Global Automotive Surface Treatment Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2248 | Automation and Process Control | Last updated: Dec, 2024 | Formats*:

Automotive Surface Treatment Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

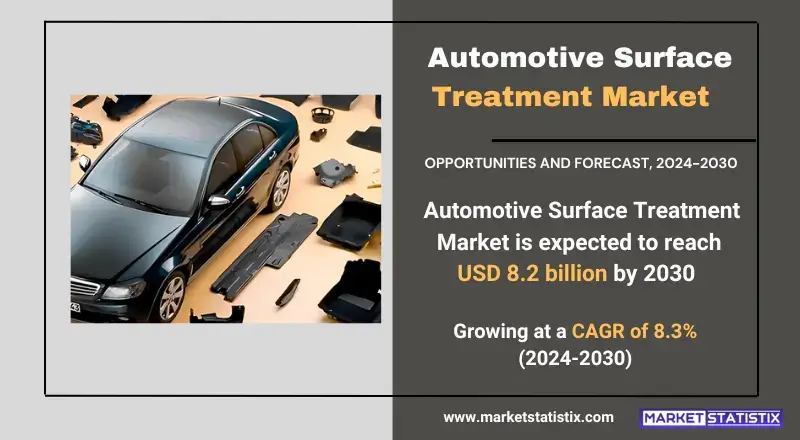

| Growth Rate | CAGR of 8.3% |

| Forecast Value (2030) | USD 8.2 billion |

| By Product Type | Anti-Rust Treatment, Spraying, Others |

| Key Market Players |

|

| By Region |

|

Automotive Surface Treatment Market Trends

The automotive surface treatment market is enlarging tremendously owing to growth in demand for enhanced durability and aesthetics of vehicles. Eco-friendly and sustainable surface treatment technology owing to environmental regulations and the automotive industry's push towards sustainability has been trending—among numerous other aspects. Popular methods such as powder coating, electroplating, and plasma treatments are rising as alternatives to conventional modes of operation, thus preventing the emission of hazardous fumes and increasing energy effectiveness. An important architrave in surface treatment is cutting-edge technology. Automation and robotics will be integrated into the drawing to streamline production and reduce costs while being better geared to assure high standards of consistent quality. Moreover, focus is drawing on such lightweight materials as aluminium and composite materials, which require different surface treatments to improve adhesion and performance in the vehicle.Automotive Surface Treatment Market Leading Players

The key players profiled in the report are Aalberts ST, ACCOMPLAST, ANDRITZ GROUP, APT, Doogood, Enviro Concepts, FUJI OOZX, Henkel, Impro, John Cockerill, Murakami, MW Components, NHE, Nittan Valve, OTTO FUCHS, Permagard Automotive, Proto MFG, REMA TIP TOP, Surface Technology, Team-MetalGrowth Accelerators

Although the automotive surface treatment market is pulled by growing demand for durability and visual appeal in vehicles, all these features are of great importance when it comes to making vehicles last as long as possible. Following this, manufacturers are increasingly turning to surface treatment technologies such as coatings, plating’s, and corrosion prevention to maintain their components. Coating up components prolongs the life of parts, improves their resistance to environmental elements, and polishes them to a fine finish, thus providing a competitive edge within the automotive industry. The use of advanced surface treatment technology on materials such as aluminium and steel used in lightweight, fuel-efficient vehicles has added the new dimension of making light vehicles at the strength and durability level without losing endurance. Another driver that is proving to be a big factor with several automotive manufacturers includes the ever-stringent environmental regulations. Mostly, these are European and North American automotive regulations that require the manufacturers to adopt some eco-friendly surface tampering that mitigate the ecological footprints, such as those privately talking about the water-based process along with powder coating and chrome-free treatments. In addition to this, there is also a general trend for electric vehicles (EVs), which need unique surface treatment of battery components and low-weight materials contributing to market growth.Automotive Surface Treatment Market Segmentation analysis

The Global Automotive Surface Treatment is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Anti-Rust Treatment, Spraying, Others . The Application segment categorizes the market based on its usage such as Passenger Cars, Commercial Vehicles. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the automotive surface treatment market is characterized by the presence of several large multinational companies alongside a good number of well-defined regional players. For instance, leading companies that dominate the market on a global scale include BASF SE, AkzoNobel N.V., and PPG Industries. These companies are specialized in manufacturing advanced surface treatment solutions and offer a complete range of products, such as coatings, primers, and sealants, to enhance the durability, corrosion resistance, and aesthetics of automotive parts. Their focus in research and development is the creation of environmentally friendly, low-cost, and high-performance solutions that meet automotive needs in terms of functionality and environmental regulations.Challenges In Automotive Surface Treatment Market

