Global Autonomous Truck Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-1947 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Autonomous truck Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

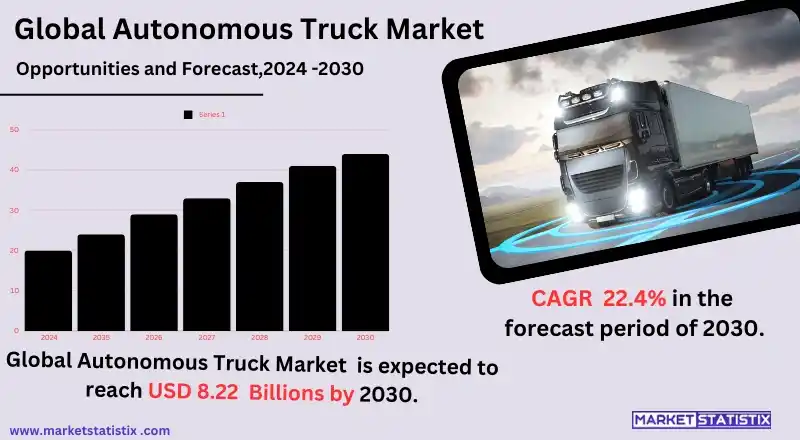

| Growth Rate | CAGR of 22.4% |

| Forecast Value (2030) | USD 8.22 Billion |

| Key Market Players |

|

| By Region |

|

Autonomous truck Market Trends

The autonomous truck market is one of the trendier markets in view of the increase witnessed on the technological fronts, together with being supported by regulatory highlights and the growing need for effective logistical solutions. One of the major trends highlighted in the case of the autonomous trucks relates to the rising artificial intelligence or machine learning algorithms to ensure enhanced safety and efficiency of the autonomous trucks. The technologies, with their ability to undertake real-time processing and act according to the data they are fed, enable trucks to take complex routes, avoid potential obstacles, and determine the most efficient routes. The largest trend is investment by the major logistics firms and truck manufacturers in autonomous trucking technology. In response to the increasing demand for the transport of freight faster and more reliably, companies are moving to partner with technology providers to develop and deploy autonomous technology. Regulatory frameworks are also changing in a manner that supports the testing and commercialisation of autonomous trucks, hence accelerating growth even further. These trends reveal the complete change within logistics and transport corporations as the requirement for self-driven trucks grows daily.Autonomous truck Market Leading Players

The key players profiled in the report are TuSimple, Inc. (U.S.), Waymo LLC (U.S.), Embark Trucks (U.S.), Tesla (U.S.), Caterpillar (U.S.), AB Volvo (Sweden), Daimler AG (Germany), Continental AG (Germany), Robert Bosch GmbH (Germany), NVIDIA Corporation (U.S.), Aptiv (Ireland),, Source: https://www.fortunebusinessinsights.com/autonomous-truck-market-103590Growth Accelerators

The autonomous truck market is growing at a tremendous pace owing to the rising need for efficiency and strategies that aim to cut down the cost of logistics and transportation. Every other day companies are on a quest of how to improve their supply chains, and considering that it is cheap to hire trucks, autonomous ones have the ability to effectively reduce labour costs and fuel consumption. They employ technologies like artificial intelligence, machine learning, and sensorial systems, which help these trucks work precisely, shorten turnaround delivery times, and streamline work processes. Diligent safety practices orientated towards minimising the number of road accidents and the consequent casualties also come into play. Autonomous trucks are created with the aim of eliminating human error, attributed as one of the major causes of traffic accidents. With the introduction of features like automatic brakes, lane-keeping, and up-to-date monitoring systems, these trucks can guarantee the safety of both the drivers and other entities on the highway. All these put a convergence degree of regulatory support, which everyone is trying very hard to include, which helps very much in driving the autonomous truck market.Autonomous truck Market Segmentation analysis

The Global Autonomous truck is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Construction, Last Mile Delivery, Freight Transport, Mining, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment regarding the market for autonomous trucks is made up of a number of auto manufacturers, tech companies, and other institutions that are working to develop autonomous truck systems, which comprise, among other things, autonomous driving technologies. Leading companies such as Tesla, Waymo, and Volvo apply their vast knowledge of vehicle manufacturing and advanced robotics to developing effective autonomous truck systems. They assist in the in the integration of advanced and safety-focused truck features, including sensors, artificial intelligence, and machine learning, to become dominant players in the changing market. Moreover, several new enterprises and companies in applied technology are being established, which seek to carve out a niche in the conventional trucking system. Aurora, TuSimple, and Embark are some players leading in the development of autonomous truck solutions, albeit for specific applications like last-mile delivery or long-haul transport. More vehicle companies and logistics players are engaging each other into partnerships, as there is a common need to speed up the process of bringing self-driving trucks into the market.Challenges In Autonomous truck Market

