Global Beverage Packaging Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-763 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

The packaging of beverages covers the business focused on developing, producing, and providing containers to store and preserve liquid beverages. This covers a wide variety of materials, such as plastic (PET, HDPE), glass, aluminium (cans), paperboard (cartons), and more and more sustainable materials, such as plant-based plastics and recycled material. The main purposes of beverage packaging are to promote product safety and quality, to increase shelf life, to assist in transportation and storage, to offer convenience for the consumer, and to be an important vehicle for branding and marketing. The market serves to meet a vast range of beverages, such as alcoholic beverages and non-alcoholic beverages such as soft drinks, juices, packaged water, milk products, and ready-to-drink beverages. The growth of the market is largely driven by changing consumer tastes, advances in packaging material and design technology, and increasing emphasis on sustainability. Driving trends include increasing consumer need for convenience and on-the-go packaging, the growth of e-commerce that creates a need for strong and damage-free solutions, and the growing trend toward visually compelling and premium packaging.

Beverage Packaging Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

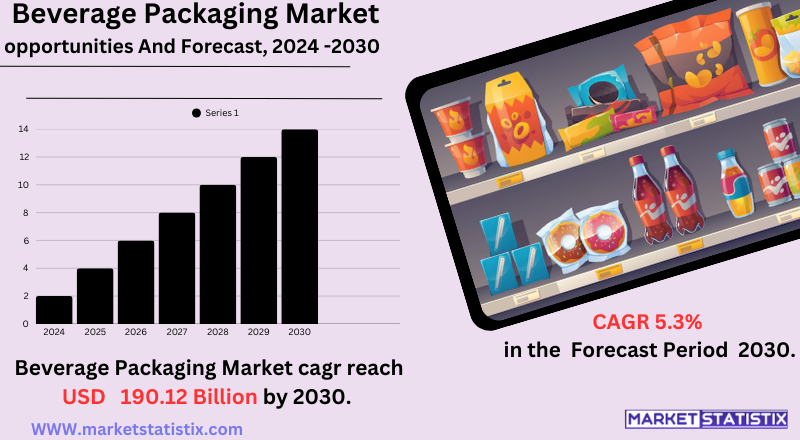

| Growth Rate | CAGR of 5.3% |

| Forecast Value (2030) | USD 190.12 Billion |

| By Product Type | Pouch, Bottle & Jar, Can, Carton, Other Products |

| Key Market Players |

|

| By Region |

|

Beverage Packaging Market Trends

One of the prominent trends is a further heading for these sustainable packaging solutions now. For instance, recyclable materials such as aluminium and glass are used; new plant-based biodegradable and compostable materials are developed; and recycled content in plastic and paperboard packaging is becoming ever more important. Furthermore, improved lightweighting of the existing packaging systems to reduce the amount of material emitted and to reduce emissions during transport has a great effect. Reusable models are innovative systems of packaging, such as refillable bottles and deposit-return schemes, which are the emerging forms for waste reduction and circularity. Another trend fundamental to beverage packaging is the incorporation of smart or innovative packaging technologies. This captures QR codes and NFC tags as technology that allows consumers to engage with the products, track the supply chains, and provide brand interaction experiences. Active packaging solutions capable of extending shelf life and ensuring product freshness as well as temperature-sensitive indicators for quality assurance are likely to gain in popularity.

Beverage Packaging Market Leading Players

The key players profiled in the report are Ball Corporation, Tetra Laval International S.A., Amcor plc, Crown, Sonoco Products Company, Graham Packaging, SIG, Reynolds Group Ltd., Bemis Company, Inc., WestRock Company, Stora Enso, Mondi, Berry Global Inc., Scholle IPN, Amber PackagingGrowth Accelerators

The beverage packaging market is significantly sensitive to organic calls. The consumer awareness for environmental matters has increased, and government regulations to curb plastic waste have globalised demand for eco-friendly solutions. This includes a transition to recyclable materials such as aluminium and glass and the development and adoption of biodegradable plastics and plant-based packaging and innovations in biodegradable and compostable materials. Another contributing factor is the constantly changing consumer preference toward convenience and on-the-go consumption. This trend pushes the demand for single-serve packaging formats that are easy to carry and offer features like resealable closures. The e-commerce growth and the direct-to-consumer sales also demand packaging solutions that could withstand shipping while being durable and secure and maintaining the product's integrity.

Beverage Packaging Market Segmentation analysis

The Global Beverage Packaging is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Pouch, Bottle & Jar, Can, Carton, Other Products . The Application segment categorizes the market based on its usage such as Alcoholic Beverages, Non-alcoholic Beverages. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market competition in the beverage packaging industry is highly dynamic and presents a blend of large multinational firms and smaller regional firms. Large international players tend to overshadow smaller regional players with their large product offerings, technology, and established distribution networks. These major players compete based on aspects such as material innovation (including eco-friendly alternatives), pricing effectiveness, and the capability to deliver bespoke packaging solutions for an array of drinks, from alcoholic and soft drinks to dairy. They are also increasingly eyeing strategic partnerships, mergers, and expansions to enhance their market share and respond to changing industry requirements.

Challenges In Beverage Packaging Market

The beverage’s packaging business is grappling with problems, most of which centre around the stringently regulated use of plastics. Single-use plastics are being banned and restricted by governments all over the world. This, in turn, has compelled manufacturers to start exploring more sustainable options. However, this does not come easy, since the shift involves the high cost of developing renewable and recyclable materials on a greater scale and the need for huge amounts of research and investment. All these reasons hinder the fast-paced realisation of sustainability goals by the market, along with profitability. Another serious challenge is the prices of raw materials like plastic, aluminium, and glass, which have been subject to fluctuating trends. On top of that, supply chain breakages, geopolitical tensions, and demand for sustainable materials add to the crisis, thus affecting not just production but also profit margins. The manufacturers must either write this off or transfer these costs to consumers. This might squeeze the competitiveness of their markets. This unpredictability also kills innovation and delays the implementation of alternative materials, thus giving companies less room to choose between affordability and sustainability goals.

