Global Automotive Cybersecurity Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-1800 | IT and Telecom | Last updated: Sep, 2024 | Formats*:

Automotive Cybersecurity Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

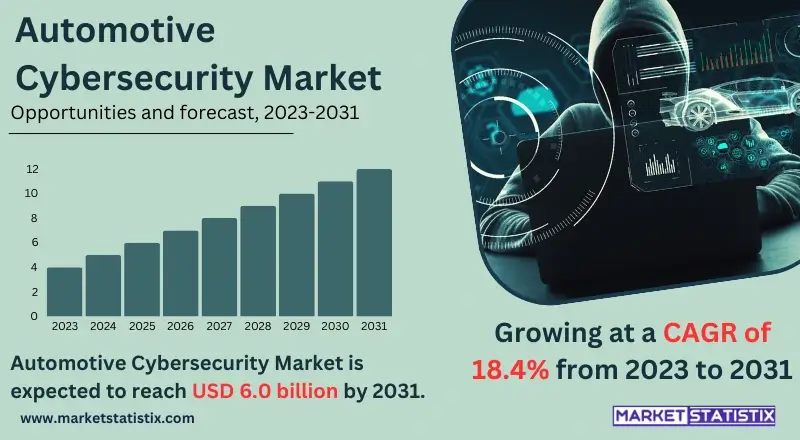

| Growth Rate | CAGR of 18.4% |

| By Product Type | Endpoint, Application, Wireless Network |

| Key Market Players |

|

| By Region |

|

Automotive Cybersecurity Market Trends

By now, you should have realised that the global automotive cybersecurity market is growing extremely well as a result of an increase in the connectivity of vehicles and new technologies in autonomous driving. With vehicles going more connected than ever before using advanced infotainment systems, telematics, and vehicle-to-everything (V2X) communication, cyber threats have become more prevalent, necessitating strong cybersecurity measures. As such, car manufacturers, together with technology companies, are investing in advanced encryption, secure software updates, and attack detection systems to protect their cars against cyber-attacks. Regulatory attention to vehicle cybersecurity is also increasing as an important trend; this means that automakers are now faced with regulations designed by governments and other players that require them to adhere to or follow through with safety and security simple plans across connected and/or autonomous vehicles. As a result, there has been an increase in innovation aimed at creating multi-layer cybersecurity frameworks that incorporate both hardware security modules as well as cloud-based solutions aimed at promoting security for vehicles connected to networks.Automotive Cybersecurity Market Leading Players

The key players profiled in the report are Sheelds, Vector Informatik GmbH, NXP Semiconductors N.V., Harman International, Broadcom Inc., Denso Corporation, Honeywell International Inc., Guard Knox Cyber-Technologies Ltd.Growth Accelerators

The increased connectivity of automobiles and the growing reliance on software and electronic systems in modern cars drives the global automotive cyber security market. However, as cars are more connected via fun-filled infotainment systems, vehicle-to-everything (v2x) communication networks, or autonomous driving technologies, there is also increased exposure to cyber insecurities. For this reason, car manufacturers are prioritising protection of critical vehicle systems against hacking, data breaches, and other cyber threats, leading to a rise in demand for strong cyber security solutions. Another driver is the increase in regulatory pressure and industry guidelines that focus on automotive cyber security. Thus, world governments and their representative bodies are coming up with strict regulations to ensure vehicle safety as well as data privacy through cyber security measures. Consequently, car manufacturers and technology providers have had to invest massively into these technologies to meet regulations while protecting vehicles from any form of cyber theft. The market is driven by a need to safeguard more complex and interconnected automotive systems.Automotive Cybersecurity Market Segmentation analysis

The Global Automotive Cybersecurity is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Endpoint, Application, Wireless Network . The Application segment categorizes the market based on its usage such as ADAS & Safety System, Infotainment, Body Electronics, Powertrain, Telematics. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global automotive cybersecurity market is characterised by a mix of well-established technology companies, car manufacturers, and specialised companies that provide cybersecurity services. Major industry players include traditional leaders in cybersecurity such as McAfee, Kaspersky, and Trend Micro, as well as automobile manufacturers like Toyota, General Motors, and Volkswagen, which are heavily investing in their own cybersecurity capabilities. Besides, there is an increasing influx of specialised car security start-ups to the market that provide innovative solutions and disrupt conventional security mechanisms. The competition landscape remains fluid, with new entrants coming up while current ones expand their scope to cater for changing demands within the automotive sector.Challenges In Automotive Cybersecurity Market

