Global Bioplastics Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-1826 | Energy and Natural Resources | Last updated: Sep, 2024 | Formats*:

Bioplastics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

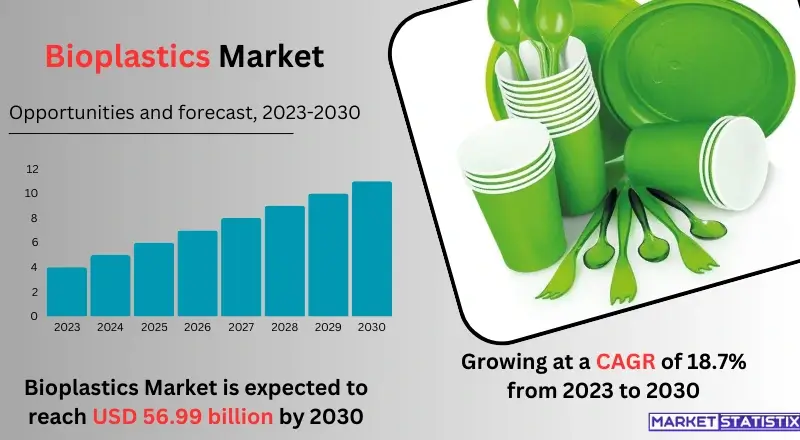

| Growth Rate | CAGR of 18.7% |

| By Product Type | Biodegradable, Non-biodegradable |

| Key Market Players |

|

| By Region |

|

Bioplastics Market Trends

Important growth in the bioplastics market has been experienced because of increasing environmental concerns as well as the need to find sustainable alternatives to conventional plastics. Bioplastics are made out of renewable resources such as plants or algae; hence, they can be biodegradable or compostable, thus having less impact on landfill sites or oceans. This is mainly due to rising consumer awareness regarding plastic pollution, stricter environmental regulations, and the desire for greener packaging solutions. Bioplastics market key trends include advancement in material technology, for example, the development of high-performance bioplastics that can match or even exceed some traditional plastics’ properties. Another trend is the growing use of bioplastics by different industries, such as packaging, automotive, and agricultural sectors, which reflect an overall effort to lower carbon footprints and adopt principles of circular economy.Bioplastics Market Leading Players

The key players profiled in the report are Avantium, PTT MCC Biochem Co. Ltd., An Phat Holdings, NatureWorks LLC, SABIC, SUPLA (JIANGSU SUPLA BIOPLASTICS CO. LTD.), Solvay, BASF SE, Futerro, TEIJIN LIMITED, TORAY INDUSTRIES INC., Toyota Tsusho Corporation, Trinseo S.A., Braskem, Total Corbion PLAIRGrowth Accelerators

Driven mainly by rising demand for sustainable, eco-friendly alternatives to traditional plastics, the bioplastics marketplace is thriving. As environmental worries about plastic waste and its effects on ecosystems mount up, both consumers as well as industries aim for biodegradable and compostable choices. Bioplastics come from renewable resources like plant materials, reducing reliance on fossil fuels while decreasing plastic pollution. Furthermore, government regulations plus incentives to reduce plastic waste are other crucial causes of bioplastics’ usage. Another substantial propellant is technical advancement in bioplastics’ manufacturing process as well as generation of novel types of biopolymers. Advances in bioplastic compositions and production methods improve the effectiveness, affordability, and versatility of these materials, broadening their scope of application from packaging through automotive components. The growth of the industry is influenced by a combination of consumers’ increased awareness about sustainability issues as well as better bioplastic technology improvements.Bioplastics Market Segmentation analysis

The Global Bioplastics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Biodegradable, Non-biodegradable . The Application segment categorizes the market based on its usage such as Packaging, Agriculture, Consumer goods, Textile, Automotive & Transportation, Building & Construction, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The bioplastics market, which operates on a global scale, is rich in established chemical firms, specialised biomaterial producers, as well as new entrants. Some of the major players in this field are NatureWorks, Danimer Scientific, Novamont, and Corbion, which have put a lot of resources into the research and development of bioplastics. They employ their knowledge and extensive market coverage to spur growth and creativity within the bioplastic’s domain. Apart from these established names, there are also quite a number of smaller companies that concentrate on particular bioplastic fields or production methods. Such businesses come up with unique solutions at very competitive prices, thus contributing towards increasing the liveliness and variety found within the world of bioplastics.Challenges In Bioplastics Market