Risks & Prospects in Beverage Packaging Market

Innovative packaging materials such as recyclables, biodegradable items, and lightweight designs have gained favour with manufacturers in their attempt to enhance the product's marketability while adhering to some environmental goals. Further popularity of the new-age packaging technologies such as slim cans, aseptic cartons, and smart labels for single-serve and on-the-go beverage formats fuels the growth of these packaging technologies. Furthermore, the stronghold of bottles in the product segment, which accounts for 52% of the market share, illustrates its versatility for several beverage types, such as soft drinks, milk, and alcoholic beverages. In an area-wise observation, Asia-Pacific emerges as the largest yet fastest-growing market, augmented by rising disposable incomes, urbanisation, and heavy consumption of bottled water and soft drinks. The North American market also holds an appreciable share due to its needs for innovative packaging formats and sustainability initiatives. In contrast, Europe's growth is spurred by stringent environmental legislation favouring the usage of eco-friendly packaging solutions. Therefore, these local dynamics emphasise the need for local strategies to tap into consumer preferences and regulatory scenarios in the evolving beverage packaging market.

Key Target Audience

The principal target customers in the beverage package market are manufacturers of beverages belonging to industries of carbonated drinks, bottled water, juices, energy drinks, alcoholic drinks, and dairy drinks. They pay utmost attention to packaging that supports product safety, shelf-life expansion, and presentation to draw more consumers. Brands are looking increasingly for environmentally friendly, light in weight, easy-to-use items such as eco-friendly PET bottles, cartons, and aluminium cans as people increasingly look up to them because of the ever-increasing pressure on natural resources. Another significant audience are packaging solution providers such as material providers, design companies, and logistics providers. These have the important role of developing and supplying customized packaging technologies to respond to the changing requirements of beverage brands. On top of that, regulatory agencies and green-minded consumers are driving the demand for sustainable and compliant packaging, prompting manufacturers to move towards greener solutions and intelligent packaging innovations

Merger and acquisition

The market for beverage packaging has witnessed intense consolidation over the past few years, characterised by major mergers and acquisitions. In November 2024, Amcor announced an all-stock acquisition of Berry Global for $8.4 billion, with the objective of forming a global consumer and healthcare packaging leader. This acquisition will create about $650 million of synergies in three years and take the operations of the combined company to more than 140 countries, employing about 70,000 employees. This move makes the new company a leading player in the packaging sector with a combined top line of $27.2 billion. Another major deal was Veritiv's buyout of Orora Packaging Solutions in December 2024 for $1.2 billion. The buyout enables Veritiv, with backing from Clayton, Dubilier & Rice, to grow its speciality packaging manufacturing and distribution in North America. Orora, meanwhile, is concentrating on premium beverage packaging, especially premium liquor bottle packaging, after it acquired French bottle maker Saverglass. These strategic shifts are a sign of a wider industry trend towards high-margin specialisation and growth in packaging areas.

>Analyst Comment

The market for the beverage packaging is anticipated to grow steadily, with its overall valuation growing from USD 156.25 billion in 2024 to USD 226.06 billion by the year 2030. The growth is due to rising demand for portable, convenient, and eco-friendly packaging solutions, especially for non-alcoholic beverages like water, juices, and soft drinks, which lead the application segment with more than 64% market share. Bottles are the most favoured package type because of their versatility, convenience in handling, and capacity to keep drinks fresh, capturing more than 52% of the market share throughout the forecast period.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Beverage Packaging- Snapshot

- 2.2 Beverage Packaging- Segment Snapshot

- 2.3 Beverage Packaging- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Beverage Packaging Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Can

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Bottle & Jar

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Pouch

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Carton

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Other Products

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Beverage Packaging Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Alcoholic Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Non-alcoholic Beverages

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Beverage Packaging Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Bemis Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Sonoco Products Company

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Scholle IPN

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Mondi

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Amcor plc

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Reynolds Group Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Crown

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Stora Enso

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Tetra Laval International S.A.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Ball Corporation

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 WestRock Company

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Graham Packaging

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 SIG

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Berry Global Inc.

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Amber Packaging

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Beverage Packaging in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Beverage Packaging market?

+

-

How big is the Global Beverage Packaging market?

+

-

How do regulatory policies impact the Beverage Packaging Market?

+

-

What major players in Beverage Packaging Market?

+

-

What applications are categorized in the Beverage Packaging market study?

+

-

Which product types are examined in the Beverage Packaging Market Study?

+

-

Which regions are expected to show the fastest growth in the Beverage Packaging market?

+

-

Which application holds the second-highest market share in the Beverage Packaging market?

+

-

What are the major growth drivers in the Beverage Packaging market?

+

-

The beverage packaging market is significantly sensitive to organic calls. The consumer awareness for environmental matters has increased, and government regulations to curb plastic waste have globalised demand for eco-friendly solutions. This includes a transition to recyclable materials such as aluminium and glass and the development and adoption of biodegradable plastics and plant-based packaging and innovations in biodegradable and compostable materials. Another contributing factor is the constantly changing consumer preference toward convenience and on-the-go consumption. This trend pushes the demand for single-serve packaging formats that are easy to carry and offer features like resealable closures. The e-commerce growth and the direct-to-consumer sales also demand packaging solutions that could withstand shipping while being durable and secure and maintaining the product's integrity.