Global Bioethanol Fuel Market – Industry Trends and Forecast to 2032

Report ID: MS-680 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Bioethanol Fuel Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

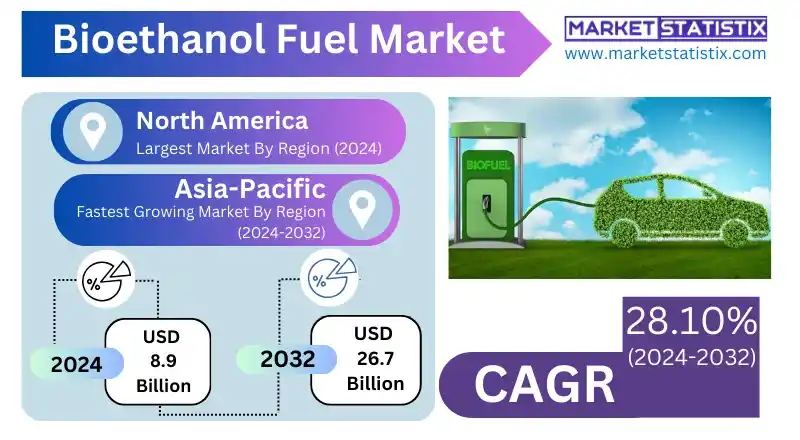

| Growth Rate | CAGR of 28.10% |

| Forecast Value (2032) | USD 26.7 Billion |

| By Product Type | Sugarcane-Based Bioethanol, Wheat-Based Bioethanol, Cellulosic Bioethanol, Corn-Based Bioethanol, Algae-Based Bioethanol |

| Key Market Players |

|

| By Region |

|

Bioethanol Fuel Market Trends

An important trend is the focus of increased attention on advanced bioethanol production from cellulosic feedstocks to avoid competition with food crops and to drive sustainability. Furthermore, it is on the growing trend towards the integration of bioethanol production with biorefineries to fully utilize biomass and maximize the diversity of bio-based products. Government mandates and incentives intended to reduce emissions of greenhouse gases and promote renewable energy have also been very important reasons for the massive growth of the market. Furthermore, the market has been characterized by the increase in collaboration among industry players, research institutions, and governments on developing more efficient and cost-effective bioethanol production technologies. The increasing demand for sustainable aviation fuels (SAF) has also opened up new doors for bioethanol, particularly in terms of feedstock for producing biojet fuels.Bioethanol Fuel Market Leading Players

The key players profiled in the report are Petrobras, CropEnergies AG, LyondellBasell Industries N.V., Cargill Inc., Abengoa Bioenergy, BP plc, The Andersons Inc., Green Plains Inc., Raízen S.A., Valero Energy Corporation, Flint Hills Resources, GranBio, Tereos S.A., Pacific Ethanol Inc., POET LLC, Royal Dutch Shell plc, Alto Ingredients Inc., Clariant AG, Aemetis Inc., Archer Daniels Midland CompanyGrowth Accelerators

The bioethanol fuel market is primarily ruled by some kind of government mandates and policies meeting the requirements to really promote such use of renewable fuels so as to reduce greenhouse gas emissions and enhance energy security. Most countries have implemented blending mandates, therefore putting the requirement for bioethanol to be mixed with gasoline, which significantly boosts the demand for it. Also, tax credits, among other incentives, stimulate both production and consumption of bioethanol, apart from being economically viable. Besides, there is rising awareness of climate change alongside the need to diversify energy sources apart from fossil fuels, which plays an important role in attaining the market growth. Another one is the price of crude oil, which has high fluctuations and therefore makes bioethanol desirable when it comes with a hike in oil prices. In addition, in cellulosic ethanol, produced from non-food term biomass, advancements within the technologies of bioethanol production are widening sources of feedstock. The growing automotive industry in developing countries, coupled with the increasing adoption of flex-fuel vehicles, also contributes to the market's expansion.Bioethanol Fuel Market Segmentation analysis

