Global Etamsylate (Ethamsylate) Market Trends and Forecast to 2031

Report ID: MS-1256 | Healthcare and Pharma | Last updated: Feb, 2025 | Formats*:

Etamsylate (Ethamsylate) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

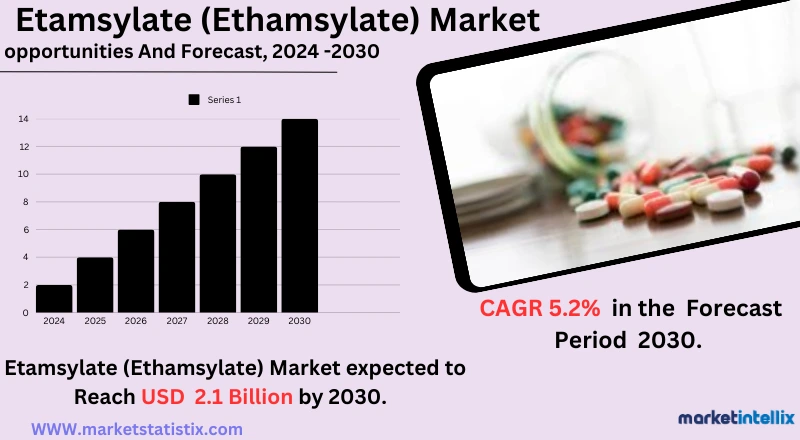

| Growth Rate | CAGR of 5.2% |

| Forecast Value (2031) | USD 2.1 Billion |

| By Product Type | Tablet, Injection |

| Key Market Players | NSK Ltd. (Japan), Schaeffler AG (Germany), Nachi Fujikoshi Corp (Japan), Myonic GmbH (Germany), LYC Bearing Corporation (China), Luoyang Huigong Bearing Technology Co. Ltd. (China), Koyo (Japan), ISB Industries (Italy), NTN Bearing Corporation (United States), SKF (Sweden), The Timken Company (United States), THB Bearings (China), Others |

| By Region |

Etamsylate (Ethamsylate) Market Trends

Smart bearings with integrated sensors and communication capabilities The Etamsylate (Ethamsylate) market is on the rise, spurred on by growing incidences of pregnancy, surgeries, and ailments relating to the menstrual cycle. This increase is further accentuated by conditions such as profuse blood loss during surgery, menorrhagia, incidental findings of periventricular haemorrhage, etc.; thus, paving a potential lucrative market for this segment. According to the report, the region of Asia Pacific is expected to have the highest CAGR owing to the increased occurrence of cases of capillary and other abnormal bleeding. Key trends in the market comprise high sales growth for the consumption of tablets owing to convenience and portability, whereas online pharmacies are emerging to address better pricing, greater accessibility, and ease of obtaining products. The major companies in the said markets include Minapharm Pharmaceuticals and Dr. Reddy's, focusing on product portfolio strengthening in a global business expansion strategy. North America and Europe exhibit steady growth, thanks to government policies and increased consumer awareness.Etamsylate (Ethamsylate) Market Leading Players

The key players profiled in the report are NSK Ltd. (Japan), Schaeffler AG (Germany), Nachi Fujikoshi Corp (Japan), Myonic GmbH (Germany), LYC Bearing Corporation (China), Luoyang Huigong Bearing Technology Co. Ltd. (China), Koyo (Japan), ISB Industries (Italy), NTN Bearing Corporation (United States), SKF (Sweden), The Timken Company (United States), THB Bearings (China), OthersGrowth Accelerators

There are many forces instrumental to the Etamsylate (Ethamsylate) market, among which the rapid rise in the incidence of haemorrhagic conditions mentioned above is the most representative. Conditions in this regard include illnesses and conditions during pregnancy and surgery, as well as those associated with the menstrual cycle, which lead to excessive blood loss. Above was observed the boosting of demand for Etamsylate. Number three, further advancement of technologies and widely adopting the injections of Etamsylate. Key market dynamics, such as trends, opportunities, and challenges, also influence the market of Etamsylate (Ethamsylate). Companies are focusing on strengthening their product portfolios and expanding their businesses, which drives market growth. The market is segmented by type (tablet, injection) and application (hospital pharmacies, retail pharmacies, online pharmacies), offering various avenues for growth and expansion.Etamsylate (Ethamsylate) Market Segmentation analysis

The Global Etamsylate (Ethamsylate) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Tablet, Injection . The Application segment categorizes the market based on its usage such as Hospital Pharmacies, Retail Pharmacies, Online Pharmacies. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Etamsylate (Ethamsylate) marketplace has been relatively quiet on the front of mergers and acquisitions, only as companies are now purely diversifying their product lines and geographical reaches. Such activity is expected to tap improvement in manufacturing technique, collaborative projects, and better formulation for accessing innovations. An already matured Etamsylate market with both big and small pharmaceutical companies competing for share through strategic partnerships, mergers, and acquisitions. However, the announcement made in February 2022, regarding the acquisition of Nimbus Health GmbH, Germany, by Dr. Reddy's, included Nimbus as a wholly owned subsidiary of Dr. Reddy's. This acquisition bodes well for the development of the competitive landscape along with the Etamsylate market . Moreover, Juggat Pharma has also announced that it is going to open two plants in FY22 to augment production.Challenges In Etamsylate (Ethamsylate) Market

