Global Babbitt Metal Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2192 | Manufacturing and Construction | Last updated: Nov, 2024 | Formats*:

Babbitt Metal Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

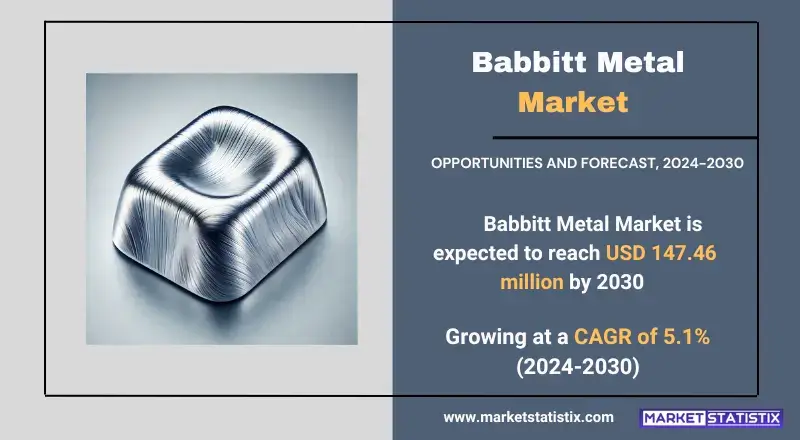

| Growth Rate | CAGR of 5.1% |

| Forecast Value (2030) | USD 147.46 Million |

| By Product Type | Tin-Based Babbitt, Lead-Based Babbitt |

| Key Market Players |

|

| By Region |

|

Babbitt Metal Market Trends

The Babbitt metal market is currently witnessing several pivotal trends owing to increased demand from automotive, industrial machinery, and manufacturing sectors. Babbitt metals, primarily utilised in bearing applications for low friction, are gradually gaining application in the use of high-speed and superior performance machines and equipment. There is increasing demand for Babbitt metals with improved wear resistance and longer life in major sectors such as automotive, aerospace, and heavy machinery owing to increasing requirements for durable, high-efficiency components. Another developing trend is focusing on environmentally friendly and lead-free Babbitt alloys. The increasing legislations on the use of lead have continued to accelerate the search for alternatives that would meet the performance requirements of lead but are free from it. This has been brought about by pressures from the legislation and increased awareness of the environment by manufacturers. The number of manufacturers adopting this form of Babbitt is expected to grow as industries try to improve their sustainability goals and take advantage of changing environmental legislation.Babbitt Metal Market Leading Players

The key players profiled in the report are AIM Metals & Alloys, Belmont Metals, CA Group, China Huaxi Alloy, Jia Da Specialty Metals, Mars Metal, NEY, Non Ferrous Metals Inc., Shangshui XiangyuGrowth Accelerators

Taking into consideration different trends, some of the major determinants in the Babbitt metal market are an increasing demand for high-performance bearings used in the automotive, aerospace, and manufacturing industries. Babbitt metal has excellent properties like wear resistance, low friction, and the capability to withstand high pressure, and thus is used to manufacture various bearings in engines, turbines, and machinery. In addition to these two, another influence is the attention now being paid to the durability and efficient use of machinery. Industries are trying to offer more maintenance-free components with potentially longer lives for critical machinery in their operation. Because of damage to bearing surfaces due to its internal features reducing friction, Babbitt metal will be very useful for production efficiency and durability improvements in the machines manufactured.Babbitt Metal Market Segmentation analysis

The Global Babbitt Metal is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Tin-Based Babbitt, Lead-Based Babbitt . The Application segment categorizes the market based on its usage such as Plain Bearing, Other. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive nature of the Babbitt metal market is somewhere between pure global players like classical manufacturers and local producers. Major manufacturing companies work on high-quality Babbitt metals, which are used primarily to manufacture bearings, machinery components, and automotive applications. They adopt unique ways for competition, such as innovations in alloy compositions, superior wear resistance, and customer-tailored solutions. Such major players are inclined towards strategic partnerships and collaborations with industries like automotive, aerospace, and heavy machinery to optimize their market operation.Challenges In Babbitt Metal Market

The fluctuation of raw material prices stands tall as one of the numerous problems. Babbitt metals are mostly composed of tin, lead, and copper and hence are very vulnerable to fluctuations in the prices of these base metals. Increasing production costs at the world level of metal fluctuate by price because the profit percentage and price policies of the manufacture also get affected. Supply chain troubles due to geopolitical issues or natural calamities can cause costs and availability of these essential materials to swing. In addition to these, another significant factor that haunts the Babbitt metal market is increasing environmental and regulatory pressures. With human beings turning their attention to the environmental hazard posed by lead and other toxic elements in Babbitt alloys, stricter rules in the use of those materials will be applied by governments. All this creates a need for investing in environmentally friendly and sustainable alternatives, like lead-free Babbitt alloys, which often require costly research and development.Risks & Prospects in Babbitt Metal Market

