Global Bicycle locks Market – Industry Trends and Forecast to 2030

Report ID: MS-2260 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Bicycle locks Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

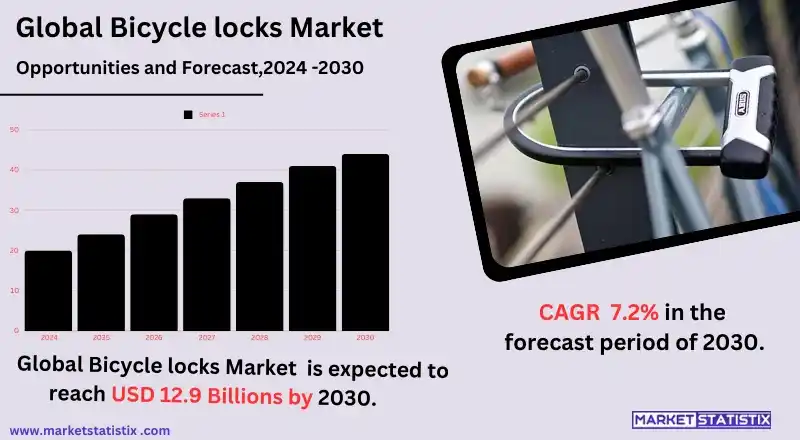

| Growth Rate | CAGR of 7.1% |

| Forecast Value (2030) | USD 12.9 Billion |

| By Product Type | U-locks, Chain Locks, Folding Locks, Cable Locks, Others |

| Key Market Players |

|

| By Region |

|

Bicycle locks Market Trends

The bicycle locks market is witnessing a significant shift towards more enhanced locking systems, necessitated by constant concern over theft of bicycles. One of the key innovations is smart locks that use Bluetooth, GPS tracking, and smartphone connectivity to remotely access and provide real-time information on lock use to the users. Most of these high-tech locks improve the facilitation of a cyclist without a key, in addition to their improved security. A similar new trend is being reflected in the booming sales of lighter locks that are easy to carry. These are quickly moving into the mainstream as standard locks among urban cyclists who like to go around with very convenient locks. With cycling becoming all the more common in urban settings today, particularly with bike-sharing programs increasing and cycling as a mode of environmentally-friendly commuting, demand grows for really compact, easy-to-carry locks.Bicycle locks Market Leading Players

The key players profiled in the report are Blackburn Design, Allegion, ABUS, OnGuard, TiGr lock, Knog, Master Lock, Seatylock, Litelok, GIANT, Tonyon, Hiplok, Oxford ProductsGrowth Accelerators

The bicycle lock market has grown incredibly due to the rising enthusiasm regarding cycling as a fun activity and transport use. The increasing number of people choosing to cycle, for fitness, transport, or leisure purposes, has greatly enhanced the demand for effective and safe locks for securing bicycles. Urbanisation itself has contributed in a significant way to the overall increase in demand for premium locks capable of providing secure protection because of the high levels of bike thefts. Speaking towards the increased impetus to sustain an environmentally friendly transport system, environmentalism is also contributing to the increased popularity of bicycles. This will subsequently lead to an increase in demand for good locking solutions. The other connector is the growth of e-commerce portals that avail shopping convenience and easier access to almost all of the consumers to the different options available for bicycle locking devices. In addition, new technology on locks, such as smart locks using Bluetooth or biometric features, pushes the prices of the respective locks in the market further.Bicycle locks Market Segmentation analysis

The Global Bicycle locks is segmented by Type, Application, and Region. By Type, the market is divided into Distributed U-locks, Chain Locks, Folding Locks, Cable Locks, Others . The Application segment categorizes the market based on its usage such as OEM, Aftermarket. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The current scenario prevailing in the market is defined and dominated by the major as well as the minor competitors in the bicycle locks segment, providing varied locking solutions, either basic cable locks or the more advanced models such as high-security U-locks or chain locks. The market is also characterised by a number of well-established players that include, among others, ABUS, Kryptonite, Master Lock, and OnGuard. These are some of the elite brands in the field known for their durability and innovative products. They compete on grounds of product quality, their security features, pricing, and, most importantly, customer trust. New innovations in lock technology, such as Bluetooth features in smart locks or biometric locks, have also helped make the competitive environment where businesses are trying to position themselves around improving convenience and advanced security regarding lock types.Challenges In Bicycle locks Market