The Global Bioethanol Fuel is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Sugarcane-Based Bioethanol, Wheat-Based Bioethanol, Cellulosic Bioethanol, Corn-Based Bioethanol, Algae-Based Bioethanol . The Application segment categorizes the market based on its usage such as Power Generation, Transportation, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The bioethanol fuel competitive market features large agricultural conglomerates, specialized biofuel producers, and emerging tech firms. Established companies, especially those working on corn and sugarcane, are using their infrastructure and supply chains to dominate production. However, these firms may see new competition due to the rising interest in utilizing cellulosic feedstocks for advanced bioethanol production by enterprising startups and technology developers. Inter-feedstock competition exists, where corn ethanol is more dominant in the US; sugarcane use prevails in Brazil, whereas other areas are beginning to examine alternative biomass opportunities. Companies' ability to react to changing environmental regulations, efficient production costs, and the commercialization of advanced bioethanol technology will most likely influence the long-term competitive landscape.Challenges In Bioethanol Fuel Market

The bioethanol fuel market remains challenged mainly by the competition for feedstock and sustainability concerns. The "food versus fuel" debate is a key issue, as large-scale bioethanol production can drive the prices of food up and thereby hamper food security. Beyond this, land use changes, such as deforestation, and the energy-intensive practices of cultivation and conversion are often cited as countering the environmental advantages that bioethanol has to offer. The sourcing of feedstock must be sustainable, and production technologies must be efficient. Moreover, the other problems that face the market are that they are yet largely unproven economically and suffer from infrastructure bottlenecks. Movements in feedstock price and high production costs can make bioethanol somewhat uncompetitive compared to conventional gasoline. The absence of a widespread infrastructure for blending and distributing high-ethanol blends in the areas where flex-fuel vehicles are not adopted acts as a curb for the growth of the market.Risks & Prospects in Bioethanol Fuel Market

New important opportunities for the market comprise an increase in cellulosic ethanol production, based on non-food feedstocks, and also advanced biorefineries with multiple biofuel and biochemical production pathways. The ongoing trend in the adoption of flex-fuel vehicles and ever-increasing blending mandates for ethanol in gas offers solid grounds for further market growth. The emerging new area of market potential is in aviation biojet fuels from ethanol. Regionally, the USA is the major North American player, being one of the highest producers of corn and having a thriving ethanol industry. Brazil, being another important sugarcane-producing country, is a major exporter of sugarcane-based ethanol. Currently, the Asia-Pacific region is growing at a fast pace, primarily due to increasing energy demand and government initiatives to promote biofuels, especially in Asian countries such as India and China. Europe is also coming out with more advanced technologies in bioethanol, all but utilizing biomass sustainably. Each region has marketing dynamics based on unique agricultural resources, policy frameworks, and energy demands.Key Target Audience

, The primary bioethanol fuel market target audience includes government agencies, fuel distributors, and automobile manufacturers. Governments, of course, include bioethanol as part of their policies and regulations, such as renewable fuel standards and tax incentives that affect market growth directly. Those governments would have interests in bioethanol as the vehicle to reducing carbon emissions, improving energy security, and stimulating domestic agriculture. Fuel distributors, including refineries and gas station chains, are major stakeholders in the blending and distribution of the bioethanol-blended fuels into the consumers. Other target clients are car manufacturers, especially those making a flex-fuel vehicle, which works with a higher blend of ethanol., Consumers, especially those concerned about the environment or who are looking for cheap fuels, constitute a secondary but important target audience. Agricultural producers growing feedstock crops like corn and sugarcane are also important because they form the basis of the supply chain. Success in the market depends on how well the different players are engaged to address their particular needs and concerns.Merger and acquisition

