansion in the BFSI industry.Artificial Intelligence in BFSI Market Segmentation analysis

The Global Artificial Intelligence in BFSI is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Chatbot, Cyber Security, Risk Management, Predictive Analytics, Data Collection & Analysis, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for artificial intelligence (AI) applications in banking, financial services, and insurance (BFSI) is wide open in terms of players. The players are technological companies, financial technology startups, and other traditional financial institutions. The likes of IBM, Google, and Microsoft have also entered the AI and machine learning-driven applications services for the banking and financial services institutions. They provide such services as analytics, risk controls, virtual assistants, and other services that help to increase efficiency and customer satisfaction. In addition, in response to growing demand in the market, fintech companies are coming up with specialised platforms based on AI technologies for specific market segments. Also, both legacy banks and insurance companies are putting their money into technologies associated with artificial intelligence to be relevant to the market and satisfy changing consumer behaviour. To this end, a large number of them are entering into deals with technology companies or making acquisitions of young companies so as to propel their incorporation of AI into their existing infrastructures. The situation is further complicated by the fact that there are rapid disruptive technological and regulatory changes, which raises the stakes for the players therein in terms of continual innovativeness and offering differentiation. As AI becomes entrenched within the value chain of BFSI, the market will undoubtedly favour those players who will not only use these technologies but will also operate within the set timelines for compliance and protection of data.Challenges In Artificial Intelligence in BFSI Market

The BFSI market is not short of challenges as far as AI implementation is concerned, with data security being the most prominent. Data privacy becomes a major issue with machine learning as it is data-driven, considering the fact that there is a lot of confidential financial information that is needed in order to train the algorithms and improve the quality of decision-making. Hence, organisations must deal with strict legislation like GDPR, CCPA, and many others. There are stiff penalties and legal issues that arise from consumer data being compromised or misused, which often engages loss of consumer loyalty and tarnishing the brand. On the other hand, organisations also have to consider the deployment of advanced security systems since vulnerabilities can be created by the AI systems. If these challenges are not enough, the other problem is how to incorporate artificial intelligence into the use of legacy systems. Most of the BFSI sector runs on legacy systems, which make the process of adopting and utilising more sophisticated AI solutions difficult. This is quite costly and time-consuming, as well as causing interruptions to normal business processes.Risks & Prospects in Artificial Intelligence in BFSI Market

The introduction of artificial intelligence (AI) into the banking, financial, and insurance services (BFSI) sectors translates into great possibilities in the streamlining of operations and increasing customer satisfaction. To put it back in turn, there are AI-based technologies, for example, machine learning and natural language processing, that enable an institution to carry out tasks that are repetitive and somewhat boring, such as data entry, transaction processing, and answering customer queries. Such processes bring operational efficiencies as they lower costs of operation and reduce mistakes and errors that emanate in work processes, therefore enabling the financial institutions to use their human resources optimally. Additionally, there is great potential for making the BFSI sector more efficient, for example, in managing risk or fighting fraud. By taking advantage of AI technologies, it can process and assess abnormal transactional activities based on tens and millions of these transactions within seconds. More so, AI technology can enhance the credit scoring and underwriting in traditional lending systems and be more appropriate to a fount of information that has not been used before in lending.Key Target Audience

The primary audience for artificial intelligence (AI) in the Banking, Financial Services, and Insurance (BFSI) industries is financial institutions, including but not limited to banks, insurers, and investment houses. These businesses are making use of more and more AI technology to improve operational effectiveness, deliver better customer service, and aid in the formulation of decisions. For instance, banks deploy AI-based customer care bots, provide credit scores based on mathematical equations, and employ data mining for stopping fraud. With the incorporation of AI in the services offered, these agencies wish to enhance their offerings and survive in the ever-changing environment of financial services.,, There is also another considerable part of the audience of technology solutions, which are mainly represented by companies and startups that advance solutions based on AI for the BFSI market. These entities develop exciting strides to provide financial entities with the capability of AI in internal processes such as risk management, compliance, and even marketing.Merger and acquisition

The recent developments concerning the mergers and acquisitions in the artificial intelligence (AI) sector, particularly in the banking, financial services, and insurance (BFSI) market, indicate that the focus of these companies is shifting towards advancements in technology and improving the capacity. A noteworthy example is the fourth quarter of 2023, during which Old National Bancorp completed a $344 million buyout of CapStar Financial Holdings in an effort to enhance its competitiveness. In this vein, First Financial Corp. disclosed a $73.4 million deal to acquire SimplyBank to pursue greater market share in its Tennessee and Georgia operations. These movements, however, are more than just sugar-coated financial activities. They indicate the emergence of trends whereby financial services institutions share knowledge and resources to apply AI and ML for the benefit of clients and operations. Partnerships, on the other hand, have also emerged as considerations in the AI-led transformation of the BFSI sector. For example, Orion Innovation partnered with FinTaar Technologies and bizAmica Software to support his company’s digital transformation projects. In addition, Alkami Technology entered into an agreement with Plaid to enable its customers to access many different financial applications and services. These examples highlight the tactical necessity of embedding artificial intelligence and other technologies with banking activities for enhancing service delivery, increasing operational efficiency, as well as competitive advantage in the midst of turbulence.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Artificial Intelligence in BFSI- Snapshot

- 2.2 Artificial Intelligence in BFSI- Segment Snapshot

- 2.3 Artificial Intelligence in BFSI- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Artificial Intelligence in BFSI Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Chatbot

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cyber Security

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Risk Management

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Predictive Analytics

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Data Collection & Analysis

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Artificial Intelligence in BFSI Market by Offering

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hardware

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Software

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Services

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Artificial Intelligence in BFSI Market by solution

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Chatbots

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Fraud Detection and Prevention

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Anti-Money Laundering

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Customer Relationship Management

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Data Analytics and Prediction

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Others

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

7: Artificial Intelligence in BFSI Market by Technology

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Machine Learning

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Natural Language Processing

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Computer Vision

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Others

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Competitive Landscape

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Google Cloud

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 AWS Inc.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 NVIDIA

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 H2O.ai

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 DataRobot

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Lemonade

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Clover Health

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Zego

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Kabbage

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Upstart

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Zest AI

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Ayasdi

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Darktrace

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Feedzai

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 IBM

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Microsoft

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Kensho Technologies

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 JPMorgan Chase

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Bank of America

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Wells Fargo

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Offering |

|

By solution |

|

By Technology |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Artificial Intelligence in BFSI market?

+

-

How do regulatory policies impact the Artificial Intelligence in BFSI Market?

+

-

What major players in Artificial Intelligence in BFSI Market?

+

-

What applications are categorized in the Artificial Intelligence in BFSI market study?

+

-

Which product types are examined in the Artificial Intelligence in BFSI Market Study?

+

-

Which regions are expected to show the fastest growth in the Artificial Intelligence in BFSI market?

+

-

What are the major growth drivers in the Artificial Intelligence in BFSI market?

+

-

Is the study period of the Artificial Intelligence in BFSI flexible or fixed?

+

-

How do economic factors influence the Artificial Intelligence in BFSI market?

+

-

How does the supply chain affect the Artificial Intelligence in BFSI Market?

+

-