Global Biomass Briquette Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-682 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Biomass Briquette Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

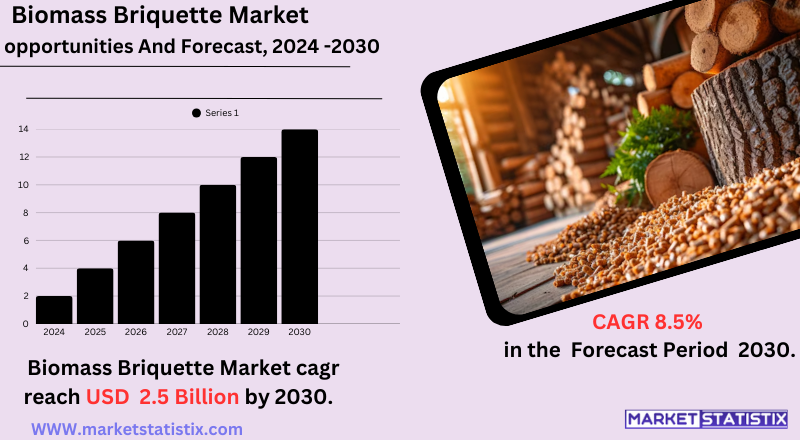

| Growth Rate | CAGR of 8.5% |

| Forecast Value (2030) | USD 2.5 Billion |

| By Product Type | Biomass Briquette, Biomass Pellet |

| Key Market Players |

|

| By Region |

|

Biomass Briquette Market Trends

A major trend has been the increasing integration of biomethane into existing natural gas grids, driven by advances in purification technologies. The use of existing infrastructure reduces the need for new investment. Important for public demand, biomethane is being used as a cleaner alternative to fossil fuels in the transport sector, with more and more infrastructures for bio-CNG and bio-LNG fuelling stations. Another trend is the diversification of feedstocks for the production of biogas and biomethane. Traditional feedstocks such as agricultural wastes are still relevant, but there is increasing importance being given to the use of municipal solid waste and organic residues, thereby enhancing circular economy principles. There is also an increase in technological innovations that address efficiency in anaerobic digestion and the overall production of biomethane.Biomass Briquette Market Leading Players

The key players profiled in the report are German Pellets, Graanul Invest Group, Biomass Secure Power, Lignetic, Enova Energy Group, Drax Biomass, Pinnacle Renewable Energy Group, Premium Pellet Ltd., Maine Woods Pellet, Bayou Wood P, Bear Mountain Forest Prod, Energex, Fram Renewable Fuels, Appalachian Wood Pellets, Agropellets, General Biofuels, Rentech, Pacific BioEnergy Corporation, Enviva, BlueFire Renewables, E-pellets, Pfeifer Group, Protocol Energy, Granules LG, Corinith Wood Pellets, RWE InnogyGrowth Accelerators

The growth of the biogas and biomethane market is attributed to several major factors. Mainly, industries and governments are now being forced to adopt cleaner alternatives in compliance with increasingly stringent environmental regulations, which work toward the reduction of greenhouse gas emissions and promotion of renewable energy sources. Government incentives, in the form of grants and tax holidays for biogas and biomethane projects, further bolster investments in these projects. Rising awareness surrounding waste management and the circular economy additionally propels the market forward since biogas actually provides a sustainable option for the disposal of organic wastes. The growing demand for renewable natural gas (RNG) in transportation and heating, where electrification is often not viable, also contributes heavily. Finally, increasing focus on energy security and diversification of energy supplies triggers adoption of biogas and biomethane, presenting an opportunity for reliable energy from local production.Biomass Briquette Market Segmentation analysis

The Global Biomass Briquette is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Biomass Briquette, Biomass Pellet . The Application segment categorizes the market based on its usage such as Power Generation, Thermal Energy, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The biogas and biomethane sector provide a competitive environment with established players and emerging companies, making the scenario more dynamic. From large energy companies interested in the production of biomethane to specialized technology providers offering anaerobic digestion solutions, key competitors are diverse. Companies are competing fiercely in the maximization of feedstock utilization, optimizing gas yield, and lowering production costs. Strategic partnerships, mergers, and acquisitions are frequently used strategies to enhance both technological capabilities and market presence. The variances in market maturity and regulatory framework across different regions also add to the fragmented competitive landscape. In Europe, for instance, established players greatly benefit from clearly defined policies and infrastructure. In stark contrast, emerging markets are faced with fierce competition, mainly driven by local players skilled in the waste management and agricultural arenas.Challenges In Biomass Briquette Market

The market for biogas and biomethane is full of potential, yet there are also significant hurdles in the way. First and foremost, of these concerns is up-front investment for the building and operation of biogas and biomethane production units. This encompasses costs for anaerobic digestion methods, upgrading equipment, grid connection infrastructure, etc. Economic feasibility is tied not only to fluctuating energy prices but also to the continuation of securing steady feedstock supplies, which could vary by region. Another major hurdle is competition with established energy sources and other alternative renewables. Biomethane is between a rock and a hard place competition-wise as far as conventional natural gases are concerned generally because it nearly always has developed systems and, for example, preferably lower production costs. And then there's the very strong competition from other renewable energy sources like solar and wind power that have already undergone enormous reductions in cost.Risks & Prospects in Biomass Briquette Market

The transition to clean fuels in transportation, industrial heating, and power generation provides an attractive market for biomethane. Increases in anaerobic digestion and gas upgrading technologies also improve production efficiency, making biogas more competitive with fossil fuels. Regionally, Europe dominates the market due to favourable policies like the EU Green Deal and the Renewable Energy Directive. Countries such as Germany, France, and the UK boast well-structured biogas sectors. The North American market is also steadily growing, with wider adoption in the U.S. and Canada, further supported by federal and state renewable energy policies. In the Asia-Pacific region, rapid industrialization and waste management initiatives in China, India, and Japan are stimulating growth in the market, whereas Latin America and Africa are emerging as potential markets for increased investments in sustainable energy projects.Key Target Audience