Due to the increasing complexity of connected vehicle systems and changing cyber threats, the global automotive cybersecurity market is facing big challenges. As cars are being integrated into the Internet, autonomous functions, and digital systems, they are becoming targets for cyber-attacks. These systems need advanced data protection that can secure all vehicle components, from entertainment systems to vital safety controls. However, rapid technological advances frequently outstrip strong security development, enabling vulnerabilities in auto networks to persist. A further challenge is that effective cybersecurity solutions have high costs and are intricate to apply across different automotive platforms. It is hard for car manufacturers to find a balance between a complete digital protection strategy and economic efficiency, particularly in the case of small-sized car companies or those operating in price-sensitive zones.Risks & Prospects in Automotive Cybersecurity Market

There are ample possibilities for the global automotive cybersecurity industry as the proliferation of connected and autonomous vehicles increases the demand for strong security measures. The integration of more advanced electronic systems into automobiles has necessitated that they be protected from cyber threats such as data breaches, hacking, and malware attacks. This indicates that there is a need for protective software for automobile communications systems, electronic control units (ECUs), and over-the-air (OTA) updates, hence presenting growth opportunities for security providers. In addition, increased adoption of electric vehicles (EVs) and vehicle-to-everything (V2X) communication systems raises the demand for automobile cybersecurity. The governments and industries are increasingly creating regulations and others such as ISO/SAE 21434, which compels car manufacturers to infuse up-to-date security systems in their designs. Therefore, automobile producers, along with tech companies, can now formulate holistic protective computer programs that enhance data protection and assure the safety of vehicles while complying with globally emerging standards.Key Target Audience

As mentioned above, inductive inference is a key element of the global automotive cybersecurity market. Automotive manufacturers, suppliers, and technology companies are among the major players in this industry. They create and implement cybersecurity solutions for connected cars and autonomous vehicles that are susceptible to cyber threats. Therefore, they must focus on safety features such as infotainment systems or driver assistance systems in order to preserve sensitive data.,, Moreover, government bodies, regulatory agencies, and cyber security service providers also participate in this business. Government bodies and regulators set the rules involved in automotive cyber security, while service providers offer specialised services as well as tools for threat identification prevention or deterrence. The rise of connected cars has coincided with more sophisticated cyber-attacks, making it an important market segment in future automotive sectors.Merger and acquisition

The automotive cybersecurity market has witnessed significant merger and acquisition activity in recent years, as companies seek to strengthen their market positions, expand their product offerings, and accelerate technological advancements. Notable deals include: Continental's Acquisition of Argus Cyber Security: This deal was targeted towards enhancing Continental’s ability to guard against intrusion, authenticate individuals using vehicles, and ensure secure communication. Avast Corporation’s Acquiring Cylance: Although primarily focused on consumers, and designed to protect individual devices from cyber threats through the collection of digital traces left behind after each interaction with virtual domains that we visit. These mergers and acquisitions show that there is a growing interest in cybersecurity within the automotive industry and an ongoing effort towards meeting changing security needs.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Cybersecurity- Snapshot

- 2.2 Automotive Cybersecurity- Segment Snapshot

- 2.3 Automotive Cybersecurity- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Cybersecurity Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Endpoint

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Application

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Wireless Network

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Automotive Cybersecurity Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 ADAS & Safety System

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Infotainment

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Body Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Powertrain

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Telematics

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Automotive Cybersecurity Market by service

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 In-Vehicle Services

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 External Cloud Services

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Automotive Cybersecurity Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Sheelds

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Vector Informatik GmbH

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 NXP Semiconductors N.V.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Harman International

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Broadcom Inc.

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Denso Corporation

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Honeywell International Inc.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Guard Knox Cyber-Technologies Ltd.

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By service |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Automotive Cybersecurity is widely popular?

+

-

What is the growth rate of Automotive Cybersecurity Market?

+

-

What are the latest trends influencing the Automotive Cybersecurity Market?

+

-

Who are the key players in the Automotive Cybersecurity Market?

+

-

How is the Automotive Cybersecurity } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Automotive Cybersecurity Market Study?

+

-

What geographic breakdown is available in Global Automotive Cybersecurity Market Study?

+

-

Which region holds the second position by market share in the Automotive Cybersecurity market?

+

-

How are the key players in the Automotive Cybersecurity market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Automotive Cybersecurity market?

+

-