Global Automotive Diesel Filters Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-107 | Automotive and Transport | Last updated: Oct, 2024 | Formats*:

Automotive Diesel Filters Report Highlights

| Report Metrics | Details |

|---|---|

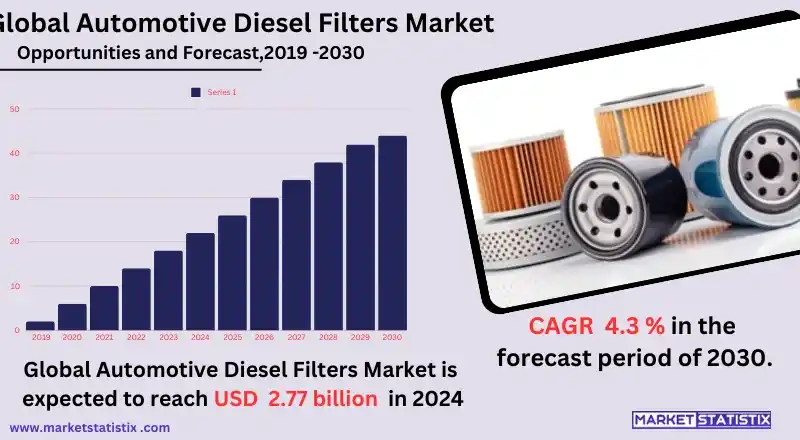

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 4.3% |

| By Product Type | Fuel filters, Diesel particulate filters (DPFs), Exhaust gas recirculation (EGR) filters, Diesel oxidation catalysts (DOCs), Catalytic converters |

| Key Market Players |

|

| By Region |

Automotive Diesel Filters Market Trends

The market for automotive diesel filters is experiencing a shift towards higher filtration efficiency and performance due to more difficult environmental laws being enforced. With governments across the globe placing tougher requirements on diesel engines, filter manufacturers are putting extra effort into developing next-generation filter technologies that not just prevent the accumulation of particulate matter but also eliminate the toxic emissions. This is because applications such as high-efficiency particulate filters (HEPF) or combined filtered devices with various functions have become very common to ensure compliance without compromising the performance of the engine. Further supporting the demand is the aftermarket diesel filter sales due to the desire for maintained vehicles and widening vehicle ownership. The aftermarket has also benefitted, with many vehicle owners realising the need to replace diesel filters more often in a bid to improve fuel efficiency and even increase the life of the engine. In addition to that, biofuels such as biodiesel and renewable diesel that are now being embraced as cleaner fuels are also changing the diesel filter design and construction.Automotive Diesel Filters Market Leading Players

The key players profiled in the report are Denso Corporation, The Goodyear Tire & Rubber Company, Cummins Inc. Sensata Technologies, Valeo, ZF Friedrichshafen AG, MAHLE GmbH, MANN+HUMMEL, Robert Bosch GmbH, Sogefi Group, Parker Hannifin Corp, Hengst SEHuf Electronics, Continental, Infineon Technology, Lear CorporationGrowth Accelerators

Environmental constraints and the need to control diesel engine emissions serve as the chief factors fuelling the growth of the market for automotive diesel filters. The automobile manufacturers are incorporating the new-age diesel filters in their vehicles as the governments in all nations are enforcing approved limits on the diesel exhaust emissions of particulate matter (PM) and nitrogen oxides (NOx). These restrictions apply not only to new machines but also to the so-called second cycle market, where active diesel filters are used to provide legal support and guarantee the operability of the engines in a sound mode. Hence the spike in demand for premium-class diesel filters that provide rims and ingresses of other foulings. Another notable factor is that diesel engines are gaining traction due to their relatively economical and torque benefits, especially in commercial and heavy-duty vehicles. As sectors, including transportation, construction, and farming, are still using diesel-operated engines, the need for effective filtration systems that enhance performance and durability of engines increases. Barring any unforeseen occurrences, the demand for automotive diesel filters will significantly increase over the years due to the rising trend of constructing cleaner and more efficient diesel engines.Automotive Diesel Filters Market Segmentation analysis

The Global Automotive Diesel Filters is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fuel filters, Diesel particulate filters (DPFs), Exhaust gas recirculation (EGR) filters, Diesel oxidation catalysts (DOCs), Catalytic converters . The Application segment categorizes the market based on its usage such as Passenger cars, Light commercial vehicles (LCVs), Heavy-duty vehicles (HDVs). Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The automotive diesel filter market is marked by fierce competition with the inability of new markets to cut out the presence of active players who readily adapt to recent technological advances. Companies such as MANN+HUMMEL, Donaldson Company, and Robert Bosch GmbH are at the forefront of this market, using their skills and technologies to manufacture environmentally friendly diesel particulate filters (DPFs) that conform to rigid regulations across the globe. The overall market is expected to witness a steep rise due to cleaner diesel technology as well as the growth rate of sales of commercial vehicles in particular regions of Asia-Pacific, where the need for regulatory compliance is growing. More so, new companies are coming into the industry with a mom focus on niche or novel filtration applications. Turning electric vehicles into final feasible products has also raised competitiveness in the behaviours of such companies, mostly diesel filter manufacturers. Research and design initiatives are being undertaken to improve the functionality and lifespan of the filters, and new materials are being researched aimed at useable performance in extreme conditions.Challenges In Automotive Diesel Filters Market

