Global Automotive Engineering Service Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-103 | Automotive and Transport | Last updated: Jun, 2025 | Formats*:

The global automotive engineering services market consists of multiple services offered by dedicated firms to aid automotive manufacturers and suppliers. Quite a number of these services comprise product design and development, engineering analysis, testing & validation, and manufacturing engineering. Providers of automotive engineering services play a significant role in the production of new vehicles and vehicles’ components. Enhancing vehicle performance, safety, fuel economy, and overall vehicle quality is part of their core business. The growth of the market is expected to persist, owing to the rising technological evolution, complexity of vehicles, and the focus on the concern of safe and green issues.

Automotive Engineering Service Report Highlights

| Report Metrics | Details |

|---|---|

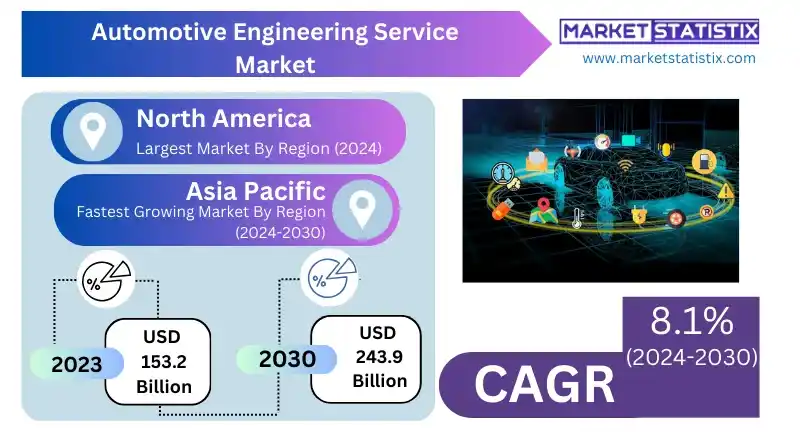

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.1% |

| Forecast Value (2030) | USD 243.9 Billion |

| By Product Type | Embedded, Mechanical, Software |

| Key Market Players |

|

| By Region |

|

Automotive Engineering Service Market Trends

The automotive engineering services market is characterized by an essential trend, which is the application of disruptive technologies such as electric vehicles (EVs), autonomous driving systems, and connected vehicle technology in automotive systems engineering. There is an increasing market for engineering services in the automotive context as the sector shifts toward environmentally friendly designs. This helps to explain the need for services geared towards the engineering and construction of electric vehicles’ propulsion systems, battery systems, lightweight composites, etc. Here’s another trend: more and more automotive manufacturers decide to outsource engineering services. In this case, lots of them have a problem similar to this; they acknowledge the advantages of working with external engineering agencies that help them complete the work faster. As a result. This enables equipment manufacturers (OEMs) to minimize their operational expenses, concentrate on their main activities, and improve their speed of adaptation to the market requirements. Last but not least, how engineering services are offered is changing drastically due to the advent of collaborative platforms and digital tools for remote working and allowing real-time data sharing and enhanced project control.

Automotive Engineering Service Market Leading Players

The key players profiled in the report are Robert Bosch GmbH (Germany), L&T Technology Services Ltd. (India), FEV Group (Canada), Continental AG (Germany), Harman International (U.S.), Capgemini Engineering (France), IAV GmbH (Germany), EDAG Engineering GmbH (Switzerland), AVL (Austria), Bertrandt AG (Germany)Growth Accelerators

The market for automotive engineering services is expected to see significant growth on account of rising vehicle design complexities and new advanced technologies in the automotive sector. The growing sophistication of vehicles entails the incorporation of electric and hybrid engines, the installation of self-driving technologies, and the introduction of complex entertainment systems, which requires manufacturers to seek engineering expertise in the invention and implementation of these technologies. The move towards electric vehicles (EVs) and strict controls on carbon emissions are additional forces behind the demand for skills in batteries, energy systems, lightweight materials, and therefore Auto engineering services are very important for any manufacturer who does not want to be outdated in the market. The growing emphasis on cost management and the shrinking product development cycles for automotive companies is another important driver. In order to be profitable in this age where the consumer expects high-quality and feature-rich vehicles, in most cases, manufacturers are outsourcing the engineering services to specialized engineering service providers. This strategy helps in obtaining external expertise, advanced tools, and technologies with the minimal costs of in-house services.

Automotive Engineering Service Market Segmentation analysis

The Global Automotive Engineering Service is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Embedded, Mechanical, Software . The Application segment categorizes the market based on its usage such as Body Engineering, Safety Systems, Chassis Engineering, Infotainment Systems, Powertrain Engineering, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The automotive engineering services market globally is extremely competitive and comprises several players ranging from large multinational companies to small engineering companies and even the engineering divisions of automotive manufacturers. Prominent companies in this market include Capgemini, IAV Automotive Engineering, Tech Mahindra, AKKA Technologies, HCL Technologies, and others. The market sees competition on account of technical competence, industry experience, penetration of the markets, and affordability of service, among other factors. What can also be observed in this particular market is a high degree of rivalry with the firms undertaking strategic alliances, mergers, and acquisitions as well as carrying out a lot of innovation. Competition is also shifting course due to the emergence of new trends such as electrification, autonomous driving, and connected vehicles, which leads to companies ramping up their research and developing new practices and solutions that fit these new demands of the automotive market.

