Global Bathroom Vanities Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2297 | Manufacturing and Construction | Last updated: Dec, 2024 | Formats*:

Bathroom Vanities Report Highlights

| Report Metrics | Details |

|---|---|

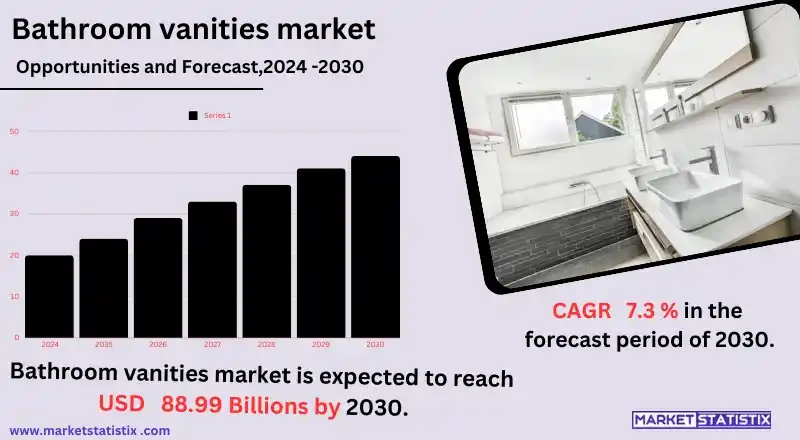

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.3% |

| Forecast Value (2030) | USD 88.99 Billion |

| Key Market Players |

|

| By Region |

|

Bathroom Vanities Market Trends

Thus, the market for bathroom vanities is expected to grow significantly over the coming years owing to the rapidly rising demands for highly stylish and modern bathroom designs. Aesthetics, utility, and storage have become a matter of priority for consumers in terms of renovations, and they are opting for bathroom vanities that are customised to suit their environmental and high-quality needs. The goods also include trends like floating vanities, which create a sleek and contemporary feel, and intelligent, convenient, integrative smart technology at vanities. Luxury and high-end bathroom vanities are yet another trend that seems to be fast gaining ground among high-end homeowners as well as people who invest in home improvement projects. The market was also influenced by shrinkage in bathroom space, as well as a trend toward more compact bathrooms. Higher density is mainly in urban areas, such as London, and has resulted in much demand for space-saving vanities as well as modular designs. All these trends indicated that the marketplace would be on a constant lookout for different, new, trending, and functional bathroom vanities.Bathroom Vanities Market Leading Players

The key players profiled in the report are American Woodmark Corporation, Avanity Corporation, Wyndham Collection, Kohler Company, Water Creation, Inc., Wilsonart LLC, Dupont Kitchen and Bath Fixtures, Caesarstone, Bellaterra Home, LLC, Design Element Group, Inc., Design House (DHI Corp.), Empire Industries, Inc., Foremost GroupsGrowth Accelerators

Growing demand for home renovations and remodelling projects drives the bathroom vanities market. Homeowners are spending increasing investments in upgrading and improving their living spaces. Increasing disposable income levels, particularly in developing economies, are causing people to adopt fashionable and functional designs for bathrooms, increasing the market for modern and luxurious vanities. Growing trends, such as spa-inspired home setups and a booming market for customised and space-savvy bathroom solution designs, will benefit the market. Another driver is the surging trend on sustainability and the use of eco-friendly materials in home décor. Consumers are developing a conscience about the environmental ramifications of their decisions and are opting for bathroom vanities made using materials like recycled wood, low-VOC finishes, and energy-efficient lighting. The latest developments in bathroom vanities, like built-in lighting, smart mirrors, and integrated storage solutions, are also attracting technology-driven customers.Bathroom Vanities Market Segmentation analysis

The Global Bathroom Vanities is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Residential, Non-Residential. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The bathroom vanity market is highly competitive; it hosts many global and regional players, all battling to fulfil diverse consumer needs. Some key players include Kohler and American Standard, among others, to add to the list of very well-known manufacturers with fantastic bathroom vanities in all possible styles, sizes, and price levels. These companies focus on their new products and use high-quality materials while ensuring one can customise the products according to their needs. In addition, competition in the market further rises with new entrants in the market targeting niche segments like luxury or eco vanities with their distinct designs, sustainable raw materials, or smart technology for their products.Challenges In Bathroom Vanities Market

The market for bathroom vanities has several challenges; the most important is the fluctuation of raw material prices. Bathroom vanity materials, such as wood, marble, and granite, are also subject to fluctuations in market price and hence become costlier during production, affecting the prices' stability. Such complications can be anticipated by the manufacturers in terms of balancing with the prices of high-quality materials in a market where the consumers are getting more attracted toward the cost-effective ones. Another challenge is the severe competition the market faces, with so many parties pitching in with multiple types of designs and features. With increasing saturation, the products must prove themselves through changing features like innovative designs, durable builds, and varied functionalities (like smart vanities or space-saving ones). To satisfy these changing demands of the consumers, manufacturers should keep innovating. The market for bathroom vanities also has its own sets of logistical challenges, such as managing shipping costs and large, bulky items, both of which lead to increased delays or operational costs.Risks & Prospects in Bathroom Vanities Market