While industries are expanding, the need for high-performance bearings, which are associated with wear and tear, durability, and energy efficiency, is never exhausted. Babbitt metal is a material that serves an increasing demand. The properties for which this material is best known are low friction, high load bearing, and corrosion resistance. In addition, the increasing application of Babbitt metal in the emerging markets, especially developing nations with fast-evolving industrial activities, could have high potential to develop markets further. Constantly improving infrastructure and energy-efficient machines and equipment continues to increase demand for advanced infrastructure in construction, mining, and power generation, among which Babbitt metal enjoys use. Opportunities for innovations and differentiations in this market will come from advancements in Babbitt metal alloys and designs made for performance improvement in extreme conditions.Key Target Audience

The targeted audience for Babbitt metal pertains mainly to industries that manufacture and service heavy machinery and equipment, such as automotive, aerospace, marine, and industrial machinery industries. This metal, characterized by its ability to provide low friction and resistance to wear, is mainly utilized as a bearing material in engines, turbines, and other types of mechanical systems with critical smooth-operating requirements. It is an effective solution for wear and tear, performance improvement, and extended life of these critical components and thus is relied upon by manufacturers and maintenance facilities.,, Another target audience is foundry and casting, where Babbitt metal is offered for production and direct sales to various clients for other uses on their machines and equipment. These include raw material and metalworking product suppliers targeting specialized industries needing metals for high-performance applications. Companies focusing on manufacturing lubricants and additives may also get into this market because they commonly utilize their products with systems for lubricating and improving the performance of rotating machinery.Merger and acquisition

It's about time when the recent mergers and acquisitions in the Babbitt metal market show the trend of strategic growth and consolidation as part of their business scope objectives. Companies like AIM Metals & Alloys, along with Belmont Metals, are concerned about market expansion and portfolio improvement by merging with other companies, such as these: North America gaining ground or going into some parts of Asia. Take NEY as an example: its company, along with Non-Ferrous Metals Inc., has been boosting their capability to meet the increasing demand for Babbitt metal applications, particularly those associated with automotive and machinery. They reflect mergers that entail a new emphasis on supply chain integration and on technological advancement in the industry. Increasing numbers of networks, such as the automotive and industrial machinery sectors, call for the industry to establish higher sustainability and quality requirements for Babbitt alloys, which is a motivating factor that drives enterprises to obtain specialized companies or establish partnerships. The increasing investment in research and development will further lead to strategic initiatives targeting improved product development, wider geographic coverage, and better operational efficiencies in the market. >Analyst Comment

"Babbitt metal is actually a soft alloy mostly comprising tin, lead, and antimony, which is used widely as a lining material for bearings incorporated in different types of machinery and equipment. This feature makes it important in industries like automotive, industrial machinery, and pumps, since it has a highly anti-friction property and can also take shape to the bearing surfaces. The global market for babbitt metals is powered by increasing expansion or industrialization at levels from local to national, demand for efficient and reliable machinery, and demand for replacement bearings. However, challenges to the growth of the market include fluctuating raw material prices, leading to environmental concerns, and replacement bearing materials."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Babbitt Metal- Snapshot

- 2.2 Babbitt Metal- Segment Snapshot

- 2.3 Babbitt Metal- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Babbitt Metal Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Tin-Based Babbitt

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lead-Based Babbitt

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Babbitt Metal Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Plain Bearing

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Other

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Babbitt Metal Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AIM Metals & Alloys

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Belmont Metals

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 CA Group

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 China Huaxi Alloy

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Jia Da Specialty Metals

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Mars Metal

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 NEY

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Non Ferrous Metals Inc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Shangshui Xiangyu

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Babbitt Metal in 2030?

+

-

What is the growth rate of Babbitt Metal Market?

+

-

What are the latest trends influencing the Babbitt Metal Market?

+

-

Who are the key players in the Babbitt Metal Market?

+

-

How is the Babbitt Metal } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Babbitt Metal Market Study?

+

-

What geographic breakdown is available in Global Babbitt Metal Market Study?

+

-

Which region holds the second position by market share in the Babbitt Metal market?

+

-

Which region holds the highest growth rate in the Babbitt Metal market?

+

-

How are the key players in the Babbitt Metal market targeting growth in the future?

+

-