The most significant factor adversely affecting the etamsylate (ethamsylate) market is the tough regulation regarding the approvals that vary regionally concerning an indication. As a haemostatic, safety and efficacy are always questioned concerning this very agent, which causes challenges in regulatory approval processes that could limit market growth. The existence of alternatives in other medications, like different agent alternatives like tranexamic acid, threatens sales of etamsylate further. Moreover, other challenges include low awareness and acceptance of etamsylate in a few regions, especially in developed markets that have advanced haemostatic drugs available. Disruption in the supply chain, changes in raw material prices, and stringent quality requirement norms hinder manufacturing and costs alike. Furthermore, ongoing long-term clinical studies and trials against it would impact its market development very adversely.Risks & Prospects in Etamsylate (Ethamsylate) Market

Etamsylate has a huge scope in an upside market. All over the world, even at the end of the growth line limits, going through surgery and finding conditions like menorrhagia have been in much demand for effective haemostasis. Therefore, the hurdles will lead to opportunities for pharmaceutical companies to research and develop or market improved formulations of etamsylate with fewer side effects or increased effectiveness. Exploration of applications of new etamsylate formulations includes possible usage in the management of bleeding disorders and cosmetic procedures that would contribute to new franchise development opportunities. Another opportunity for the company's growth lies with emerging markets. Most regions are characterised by limited access to sophisticated health care facilities and the high burden of conditions requiring haemostatic agents, for example, menorrhagia. Such companies stand to gain market share as most of these countries depend on affordable, yet accessibly priced, etamsylate offerings.Key Target Audience

The prime target groups of the Etamsylate (Ethamsylate) market are the pharmaceutical companies, healthcare providers, and research and development institutes. Among all, pharmaceutical manufacturers are the prime stakeholders focusing on the production and distribution of Etamsylate-based medications used for the treatment of haemorrhages and capillary bleeding disorders. Hospitals, clinics, and health care professionals, including gynaecologists and haematologists, form another of the major segments as they prescribe the medication Etamsylate for such indications as menorrhagia, postoperative bleeding, and other haemostatic indications.,, Moreover, regulatory agencies and contract research organisations (CROs) also contribute to the development of the market through their requirements for compliance with drug safety standards, as well as through conducting clinical trials for new formulations. Finally, the market also caters to wholesalers, distributors, and online pharmacy gateways that facilitate Etamsylate to different end-users. Growing demand from emerging markets created awareness, while improving healthcare facilities also widened the scope of the audience for this drug.Merger and acquisition

The Etamsylate (Ethamsylate) market has seen only mild activity in terms of mergers and acquisitions because companies are simply broadening their product line and geographical reach. This kind of activity is good for accessing innovations through improved manufacturing techniques, collaborative projects, and better formulation. An established Etamsylate market with both big and small pharmaceutical companies competing for share through strategic partnerships, mergers, and acquisitions. On the other hand, the announcement of the acquisition of Nimbus Health GmbH, Germany, by Dr. Reddy's in February 2022 included Nimbus as a wholly owned subsidiary of Dr. Reddy's. This acquisition holds much promise in evolving the competitive landscape along with the Etamsylate market. Furthermore, Juggat Pharma has also announced plans to set up two plants in FY22 to boost production. >Analyst Comment

The worldwide Etamsylate (Ethamsylate) market has witnessed growth owing to the growing incidence of bleeding disorders, increased number of surgeries performed, and various government policies to improve the health-care infrastructure. The market was valued at USD 10.89 billion in 2024 and is forecast to reach USD 21.17 billion by 2032. Etamsylate is prescribed to prevent and control bleeding associated with surgery, dental procedures, epistaxis, menorrhagia, and injury. Various factors have contributed to sustaining the momentum in the market, such as increasing awareness regarding the benefits of Etamsylate regarding bleeding control, an increase in the number of patients suffering from chronic diseases and trauma, and increased demand for haemostatic agents in surgical procedures.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Etamsylate (Ethamsylate)- Snapshot

- 2.2 Etamsylate (Ethamsylate)- Segment Snapshot

- 2.3 Etamsylate (Ethamsylate)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Etamsylate (Ethamsylate) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Tablet

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Injection

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Etamsylate (Ethamsylate) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hospital Pharmacies

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Retail Pharmacies

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Online Pharmacies

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 NSK Ltd. (Japan)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Schaeffler AG (Germany)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Nachi Fujikoshi Corp (Japan)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Myonic GmbH (Germany)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 LYC Bearing Corporation (China)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Luoyang Huigong Bearing Technology Co. Ltd. (China)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Koyo (Japan)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 ISB Industries (Italy)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 NTN Bearing Corporation (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 SKF (Sweden)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 The Timken Company (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 THB Bearings (China)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Others

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Etamsylate (Ethamsylate) in 2031?

+

-

Which type of Etamsylate (Ethamsylate) is widely popular?

+

-

What is the growth rate of Etamsylate (Ethamsylate) Market?

+

-

What are the latest trends influencing the Etamsylate (Ethamsylate) Market?

+

-

Who are the key players in the Etamsylate (Ethamsylate) Market?

+

-

How is the Etamsylate (Ethamsylate) } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Etamsylate (Ethamsylate) Market Study?

+

-

What geographic breakdown is available in Global Etamsylate (Ethamsylate) Market Study?

+

-

Which region holds the second position by market share in the Etamsylate (Ethamsylate) market?

+

-

How are the key players in the Etamsylate (Ethamsylate) market targeting growth in the future?

+

-