The worldwide market of automotive diesel filters is faced with several issues that arise due to increased environmental awareness and the quest for more electrification in the automobile sector. As countries across the globe enforce pollution control measures and introduce stringent emission standards, diesel engines are facing challenges to improve their emissions performance. Advanced diesel particulate filters (DPFs) and other exhaust aftertreatment units have been developed to fix the problem, which has made the production process more complicated and expensive for the producers. Moreover, with the changes in regulations, it is expected that the demand for diesel vehicles would also fall; this too would have a negative effect on the market for diesel filters. One more challenge, which is presented most recently, is a strong competition from alternative-fuelled technologies and the growth of electric vehicles (EVs). Given that sustainability is becoming the order of the day with consumers and manufacturers looking for cleaner alternatives, there is a possibility that the market for diesel engines and their parts, especially filters, will be affected. This may lead to a shrinking of the market for the old diesel automotive filter manufacturers, forcing them to come up with more innovative solutions and a wider range of products.Risks & Prospects in Automotive Diesel Filters Market

The market for automotive diesel exhaust filters or silencers is growing due to high levels of environmental protection requirements and a shift towards cleaner emissions from diesel engines. The stringent emission norms established all over the world, especially in countries like Europe and North America, are compelling the automotive industry to improve the performance of diesel filtration systems. This in turn increases the need for the next-generation diesel particulate filters (DPFs) and fuel filters designed specifically to trap all exhaust particulate matter and other gas contaminants. As more automotive manufacturers incorporate eco-friendly practices within their operations, there is scope for the manufacturers to come up with advanced filtration systems with high efficiency. Also, the increasing trend of adoption of diesel vehicles in developing countries is another optimistic factor for the growth of the automotive diesel filter market. Developing countries that are becoming urbanised and industrialised are experiencing a growing market for diesel automobile sales because diesel vehicles are more efficient and emit less carbon dioxide in comparison to gasoline vehicles. With the growth of these markets, there is also a growing demand for quality diesel filters to ensure that these vehicles are properly maintainedKey Target Audience

The automotive diesel filters market focuses on vehicle manufacturers and original equipment manufacturers (OEMs) that housing diesel engines in their vehicle structures. With the tightening of emissions regulations and the need for cleaner as well as more efficient diesel engines, OEMs are in need of high-quality diesel filters that focus not only on the reduction of particulate matter but also on improving the engine's operations. This audience includes automotive companies manufacturing private cars, commercial trucks, buses, off-road vehicles, and all such vehicles where effective filtration is necessary to comply with existent regulations and protect the vehicle.,, Another major audience focuses on aftermarket suppliers and service providers, for example, repair stations and parts distributors. These are involved in the functional operation of diesel vehicles, and so they would need constant supply of quality diesel filters that match the OEM expectations. With vehicle users understanding the need for taking care of their diesel engines for optimal performance and durability, the aftermarket diesel filter sector is booming.Merger and acquisition

The latest developments in the automotive diesel filters market exemplify the efforts of various companies to reposition their offerings to new heights while still meeting competition owing to changes in the market. In January 2024, MANN+HUMMEL, while strengthening its hold in the automotive filter sector, announced that it had gone ahead to purchase WIX Filters, which is a North American company. The acquisition not only increases the product mix of MANN + HUMMEL but also improves the distribution structures, enabling the company to meet the rising need for diesel filters among commercial vehicles. The acquisition is also consistent with the principles of the prevailing trend in the market, which is consolidation, whereby a company buys another firm to gain benefits. Similarly, Donaldson Company, Inc. has been pursuing growth through acquisitions. In March 2023, Donaldson purchased the automotive filter operations of Sogefi Group, which include high-efficiency diesel filter manufacture. This acquisition will augment the company’s filtration service provision in addressing emissions-related regulations. These strategic mergers and acquisitions foster the development and vertical growth of firms within the industry as the automotive sector gears towards cleaner solutions and propounds stricter emission regulations.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Diesel Filters- Snapshot

- 2.2 Automotive Diesel Filters- Segment Snapshot

- 2.3 Automotive Diesel Filters- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Diesel Filters Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fuel filters

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Diesel particulate filters (DPFs)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Exhaust gas recirculation (EGR) filters

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Diesel oxidation catalysts (DOCs)

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Catalytic converters

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Automotive Diesel Filters Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger cars

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Light commercial vehicles (LCVs)

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Heavy-duty vehicles (HDVs)

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Automotive Diesel Filters Market by Fuel Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Petrol

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Diesel

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Alternative Fuels

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Automotive Diesel Filters Market by Vehicle Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Passenger Car

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Commercial Vehicle

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Competitive Landscape

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Denso Corporation

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 The Goodyear Tire & Rubber Company

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Cummins Inc. Sensata Technologies

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Valeo

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 ZF Friedrichshafen AG

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 MAHLE GmbH

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 MANN+HUMMEL

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Robert Bosch GmbH

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Sogefi Group

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Parker Hannifin Corp

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Hengst SEHuf Electronics

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Continental

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Infineon Technology

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Lear Corporation

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Fuel Type |

|

By Vehicle Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Automotive Diesel Filters Market?

+

-

What major players in Automotive Diesel Filters Market?

+

-

What applications are categorized in the Automotive Diesel Filters market study?

+

-

Which product types are examined in the Automotive Diesel Filters Market Study?

+

-

Which regions are expected to show the fastest growth in the Automotive Diesel Filters market?

+

-

What are the major growth drivers in the Automotive Diesel Filters market?

+

-

Is the study period of the Automotive Diesel Filters flexible or fixed?

+

-

How do economic factors influence the Automotive Diesel Filters market?

+

-

How does the supply chain affect the Automotive Diesel Filters Market?

+

-

Which players are included in the research coverage of the Automotive Diesel Filters Market Study?

+

-