Global Automotive Nonwoven Market – Industry Trends and Forecast to 2031

Report ID: MS-1605 | Automotive and Transport | Last updated: Sep, 2024 | Formats*:

Automotive Nonwoven Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

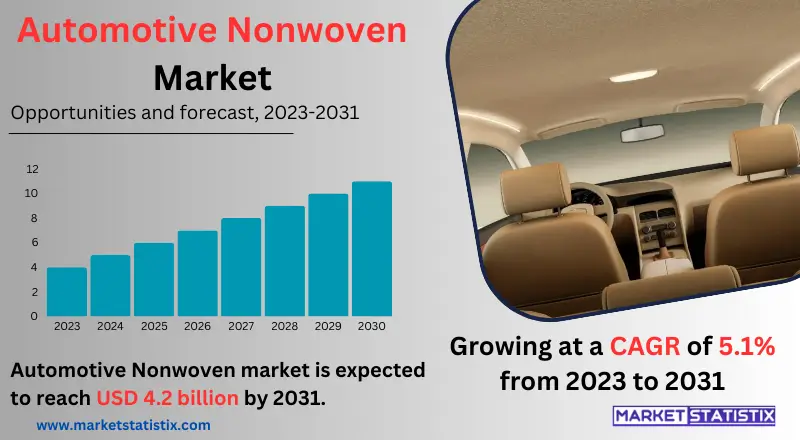

| Growth Rate | CAGR of 5.1% |

| By Product Type | Polyester, Polypropylene, Nylon, Polyethylene, Other Synthetic Fibers |

| Key Market Players |

|

| By Region |

|

Automotive Nonwoven Market Trends

Growth in the automotive nonwoven market is on the go; demand soars for lightweight, cost-effective, eco-friendly materials. Growingly, fuel efficiency and reduced emissions worries are raising the adoption rate of non-woven components in a vehicle. Advancements in non-woven technology, like the development of high-performance materials and innovative manufacturing processes, further act to boost the market. Some of the key trends that shape the market are e-mobility, for which EV-specific nonwoven parts in battery insulation and thermal management will be used. Moreover, with enhanced vehicle safety and comfort features, demands for advanced nonwoven materials for acoustic insulation, air filtration, and interior components are growing. The use of nonwoven fabric is most likely to increase with further innovations in the automotive sector.Automotive Nonwoven Market Leading Players

The key players profiled in the report are DuPont de Nemours, Lydall, Ahlstrom-Munksj, Kimberly-Clark Corporation, Hollingsworth & Vose Company, Toray Industries, Freudenberg Performance Materials, Mitsui Chemicals, Berry Global Group, Asahi Kasei CorporationGrowth Accelerators

Some major factors driving the growth of the automotive nonwoven market are the increasing trend and necessity of lightweight vehicles in order to enhance fuel efficiency without compromising on performance and to reduce emissions. The characteristic combination of low weight with a high strength-to-weight ratio of nonwovens offers increasingly attractive solutions. Moreover, increasing interest in vehicle interior comfort and acoustic performance has driven applications in nonwoven use for sound insulation and thermal management. Another major factor driving demand for nonwoven products in this industry is the strict safety and other regulations that the industry is facing, making the incorporation of nonwoven materials in most components vital. Since these materials have a high cushioning and impact-absorption tendency and even filtering properties, they improve the safety of the vehicle. Again, the increasing customisation and personalisation in automobile manufacturing are increasing the demands for different nonwoven fabrics, as there are many diverse tastes and needs to cater to in the consumer class.Automotive Nonwoven Market Segmentation analysis

The Global Automotive Nonwoven is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Polyester, Polypropylene, Nylon, Polyethylene, Other Synthetic Fibers . The Application segment categorizes the market based on its usage such as Parcel Shelf, Trunk Liners, Air Filters, Engine Covers, Interior Trim, Upholstery, Carpeting, Headliners, Insulation, Other application. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The nonwoven automotive market has a blend of established players and emerging innovators. The important players operating in the industry are large-scale nonwoven fabric manufacturers, chemical companies, and automotive OEMs. These companies compete based on product quality, technology, capacity, and cost. Consolidation through mergers and acquisitions is increasing in the market, with every company aiming at product portfolio expansion and new geographies. Another important trend that is rampant across the market is a focus on sustainability and eco-friendly material-based products. Regional differences in terms of consumer preference, regulatory framework, and economic conditions further intensify the competitive scenario.Challenges In Automotive Nonwoven Market