It offers lucrative opportunities in the booming market of bathroom vanities, which is driven by a growing demand for renovation and remodelling in homes, especially in residential properties. Most likely, this is because homeowners want to upgrade their bathrooms for a much better look. Homeowners on average prefer the stylish, space-efficient, and high-quality vanities that interest them today. Disposable income increases the luxury market within emerging economies, particularly among the newly middle-class individuals. Another opportunity within the bathroom vanities market is the increasing demand for sustainable and green products. As individuals become increasingly aware of sustainability, they look for green options such as vanities made from recycled materials or those equipped with technology that saves water. Luxurious bathrooms continue to gain in popularity, while innovations include the smart bath, laced with such technology as LED lighting, temperature controls, and touchless faucets. These are growth opportunities available for proponents in this market.Key Target Audience

Bathroom vanities are marketed specifically to homeowners, interior designers, and contractors who are involved in the construction or renovation of residential and commercial projects. Some of the most important customers are homeowners—they are generally those who tend to be renovating an area of their house, specifically the bathroom, and are looking for stylish, functional, and space-efficient bathroom vanities to improve the overall appearance and feel of their bathrooms. Another customer group is comprised of contractors who include the vanities as part of their building or renovation plans.,, The market is also extended in terms of selling bathroom furniture and fixtures to online and offline retail stores. Such businesses cater to a variety of clientele and offer diverse types, sizes, and materials to meet different consumer needs. Commercial manufacturers and suppliers of bathroom vanities also form the second target audience of the market, since they produce high-quality, innovative products meeting the consumers' preferences in terms of durability, design, and ease of installation.Merger and acquisition

Currently, the market for bathroom vanities is witnessing continuous mergers and acquisitions by which companies target the broadening product portfolio as well as new markets. A good instance is CMO Group PLC's acquisition during 2022 of Whiteholme Limited that enabled the UK-based building supplies retailer to further strengthen itself in e-commerce for bathroom products. This is part of a trend whereby companies move together to increase their revenue shares in an increasingly growing demand for innovative and aesthetically looking bathrooms. Also, Somany Ceramics showcased new vanity lines in 2021. This demonstrates that companies are not just going ahead acquiring but also launching innovations to bring in consumers. The increasingly associated market dynamics in the contemporary setting will also bring more partnerships and corporations among manufacturers and designers as the vehicle for driving market growth in the residential, hence commercial, applications. As smart devices build into vanity designs, it adds particular value for eco-friendly, high-technology-enhanced functionality consumers. This makes mergers and acquisitions all the more relevant in driving innovation in the bathroom vanities and various consumers' needs. >Analyst Comment

"According to reports, the global bathroom vanities market is expected to grow at a significant rate due to the changing infrastructure and increase in disposable incomes. Consumers are focusing more on creating an aesthetically appealing environment in the bathroom, due to which the demand for modern and functional bathroom vanities will be increased. The market will be segmented on the basis of product type, material, prices, and distribution channel. Some of the major companies focusing on the above market include Masco Corporation, Master Brand Cabinets Inc., and Kohler Co., among others."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bathroom Vanities- Snapshot

- 2.2 Bathroom Vanities- Segment Snapshot

- 2.3 Bathroom Vanities- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bathroom Vanities Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Residential

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-Residential

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Bathroom Vanities Market by Material

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Stone

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Ceramic

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Glass

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Wood

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Metal

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Bathroom Vanities Market by Size

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 24 - 35 Inch

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 38 - 47 Inch

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 48 - 60 Inch

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Bathroom Vanities Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 American Woodmark Corporation

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Avanity Corporation

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Wyndham Collection

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Kohler Company

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Water Creation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Inc.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Wilsonart LLC

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Dupont Kitchen and Bath Fixtures

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Caesarstone

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Bellaterra Home

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 LLC

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Design Element Group

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Inc.

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Design House (DHI Corp.)

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Empire Industries

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Inc.

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Foremost Groups

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Material |

|

By Size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Bathroom Vanities in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Bathroom Vanities market?

+

-

How big is the Global Bathroom Vanities market?

+

-

How do regulatory policies impact the Bathroom Vanities Market?

+

-

What major players in Bathroom Vanities Market?

+

-

What applications are categorized in the Bathroom Vanities market study?

+

-

Which product types are examined in the Bathroom Vanities Market Study?

+

-

Which regions are expected to show the fastest growth in the Bathroom Vanities market?

+

-

Which application holds the second-highest market share in the Bathroom Vanities market?

+

-

Which region is the fastest growing in the Bathroom Vanities market?

+

-