The biggest issues that the autonomous truck market will face relate to regulatory hurdles. Governments around the globe are creating frameworks for testing and operating autonomous vehicles, thus generating uncertainties that could weigh upon investment and deployment. There is a relative paucity of standardised regulations around safety, liability, and insurance—for most companies looking to innovate their solutions in autonomous trucking, this presents barriers to introducing them to the market. As stakeholders, including manufacturers, logistics providers, and regulatory bodies, strive to establish clear guidelines, the market may experience delays in widespread adoption and integration. An important challenge will be the technology required to develop fully autonomous trucks. It will certainly involve reliance on very sophisticated sensors in diverse and sometimes unpredictable environments, such as highways and urban areas, advanced AI algorithms, and robust communication networks. The factors that could hinder the full realisation of the market, however, are the integration of autonomous trucks into existing logistics networks and how the public views their safety and reliability.Risks & Prospects in Autonomous truck Market

The autonomous truck market is a great opportunity, growing with the increasing demand for efficient logistics and supply chain management. As e-commerce continues to rise, companies are looking for ways to optimise their transportation processes and minimise operational costs. Autonomous trucks would fill this gap with round-the-clock operation capabilities, reduced driver fatigue, and increased fuel efficiency. Another promising opportunity is in supporting regulatory policies and infrastructure development in support of autonomous trucks. Governments and other regulatory bodies will begin to gain an appreciation for the safety, traffic mitigation, and environmental benefits of autonomous trucks. The market will grow as more and more jurisdictions develop positive regulation and invest in autonomous truck-friendly infrastructure, including dedicated lanes and charging stations for electric autonomous trucks.Key Target Audience

Companies operating within the logistics and transportation industries are the major customers of autonomous trucks, companies that have sought to adopt automation as a means to streamline their operations and, by extension, save money. This is where most of these companies have received autonomous trucking technologies with open arms as a means of addressing issues like driver scarcity, labour wage increases, and the demand for more rapid delivery. Companies introducing autonomous trucks into their fleets can optimise routes, reduce fuel expenses, and become better at road safety when transporting goods, thereby giving them the upper hand in logistics.,, Another key segment in the autonomous trucking systems is made of technology providers/manufacturers of the respective system-software firms, sensor manufacturers, and automation solution providers. These firms will be key to bringing the needed technology and infrastructure for the practical application of autonomous trucking, including vehicle-to-vehicle communication, sophisticated AI applications, and enhanced safety systems.Merger and acquisition

The recent mergers and acquisitions across the autonomous truck market reflect the growing consolidation and investment in this fast-changing segment. A significant example would be that in 2023, Embark Trucks, the market leader in self-driving technology for freight, was acquired by a leading logistics company, allowing these trucks to be used with its existing fleet and improving their operational efficiency. According to the pundits, this is the indicator of the growing adoption of the traditional logistics companies embracing automation to cut costs and optimise the services rendered. Another landmark development was the announcement of the partnership between Volvo and Aurora, a technology firm dedicated solely to self-driving technologies, for building autonomous trucks for the freight industry. Not only will the company that excels at manufacturing commercial vehicles be merging the knowledge with the cutting-edge autonomous technology of Aurora, but it will also be making a strategic play to capture share in this burgeoning autonomous transportation market. Mergers and collaborations such as these would be expected to play an important role in the future of the autonomous truck market as demand for efficient and cost-effective logistics solutions continues to increase.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Autonomous truck- Snapshot

- 2.2 Autonomous truck- Segment Snapshot

- 2.3 Autonomous truck- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Autonomous truck Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Construction

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Last Mile Delivery

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Freight Transport

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Mining

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Autonomous truck Market by Level of Autonomy

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Semi-Autonomous

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Fully Autonomous

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Autonomous truck Market by Drive

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 IC Engine

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Electric

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Hybrid

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Autonomous truck Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 TuSimple

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Inc. (U.S.)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Waymo LLC (U.S.)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Embark Trucks (U.S.)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Tesla (U.S.)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Caterpillar (U.S.)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 AB Volvo (Sweden)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Daimler AG (Germany)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Continental AG (Germany)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Robert Bosch GmbH (Germany)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 NVIDIA Corporation (U.S.)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Aptiv (Ireland)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Source: https://www.fortunebusinessinsights.com/autonomous-truck-market-103590

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Level of Autonomy |

|

By Drive |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Autonomous truck in 2030?

+

-

How big is the Global Autonomous truck market?

+

-

How do regulatory policies impact the Autonomous truck Market?

+

-

What major players in Autonomous truck Market?

+

-

What applications are categorized in the Autonomous truck market study?

+

-

Which product types are examined in the Autonomous truck Market Study?

+

-

Which regions are expected to show the fastest growth in the Autonomous truck market?

+

-

What are the major growth drivers in the Autonomous truck market?

+

-

Is the study period of the Autonomous truck flexible or fixed?

+

-

How do economic factors influence the Autonomous truck market?

+

-