Despite the present potential for growth within the automotive nonwovens market, several challenges could be faced. First and foremost, the high stress placed on sustainability with minimal negative environmental impact places a burden on the industry to develop nonwovens with recycled content and biodegradable properties. Raw material prices, particularly synthetic fibres, have strong price volatility and thereby impact the bottom line. Furthermore, aggressive competition among nonwoven manufacturers demands ongoing innovation and cost reduction to maintain market share. So, part of the opportunities and challenges that will come with this shift by the automotive industry towards EVs is that even though the EVs come with new non-woven components for insulation and thermal management of batteries, the move might experience a fluctuation in demand for automotive components during the transition phase.Risks & Prospects in Automotive Nonwoven Market

The changing consumer preferences and industry trends open up several opportunities for growth in the automotive nonwoven markets. This growing usage of lightweighting of vehicle design to improve fuel efficiency, thereby reducing emissions, is finding more and more applications for nonwovens. And with greater importance given to cabin comfort and noise reduction, opportunities exist for advanced nonwoven solutions in acoustic insulation and thermal management. The electrification of the automotive industry also offers new opportunities for nonwovens. EVs require special components, such as battery separators and insulation materials; nonwovens can again offer very special benefits in these areas. Additionally, with growing concern for the environment, a heightened interest in sustainable and green materials is also supporting the development of re-cycled and biodegradable non-woven solutions for automotive applications.Key Target Audience

The major customers of automotive nonwovens are automotive original equipment manufacturers and Tier-1 suppliers. Basically, these companies are the big customers for non-woven material consumption, both for interior and exterior parts of a vehicle. Emphasis is given to product quality, cost, and standards related to the industry. On the other hand, aftermarket manufacturers and automotive upholstery suppliers also consume a substantial amount in relation to automotive nonwovens, serving the replacement market for vehicle parts and accessories., Another important target audience is the research and development community of companies, including automotive OEMs and material science companies. They drive innovation in the technology of nonwoven technologies through new material compositions that give advanced properties and functionalities for evolving automotive trends and regulations.Merger and acquisition

Noticeable consolidation through mergers and acquisitions marked the recent past of the automotive nonwoven market. This would encompass strategies aimed at improving market position, expanding product portfolios, and achieving economies of scale. Key players in the industry have been acquiring businesses or firms to make a mark in any specific segment or region. Furthermore, collaborative and joint-venture approaches have become instrumental in leveraging the strengths of various companies in order to explore new market opportunities. Increasingly, partnerships between nonwoven manufacturers and the automotive OEMs are entered into for the development of new materials and solution offerings, the specifications of which would suit particular types of vehicles.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Nonwoven- Snapshot

- 2.2 Automotive Nonwoven- Segment Snapshot

- 2.3 Automotive Nonwoven- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Nonwoven Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Polyester

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Polypropylene

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Nylon

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Polyethylene

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Other Synthetic Fibers

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Automotive Nonwoven Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Parcel Shelf

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Trunk Liners

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Air Filters

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Engine Covers

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Interior Trim

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Upholstery

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Carpeting

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Headliners

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Insulation

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

- 5.11 Other application

- 5.11.1 Key market trends, factors driving growth, and opportunities

- 5.11.2 Market size and forecast, by region

- 5.11.3 Market share analysis by country

6: Automotive Nonwoven Market by Technology

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Spunbond

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Needle Punched

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Meltblown

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Wetlaid

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Other technology

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Automotive Nonwoven Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 DuPont de Nemours

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Lydall

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Ahlstrom-Munksj

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Kimberly-Clark Corporation

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Hollingsworth & Vose Company

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Toray Industries

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Freudenberg Performance Materials

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Mitsui Chemicals

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Berry Global Group

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Asahi Kasei Corporation

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technology |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Automotive Nonwoven market?

+

-

How do regulatory policies impact the Automotive Nonwoven Market?

+

-

What major players in Automotive Nonwoven Market?

+

-

What applications are categorized in the Automotive Nonwoven market study?

+

-

Which product types are examined in the Automotive Nonwoven Market Study?

+

-

Which regions are expected to show the fastest growth in the Automotive Nonwoven market?

+

-

What are the major growth drivers in the Automotive Nonwoven market?

+

-

Is the study period of the Automotive Nonwoven flexible or fixed?

+

-

How do economic factors influence the Automotive Nonwoven market?

+

-

How does the supply chain affect the Automotive Nonwoven Market?

+

-