The market for bicycle locks is facing a host of challenges that stem from the continuous evolution of security threats. As the sophistication of bicycle theft becomes higher, manufacturers of locks find it necessary to stay ahead by innovating to produce secure products. The prohibition of continuous innovation, however, takes much funding directed towards research and development. One of the most crucial challenges is trying to strike a balance between security and price, especially as most of the high-security locks tend to be on the expensive side, thus denying access to a wider consumer base. An issue is competition within the market, where numerous brands exhibit a wide array of locks at various levels of security features. With that, consumers might sometimes find it hard to identify the most effective products, and the companies also face difficulty in differentiating their offerings. Furthermore, the increased online retailing has resulted in a high number of counterfeit or poor-quality bicycle locks, thereby harming the reputation of legitimate brands and affecting consumer confidence in the market.Risks & Prospects in Bicycle locks Market

Cycling is being embraced not just as a means of transport but also as a recreational activity, and with it, increased demand for bicycle locks. With rising numbers considering biking as a greener way to get around, demand for good and reliable locks for bicycles will always be ever-increasing for those who do so in urban areas that have a higher potential for theft risk. The advent of high-tech lock models, such as Bluetooth-connected smart locks and GPS tracking features, gives room for innovations targeted at the tech-aware cyclists. This would include the growing awareness of cycling as one of the activities in fitness and the resulting increase in cycling tourism, which are additional market opportunities. Moreover, increasing opportunities are now provided for manufacturers to reach more consumers given the growth of e-commerce platforms and direct-to-consumer models for different varieties of locks, from classical U-locks to the most advanced app-controlled models direct to consumers by such means.Key Target Audience

The major consumers of the bicycle locks market are cyclists—common commuting urban cyclists with their recreational riders and professional athletes, all of whom are concerned with securing their bicycles from theft. These consumers would thus be expecting good locks from reliable producers to safeguard their valuable bikes. Of course, they can be expected to seek these high-quality, affordable locks in at-risk, high-theft areas such as busy city centres, universities, and public spaces. Features sought by cyclists commonly are portability, ease of use, and resistance to cutting or tampering, while increasing smart locks integrated with mobile for enhanced security capture a significant proportion of the market., This also includes bicycle shops, rental services, and bicycle-sharing schemes as main target audience groups for bicycle locks. These businesses necessitate a range of locking solutions to offer customers or clientele for securing shared or rental fleet bicycles. Other critical target markets would include all manufacturers, distributors, or wholesalers of locks and logistics and transport companies offering secure bike storage solutions.Merger and acquisition

Likewise in the bicycle lock sector, these mergers and acquisitions have aimed at consolidating product lines in a bid to extend marketing reach. Companies including Allegion and ABUS have recently been focusing on the acquisition of those engaged in the security hardware business to enhance their positions. Such mergers are bent towards creating a range of more extensive solutions to bike locking by tapping into the trends of cycling activities and commuting within cities. For example, Master Lock and OnGuard also have such partnerships and acquisitions used for the strategic innovation of their products. Most of these innovations target the areas of improved durability, anti-theft technology, and consumer comfort. Overall, the acquisitions aim to leverage cross-industry expertise for enhanced and more user-friendly products, including digital and smart lock systems, to meet increasing consumer demands for connected and efficient security solutions. >Analyst Comment

"The market for bicycle locks is showing a gradual growth with an increase in the interest towards cycling as a mode of transport and as a recreational activity. As many more cyclists increase, more will be the need for proper and effective security measures for bicycles to be shielded from theft. Key drivers for the growth of the market are advances in lock technologies that provide high-security materials and innovative locking systems. Increased awareness concerning prevention of bike theft and demand for portable, sturdy locks have also contributed to the market growth."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bicycle locks- Snapshot

- 2.2 Bicycle locks- Segment Snapshot

- 2.3 Bicycle locks- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bicycle locks Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 U-locks

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Chain Locks

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Folding Locks

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Cable Locks

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Bicycle locks Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 OEM

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Aftermarket

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Bicycle locks Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Blackburn Design

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Allegion

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 ABUS

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 OnGuard

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 TiGr lock

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Knog

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Master Lock

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Seatylock

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Litelok

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 GIANT

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Tonyon

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Hiplok

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Oxford Products

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Bicycle locks in 2030?

+

-

Which type of Bicycle locks is widely popular?

+

-

What is the growth rate of Bicycle locks Market?

+

-

What are the latest trends influencing the Bicycle locks Market?

+

-

Who are the key players in the Bicycle locks Market?

+

-

How is the Bicycle locks } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Bicycle locks Market Study?

+

-

What geographic breakdown is available in Global Bicycle locks Market Study?

+

-

Which region holds the second position by market share in the Bicycle locks market?

+

-

How are the key players in the Bicycle locks market targeting growth in the future?

+

-