Challenges abound in the bioplastics market, mostly to do with production costs and scalability. While bioplastics cost more to produce as they use special raw materials or advanced manufacturing processes; for that matter, it limits competitiveness in price-sensitive markets, which may also restrain widespread adoption. Additionally, bioplastic performance varies from traditional plastic performance or properties. Despite promoting environmental conservation through lessening carbon emissions as well as being biodegradable, there are times when bioplastics don’t have such mechanical properties that make conventional plastic strong. As a result, they cannot be used across various sectors until more studies have been done for their improvements. For these reasons, addressing these challenges is imperative for accelerating the growth and uptake of bioplastics worldwide.Risks & Prospects in Bioplastics Market

Market bioplastics could have been given emphatic chances as raised demands for eco-friendly alternatives to common plastic grew increasingly. The alternative polymer that decomposes favours plant-based resources and agricultural byproducts, as they pose a supplementary solution due to increased awareness of pollution caused by such products and concern for the environment. However, this change is mainly due to regulations and consumer preferences towards environmentally sounder alternatives, leading to innovation as well as diversification plans in several areas. The major chances found in the market of these organic plastics are designing next-generation materials with advanced attributes like high strength or being biologically degradable and long-lasting at the same time. Thus, the rising number of uses across industries is anticipated to necessitate this development. Besides, more investments channelled into such fields are expected to facilitate market expansion. With advancing technologies and improving production processes, bioplastics will soon be more cost-competitive than traditional plastics, thus creating new market segments globally as well as accelerating widespread acceptance.Key Target Audience

The main target group of people in the bioplastics industry includes manufacturers in such areas as packaging, automotive, and consumer goods looking for sustainable substitutes of conventional plastics. Among those companies that pack items, they are very important since they create demand for bio-plastics because there is increasing pressure from consumers and regulations to have environmentally friendly packages. This means that they play a big role when it comes to demand creation since people are more aware and concerned about environmental issues. Besides this, the automobile industry is also moving towards reducing its carbon footprint by using bio-plastics, thereby meeting sustainability requirements., Another important audience comprises environmental organisations, governmental agencies, and regulatory authorities who champion policies that promote the use of sustainable materials. Through regulations and incentives aimed at promoting the adoption of bioplastics, these organisations shape market trends. Therefore, with an increasing focus on sustainability across different sectors in the economy, bioplastics markets are growing to meet the varying needs of these stakeholders in order to help reduce environmental degradation and improve product sustainability.Merger and acquisition

The research on the worldwide bioplastics market has been optimised to achieve cross-industrial expansion of market share, improvement of the existing product offerings, and advancement of technology. Some major activities have been the partnerships between established chemical companies and bioplastics startups as well as the takeover of manufacturers dealing with bioplastics. In several dimensions, mergers and acquisitions bring together various forms of expertise in materials science, production, and large customer bases, creating more complete and competitive solutions for bioplastics. Besides, they could also help to attain economies of scale, prepare good supply chains, and encourage R&D activities that drive innovation and growth in the bioplastics sector.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bioplastics- Snapshot

- 2.2 Bioplastics- Segment Snapshot

- 2.3 Bioplastics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bioplastics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Biodegradable

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-biodegradable

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Bioplastics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Packaging

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Agriculture

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer goods

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Textile

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Automotive & Transportation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Building & Construction

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Bioplastics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Avantium

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 PTT MCC Biochem Co. Ltd.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 An Phat Holdings

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 NatureWorks LLC

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 SABIC

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 SUPLA (JIANGSU SUPLA BIOPLASTICS CO. LTD.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Solvay

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 BASF SE

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Futerro

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 TEIJIN LIMITED

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 TORAY INDUSTRIES INC.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Toyota Tsusho Corporation

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Trinseo S.A.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Braskem

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Total Corbion PLAIR

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Bioplastics is widely popular?

+

-

What is the growth rate of Bioplastics Market?

+

-

What are the latest trends influencing the Bioplastics Market?

+

-

Who are the key players in the Bioplastics Market?

+

-

How is the Bioplastics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Bioplastics Market Study?

+

-

What geographic breakdown is available in Global Bioplastics Market Study?

+

-

Which region holds the second position by market share in the Bioplastics market?

+

-

How are the key players in the Bioplastics market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Bioplastics market?

+

-