The bioethanol fuel market is a big melting pot of mergers and acquisitions trends, such as such transitions made by various industry players toward greener and better prospects. On June 30, 2024, BP and Bunge announced that they have reached an agreement for BP to acquire its half of the other joint venture BP Bunge Bioenergia S.A. The price tag for the transaction will be around $1.4 billion. It has made BP one of the leading producers of biofuels in Brazil by adding to its bioenergy portfolio in this region. In another example, KKR, in October 2024, bought a 25% stake in the biofuel company of Eni, Enilive, at €2.94 billion. This gives the unit an enterprise value of almost €12 billion. In February 2025, KKR took the option to acquire another 5% investment at €587.5 million, thereby raising its stake to 30%. These deals fall within the strategy of Eni to attract co-investors in furthering its energy transition agenda. These strategic moves underscore the bioethanol sector's dynamic landscape, with companies actively pursuing partnerships and investments to bolster their positions in the evolving energy market. >Analyst Comment

The gradual increase in bioethanol fuel market development may be attributed to the factors of growing demand for renewable energy, as well as the demand to put a brake on global warming environmental effects. Bioethanol is mainly produced from plant-derived feedstock such as corn, sugarcane, and wheat and acts as an alternative to gasoline in the transportation sector. Moreover, government mandates and subsidies to reduce fossil fuel dependence, enhance energy security, and promote sustainable agriculture practices stimulate this market further. The prominent technical emphasis on energy transition by the various countries sees bioethanol as an essential fuel to decarbonize the transportation industry and achieve certain environmental goals.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bioethanol Fuel- Snapshot

- 2.2 Bioethanol Fuel- Segment Snapshot

- 2.3 Bioethanol Fuel- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bioethanol Fuel Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Corn-Based Bioethanol

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Sugarcane-Based Bioethanol

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Cellulosic Bioethanol

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Wheat-Based Bioethanol

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Algae-Based Bioethanol

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Bioethanol Fuel Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Transportation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Power Generation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Bioethanol Fuel Market by Feedstock

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Sugarcane

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Corn

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Wheat

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Barley

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Bioethanol Fuel Market by Blend Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 E10

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 E20

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 E85

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Others

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Bioethanol Fuel Market by End-User

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Automotive

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Aviation

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Marine

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Others

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

9: Bioethanol Fuel Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Flint Hills Resources

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Valero Energy Corporation

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 LyondellBasell Industries N.V.

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Royal Dutch Shell plc

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Raízen S.A.

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Tereos S.A.

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Cargill Inc.

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 GranBio

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Abengoa Bioenergy

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Green Plains Inc.

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Alto Ingredients Inc.

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 The Andersons Inc.

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 CropEnergies AG

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Petrobras

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 BP plc

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 Aemetis Inc.

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 Clariant AG

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

- 11.18 Pacific Ethanol Inc.

- 11.18.1 Company Overview

- 11.18.2 Key Executives

- 11.18.3 Company snapshot

- 11.18.4 Active Business Divisions

- 11.18.5 Product portfolio

- 11.18.6 Business performance

- 11.18.7 Major Strategic Initiatives and Developments

- 11.19 POET LLC

- 11.19.1 Company Overview

- 11.19.2 Key Executives

- 11.19.3 Company snapshot

- 11.19.4 Active Business Divisions

- 11.19.5 Product portfolio

- 11.19.6 Business performance

- 11.19.7 Major Strategic Initiatives and Developments

- 11.20 Archer Daniels Midland Company

- 11.20.1 Company Overview

- 11.20.2 Key Executives

- 11.20.3 Company snapshot

- 11.20.4 Active Business Divisions

- 11.20.5 Product portfolio

- 11.20.6 Business performance

- 11.20.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Feedstock |

|

By Blend Type |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Bioethanol Fuel in 2032?

+

-

Which type of Bioethanol Fuel is widely popular?

+

-

What is the growth rate of Bioethanol Fuel Market?

+

-

What are the latest trends influencing the Bioethanol Fuel Market?

+

-

Who are the key players in the Bioethanol Fuel Market?

+

-

How is the Bioethanol Fuel } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Bioethanol Fuel Market Study?

+

-

What geographic breakdown is available in Global Bioethanol Fuel Market Study?

+

-

Which region holds the second position by market share in the Bioethanol Fuel market?

+

-

Which region holds the highest growth rate in the Bioethanol Fuel market?

+

-