Challenges In Automotive Engineering Service Market

The market for automotive engineering services is confronted with a multitude of difficulties, among which the most pressing is the speed of technological evolution. With the marketing focus moving to electric vehicles (EVs), autonomous driving vehicles, and more advanced driver assistance systems (ADAS), it has become imperative for automotive engineering companies to always advance their services and skills base. Significant spending on research and development activities as well as engineering training is necessary to implement these new technologies. Nevertheless, the expansion of automotive engineering services is also stifled by the increasing demands imposed by the law and environmental concerns. Stricter emissions limits and safety policies are being introduced by governments around the globe almost on a yearly basis, and making automotive firms adhere to the policies involves money and more sustainable strategies adopted. This complicates the engineering processes and causes delays in the introduction of new products. Strategic management, teamwork, and attention to new ideas being the great assets of fighting on the competitive market, all of those will have to be applied in order to cope with this kind of situation.

Risks & Prospects in Automotive Engineering Service Market

The automotive engineering service market is gaining traction thanks to the changes in technology and the need for more innovative automotive designs. Electric vehicles (EVs), along with the ongoing development of autonomous driving systems, have prompted many companies to look for specialized engineering services that will aid in designing and integrating these advanced systems. Such a development does not only allow engineering firms to gain expertise in battery systems, powertrains, and systems software but also fosters their partnerships with vehicle manufacturers who are looking to enhance their offerings in the wake of competition and industry changes. Furthermore, sustainability and regulation as competitive advantage principles that are making waves in the automotive industry is another opportunity. In a scenario where nations are imposing tougher emission limits and encouraging green techniques, there is some noticeable shift in the attitude of automotive businesses towards the engineering services sector in a bid to come up with cleaner technologies. This indicates a need for engineering companies that can provide green materials and energy-saving designs along with waste management measures.

Key Target Audience

The primary customer segment in the automotive engineering service market comprises automotive assemblers and OEMs, who look for value addition through advanced engineering solutions to optimise the vehicle design, development, and manufacturing stages. In these cases, companies often ask for help with advanced vehicle dynamics or dealing with powertrain development, to name a few, and even governance compliance. Electronic and smart automotive features are some of the trends that have transformed the automotive industry. Innovations are propelled into and within the product range as a result of the growing dependence of manufacturers on engineering service providers to maximise efficiency, shorten product life cycle, and enhance the performance of the vehicles as a whole. The manufacturers also have a considerable audience of component and system suppliers and technology-orientated companies. These categories of customers usually partner with engineering service providers in creating technologies like advanced driver assistance systems (ADAS), smart electric vehicle (EV) parts, etc. Moreover, automotive engineering services are employed by companies that perform vehicle testing and validation to ensure the products are safe and perform their intended functions.

Merger and acquisition

Over the last few years, the automotive engineering services market has undergone noteworthy consolidation as a result of necessity created by desire for improved capabilities, service extension, and geographic expansion. Among others, the notable mergers and acquisitions include: Acquisition of ASAP Group by HCLTech: in 2023, HCLTech was able to acquire German engineering and services firm ASAP Group to bolster growth in sectors such as autonomous driving, e-mobility, and connectivity. Strategic alliances and joint ventures: A number of automotive engineering service providers are entering into partnerships and joint ventures in order to harness complementary skills in the creation of new products. For example, Alten has teamed up with Syrphus GmBh to design unmanned ground vehicles and aerial drones. These changes are greatly affecting the structure of competition within the automotive engineering services market due to the tendency to create new, bigger firms that are diversified enough to cater for all the needs of vehicle manufacturers and their suppliers.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Engineering Service- Snapshot

- 2.2 Automotive Engineering Service- Segment Snapshot

- 2.3 Automotive Engineering Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Engineering Service Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mechanical

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Embedded

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Software

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Automotive Engineering Service Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Body Engineering

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Chassis Engineering

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Powertrain Engineering

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Safety Systems

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Infotainment Systems

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Automotive Engineering Service Market by Location

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 In-house

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Outsource

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Automotive Engineering Service Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 EDAG Engineering GmbH (Switzerland)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Capgemini Engineering (France)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 IAV GmbH (Germany)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 FEV Group (Canada)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 AVL (Austria)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Harman International (U.S.)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Robert Bosch GmbH (Germany)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Continental AG (Germany)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 L&T Technology Services Ltd. (India)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Bertrandt AG (Germany)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Location |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Automotive Engineering Service in 2030?

+

-

How big is the Global Automotive Engineering Service market?

+

-

How do regulatory policies impact the Automotive Engineering Service Market?

+

-

What major players in Automotive Engineering Service Market?

+

-

What applications are categorized in the Automotive Engineering Service market study?

+

-

Which product types are examined in the Automotive Engineering Service Market Study?

+

-

Which regions are expected to show the fastest growth in the Automotive Engineering Service market?

+

-

What are the major growth drivers in the Automotive Engineering Service market?

+

-

The market for automotive engineering services is expected to see significant growth on account of rising vehicle design complexities and new advanced technologies in the automotive sector. The growing sophistication of vehicles entails the incorporation of electric and hybrid engines, the installation of self-driving technologies, and the introduction of complex entertainment systems, which requires manufacturers to seek engineering expertise in the invention and implementation of these technologies. The move towards electric vehicles (EVs) and strict controls on carbon emissions are additional forces behind the demand for skills in batteries, energy systems, lightweight materials, and therefore Auto engineering services are very important for any manufacturer who does not want to be outdated in the market. The growing emphasis on cost management and the shrinking product development cycles for automotive companies is another important driver. In order to be profitable in this age where the consumer expects high-quality and feature-rich vehicles, in most cases, manufacturers are outsourcing the engineering services to specialized engineering service providers. This strategy helps in obtaining external expertise, advanced tools, and technologies with the minimal costs of in-house services.

Is the study period of the Automotive Engineering Service flexible or fixed?

+

-

How do economic factors influence the Automotive Engineering Service market?

+

-