Environmental concerns and sustainability issues are some of the biggest challenges that the automotive surface treatment market is currently battling. Decreasing environmental impacts has forced stricter regulations on hazardous chemicals, coatings, and solvents in surface treatment processes. This raises the cost of research and development by pushing companies toward eco-friendly solutions, which can be expensive and take time to develop. Raw materials are becoming more expensive, and supply chain disruption also poses a challenge to the automotive surface treatment market. Increased prices for important materials, including metals, coatings, and chemicals—the uncertain nature of their prices caused partly by global supply chain hiccups—push production costs upward, leading to delays. This, besides rendering unprofitable many car manufacturers, also disadvantages them in remaining competitive in a highly competitive market.Risks & Prospects in Automotive Surface Treatment Market

The automotive surface treatment market has the potential to be bolstered by the increasing demand for durability as well as the appearance of vehicles. In effect, these surface treatments—coatings, electroplating, and anodising—have been utilised to protect parts of the vehicle from corrosion, wear, and environmental factors. The trend is, however, more pronounced in regions with extreme weather conditions and high environmental pollutants, thus requiring better protection for vehicle components. Further, the other opportunity existing in this market is green and sustainable advancement of surface treatment technologies. Increased awareness about the environment and strict regulation requirements have encouraged more eco-friendly treatments like water-based coatings and nontoxic materials. This has created market needs for new solutions that reduce harmful emissions and the waste of the production process.Key Target Audience

Key target audiences in the automotive surface treatment market include automobile manufacturers and OEMs who require surface treatment processes to improve the durability, appearance, and performance of vehicle components. Typically, a manufacturer will carry out surface treatment processes such as coating, plating, and polishing in order to improve corrosion resistance, wear and tear, and aesthetic surfaces for external and internal parts. The bulk of surface treatment is consumed most in the automotive industry, including electric and traditional vehicles, since these surface treatments are expected to comply with industry standards of performance and longevity for the vehicles.,, Another large sector comprises the automotive suppliers and aftermarket service providers who carry out surface treatments on spare parts and components for repairs or replacements. These suppliers work with treatment technologies and systems to ensure parts meet the required aesthetic and quality standards. In addition, automotive design and engineering companies involved in the innovative manufacturing and prototyping of vehicles form another vital segment of the market.Merger and acquisition

The automotive surface treatment market has been active, with surging intensity on merger and acquisition fronts as companies seek to grow their competitive power and service offerings. In this movement, PPG Industries, in February 2022, acquired the powder coatings division of Arsonsisi with the immediate impact of expanding the portfolio of PPG in the Southern Europe, Middle East, and Africa regions—all possible growth areas in a rapidly advancing sector of metallic bonding for automotive applications. Further, such acquisition is in line with the ongoing move of the industry into more sustainable and innovative solutions for surface treatments—there is increasing emphasis on environment-friendly processes, including such methods as water-based coatings and powder coating technologies. Besides the acquisition of PPG, there are several companies still seeking to do some "M&A" to get the open opportunities in the emerging market. For example, Aalberts Surface Technologies has been very active in setting up strategic cooperation for efficiencies in surface treatment processes. Part of the drive is that these mergers and acquisitions are being directed towards automotive applications. Because the automotive sector continues to maintain a high demand for durability and quality, innovative special services are enticing businesses to set up such forms of partnerships. >Analyst Comment

"The automotive surface treatment market has been booming under several factors, such as rising vehicle productions, stringent emission norms, and increasing demand for high-quality, durable, and aesthetic cars. It is highly competitive and consists of a variety of players, such as automotive manufacturers and suppliers of coatings and surface treatments and chemicals. Some of the key trends shaping this market include increased popularity for advanced surface treatment technologies, increased preference for lightweight materials, and increased demand for green and sustainable coatings."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Automotive Surface Treatment- Snapshot

- 2.2 Automotive Surface Treatment- Segment Snapshot

- 2.3 Automotive Surface Treatment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Automotive Surface Treatment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Anti-Rust Treatment

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Spraying

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Automotive Surface Treatment Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger Cars

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial Vehicles

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Automotive Surface Treatment Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Aalberts ST

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 ACCOMPLAST

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 ANDRITZ GROUP

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 APT

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Doogood

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Enviro Concepts

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 FUJI OOZX

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Henkel

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Impro

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 John Cockerill

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Murakami

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 MW Components

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 NHE

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Nittan Valve

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 OTTO FUCHS

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Permagard Automotive

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Proto MFG

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 REMA TIP TOP

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Surface Technology

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Team-Metal

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Automotive Surface Treatment in 2030?

+

-

What is the growth rate of Automotive Surface Treatment Market?

+

-

What are the latest trends influencing the Automotive Surface Treatment Market?

+

-

Who are the key players in the Automotive Surface Treatment Market?

+

-

How is the Automotive Surface Treatment } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Automotive Surface Treatment Market Study?

+

-

What geographic breakdown is available in Global Automotive Surface Treatment Market Study?

+

-

Which region holds the second position by market share in the Automotive Surface Treatment market?

+

-

Which region holds the highest growth rate in the Automotive Surface Treatment market?

+

-

How are the key players in the Automotive Surface Treatment market targeting growth in the future?

+

-