, The main target audience for the biogas and biomethane market includes industries, government establishments, and energy producers interested in sustainable solutions. The industrial sectors constitute the primary consumers of biogas, mostly for waste management and energy generation. Agriculture, food processing, and wastewater treatment plants use biogas as energy generation and waste management., Another large segment is formed by the investors, technology vendors, and research institutions working on biogas upgrading technologies and infrastructure development. An increasing number of energy companies and utility providers are also injecting biomethane into the existing gas grids in the spirit of sustainability. Another market driver is the environmental NGOs and eco-friendly consumers looking for renewable energy solutions.Merger and acquisition

Recently, the biogas and biomethane markets have seen significant phases of mergers and acquisitions, demonstrating the vibrant growth and strategic importance of the industry in the renewable energy arena. In October 2024, Italian energy giant Eni agreed to sell a 25 percent stake in its biofuel subsidiary, Enilive, to KKR for €2.94 billion, valuing Enilive at almost €12 billion. This is in line with Eni's plans to try and attract co-investors in support of its transition to energy. Enilive runs biorefineries and biomethane production sites across Europe and the U.S., thus further emphasizing the growing worth that is increasingly attached to biomethane assets in the international energy marketplace. Additionally, in November 2024, Finland's Gasum acquired Haerup Biogas, a Danish biogas plant utilizing manure to produce about 40 GWh of biogas annually. Acquiring Haerup Biogas demonstrates that Denmark is an attractive location for biogas production with its secure agricultural basis and good conditions for feedstock availability. It will build a gas upgrading unit and grid connection to exploit the capacity generated by the plant with these investments. These strategic acquisitions are evidence of the growing importance given to expanding biomethane production capabilities and to the interfacing consolidation dynamic within the industry. >Analyst Comment

The market for biogas and biomethane has been growing phenomenally in recent years, especially due to strong global initiatives towards sustainable energy alternatives. Such phenomenal growth is heavily driven by the severe regulatory environment, the incentives by governments for the promotion of the use of renewable energy sources, and major advances in the technology of anaerobic digestion. The flexibility of the market is illustrated in its number of applications, which include using it to generate electricity, using it as fuel for vehicles, and injecting it into existing gas grids, thus showing promise as a widely adopted application for such technology. Currently, Europe enjoys superiority in the market while the Asia-Pacific region shows the fastest growth due to the degree of industrialization and consequent generation of waste.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Biomass Briquette- Snapshot

- 2.2 Biomass Briquette- Segment Snapshot

- 2.3 Biomass Briquette- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Biomass Briquette Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Biomass Briquette

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Biomass Pellet

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Biomass Briquette Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Power Generation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Thermal Energy

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Biomass Briquette Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Agropellets

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Appalachian Wood Pellets

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bayou Wood P

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Bear Mountain Forest Prod

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Biomass Secure Power

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 BlueFire Renewables

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Corinith Wood Pellets

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Drax Biomass

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 E-pellets

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Enova Energy Group

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Energex

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Enviva

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Fram Renewable Fuels

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 General Biofuels

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 German Pellets

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Granules LG

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Graanul Invest Group

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Lignetic

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Maine Woods Pellet

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Pacific BioEnergy Corporation

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 Pfeifer Group

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

- 8.22 Pinnacle Renewable Energy Group

- 8.22.1 Company Overview

- 8.22.2 Key Executives

- 8.22.3 Company snapshot

- 8.22.4 Active Business Divisions

- 8.22.5 Product portfolio

- 8.22.6 Business performance

- 8.22.7 Major Strategic Initiatives and Developments

- 8.23 Premium Pellet Ltd.

- 8.23.1 Company Overview

- 8.23.2 Key Executives

- 8.23.3 Company snapshot

- 8.23.4 Active Business Divisions

- 8.23.5 Product portfolio

- 8.23.6 Business performance

- 8.23.7 Major Strategic Initiatives and Developments

- 8.24 Protocol Energy

- 8.24.1 Company Overview

- 8.24.2 Key Executives

- 8.24.3 Company snapshot

- 8.24.4 Active Business Divisions

- 8.24.5 Product portfolio

- 8.24.6 Business performance

- 8.24.7 Major Strategic Initiatives and Developments

- 8.25 Rentech

- 8.25.1 Company Overview

- 8.25.2 Key Executives

- 8.25.3 Company snapshot

- 8.25.4 Active Business Divisions

- 8.25.5 Product portfolio

- 8.25.6 Business performance

- 8.25.7 Major Strategic Initiatives and Developments

- 8.26 RWE Innogy

- 8.26.1 Company Overview

- 8.26.2 Key Executives

- 8.26.3 Company snapshot

- 8.26.4 Active Business Divisions

- 8.26.5 Product portfolio

- 8.26.6 Business performance

- 8.26.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Biomass Briquette in 2030?

+

-

Which type of Biomass Briquette is widely popular?

+

-

What is the growth rate of Biomass Briquette Market?

+

-

What are the latest trends influencing the Biomass Briquette Market?

+

-

Who are the key players in the Biomass Briquette Market?

+

-

How is the Biomass Briquette } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Biomass Briquette Market Study?

+

-

What geographic breakdown is available in Global Biomass Briquette Market Study?

+

-

Which region holds the second position by market share in the Biomass Briquette market?

+

-

How are the key players in the Biomass Briquette market targeting growth in the future?

+

-